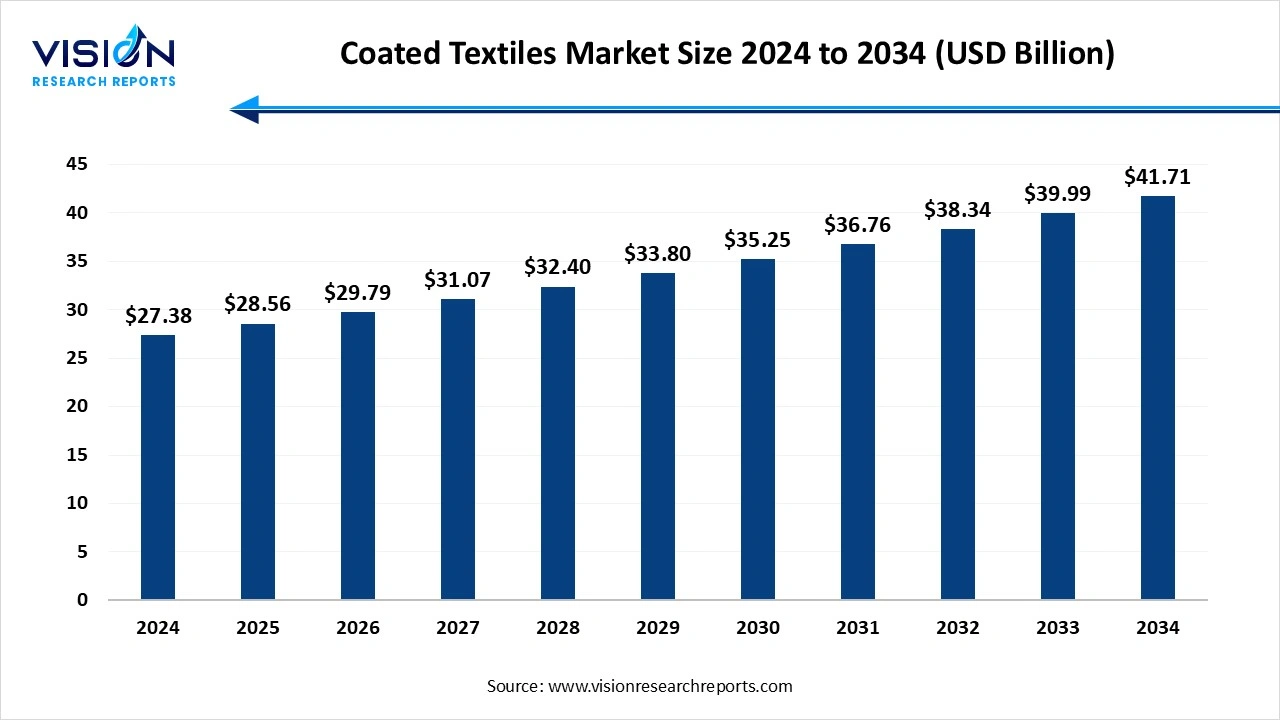

The global coated textiles market size was valued at USD 27.38 billion in 2024 and is anticipated to reach around USD 41.71 billion by 2034, growing at a CAGR of 4.30% from 2025 to 2034.

The coated textiles market has witnessed significant growth in recent years, driven by the increasing demand across various industries such as automotive, construction, healthcare, and sportswear. Coated textiles are fabrics that have been treated with a layer of polymer or other substances to enhance their properties, including water resistance, durability, and aesthetic appeal. This unique combination of flexibility and functionality makes coated textiles highly sought after for applications requiring protection against environmental elements. Innovation in coating materials and techniques has further propelled market expansion. Manufacturers are increasingly adopting eco-friendly and sustainable coatings to meet the rising consumer preference for green products. Advanced coatings not only improve performance but also extend the lifespan of textiles, which is crucial in sectors like outdoor gear and industrial safety equipment.

The growth of the coated textiles market is primarily fueled by the rising demand for durable and high-performance materials across various end-use industries. Sectors such as automotive, construction, healthcare, and outdoor apparel increasingly require textiles that offer enhanced protection against water, chemicals, and abrasion. Coated textiles fulfill these needs by providing improved resistance and longevity, which is especially critical in harsh or demanding environments.

