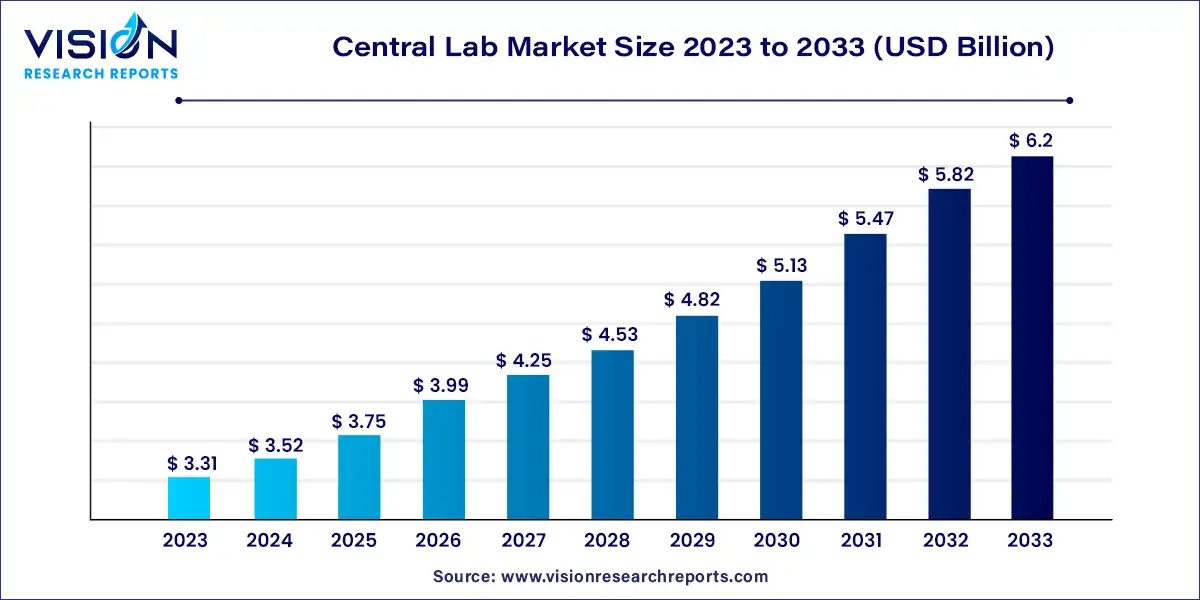

The global central lab market was estimated to be at USD 3.31 billion in 2023, which is expected to grow with a CAGR of 6.47% and reach USD 6.2 billion by 2033.

In the healthcare, central laboratories play a pivotal role in facilitating diagnostic testing, clinical trials, and research endeavors. As the demand for advanced healthcare solutions continues to escalate, understanding the landscape of the central lab market becomes paramount.

The growth of the central lab market is propelled by various factors contributing to its expansion and evolution. One significant driver is the increasing prevalence of chronic diseases worldwide, necessitating robust diagnostic capabilities to facilitate early detection and effective management. Additionally, the rising adoption of personalized medicine is fueling demand for specialized laboratory services tailored to individual patient profiles. Moreover, the expanding pharmaceutical and biotechnology sectors, coupled with a surge in clinical research activities, are driving the need for comprehensive testing solutions to support drug development and regulatory compliance. Furthermore, advancements in laboratory automation, molecular diagnostics, and data analytics are enhancing efficiency and accuracy in testing processes, thereby driving market growth.

In 2023, biomarker services dominated the market with a significant share of 39%. Biomarkers offer a promising avenue for clinical development programs, enabling the exploration of new diagnostic pathways and understanding disease mechanisms to enhance therapeutic development. These studies play a crucial role in early disease detection, assessing the risk of side effects associated with investigational therapies, and tracking disease progression in clinical trial participants. Market players are increasingly expanding their biomarker service offerings to consolidate their market presence.

The genetic services segment is expected to witness the highest growth rate, with a projected CAGR of 7.68% over the forecast period. This growth is fueled by the growing importance of genetic analysis in clinical research. Understanding genetic factors underlying various diseases, including cancer and hereditary conditions, is crucial for developing targeted therapies. Additionally, genetic variations affecting drug metabolism pathways can influence individual responses to treatment. The rise in research endeavors focusing on genetic testing is expected to drive the demand for central lab genetic services in the coming years. For instance, in December 2022, the Cystic Fibrosis Foundation Therapeutics Lab announced initiatives to support the development of genetic-based therapies for individuals affected by cystic fibrosis.

In 2023, the pharmaceutical companies' end-use segment commanded the largest market share, accounting for 46% of the market. Pharmaceutical companies heavily rely on central laboratory service providers to assess the efficacy of their new drug products. These service providers offer a wide range of tests including biochemistry, hematology, histopathology, immunology, endocrinology, microbiology, real-time PCR, and clinical pathology for the evaluation of investigational drugs. Leading central lab service providers such as Covance, Celerion, Altasciences, NorthEast BioAnalytical Laboratories LLC, and Shanghai Medicilon offer comprehensive preclinical and clinical trial services to pharmaceutical companies to facilitate the completion of clinical trials.

