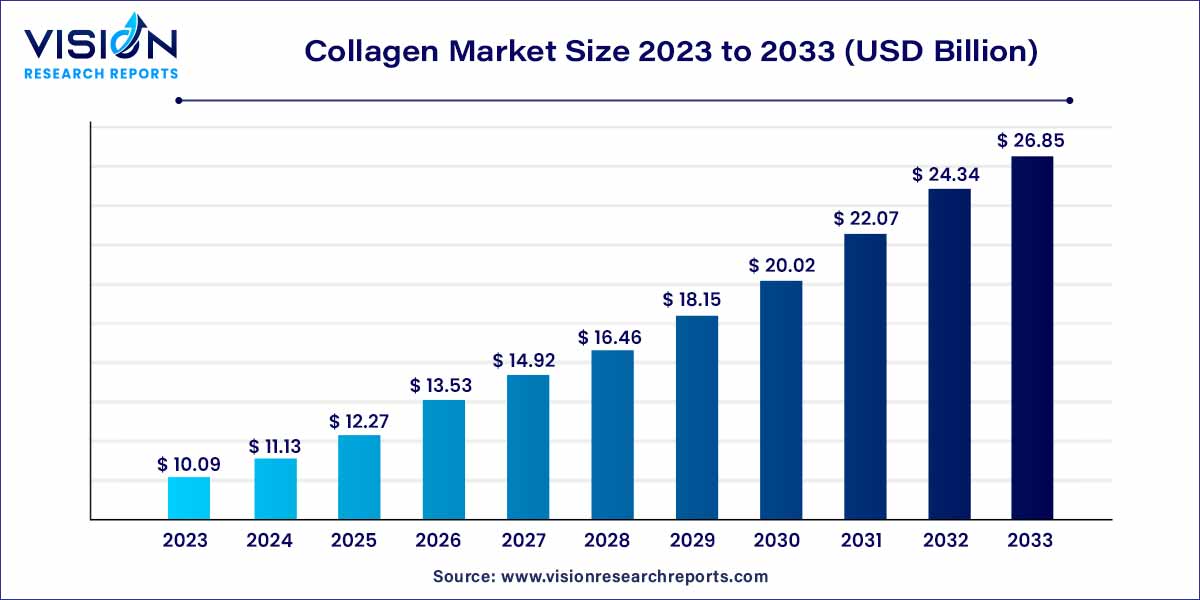

The global collagen market was surpassed at USD 10.09 billion in 2023 and is expected to hit around USD 26.85 billion by 2033, growing at a CAGR of 10.28% from 2024 to 2033. The collagen market is driven by the versatile applications across industries, increasing health and wellness consciousness, innovations in extraction technologies, and research and development initiatives

A broad perspective on the always changing collagen industry shows a tapestry woven with innovation, shifting consumer demand, and game-changing uses. This summary acts as a compass, directing interested parties through the salient features that characterize the collagen industry's present situation and potential future directions.

The remarkable growth trajectory of the collagen market can be attributed to a confluence of pivotal factors steering its ascent. Firstly, heightened awareness and prioritization of health and wellness among consumers have led to an increased demand for collagen-infused products. This surge is notably observed in skincare formulations capitalizing on collagen's role in maintaining skin elasticity and vitality. Secondly, an aging global population seeking solutions for joint health has spurred the demand for collagen supplements. Additionally, the diverse applications of collagen in the food and healthcare industries have expanded its market reach. The continuous evolution of extraction technologies, coupled with a growing emphasis on sustainable sourcing practices, contributes to the market's dynamic growth. These factors collectively propel the collagen market forward, creating a landscape ripe with opportunities for industry players navigating the intersection of science, health, and consumer preferences.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 26.85 billion |

| Growth Rate from 2024 to 2033 | CAGR of 10.28% |

| Revenue Share of Asia Pacific in 2023 | 23% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The gelatin product segment held the largest revenue share of 67% in 2023. This dominance is primarily linked to the pivotal role played by the food and beverage industry, a major contributor to the demand for gelatin collagen. Recognized as an essential protein for the human body, gelatin offers a plethora of nutritional, skin, and health benefits. Within the food and beverage sector, it finds applications in diverse categories such as bakery products, dietary supplements, sports nutrition, and more. The market is poised for sustained growth driven by increasing health and fitness concerns, evolving consumer preferences favoring high-nutrition products, shifting lifestyles, and the endorsement of gelatin use in food products.

