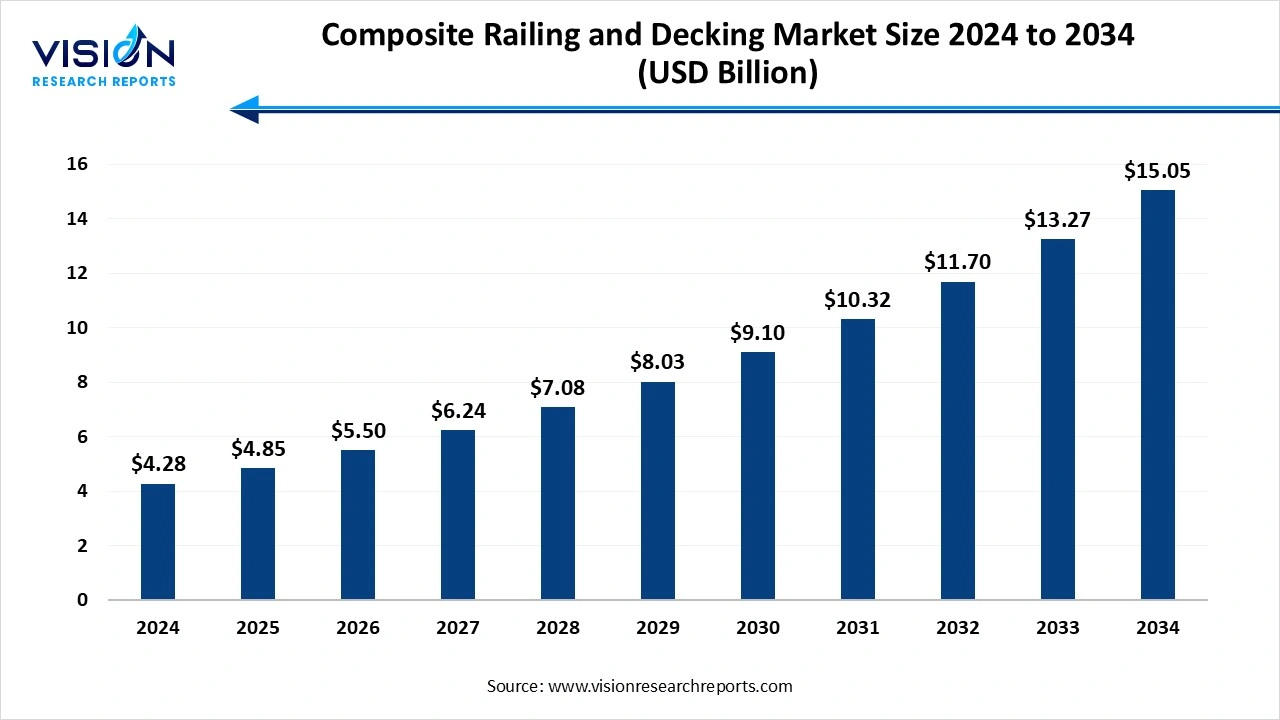

The global composite railing and decking market size was evaluated at around USD 4.28 billion in 2024 and it is projected to hit around USD 15.05 billion by 2034, growing at a CAGR of 13.40% from 2025 to 2034.

The composite railing and decking market has been experiencing significant growth in recent years, driven by rising demand for durable, low-maintenance, and environmentally friendly construction materials. Composite materials, typically made from a combination of recycled plastics and wood fibers, offer superior resistance to moisture, insects, and fading compared to traditional wood. This makes them an ideal choice for outdoor structures such as decks, railings, and patios. As homeowners and commercial developers increasingly prioritize longevity and aesthetics, the adoption of composite products continues to rise.

One of the key growth factors of the composite railing and decking market is the increasing preference for low-maintenance and long-lasting building materials. Unlike traditional wood, composite materials do not warp, splinter, or require frequent staining or sealing, making them more appealing to homeowners and builders looking for durable outdoor solutions.

Another major driver is the steady rise in residential and commercial construction projects, particularly in urban and suburban areas. As the demand for aesthetically pleasing outdoor living spaces increases, so does the interest in stylish and customizable decking and railing systems. Innovations in product design such as multi-color finishes, slip resistance, and hidden fastener systems are also enhancing consumer interest.

One of the notable trends in the composite railing and decking market is the growing demand for high-performance materials that offer enhanced aesthetics and durability. Consumers are increasingly drawn to composite products that mimic the look and texture of natural wood but without the associated maintenance. This has led manufacturers to focus on advanced surface technologies, color variation, and realistic wood grain finishes.

