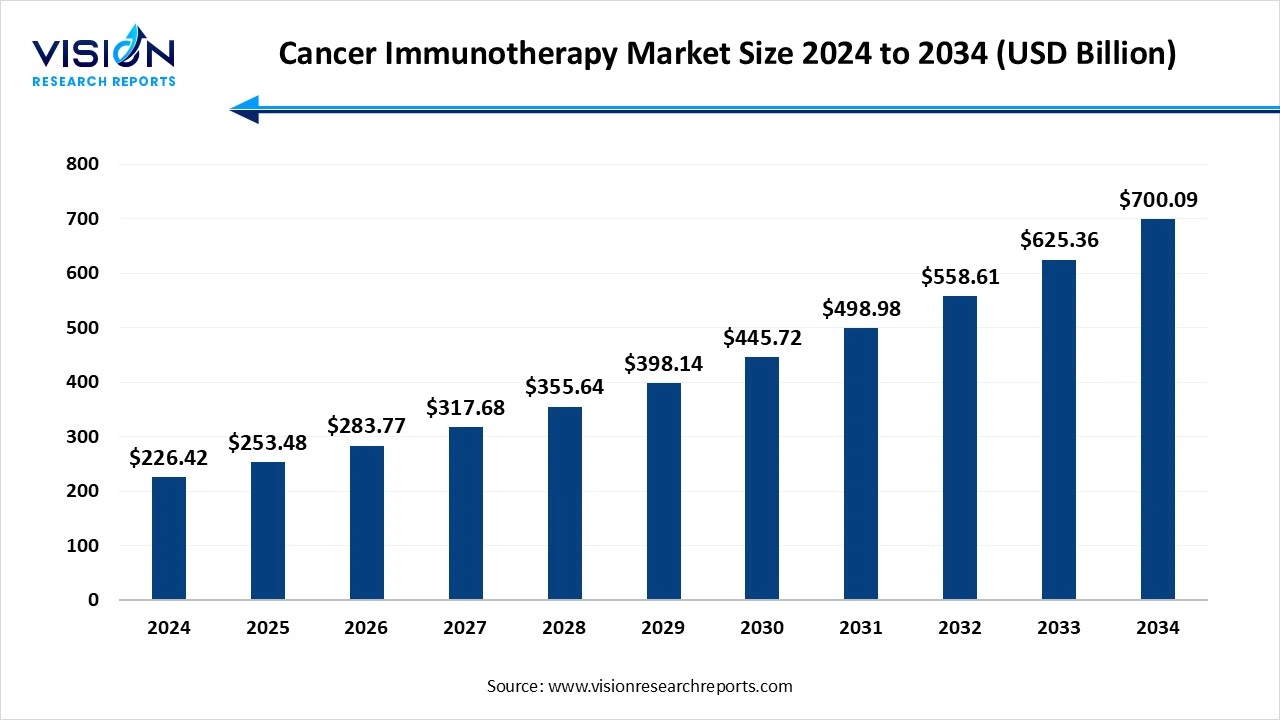

The global cancer immunotherapy market size stood at USD 226.42 billion in 2024 and is estimated to reach USD 253.48 billion in 2025. It is projected to hit USD 700.09 billion by 2034, registering a robust CAGR of 11.95% from 2025 to 2034. The cancer immunotherapy market is growing rapidly due to rising cancer prevalence, expanding approvals for targeted and personalized therapies, strong R&D pipelines, and increasing adoption across major cancers like lung and breast. Uptake is highest in hospitals and clinics, while digital and home-based care are boosting retail and online pharmacy demand.

In recent years, the landscape of cancer treatment has undergone a paradigm shift with the emergence of immunotherapy as a groundbreaking approach. Harnessing the power of the body's own immune system to combat cancer, immunotherapy has ushered in new hope for patients worldwide. This article provides a comprehensive overview of the cancer immunotherapy market, highlighting its key components, growth drivers, challenges, and future prospects.

