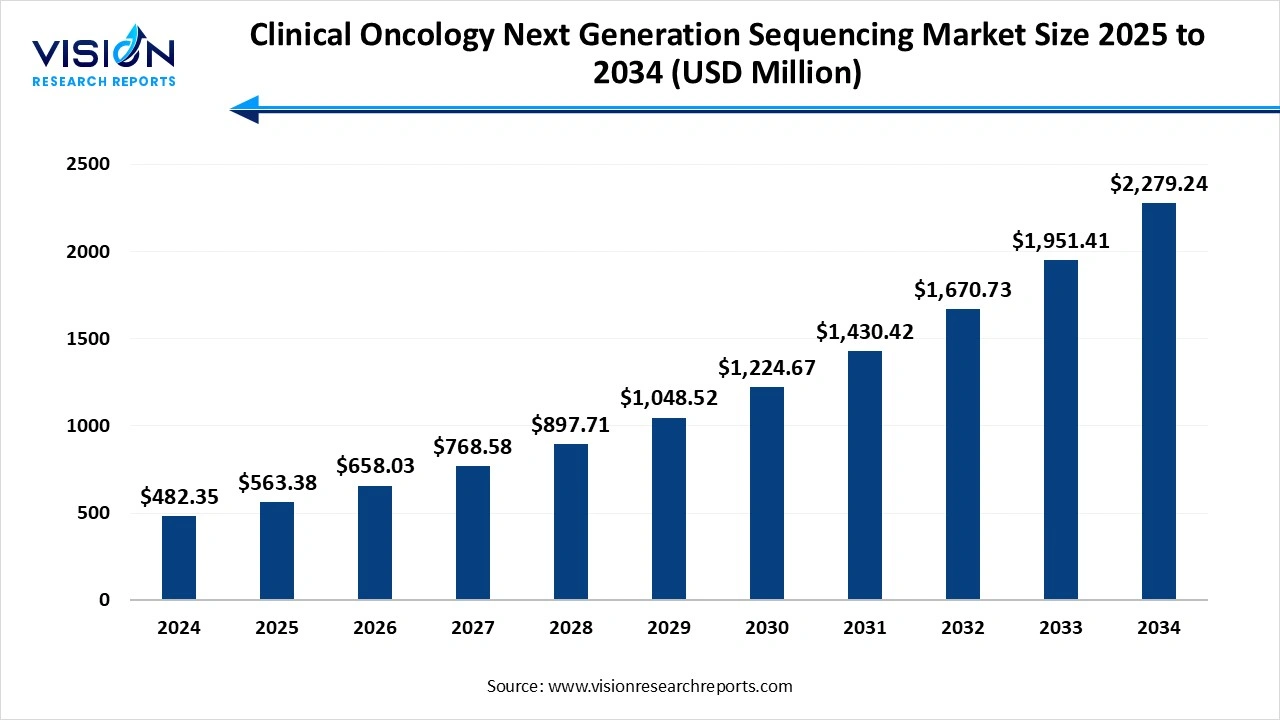

The global clinical oncology next generation sequencing market size was valued at USD 482.35 million in 2024 and it is projected to hit around USD 2,279.24 million by 2034, growing at a CAGR of 16.8% from 2025 to 2034. The market growth is driven by the increasing prevalence of cancer and the growing demand for personalized medicine, the clinical oncology next generation sequencing (NGS) market is experiencing significant growth.