Another significant growth factor is the rising focus on sustainability and technological innovation within the textile industry. Manufacturers are investing in eco-friendly coatings made from biodegradable or recycled materials to reduce environmental impact, aligning with global trends towards sustainable production. Innovations in coating technologies, including antimicrobial, flame-retardant, and UV-resistant finishes, are further expanding the application scope of coated textiles.

The Asia Pacific coated textiles market captured the largest revenue share, approximately 48% in 2024. fueled by rapid industrial growth, a thriving automotive industry, and increasing construction projects. Key players such as China, India, and Japan significantly contribute to this dominance, supported by their extensive manufacturing infrastructure and rising demand for protective wear, technical textiles, and industrial fabrics. Additionally, the region's advantages of cost-effective labor, plentiful raw material availability, and robust export capacity have established it as a leading global center for coated textile manufacturing.

Europe’s coated textiles market is distinguished by its robust technical textile sector and strict environmental regulations. Significant investments are being made in sustainable coatings and advanced applications, particularly in automotive interiors, architecture, and industrial safety. EU policies promoting the circular economy and textile recycling are driving innovation in coated textiles. Additionally, European consumers increasingly prefer bio-based and recyclable fabrics, shaping market trends.

Europe’s coated textiles market is distinguished by its robust technical textile sector and strict environmental regulations. Significant investments are being made in sustainable coatings and advanced applications, particularly in automotive interiors, architecture, and industrial safety. EU policies promoting the circular economy and textile recycling are driving innovation in coated textiles. Additionally, European consumers increasingly prefer bio-based and recyclable fabrics, shaping market trends.

The polyurethane (PU) coated textiles segment dominated the industry, capturing the largest revenue share of 64% in 2024. PU coatings provide fabrics with enhanced elasticity and breathability compared to other coating materials, making them particularly popular in applications such as sportswear, medical textiles, and automotive interiors. Additionally, PU coated textiles offer good water resistance and a softer hand feel, which increases comfort in wearable products. The versatility of PU coatings allows manufacturers to tailor the performance characteristics of textiles, contributing to the expanding demand across various end-use industries.

Polyvinyl Chloride (PVC) coated textiles are widely used owing to their durability, cost-effectiveness, and strong resistance to chemicals and environmental factors. PVC coatings impart robust waterproofing and flame-retardant properties, making these textiles ideal for heavy-duty applications such as industrial covers, tarpaulins, and outdoor furniture. Although PVC coated fabrics tend to be heavier and less flexible compared to PU variants, their affordability and high resistance to wear and tear continue to drive their adoption in construction, transportation, and marine sectors.

The automotive segment dominated the industry, capturing the largest revenue share of 32% in 2024. Coated textiles are widely used in automotive interiors, including seat covers, door panels, and headliners, where they offer enhanced resistance to wear, stains, and UV exposure. The ability of coated fabrics to combine comfort with durability makes them ideal for improving passenger experience while contributing to vehicle weight reduction, which is crucial for fuel efficiency and emission control.

In the construction industry, coated textiles play a critical role in providing solutions for roofing membranes, architectural fabrics, protective covers, and insulation materials. Their waterproof, flame-retardant, and weather-resistant properties make coated textiles indispensable for both temporary and permanent structures. The increasing trend towards sustainable and energy-efficient buildings has also encouraged the use of coated textiles that offer thermal insulation and durability under harsh environmental conditions.

By Product

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Coated Textiles Market

5.1. COVID-19 Landscape: Coated Textiles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Coated Textiles Market, By Product

8.1. Coated Textiles Market, by Product

8.1.1. Polyurethane (PU) Coated Textiles

8.1.1.1. Market Revenue and Forecast

8.1.2. Polyvinyl Chloride (PVC) Coated Textiles

8.1.2.1. Market Revenue and Forecast

8.1.3. Silicone Coated Textiles

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Coated Textiles Market, By End-use

9.1. Coated Textiles Market, by End-use

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast

9.1.2. Construction

9.1.2.1. Market Revenue and Forecast

9.1.3. Furniture

9.1.3.1. Market Revenue and Forecast

9.1.4. Industrial

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Coated Textiles Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by End-use

Chapter 11. Company Profiles

11.1. Berry Global Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Serge Ferrari

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Mehler Texnologies GmbH

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Toray Industries, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Lanxess AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Saint-Gobain Performance Plastics

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Glen Raven, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Trelleborg AB

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Huntsman Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. TenCate Advanced Composites

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others