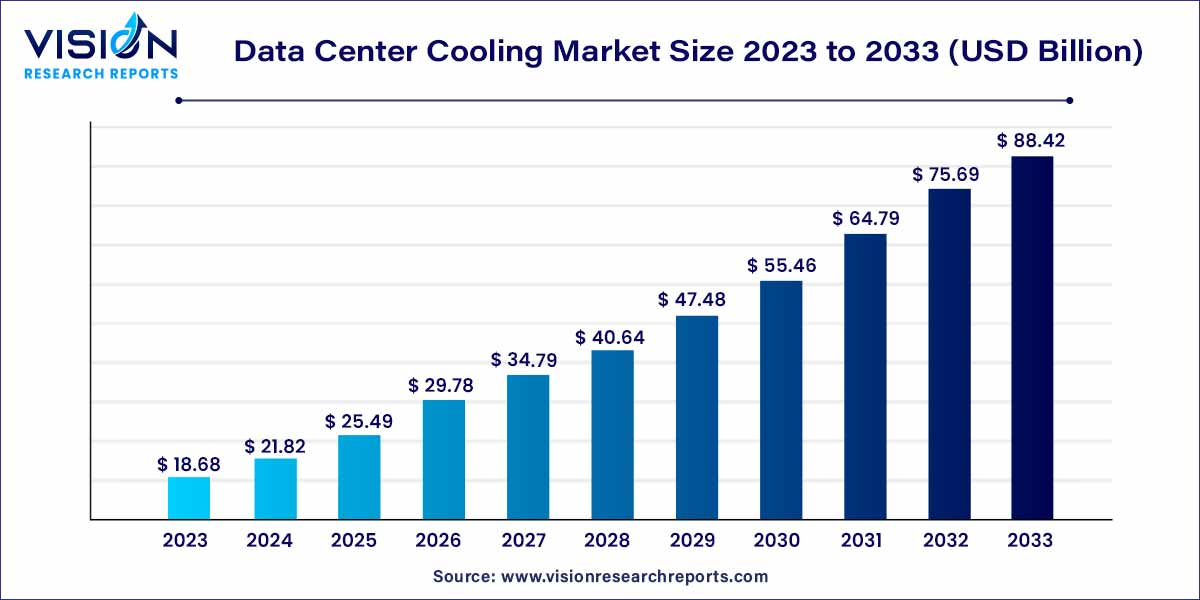

The global data center cooling market size was estimated at USD 18.68 billion in 2023 and it is expected to surpass around USD 88.42 billion by 2033, poised to grow at a CAGR of 16.82% from 2024 to 2033.

The data center cooling market is experiencing robust growth driven by several key factors. Firstly, the exponential expansion of digital infrastructure and the proliferation of data-intensive technologies such as cloud computing, big data analytics, and the Internet of Things (IoT) are fueling the demand for efficient cooling solutions to maintain optimal operating temperatures. Additionally, increasing environmental concerns and regulatory mandates are pushing organizations to adopt energy-efficient cooling technologies that minimize carbon emissions and reduce power consumption.

In 2023, the solution segment dominated the market, holding the largest market share. Data center cooling solutions play a crucial role in maintaining optimal temperatures and ensuring the smooth operation of data centers. Additionally, these solutions are often utilized for pre-cooling air to achieve appropriate cooling levels during warmer weather conditions. These factors are anticipated to fuel the expansion of this segment.

On the other hand, the services segment is projected to witness the highest Compound Annual Growth Rate (CAGR) from 2024 to 2033. Data center operators are increasingly embracing data center cooling services, such as power distribution units, to accommodate the growing demand for data storage and associated services, including data backup and archiving, authentication management, and authorization. This surge in demand for services is expected to propel the growth of this segment.

In 2023, the air conditioners segment held the largest share of over 31% of the overall revenue. Air conditioners are favored by many end-users due to their ability to provide round-the-clock protection while also reducing energy costs. With heavily packed racks generating substantial heat during data storage and analysis for decision-making, air conditioners play a crucial role in maintaining optimal temperature levels and ensuring the smooth operation of data centers. Additionally, serving as heat exchangers, air conditioners regulate room temperature effectively in sensitive IT environments.