The growth of the cancer immunotherapy market is driven by several factors. Firstly, the increasing prevalence of cancer globally fuels the demand for innovative treatment options, driving market expansion. Secondly, growing awareness among patients and healthcare professionals about the benefits of immunotherapy contributes to its adoption. Thirdly, advancements in biotechnology and genetic engineering enable the development of more effective and targeted immunotherapy treatments, driving research and investment in the field. Furthermore, the favorable regulatory environment for drug approvals facilitates the introduction of new immunotherapy drugs into the market. Overall, these factors collectively drive the growth of the cancer immunotherapy market, offering hope for improved outcomes and quality of life for cancer patients.

| Report Coverage | Details |

| Market Size in 2024 | USD 226.42 Billion |

| Revenue Forecast by 2034 | USD 700.09 Billion |

| Growth rate from 2025 to 2034 | CAGR of 11.95% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Pfizer Inc., AstraZeneca, Merck & Co., Inc., F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb Company, Novartis AG, Lilly, Johnson & Johnson Services, Inc., and Immunocore Ltd. |

The cancer immunotherapy market is primarily driven by the increasing adoption of highly targeted and personalized treatment approaches. Oncologists are rapidly turning to immune-based therapies that selectively detect and destroy cancer cells, resulting in improved treatment precision and clinical outcomes. This trend is boosting the demand for advanced modalities including checkpoint inhibitors, CAR-T cell therapies, monoclonal antibodies, and cancer vaccines. Deeper insights into tumor biology, coupled with strong survival benefits observed in clinical studies, continue to accelerate the uptake of precision immunotherapies across a wide range of cancer indications.

Despite strong expansion prospects, the market faces significant barriers due to high treatment costs. Immunotherapy often requires complex manufacturing workflows, specialized administration procedures, and continuous patient monitoring, contributing to substantial pricing challenges. In many regions, limited reimbursement coverage, uneven access to cutting-edge oncology centers, and financial constraints pose obstacles to broad adoption. These economic barriers may delay treatment initiation and hinder the scalability of advanced immunotherapies, especially in low- and middle-income countries.

The development of next-generation immunotherapy platforms represents a major growth opportunity. Promising innovations such as personalized neoantigen vaccines, engineered T-cell therapies, and combination immunotherapy regimens are showing potential to overcome resistance mechanisms, enhance patient response rates, and broaden treatment options for difficult-to-treat cancers. Increasing R&D investments, strong biotech collaboration activity, and favorable regulatory support are expected to accelerate commercialization, unlocking significant new market value in the coming years.

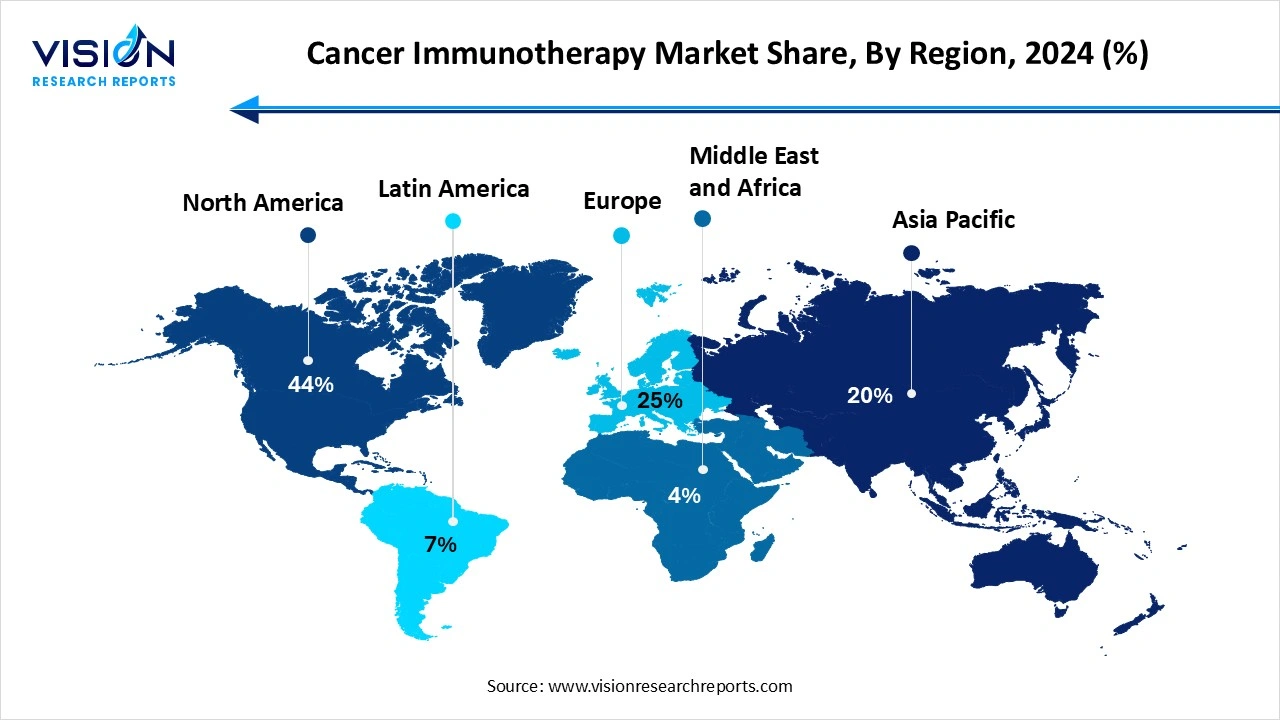

North America asserted its dominance in the market, capturing a significant 44% share in 2024. This stronghold is propelled by several factors, including increasing patient awareness, a high burden of disease, proactive government initiatives, technological advancements, and enhancements in healthcare infrastructure. Moreover, the presence of key industry players in this region significantly contributes to market growth. As reported by Elsevier Ltd. in April 2023, the US National Cancer Institute published its anticipated national cancer plan, outlining a roadmap and a call to action for enhancing all aspects of cancer care, from prevention and detection to diagnosis, treatment, and recovery.

Meanwhile, the Asia Pacific region is poised to witness the fastest compound annual growth rate (CAGR) in the global market. This growth trajectory is fueled by factors such as the burgeoning elderly population, a substantial number of patients with targeted diseases, and improvements in healthcare infrastructure. Additionally, the expansion of this region is facilitated by the increasing legal acceptance of immunotherapeutics. For instance, as per the MJH Life Sciences article published in November 2023, China's National Medical Products Administration approved durvalumab (Imfinzi) in combination with gemcitabine and cisplatin for frontline use in adult patients with locally advanced or metastatic biliary tract cancer, further underscoring the region's growth potential.

The monoclonal antibodies segment emerged as the leader in the market, capturing the largest revenue share of 65% in 2024. The increased investment in Research and Development (R&D) of monoclonal antibodies, including bispecific antibodies, conjugated monoclonal antibodies, and naked antigen binding antibodies, has paved the way for growth opportunities within the oncology therapeutics sector. Modern monoclonal antibodies are specifically engineered to confer adaptive immunity, antibody-dependent cellular toxicity, and antigen specificity, making them a focus of extensive research for their therapeutic potential against various cancer types.

Meanwhile, the oncolytic viral therapies and cancer vaccines segment is poised for significant market growth in the forecast period. The development of cancer vaccines, while facing obstacles such as the lack of immunogenicity and immunosuppressive effects within the tumor microenvironment, holds promise for addressing unmet medical needs. According to the American Association for Cancer Research in June 2023, the US Food and Drug Administration has approved only a limited number of therapeutic vaccines.

In 2024, the hospital pharmacy segment emerged as the dominant force in the market. This dominance is attributed to the escalating demand for immunotherapies within hospital settings, coupled with a surge in hospitalizations due to the rising incidence of cancer. Particularly, the challenges associated with cancer treatment and the higher prevalence of patients aged over 65 years have contributed to an increased rate of hospital admissions among cancer patients. Consequently, the Hospital Pharmacy segment commands a significant share of the market, reflecting its substantial presence.

Meanwhile, the online pharmacy segment is poised for remarkable growth, projected to register a substantial compound annual growth rate (CAGR) throughout the forecast period. Several factors underpin this anticipated growth, notably the increasing demand for internet-based pharmacy services. This surge is fueled by factors such as the expanding reach of the internet, a rising adoption of telemedicine practices, and the widespread utilization of technology for healthcare purposes, all of which enhance convenience and time efficiency for consumers.

The lung cancer segment commanded the largest revenue share in 2024. This dominance is fueled by several key factors including the rising prevalence of lung malignancies, heightened awareness programs, increased adoption of immunotherapy, and a robust pipeline of investigational candidates. Additionally, the segment's growth is propelled by the continuous influx of product approvals and launches. For example, in November 2023, the US Food and Drug Administration (FDA) granted marketing authorizations to Augtyro (Bristol, Inc.) for the treatment of locally refractory or metastatic Non-Small Cell Lung Cancer (NSCLC) with Repotrectinib.

On the other hand, the Breast Cancer segment is poised to register a significant compound annual growth rate (CAGR) over the forecast period. This projection is driven by factors such as the high prevalence of the disease, ongoing research and development endeavors, and substantial investments by key industry players to introduce novel therapeutics for breast malignancies. Notably, in November 2023, AstraZeneca received FDA approval for their breast cancer drug capivasertib in combination with fulvestrant, further underscoring the segment's growth prospects.

The hospitals & clinics segment held the largest revenue share in 2024. This dominance can be attributed to several factors, including the increasing incidence of diseases, higher treatment rates, heightened awareness, improved diagnosis of malignancies, and the availability of immunotherapies in a large number of hospitals. The adoption of immunotherapies by hospitals for cancer treatment is particularly noteworthy. According to an article published by the National Cancer Institute in April 2023, 25% of patients in the United States passed away in a hospital setting, with 62% being hospitalized at least once during the last month of life for cancer treatments.

Meanwhile, the Cancer Research Centers segment is expected to witness a significant compound annual growth rate (CAGR) over the forecast period. This growth trajectory is driven by increased research on cancer and supportive activities conducted by governmental or national organizations in the form of grant funding, aimed at stimulating demand. As reported by Becker's Healthcare in November 2023, Texas Oncology recently unveiled its Amarillo Comprehensive Cancer Center, representing a substantial investment of USD 150 million. This state-of-the-art facility is poised to advance cancer care by offering comprehensive services in the Amarillo region, thereby boosting the market.

By Product

By Application

By Distribution Channel

By End Use

By Region

Cancer Immunotherapy Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cancer Immunotherapy Market

5.1. COVID-19 Landscape: Cancer Immunotherapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cancer Immunotherapy Market, By Product

8.1. Cancer Immunotherapy Market, by Product

8.1.1. Monoclonal Antibodies

8.1.1.1. Market Revenue and Forecast

8.1.2. Immunomodulators

8.1.2.1. Market Revenue and Forecast

8.1.3. Oncolytic Viral Therapies & Cancer Vaccines

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Cancer Immunotherapy Market, By Application

9.1. Cancer Immunotherapy Market, by Application

9.1.1. Lung Cancer

9.1.1.1. Market Revenue and Forecast

9.1.2. Breast Cancer

9.1.2.1. Market Revenue and Forecast

9.1.3. Colorectal Cancer

9.1.3.1. Market Revenue and Forecast

9.1.4. Melanoma

9.1.4.1. Market Revenue and Forecast

9.1.5. Prostate Cancer

9.1.5.1. Market Revenue and Forecast

9.1.6. Head & Neck Cancer

9.1.6.1. Market Revenue and Forecast

9.1.7. Ovarian Cancer

9.1.7.1. Market Revenue and Forecast

9.1.8. Pancreatic Cancer

9.1.8.1. Market Revenue and Forecast

9.1.9. Others

9.1.9.1. Market Revenue and Forecast

Chapter 10. Global Cancer Immunotherapy Market, By Distribution Channel

10.1. Cancer Immunotherapy Market, by Distribution Channel

10.1.1. Hospital Pharmacy

10.1.1.1. Market Revenue and Forecast

10.1.2. Retail Pharmacy

10.1.2.1. Market Revenue and Forecast

10.1.3. Online Pharmacy

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Cancer Immunotherapy Market, By End Use

11.1. Cancer Immunotherapy Market, by End Use

11.1.1. Hospitals & Clinics

11.1.1.1. Market Revenue and Forecast

11.1.2. Cancer Research Centers

11.1.2.1. Market Revenue and Forecast

11.1.3. Others

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Cancer Immunotherapy Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Distribution Channel

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Distribution Channel

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Distribution Channel

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Distribution Channel

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Distribution Channel

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Distribution Channel

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Distribution Channel

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Distribution Channel

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Distribution Channel

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Distribution Channel

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Distribution Channel

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Distribution Channel

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Distribution Channel

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Distribution Channel

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Distribution Channel

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Distribution Channel

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Distribution Channel

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Distribution Channel

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Distribution Channel

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Pfizer Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AstraZeneca

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Merck & Co., Inc

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Bristol-Myers Squibb Company

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Novartis AG

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Abbott

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Lilly

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Johnson & Johnson Services, Inc

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Immunocore, Ltd

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others