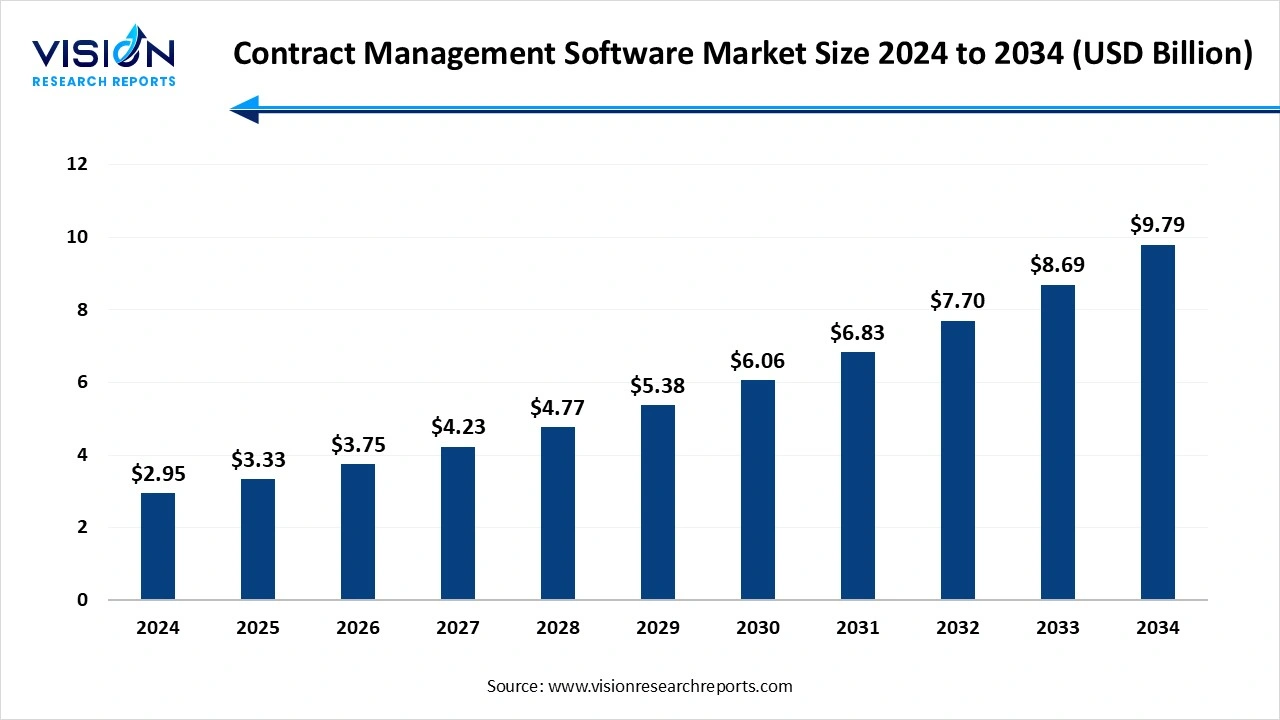

The global contract management software market size was estimated at USD 2.95 billion in 2024 and it is expected to surpass around USD 9.79 billion by 2034, poised to grow at a CAGR of 12.75% from 2025 to 2034.

The contract management software market has witnessed significant growth in recent years, driven by the increasing demand for streamlined contract lifecycle management and enhanced regulatory compliance across various industries. This software facilitates the creation, negotiation, execution, and monitoring of contracts, enabling organizations to reduce risks, improve operational efficiency, and ensure transparency. With the rising complexity of business agreements and the growing need for automation, companies are adopting advanced contract management solutions powered by artificial intelligence, cloud computing, and analytics.

The contract management software market is experiencing significant growth due to the increasing complexity and volume of contracts in modern business environments. Organizations are under mounting pressure to streamline contract processes to reduce errors, minimize risks, and accelerate deal closures. Manual contract handling is often time-consuming and prone to compliance issues, making automation essential. Businesses are therefore adopting contract management software to enhance operational efficiency, improve contract visibility, and ensure adherence to legal and regulatory standards.

Another major growth driver is the widespread adoption of cloud-based and AI-powered contract management solutions. Cloud technology offers scalable, flexible, and secure platforms that support remote and collaborative work environments, which have become especially vital in the post-pandemic era. The integration of artificial intelligence and machine learning enables organizations to leverage features like automated contract analysis, risk detection, and predictive insights, allowing for smarter decision-making and proactive risk mitigation.

North America accounted for a significant share of over 39% in the contract management software market in 2024. This dominance is driven by the region’s advanced digital infrastructure and strong emphasis on technological innovation. Businesses across a wide range of industries are increasingly leveraging automation tools, including contract management software, to boost operational efficiency and productivity. North America's digital maturity supports the rapid adoption of advanced CMS capabilities such as AI and analytics, enabling organizations to minimize legal risks, maintain compliance, and optimize the entire contract lifecycle.

