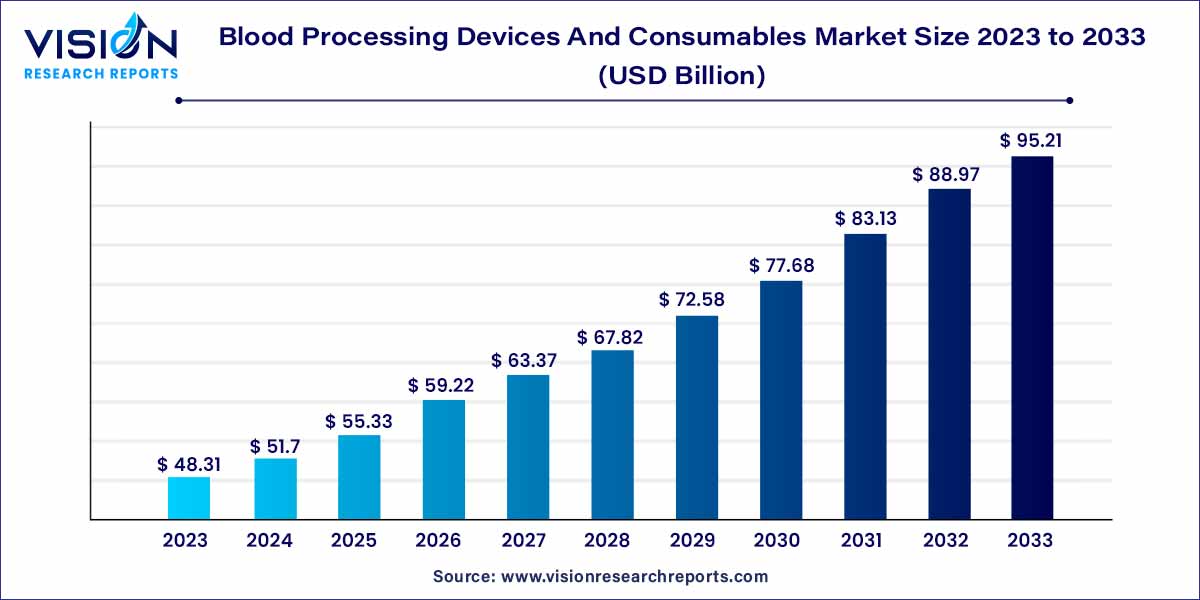

The global blood processing devices and consumables market size was estimated at USD 48.31 billion in 2023 and it is expected to surpass around USD 95.21 billion by 2033, poised to grow at a CAGR of 7.02% from 2024 to 2033.

The blood processing devices and consumables market is a vital sector within the healthcare industry, playing a pivotal role in the safe and efficient management of blood products. This market encompasses a diverse range of devices and consumables designed to collect, process, store, and transfuse blood and its components. Blood processing devices include automated systems for blood separation, centrifuges, and blood bank refrigerators, while consumables comprise collection sets, blood bags, and various reagents used in blood testing.

The growth of the blood processing devices and consumables market is fueled by several key factors. One of the primary drivers is the increasing demand for blood transfusions due to rising surgical procedures, trauma cases, and prevalence of chronic diseases. Technological advancements in blood processing devices, such as automated systems and advanced testing methods, contribute significantly to market growth by enhancing the efficiency and safety of blood processing procedures. Additionally, growing awareness initiatives promoting voluntary blood donations have ensured a steady supply of blood, necessitating the adoption of advanced processing equipment. Furthermore, the prevalence of blood disorders, such as anemia and hemophilia, continues to drive the demand for blood products, further boosting the market. Despite challenges like stringent regulatory compliance and high initial costs, the market's future outlook remains positive, with collaborative efforts and continuous innovations expected to drive sustained growth.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 42% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.46% |

| Revenue Forecast by 2033 | USD 95.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.02% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The devices segment accounted for the largest revenue share of 62% in 2023. Blood processing devices comprise a range of sophisticated equipment designed to handle various stages of blood processing, from collection to storage. These devices include automated blood component separation systems, centrifuges, blood bank refrigerators, and blood irradiation equipment. Automated systems are gaining prominence due to their ability to process large volumes of blood quickly and accurately, ensuring the efficient separation of blood components like red blood cells, plasma, and platelets. Centrifuges, on the other hand, are essential for separating blood components by density, while blood bank refrigerators are vital for preserving blood products at specific temperatures to maintain their integrity. Blood irradiation equipment is utilized for pathogen reduction, enhancing the safety of blood transfusions.