| Report Coverage | Details |

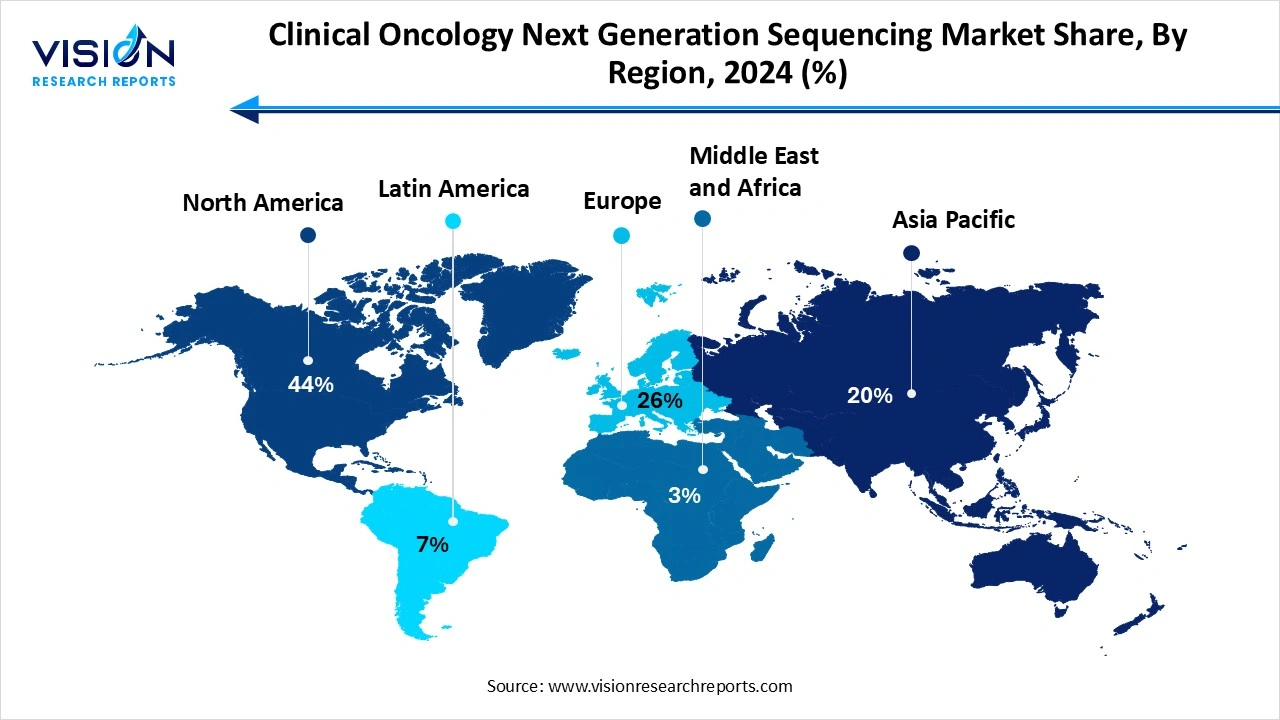

| Revenue Share of North America in 2022 | 44% |

| Revenue Forecast by 2034 | USD 2,279.24 million |

| Growth Rate from 2025 to 2034 | CAGR of 16.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Illumina, Inc., Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Agilent Technologies, Myriad Genetics, Perkin Elmer; Pacific Bioscience, Oxford Nanopore Technologies Ltd., Eurofins Scientific S.E., Qiagen N.V. |

The Clinical Oncology Next Generation Sequencing (NGS) market has emerged as a transformative force in cancer diagnostics and personalized medicine. This market is driven by the increasing demand for precise, efficient, and comprehensive genomic profiling in oncology. NGS technologies enable the identification of genetic mutations, alterations, and biomarkers associated with various cancer types, allowing for tailored treatment strategies and improved patient outcomes. The growing prevalence of cancer worldwide, coupled with advancements in sequencing technologies and a shift toward precision medicine, is fueling market growth. Additionally, increasing investments in cancer genomics research, the rising adoption of companion diagnostics, and supportive government initiatives further contribute to the expansion of this market.

Several key factors are contributing to the robust growth of the Clinical Oncology Next Generation Sequencing (NGS) market. One of the primary drivers is the increasing global burden of cancer, which has led to a growing need for advanced diagnostic tools that can offer deeper insights into tumor genetics. NGS technology allows for high-throughput sequencing, enabling the detection of multiple genetic alterations simultaneously with greater accuracy and speed. This capability is essential for identifying actionable mutations and guiding targeted therapies, which are becoming increasingly important in personalized oncology.

Another significant growth factor is the expanding role of precision medicine and companion diagnostics in oncology. Pharmaceutical companies are increasingly collaborating with diagnostic firms to develop NGS-based companion diagnostics that can predict patient response to specific cancer therapies. This trend is supported by favorable regulatory frameworks and increased funding for genomic research by public and private institutions.

Despite its promising potential, the Clinical Oncology Next Generation Sequencing (NGS) market faces several key challenges. One of the most significant barriers is the complexity of data interpretation. NGS generates vast amounts of genomic data, and accurately analyzing and translating this information into actionable clinical insights requires advanced bioinformatics tools and skilled professionals. Many healthcare institutions, especially in developing regions, lack the infrastructure and expertise to manage and interpret such complex data effectively. This can lead to delays in diagnosis and treatment decisions, reducing the overall efficiency and clinical value of NGS-based testing.

Another major challenge is the high cost associated with NGS testing and the limited reimbursement coverage in many healthcare systems. While sequencing costs have decreased over time, the total expense including sample preparation, data analysis, and reporting remains a concern for widespread adoption, particularly in resource-limited settings. Additionally, regulatory hurdles and standardization issues continue to impact the market, as variations in testing protocols and quality assurance can affect the reliability and consistency of results.

