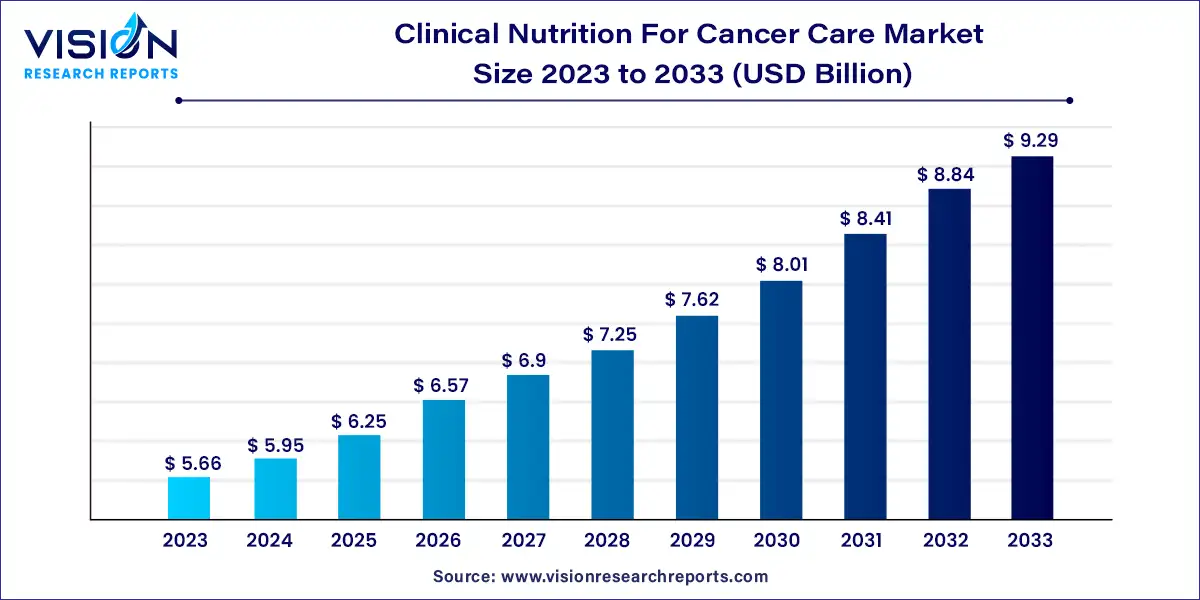

The global clinical nutrition for cancer care market size was estimated at around USD 5.66 billion in 2023 and it is projected to hit around USD 9.29 billion by 2033, growing at a CAGR of 5.08% from 2024 to 2033.

The clinical nutrition for cancer care market is witnessing significant growth as healthcare providers increasingly recognize the crucial role of nutrition in supporting cancer treatment outcomes.

The growth of the clinical nutrition for cancer care market is driven by the rising prevalence of cancer worldwide is driving demand for specialized nutritional interventions to support patients throughout their treatment journey. Additionally, advancements in medical nutrition therapy and the development of innovative nutritional products tailored to the unique needs of cancer patients are contributing to market expansion. Moreover, increasing awareness among healthcare professionals about the critical role of nutrition in cancer care is leading to greater adoption of evidence-based nutrition interventions, further driving market growth. Furthermore, the growing trend towards personalized medicine and multidisciplinary approaches to cancer treatment is creating opportunities for the development of customized nutrition plans that can optimize treatment outcomes and improve patient quality of life.

In 2023, oral clinical nutrition emerged as the dominant force in the market, commanding over 45% of the market share. These orally administered nutrition products specifically target cancer-related malnutrition, which stems from metabolic dysregulation and anorexia induced by both the tumor and its treatment. Their pivotal role lies in improving the quality of life for cancer patients by thwarting malnutrition, mitigating complications, and enhancing clinical outcomes. Additionally, these products are formulated to address common taste and smell alterations experienced by patients undergoing systemic antitumor therapy. Furthermore, their ease of consumption makes them highly suitable for patients who possess the ability to eat but face malnutrition or are at risk of it.

Looking ahead, the parenteral nutrition segment is poised for rapid growth during the forecast period. Parenteral nutrition assumes critical significance in cancer care due to the high prevalence of malnutrition among patients. Malnutrition not only leads to muscle depletion but also diminishes treatment response and overall quality of life. Hence, parenteral nutrition administers vital nutrients directly into the bloodstream, bypassing the digestive system. This method effectively slows down protein breakdown and reverses protein loss in organs, thereby potentially amplifying treatment outcomes.