The consumables segment is expected to grow at the fastest CAGR of 7.66% during the forecast period. Blood processing consumables encompass a wide array of supplies required for collecting, testing, and storing blood. These include blood bags, blood collection tubes, needles, anticoagulants, and various reagents used in blood testing procedures. Blood bags, available in different sizes and configurations, serve as the primary containers for collected blood and its components. Blood collection tubes are designed to collect blood samples for diagnostic testing, and needles facilitate safe and efficient blood collection procedures. Anticoagulants are essential additives that prevent blood clotting, ensuring the preservation of blood samples for testing purposes. Reagents, such as enzymes and antibodies, are critical components used in blood typing and screening tests, providing accurate results for compatibility assessments prior to transfusions.

The other segment captured the maximum market share of 47% in 2023. The category of "Others" in the blood processing devices and consumables market includes a wide array of end users such as research institutions, biotechnology companies, and pharmaceutical firms. These entities utilize blood processing devices and consumables in various research applications, including drug development, clinical trials, and academic research. Blood-related research is crucial for understanding diseases, developing new therapies, and conducting experiments that advance medical knowledge. Therefore, the demand for specialized blood processing devices and high-quality consumables is substantial among these diverse entities. These end users often require customized solutions to meet their specific research needs, leading to a continuous demand for innovative and advanced blood processing products.

The diagnostic laboratories segment is expected to expand at the highest CAGR of 8.37% over the forecast period. Diagnostic laboratories are a cornerstone of the healthcare industry, providing critical information to healthcare providers for accurate diagnoses and treatment decisions. These laboratories perform a wide range of blood tests, including blood typing, infectious disease screening, and monitoring of various health parameters. Blood processing devices and consumables are indispensable tools for diagnostic laboratories, enabling them to process blood samples efficiently and accurately. Automated systems, centrifuges, blood collection tubes, and reagents are essential components of diagnostic laboratories, ensuring the precision and reliability of test results. With the increasing prevalence of diseases requiring regular monitoring, such as diabetes and cardiovascular conditions, diagnostic laboratories continue to experience a growing demand for blood processing devices and consumables. Additionally, advancements in diagnostic technologies have led to the development of innovative devices that enhance the speed and accuracy of blood tests, further driving the market in this segment.

North America dominated the market with largest revenue share of 42% in 2023. North America, particularly the United States, stands as a major market for blood processing devices and consumables. The region benefits from robust healthcare infrastructure, extensive research and development activities, and high healthcare expenditure. Stringent regulatory standards ensure the quality and safety of blood processing products, driving innovation within the industry. Additionally, the presence of key market players and the high prevalence of chronic diseases contribute significantly to market growth in this region.

Asia Pacific is anticipated to grow at the fastest CAGR of 8.47% during the forecast period. The Asia-Pacific region is witnessing rapid growth in the Blood Processing Devices and Consumables market. Developing countries like China and India are investing substantially in healthcare infrastructure, leading to increased demand for blood processing devices. The market in this region benefits from a large patient pool, rising prevalence of chronic diseases, and initiatives to improve healthcare accessibility. Moreover, the presence of emerging economies fosters collaborations between local manufacturers and international companies, encouraging market growth.

By Product

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blood Processing Devices And Consumables Market

5.1. COVID-19 Landscape: Blood Processing Devices And Consumables Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Blood Processing Devices And Consumables Market, By Product

8.1. Blood Processing Devices And Consumables Market, by Product, 2024-2033

8.1.1. Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Blood Processing Devices And Consumables Market, By End Use

9.1. Blood Processing Devices And Consumables Market, by End Use, 2024-2033

9.1.1. Hospitals and Clinics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Laboratories

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Blood Processing Devices And Consumables Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End Use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 11. Company Profiles

11.1. Biomerieux SA

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Abbott

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bio-Rad Laboratories, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BD.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. F. Hoffmann-La Roche Ltd

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Danaher

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Immucor, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. ThermoGenesis Holdings, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Grifols

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Terumo Corporation Haemonetics Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others