North America led the global clinical oncology next-generation sequencing market, accounting for the largest revenue share of 44% in 2024. The United States, in particular, is a major contributor to regional dominance due to the strong presence of key industry players, government-funded genomic research initiatives, and the increasing use of NGS-based companion diagnostics in clinical oncology. Favorable reimbursement policies and the integration of precision medicine into mainstream cancer care further support the expansion of NGS applications in the region. The Asia Pacific clinical oncology NGS market is projected to experience the fastest growth, registering a CAGR of 18.29% over the forecast period. The Asia Pacific region is expected to witness the fastest growth over the forecast period, fueled by rising cancer incidence, improving healthcare infrastructure, and increasing investments in genomic research and diagnostic technologies. Countries like China, Japan, and India are accelerating their adoption of NGS through government-backed health initiatives and a surge in private sector participation.

The Asia Pacific clinical oncology NGS market is projected to experience the fastest growth, registering a CAGR of 18.29% over the forecast period. The Asia Pacific region is expected to witness the fastest growth over the forecast period, fueled by rising cancer incidence, improving healthcare infrastructure, and increasing investments in genomic research and diagnostic technologies. Countries like China, Japan, and India are accelerating their adoption of NGS through government-backed health initiatives and a surge in private sector participation.

The targeted sequencing and resequencing segment accounted for the largest market share, reaching 65% in 2024. This approach is widely adopted in oncology diagnostics as it enables clinicians to focus on known cancer-related genes, reducing the complexity and data burden compared to whole genome sequencing. By narrowing the sequencing scope, targeted panels allow for faster turnaround times and streamlined data analysis, making them ideal for routine clinical use. This has made targeted sequencing a preferred choice for identifying actionable mutations that guide personalized cancer treatment, monitor disease progression, and assess treatment resistance.

The whole-genome sequencing (WGS) is projected to be the fastest-growing segment, registering a CAGR of 18.4% from 2025 to 2034. While it remains less commonly used in routine diagnostics due to its higher cost and data complexity, it is gaining traction in translational oncology research and complex case evaluations. WGS enables the discovery of novel mutations, rare variants, and structural alterations that might be missed by targeted approaches. As sequencing technologies advance and bioinformatics tools become more sophisticated, the integration of WGS in clinical workflows is expected to rise, particularly in comprehensive tumor profiling and the development of personalized cancer therapies.

The NGS sequencing segment held the largest revenue share of 57% in 2024. This stage involves crucial steps including sample collection, DNA/RNA extraction, quantification, and library preparation. The effectiveness of the pre-sequencing process directly impacts the quality of sequencing output, as improper handling or preparation of samples can lead to erroneous results or failed runs. In clinical oncology, where precision is vital, standardized and automated pre-sequencing protocols are increasingly being adopted to improve throughput, reduce variability, and ensure consistency across tests.

The NGS data analysis segment in the clinical oncology NGS market is projected to witness a notable CAGR of 16.1% over the forecast period. This stage involves interpreting vast amounts of genomic data to identify clinically relevant mutations and variations that may guide cancer treatment. Data analysis includes sequence alignment, variant calling, annotation, and clinical interpretation. The complexity of this process requires robust bioinformatics pipelines and specialized software tools capable of managing large datasets efficiently and accurately. As personalized oncology grows, the need for intuitive, AI-driven data analysis platforms is increasing, allowing clinicians to extract actionable insights in a shorter time frame. Ensuring data accuracy, minimizing interpretation errors, and integrating findings with clinical decision support systems are key objectives in this segment, which continues to evolve with the integration of machine learning algorithms and cloud-based solutions.

The companion diagnostics accounted for the largest market share, contributing 72% of the total revenue in 2024. This application is critical in guiding oncologists to select the most effective treatment options based on a patient’s unique genetic profile, thereby improving therapeutic outcomes and minimizing adverse effects. The integration of companion diagnostics into clinical practice is being fueled by increasing collaborations between pharmaceutical companies and diagnostic firms, which aim to co-develop targeted drugs alongside validated diagnostic tools. Regulatory support and approvals for NGS-based companion diagnostics are also accelerating their adoption in oncology, particularly for cancers such as non-small cell lung cancer, breast cancer, and colorectal cancer, where targeted therapies are becoming standard treatment options.

The screening application segment in the clinical oncology NGS market is projected to witness a notable CAGR of 12.6% over the forecast period NGS enables the identification of genetic mutations and alterations at an early stage, often before symptoms appear, allowing for timely intervention and more effective disease management. This application is particularly useful in high-risk populations or individuals with a family history of cancer, where genetic screening can help in assessing predisposition to certain cancer types. Technological advancements in sequencing accuracy, combined with the development of non-invasive testing methods such as liquid biopsies, have further strengthened the potential of NGS in cancer screening.