In 2023, adults dominated the segment, commanding over 81% of the market revenue share, and are projected to experience the most rapid growth throughout the forecast period. This trend is primarily driven by the prevalent occurrence of malnutrition among adult cancer patients. Clinical nutrition interventions have the potential to mitigate protein degradation and combat organ protein loss, ultimately leading to potential improvements in treatment outcomes. Furthermore, the implementation of clinical nutrition strategies is carefully tailored to each patient, taking into account their unique health circumstances and nutritional requirements.

According to the CDC, approximately 58% of cancer cases are diagnosed in adults aged 65 years or older. To address their specific nutritional needs, there has been a notable surge in the introduction of new oncology nutrition products. These products are specifically formulated to assist patients in managing diseases and coping with the side effects of treatment. Moreover, there is a growing recognition of the critical role of nutrition in cancer care, with increasing emphasis placed on its impact on patient health and well-being. This concerted effort includes the collaborative design of cancer nutrition care pathways, which is expected to further drive market growth.

In 2023, institutional sales emerged as the frontrunner in market revenue, commanding over 41% share. These institutions encompass government organizations, hospitals, and research institutes. With the escalating prevalence of cancer, there's a growing imperative for heightened nutritional support, precipitating a surge in clinical nutrition sales within hospital settings. Recent healthcare reforms have exerted pressure on hospitals to deliver cost-efficient, high-quality care, thereby fueling the demand for clinical nutrition products. Essentially, the robust demand for clinical nutrition for cancer care, combined with the expanding influence of hospitals and the intricacies of healthcare systems, elucidates why hospitals and institutional sales dominate clinical nutrition sales.

Meanwhile, the online sales segment is poised for the fastest growth over the forecast period. Advancements in telemedicine have facilitated the global dissemination of clinical nutrition products, enabling manufacturers to broaden their market outreach and cater to underserved communities. Consequently, online sales have experienced a notable upsurge owing to the mounting customer demand for medical foods tailored to address nutrition-based deficiencies in cancer patients.

North America asserted its dominance in the market by capturing nearly 35% of the revenue share in 2023, and is poised to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. Diseases such as esophageal cancer, gastric cancer, head & neck cancer, and laryngeal cancer often impede oral food intake in patients. The escalating prevalence of these conditions is anticipated to propel the demand for enteral and parenteral nutrition solutions in the region.

In 2023, Europe emerged as the second-largest regional market for clinical nutrition for cancer care. The region has proposed evidence-based recommendations concerning the organization of food catering, prescriptions, and indications of diets, as well as the monitoring of food intake at hospitals, rehabilitation centers, and nursing homes. The burgeoning healthcare expenditure in Europe is expected to drive technological advancements in the healthcare sector, thereby boosting the parenteral nutrition market in the region. Additionally, favorable reimbursement policies, increasing government investments in long-term healthcare, and enhancements in healthcare research infrastructure are anticipated to augment the utilization rates of parenteral nutrition over the next seven years.

By Product

By Stage

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clinical Nutrition for Cancer Care Market

5.1. COVID-19 Landscape: Clinical Nutrition for Cancer Care Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clinical Nutrition for Cancer Care Market, By Product

8.1. Clinical Nutrition for Cancer Care Market, by Product, 2024-2033

8.1.1 Oral Nutrition

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Parenteral Nutrition

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Enteral Feeding Formulas

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Clinical Nutrition for Cancer Care Market, By Stage

9.1. Clinical Nutrition for Cancer Care Market, by Stage, 2024-2033

9.1.1. Stage

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Pediatric

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Clinical Nutrition for Cancer Care Market, By Sales Channel

10.1. Clinical Nutrition for Cancer Care Market, by Sales Channel, 2024-2033

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Retail

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Institutional Sales

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Clinical Nutrition for Cancer Care Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Stage (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Stage (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Stage (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Stage (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Stage (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Stage (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Stage (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Stage (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Stage (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Stage (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Stage (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Abbott Nutrition.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Pfizer Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bayer AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nestle Health Science S.A.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. GlaxoSmithKline plc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Baxter International Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Otsuka Holdings Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mead Johnson & Company, LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Danone Nutricia.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Victus, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others