Anticipated to witness a surge in demand, hydrolyzed collagen is set to grow, propelled by the increasing consumption of health and beauty supplements. Renowned for enhancing the texture and quality of hair, nails, and skin, as well as fortifying bone and joint health, hydrolyzed collagen is a sought-after ingredient in sports nutrition and functional food and beverage products, contributing to elevated protein content.

In contrast, synthetic collagen, susceptible to the same enzymes that break down natural collagen in the human body, finds utility in diverse biomedical applications. Notably, its use mitigates immune-related problems associated with natural collagen derived from animal sources like cows. The escalating demand for synthetic-sourced products contributes significantly to the overall growth of the collagen market.

The bovine source segment had the largest market share of 35% in 2022. This dominance is primarily attributed to its larger share compared to other sources, facilitated by the abundant availability of cattle and lower costs. The escalating demand for bovine-based products in biomedical applications, addressing medical conditions like arthritis, enhancing skin health, and combating osteoporosis, is a key driver propelling market growth over the forecast period. Furthermore, the affordability of bovine-based products relative to other sources, particularly marine, is expected to fuel the demand for bovine collagen in the foreseeable future.

Poultry sources encompass domesticated species such as chickens, ducks, geese, and turkeys, with chicken collagen being the primary source. Derived from cartilage, bones, and tissues, chicken collagen is increasingly used to address joint and arthritic conditions, promoting overall immunity. The poultry source segment is poised for rapid expansion, driven by the growing utilization of chicken collagen for joint-related treatments.

Marine collagen, employed in various health supplements to enhance bone health, combat arthritis, and safeguard the gastrointestinal tract's mucosa, is gaining prominence in cosmetics as a moisturizer and natural humectant. Cosmetic manufacturers are actively developing formulations sourced from marine collagen, capitalizing on its skin benefits, including its properties, configuration structure, species, and catching origin.