The contract management software (CMS) market in the Asia Pacific region is projected to experience the fastest growth globally, with a compound annual growth rate (CAGR) of 14% from 2025 to 2034. This surge is largely driven by the region’s rapid digital transformation. Countries such as China, Japan, India, and Singapore are spearheading digital initiatives aimed at modernizing operations, enhancing transparency, and strengthening regulatory compliance across both public and private sectors.

The software segment held a market share exceeding 68% in 2024. These software platforms are designed to enhance efficiency, reduce risks, and ensure compliance through features such as centralized contract repositories, automated alerts, and advanced analytics. With increasing digital transformation efforts, businesses are prioritizing software adoption to gain better control over contract management processes and drive operational agility.

The services segment is expected to experience substantial growth at a notable CAGR throughout the forecast period. These services are essential for tailoring software solutions to specific business requirements, ensuring seamless integration with existing systems, and enabling user adoption through comprehensive training programs.

The legal segment captured the largest market share in 2024. The legal segment of the global Contract Management Software market plays a pivotal role in addressing the unique requirements of law firms, corporate legal departments, and legal service providers. Contract management software tailored for the legal industry offers specialized features such as clause libraries, compliance tracking, and automated workflow approvals to streamline contract drafting, review, and negotiation processes. These tools enable legal professionals to minimize risks, ensure regulatory compliance, and accelerate contract cycles, thereby enhancing overall productivity.

The sales segment is projected to experience the highest compound annual growth rate (CAGR) of 13.5% throughout the forecast period. Increasing regulatory pressures and the necessity for strict adherence to compliance standards further accelerate the adoption rate. Additionally, the growing trend of outsourcing legal processes and the expansion of in-house legal teams have boosted the market’s sales volume.

The cloud segment held the largest market share, exceeding 69% in 2024. Cloud deployment has gained substantial traction due to its flexibility, scalability, and cost-effectiveness. Organizations increasingly prefer cloud-based contract management software because it enables real-time access to contracts from any location, supports remote collaboration, and reduces the burden of IT infrastructure management.

The on-premises segment is projected to expand at a compound annual growth rate (CAGR) of 10.9% throughout the forecast period. This model allows companies to maintain contract management systems within their internal networks, ensuring full customization and direct oversight of data privacy. While on-premises solutions may involve higher upfront costs and longer implementation times compared to cloud-based options, they appeal to enterprises in highly regulated sectors such as government and finance.

The large enterprises segment held the largest share of the contract management software market in 2024. These organizations benefit from advanced features such as customization, scalability, and comprehensive analytics, which help streamline contract lifecycle management at scale, reduce risks, and ensure regulatory adherence. The investment capacity and strategic focus on digital transformation further enable large enterprises to implement robust contract management systems that align with their broader enterprise resource planning and legal frameworks.

The SMEs segment is anticipated to experience substantial growth at a notable CAGR over the forecast period. The rising availability of cost-effective, cloud-based solutions has lowered entry barriers for SMEs, enabling them to automate contract creation, approval, and storage without significant upfront investment. SMEs leverage these tools to improve contract visibility, accelerate sales cycles, and maintain compliance, which is critical for growth and competitive advantage.

The BFSI sector held the dominant share of the market in 2024. Organizations within BFSI operate under stringent regulatory frameworks, where any non-compliance can lead to hefty fines and damage to their reputation. Contract Management Systems (CMS) play a crucial role in reducing these risks by ensuring contracts consistently comply with industry regulations. Features such as automated compliance monitoring, audit trails, and real-time alerts keep companies informed about regulatory updates, significantly lowering the chances of compliance breaches. Moreover, CMS solutions enhance contract visibility and transparency by providing stakeholders with real-time access to contract information.

The manufacturing sector is projected to experience substantial CAGR growth throughout the forecast period. Manufacturing companies often deal with complex supplier and vendor agreements that include a range of terms, payment schedules, delivery conditions, and performance standards. Contract Management Systems (CMS) simplify handling these complexities by tracking and monitoring all contract terms, thereby minimizing risks related to delays, non-compliance, and missed deadlines. This supports seamless supply chain operations. Furthermore, effective contract management is crucial for maximizing supply chain efficiency.

By Component

By Business Function

By Deployment Mode

By Organization Size

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Contract Management Software Market

5.1. COVID-19 Landscape: Contract Management Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Contract Management Software Market, By Component

8.1. Contract Management Software Market, by Component

8.1.1. Software

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Contract Management Software Market, By February

9.1. Contract Management Software Market, by February

9.1.1. Legal

9.1.1.1. Market Revenue and Forecast

9.1.2. Sales

9.1.2.1. Market Revenue and Forecast

9.1.3. Procurement

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Contract Management Software Market, By Deployment Mode

10.1. Contract Management Software Market, by Deployment Mode

10.1.1. Cloud

10.1.1.1. Market Revenue and Forecast

10.1.2. On-premise

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Contract Management Software Market, By Organization Size

11.1. Contract Management Software Market, by Organization Size

11.1.1. SMEs

11.1.1.1. Market Revenue and Forecast

11.1.2. Large enterprises

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Contract Management Software Market, By End Use