The laboratories accounted for the largest share of the market, generating 64% of the total revenue in 2024. Equipped with advanced sequencing platforms, bioinformatics infrastructure, and trained personnel, laboratories handle critical stages of the NGS workflow from sample processing and sequencing to data interpretation and reporting. Their ability to manage high throughput testing and maintain quality standards makes them vital to supporting large-scale oncology research and clinical diagnostics. As demand for personalized medicine continues to rise, many laboratories are expanding their NGS capabilities to offer comprehensive genomic profiling services that help oncologists tailor treatments to individual patients.

The clinics in the end-use segment of the clinical oncology NGS industry are anticipated to record the highest CAGR of 19.22% throughout the forecast period. With advancements in sequencing technology and the availability of more compact and user-friendly platforms, NGS is increasingly being implemented at the clinical level to support on-site cancer diagnostics. Clinics utilize NGS to assess tumor profiles, identify actionable mutations, and recommend targeted therapies, particularly in cases where traditional diagnostic approaches may fall short. The ability to provide point-of-care genomic testing enhances patient access to precision oncology services and reduces the time between diagnosis and treatment initiation. As the field of oncology moves toward more personalized and data-driven care models, clinics are expected to play a larger role in the decentralized delivery of NGS-based diagnostics, particularly in community and outpatient settings.

By Technology

By Workflow

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clinical Oncology Next Generation Sequencing Market

5.1. COVID-19 Landscape: Clinical Oncology Next Generation Sequencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clinical Oncology Next Generation Sequencing Market, By Technology

8.1. Clinical Oncology Next Generation Sequencing Market, by Technology

8.1.1. Whole Genome Sequencing

8.1.1.1. Market Revenue and Forecast

8.1.2. Whole Exome Sequencing

8.1.2.1. Market Revenue and Forecast

8.1.3. Targeted Sequencing & Resequencing

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Clinical Oncology Next Generation Sequencing Market, By Workflow

9.1. Clinical Oncology Next Generation Sequencing Market, by Workflow

9.1.1. NGS Pre-Sequencing

9.1.1.1. Market Revenue and Forecast

9.1.2. NGS Sequencing

9.1.2.1. Market Revenue and Forecast

9.1.3. NGS Data Analysis

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Clinical Oncology Next Generation Sequencing Market, By Application

10.1. Clinical Oncology Next Generation Sequencing Market, by Application

10.1.1. Screening

10.1.1.1. Market Revenue and Forecast

10.1.2. Companion Diagnostics

10.1.2.1. Market Revenue and Forecast

10.1.3. Others

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Clinical Oncology Next Generation Sequencing Market, By End Use

11.1. Clinical Oncology Next Generation Sequencing Market, by End Use

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast

11.1.2. Clinics

11.1.2.1. Market Revenue and Forecast

11.1.3. Laboratories

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Clinical Oncology Next Generation Sequencing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology

12.1.2. Market Revenue and Forecast, by Workflow

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology

12.1.5.2. Market Revenue and Forecast, by Workflow

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology

12.1.6.2. Market Revenue and Forecast, by Workflow

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology

12.2.2. Market Revenue and Forecast, by Workflow

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology

12.2.5.2. Market Revenue and Forecast, by Workflow

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology

12.2.6.2. Market Revenue and Forecast, by Workflow

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology

12.2.7.2. Market Revenue and Forecast, by Workflow

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology

12.2.8.2. Market Revenue and Forecast, by Workflow

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology

12.3.2. Market Revenue and Forecast, by Workflow

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology

12.3.5.2. Market Revenue and Forecast, by Workflow

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology

12.3.6.2. Market Revenue and Forecast, by Workflow

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology

12.3.7.2. Market Revenue and Forecast, by Workflow

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology

12.3.8.2. Market Revenue and Forecast, by Workflow

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology

12.4.2. Market Revenue and Forecast, by Workflow

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology

12.4.5.2. Market Revenue and Forecast, by Workflow

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology

12.4.6.2. Market Revenue and Forecast, by Workflow

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology

12.4.7.2. Market Revenue and Forecast, by Workflow

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology

12.4.8.2. Market Revenue and Forecast, by Workflow

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology

12.5.2. Market Revenue and Forecast, by Workflow

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology

12.5.5.2. Market Revenue and Forecast, by Workflow

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology

12.5.6.2. Market Revenue and Forecast, by Workflow

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Illumina, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Thermo Fisher Scientific

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. F. Hoffmann-La Roche Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Agilent Technologies

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Myriad Genetics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Perkin Elmer

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Pacific Bioscience

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Oxford Nanopore Technologies Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Eurofins Scientific S.E.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Qiagen N.V.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others