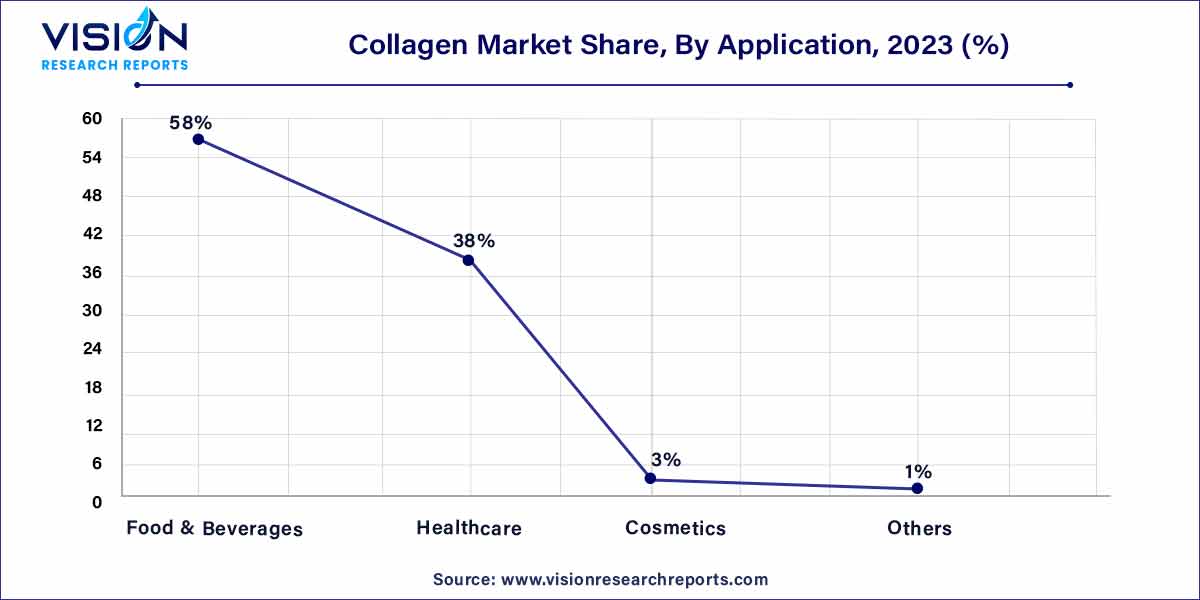

The global market saw food and beverage segment contributed the largest market share of 58% in 2022. This dominance is attributed to the heightened demand for dietary supplements and functional food and beverages, notably in North America and Europe. Collagen plays a crucial role in enhancing the stability, consistency, and elasticity of products, serving as a valuable food additive to improve color, texture, and flavor. Additionally, it finds widespread use in collagen-infused drinks such as cappuccino, cocoa, juices, and energy drinks, contributing to its significant presence in the food and beverage sector.

The burgeoning consumer awareness regarding collagen's benefits contributes to the growth of the beauty supplements segment. These supplements play a vital role in enhancing skin elasticity and connective tissue strength, leading to improved skin texture. Moreover, they promote healthy, youthful-looking skin and aid in reducing the appearance of fine lines and wrinkles. Collagen's involvement in the production of other skin-structuring proteins, such as elastin and fibrillin, underscores its significance in maintaining skin integrity. The consumption of collagen-infused supplements not only hydrates the skin but also stimulates skin regeneration, making them pivotal factors expected to drive product demand over the forecast period.

The Asia Pacific region dominated the market with the largest market share of 23% in 2022. This dominance is attributed to rapid developments in key economies, notably India and China, driving substantial growth in the market. The well-established meat processing industry in these economies is contributing to increased captive consumption production levels.

Australia, in particular, is gaining prominence for its ovine collagen, with the product holding a monopoly in the industry. This factor significantly contributes to the market's growth in Australia. Moreover, the region is witnessing a surge in demand for collagen-based films and formulations, especially in surgical applications, further propelling product demand.

India is experiencing a boost in cosmetics production, driven by the introduction of premium brands and significant investments from international players. Renowned brands such as The Face Shop and Kiehls India are offering cosmetic products infused with collagen, garnering positive feedback from consumers.

The contract between Symatese and Evolus for Symatese's line of dermal fillers was finalized in May 2023. The First-Generation Cold Technology HA serves as the foundation for these fillers.

The use of highly pure gelatin-based biomaterials for in vitro 3D models has been shown to significantly increase the reproducibility and dependability of these models, according to a study released in March 2023 by Rousselot, a health brand of Darling Ingredients, the global leader in collagen-oriented products. This will open up new options for substituting animal testing before clinical development

A ceremony was held in March 2023 to commemorate the opening of PB Leiner (Hainan) Biotechnology Ltd., a fish collagen peptides plant. PB Leiner is a business subsidiary of Tessenderlo Group. The new company's goal is to produce and market a high-end line of SOLUGEL fish collagen peptide products. This will assist the company in meeting the rapidly increasing demand for high-quality collagen peptides derived from marine sources worldwide.

By Product

By Source

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Collagen Market

5.1. COVID-19 Landscape: Collagen Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Collagen Market, By Product

8.1. Collagen Market, by Product, 2024-2033

8.1.1 Gelatin

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hydrolyzed Collagen

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Native Collagen

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Synthetic Collagen

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Collagen Market, By Source

9.1. Collagen Market, by Source, 2024-2033

9.1.1. Bovine

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Porcine

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Poultry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Marine

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Collagen Market, By Application

10.1. Collagen Market, by Application, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cosmetics

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Othersb

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Collagen Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Rousselot.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GELITA AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tessenderlo Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. STERLING GELATIN.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Weishardt Holding SA.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Juncà Gelatines SL

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Xiamen Yiyu Biological Technology Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Symatese

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Collagen Matrix, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Collagen Solutions Plc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others