12.1. Contract Management Software Market, by End Use

12.1.1. Government

12.1.1.1. Market Revenue and Forecast

12.1.2. Retail and eCommerce

12.1.2.1. Market Revenue and Forecast

12.1.3. Healthcare and Life Sciences

12.1.3.1. Market Revenue and Forecast

12.1.4. Banking, Financial Services, and Insurance (BFSI)

12.1.4.1. Market Revenue and Forecast

12.1.5. IT and Telecommunications

12.1.5.1. Market Revenue and Forecast

12.1.5. Transportation and Logistics

12.1.5.1. Market Revenue and Forecast

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast

12.1.5. Others

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Contract Management Software Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component

13.1.2. Market Revenue and Forecast, by February

13.1.3. Market Revenue and Forecast, by Deployment Mode

13.1.4. Market Revenue and Forecast, by Organization Size

13.1.5. Market Revenue and Forecast, by End Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component

13.1.6.2. Market Revenue and Forecast, by February

13.1.6.3. Market Revenue and Forecast, by Deployment Mode

13.1.6.4. Market Revenue and Forecast, by Organization Size

13.1.7. Market Revenue and Forecast, by End Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component

13.1.8.2. Market Revenue and Forecast, by February

13.1.8.3. Market Revenue and Forecast, by Deployment Mode

13.1.8.4. Market Revenue and Forecast, by Organization Size

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component

13.2.2. Market Revenue and Forecast, by February

13.2.3. Market Revenue and Forecast, by Deployment Mode

13.2.4. Market Revenue and Forecast, by Organization Size

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component

13.2.6.2. Market Revenue and Forecast, by February

13.2.6.3. Market Revenue and Forecast, by Deployment Mode

13.2.7. Market Revenue and Forecast, by Organization Size

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component

13.2.9.2. Market Revenue and Forecast, by February

13.2.9.3. Market Revenue and Forecast, by Deployment Mode

13.2.10. Market Revenue and Forecast, by Organization Size

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component

13.2.12.2. Market Revenue and Forecast, by February

13.2.12.3. Market Revenue and Forecast, by Deployment Mode

13.2.12.4. Market Revenue and Forecast, by Organization Size

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component

13.2.14.2. Market Revenue and Forecast, by February

13.2.14.3. Market Revenue and Forecast, by Deployment Mode

13.2.14.4. Market Revenue and Forecast, by Organization Size

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component

13.3.2. Market Revenue and Forecast, by February

13.3.3. Market Revenue and Forecast, by Deployment Mode

13.3.4. Market Revenue and Forecast, by Organization Size

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component

13.3.6.2. Market Revenue and Forecast, by February

13.3.6.3. Market Revenue and Forecast, by Deployment Mode

13.3.6.4. Market Revenue and Forecast, by Organization Size

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component

13.3.8.2. Market Revenue and Forecast, by February

13.3.8.3. Market Revenue and Forecast, by Deployment Mode

13.3.8.4. Market Revenue and Forecast, by Organization Size

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component

13.3.10.2. Market Revenue and Forecast, by February

13.3.10.3. Market Revenue and Forecast, by Deployment Mode

13.3.10.4. Market Revenue and Forecast, by Organization Size

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component

13.3.11.2. Market Revenue and Forecast, by February

13.3.11.3. Market Revenue and Forecast, by Deployment Mode

13.3.11.4. Market Revenue and Forecast, by Organization Size

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component

13.4.2. Market Revenue and Forecast, by February

13.4.3. Market Revenue and Forecast, by Deployment Mode

13.4.4. Market Revenue and Forecast, by Organization Size

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component

13.4.6.2. Market Revenue and Forecast, by February

13.4.6.3. Market Revenue and Forecast, by Deployment Mode

13.4.6.4. Market Revenue and Forecast, by Organization Size

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component

13.4.8.2. Market Revenue and Forecast, by February

13.4.8.3. Market Revenue and Forecast, by Deployment Mode

13.4.8.4. Market Revenue and Forecast, by Organization Size

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component

13.4.10.2. Market Revenue and Forecast, by February

13.4.10.3. Market Revenue and Forecast, by Deployment Mode

13.4.10.4. Market Revenue and Forecast, by Organization Size

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component

13.4.11.2. Market Revenue and Forecast, by February

13.4.11.3. Market Revenue and Forecast, by Deployment Mode

13.4.11.4. Market Revenue and Forecast, by Organization Size

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component

13.5.2. Market Revenue and Forecast, by February

13.5.3. Market Revenue and Forecast, by Deployment Mode

13.5.4. Market Revenue and Forecast, by Organization Size

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component

13.5.6.2. Market Revenue and Forecast, by February

13.5.6.3. Market Revenue and Forecast, by Deployment Mode

13.5.6.4. Market Revenue and Forecast, by Organization Size

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component

13.5.8.2. Market Revenue and Forecast, by February

13.5.8.3. Market Revenue and Forecast, by Deployment Mode

13.5.8.4. Market Revenue and Forecast, by Organization Size

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. SAP SE – SAP Ariba Contract Management

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. DocuSign, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Icertis

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Coupa Software Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Conga (formerly Apttus)

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Oracle Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Agiloft

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. IBM Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. ContractWorks

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others