The biotechnology companies segment is poised to exhibit the fastest growth rate in the market, with a projected CAGR of 7.12% over the forecast period. The market is anticipated to be driven by an increase in activities related to the development of biological therapies in the coming years. By 2025, the U.S. FDA is expected to approve 10 to 20 cell and gene therapy products annually. In response to the growing demand for these therapies, the market for cell and gene therapy-related services, encompassing contract development and manufacturing, analytical testing, and regulatory consulting, is experiencing rapid expansion. Moreover, Pace Analytical has bolstered its capabilities to support gene therapy projects by investing in advanced analytical equipment, including capillary electrophoresis, Ultrapressure Liquid Chromatography (UPLC), large-molecule time-of-flight mass spectroscopy, and microplate readers.

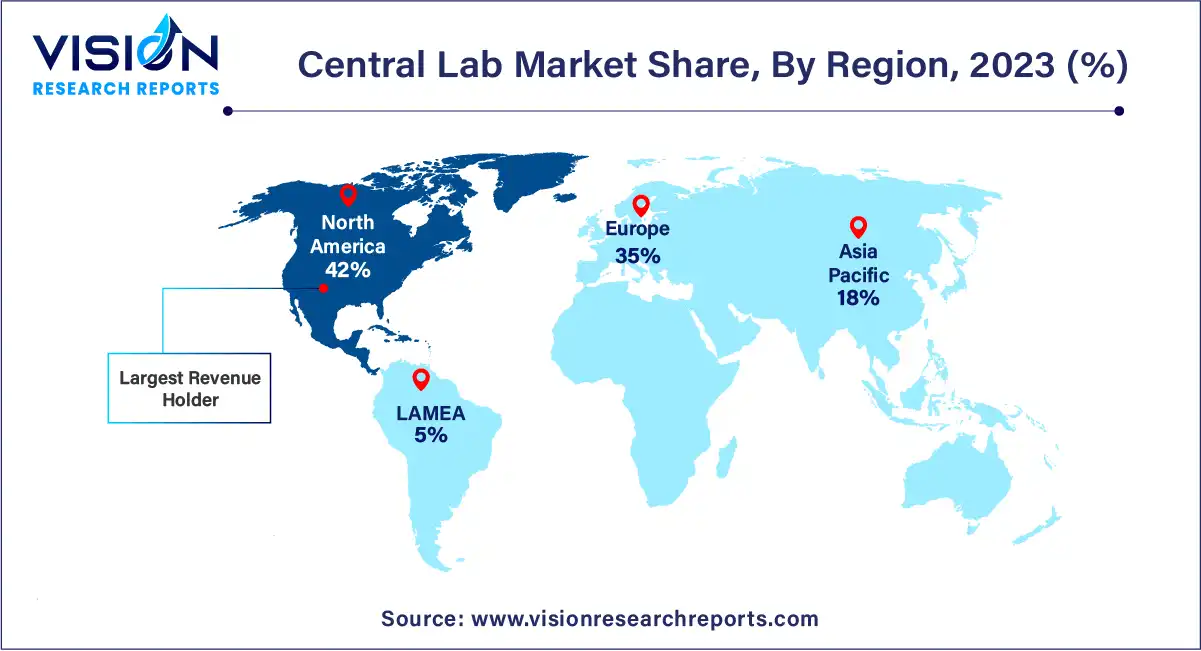

In 2023, North America emerged as the dominant market leader, commanding a share of 42%. The region's market growth is driven by the widespread adoption of molecular testing, known for its high accuracy, sensitivity, and specificity. Additionally, the high prevalence of infections such as Sexually Transmitted Infections (STIs) and tuberculosis in North America is expected to fuel demand for clinical research aimed at developing diagnostic devices and therapeutics. For instance, according to the CDC, as of March 2022, the U.S. anticipates over 20 million new cases of STIs annually, incurring an estimated annual cost of USD 10–USD 17 billion. This prevalence is projected to further increase. Furthermore, major players in the industry are actively expanding their presence in clinical development. For example, in July 2022, LabCorp announced the establishment of a spin-off company dedicated to enhancing Contract Research Organization (CRO) capabilities, underscoring the region's growth potential.

Asia Pacific is forecasted to experience the fastest market growth, with a projected CAGR of 7.76% over the forecast period, primarily due to the rising adoption of central lab services across the region. China and India are emerging as promising business hubs for clinical testing and service providers. Moreover, factors such as urbanization, increasing disposable income, growing awareness about disease prevention, and improvements in education are expected to drive market expansion in the region. Notably, countries like Australia, China, Korea, and Taiwan already have established healthcare reimbursement systems that cover diagnostic tests. Additionally, increased government support is creating opportunities for drug development companies. For instance, in September 2019, the Ministry of Food and Drug Safety in South Korea announced a 5-year plan aimed at advancing clinical trials management by 2023, further enhancing the region's prospects for clinical research and development.

By Services

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others