Another emerging trend is the rise of environmentally conscious consumer choices, pushing companies to develop more sustainable and recyclable composite products. Manufacturers are emphasizing the use of recycled content and eco-friendly production processes to meet green building certifications such as LEED. Modular and easy-to-install systems are also gaining traction, particularly among DIY homeowners and contractors seeking quicker installation with professional results.

One of the primary challenges faced by the composite railing and decking market is the relatively high upfront cost compared to traditional wood materials. Although composite products offer long-term savings through reduced maintenance, the initial investment can be a deterrent for price-sensitive consumers. This is especially relevant in emerging economies where cost remains a major factor in material selection. Additionally, the perception that composites lack the authentic look and feel of natural wood continues to influence consumer preferences, despite advancements in design and texture.

Another challenge lies in the technical limitations and performance issues associated with some composite products. In certain cases, composites may be prone to expansion, contraction, or surface fading when exposed to extreme weather conditions, particularly if lower-quality materials are used. This can impact customer satisfaction and brand reputation.

North America led the global composite railing and decking industry, accounting for the largest revenue share of approximately 30% in 2024. This leadership is driven by strong demand for durable, low-maintenance building materials, high consumer preference for outdoor living spaces, and robust construction activities in residential and commercial sectors. Additionally, the presence of major industry players and growing environmental concerns have supported the shift toward composite materials made from recycled plastics and wood fibers.

The Asia Pacific composite railing and decking market is experiencing significant growth, driven by rapid urbanization, expanding construction activities, and a rising middle-class population with evolving lifestyle preferences. Countries like India, Japan, and various Southeast Asian nations are increasingly adopting composite materials across residential and commercial sectors, supported by enhanced building standards and growing awareness of eco-friendly alternatives.

The capped composite decking and railing segment dominated the market, capturing the largest revenue share of 59% in 2024. These products feature a protective polymer shell that surrounds the composite core, offering resistance to moisture, UV rays, mold, and staining. This protective layer not only prolongs the lifespan of the material but also helps maintain its aesthetic appeal over time, making it an ideal choice for homeowners and commercial builders seeking long-term value and minimal maintenance.

The uncapped composite decking and railing, while more affordable, lack the protective outer layer found in capped variants. These products are composed solely of wood fiber and plastic blends, offering basic durability and weather resistance. However, they are more susceptible to staining, fading, and mold growth over time, especially in high-moisture environments. Despite these limitations, uncapped composites still hold a notable share in the market due to their cost-effectiveness and suitability for applications where appearance and extended durability are less critical. In many developing markets or cost-conscious projects, uncapped composites are a practical solution that provides the advantages of composite materials without the premium price tag.

The polyethylene composite decking and composite railing segment led the market, securing the highest revenue share of 33% in 2024. Polyethylene composite decking and composite railing are widely used due to their cost-effectiveness, flexibility, and resistance to moisture. These materials are typically made using high-density or low-density polyethylene blended with wood fibers, providing a balance of strength, durability, and affordability. PE-based composites are favored for residential applications as they offer decent performance and are available in a variety of colors and textures that appeal to modern aesthetic preferences.

The PVC and recycled wood composite decking and railing represent a more premium segment of the market, offering higher resistance to weathering, insects, and fading. PVC-based products are made without any wood content, which makes them entirely resistant to moisture absorption and ideal for high-humidity or coastal environments. These materials are also lighter in weight and easier to clean, making them suitable for both residential and commercial settings.

By Product

By Material

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Composite Railing And Decking Market

5.1. COVID-19 Landscape: Composite Railing And Decking r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Composite Railing And Decking Market, By Product

8.1. Composite Railing And Decking Market, by Type, 2024-2033

8.1.1. Capped Composite Decking & Railing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Uncapped Composite Decking & Railing

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Composite Railing And Decking Market, By Material

9.1. Composite Railing And Decking Market, by Application, 2024-2033

9.1.1. Polyethylene Composite Decking & Composite Railing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Polypropylene Composite Decking & Composite Railing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Polyvinyl Chloride Composite Decking & Composite Railing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. PVC & Recycled wood Composite Decking & Composite Railing

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Material (2021-2033)

Chapter 11. Company Profiles

11.1. Trex Company, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Fiberon LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. TimberTech (Azek Company Inc.)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. MoistureShield (Oldcastle APG)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DuraLife Decking and Railing Systems

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. UPM-Kymmene Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Green Bay Decking, LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Eva-Last

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Barrette Outdoor Living

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. CertainTeed (a subsidiary of Saint-Gobain)

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others