Moreover, the precision air conditioners segment is anticipated to grow at a CAGR exceeding 18.05% from 2024 to 2033. This growth is driven by technological advancements and the development of energy-efficient units, which are expected to bolster demand for precision air conditioners. These specialized air conditioners offer various benefits, including continuous operation, precise humidity control, improved air distribution, and automatic regulation of individual AC loads for efficient cooling.

In 2023, the installation and deployment segment led the market, capturing the highest revenue share. The increased adoption of liquid-based heat removal equipment for installation and deployment is significantly impacting power-supporting climate control systems, thus driving the growth of this segment. The trend towards higher-density installations is influencing IT power planning, with additional services such as other coolants and fan installations contributing to better design and optimization balance.

Looking ahead, the maintenance service segment is expected to experience a significant Compound Annual Growth Rate (CAGR) from 2024 to 2033. Data center cooling maintenance services facilitate the rapid expansion of infrastructure, power consumption, and storage capacity for enterprises. This sector of maintenance and service enables seamless integration and development of modular designs, providing companies with the flexibility to adapt their cooling systems to evolving technological requirements.

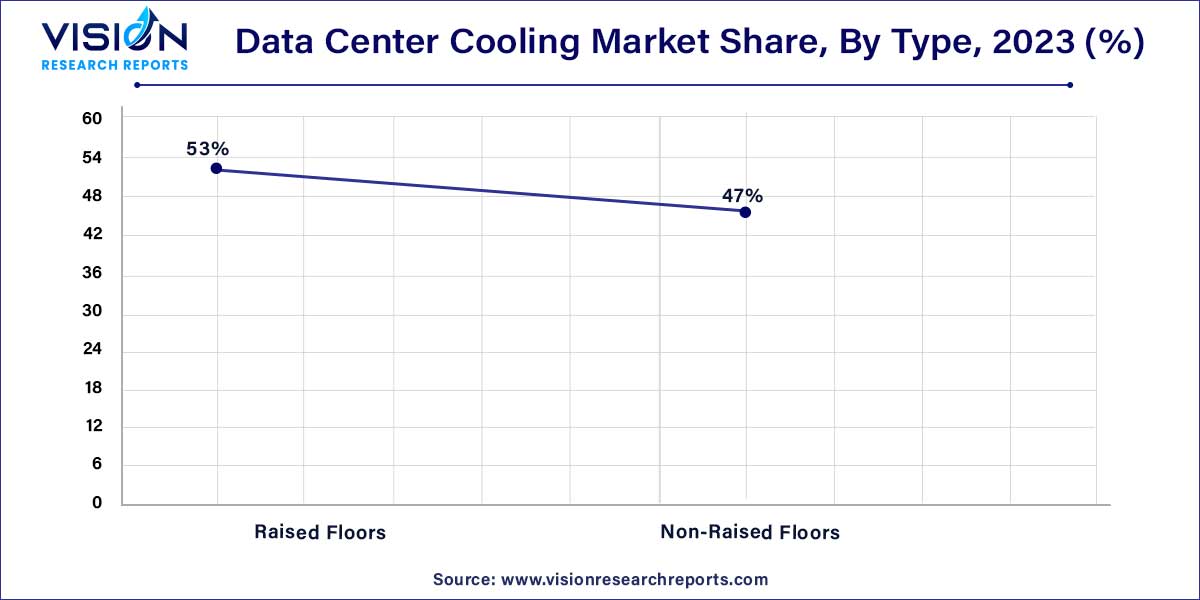

In 2023, the non-raised floor segment commanded the largest revenue share, accounting for nearly 53%. Non-raised floor infrastructure plays a vital role in integrating modern surveillance and thermal assessment systems within data centers. This infrastructure enables service providers to proactively detect and resolve issues by offering real-time monitoring of temperature fluctuations across the facility. The streamlined construction process associated with non-raised floors results in reduced labor and material costs, thereby lowering upfront expenses.

Looking forward, the raised floor segment is projected to achieve the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. Technological advancements are driving market expansion for raised floor data center cooling solutions. