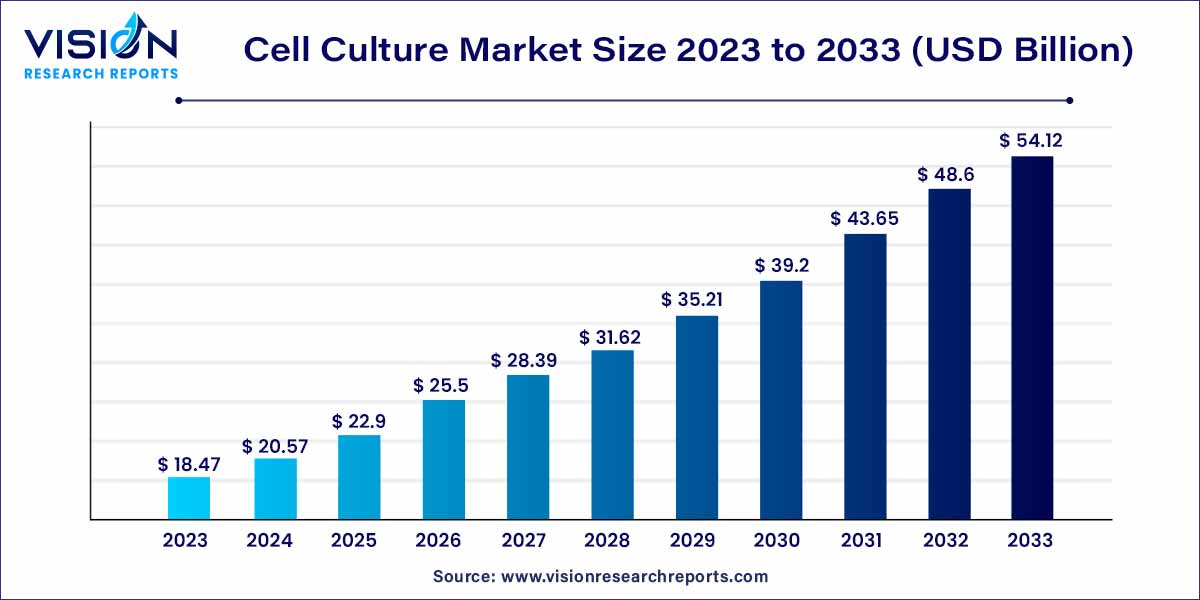

The global cell culture market size was valued at USD 18.47 billion in 2023 and it is predicted to surpass around USD 54.12 billion by 2033 with a CAGR of 11.35% from 2024 to 2033. The cell culture market is driven by an increasing demand for biopharmaceuticals, rising research and development (r&d) expenditure, and growing biotechnology and biopharmaceutical industries.

The cell culture market has emerged as a critical component within the realm of biotechnology and pharmaceutical research. This dynamic sector plays a pivotal role in advancing scientific understanding, drug development, and therapeutic innovations. This overview aims to shed light on the key aspects of the cell culture market, including its growth drivers, challenges, and the evolving landscape.

The cell culture market is experiencing robust growth propelled by several key factors. Firstly, the escalating demand for biopharmaceuticals, driven by a focus on personalized medicine and biologics, has significantly contributed to the expansion of the market. Technological advancements, including innovations in 3D cell culture and perfusion systems, have enhanced the efficiency and reproducibility of cell-based assays, fostering market growth. Moreover, increased investments in research and development, particularly in regenerative medicine and stem cell research, have led to the introduction of novel products and methodologies. These growth factors collectively underscore the pivotal role of the cell culture market in advancing scientific research, drug development, and therapeutic innovations.

In 2023, the consumables segment held the predominant market share at 58% and is anticipated to experience noteworthy growth throughout the forecast period. This can be attributed primarily to the continuous demand for consumables and frequent procurement. A key factor fueling the growth of this segment is the escalated research and development spending by biotechnology and biopharmaceutical enterprises, especially in the development of advanced biologics like monoclonal antibodies and vaccines. The demand for consumables, including reagents, media, and sera, is projected to remain high in the foreseeable future.

Within the consumables segment, cell culture media emerged as the dominant category, constituting 46% of the market in 2023. The surge in research and development investments, the expanding life sciences sector—particularly in biopharmaceutical products—and the overall growth of the biotechnology industry significantly contribute to the rise of the media market. Additionally, the growing interest in stem cells and their evolving applications in biotechnological research are poised to be key drivers for the continued expansion of this market.

In 2023, the biopharmaceutical production application segment asserted its dominance in the market, securing a substantial revenue share of 33%. The prominence of cell culture techniques in biopharmaceutical applications is expected to grow, driven by the utilization of mammalian cell lines, including the Chinese hamster ovary, for the production of biopharmaceuticals. This surge is further propelled by an increasing demand for alternative medicines. Noteworthy innovations in grafting procedures and the emergence of new alternatives in personalized therapy have expanded the potential of the biopharmaceutical domain.

Concurrently, the diagnostics segment is poised for rapid growth, projected to achieve the highest Compound Annual Growth Rate (CAGR) of 14.32% from 2024 to 2033. Cell cultures find significant utility in metabolomics, facilitating the identification of biomarkers indicative of pathologically relevant conditions. Moreover, metabolites play a pivotal role in cancer diagnosis and recurrence assessment, thereby amplifying the application scope of cell culture media products in disease diagnosis.

In 2023, North America claimed the largest market share at 36%, a position attributed to the well-established pharmaceutical and biotech sectors in the region, particularly the utilization of technologically advanced solutions in the United States. The prevalence of extensive cell therapy research initiatives conducted by numerous universities has also contributed to the substantial market for cell culture technologies. This demand is further accentuated by the growing incidence of chronic and infectious diseases, driving the need for cell culturing technologies in both research and clinical applications.

Contrastingly, the Asia Pacific region is anticipated to exhibit the most rapid CAGR of 13.81% throughout the forecast period. This growth is fueled by increasing healthcare expenditure, a heightened awareness of cell and gene therapies, and significant potential for clinical research applications. The region's adoption of scientific technologies and its embrace of emerging therapeutics, including regenerative medicines and cancer immunotherapies, are expected to fortify its growth trajectory in the foreseeable future.

By Product

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others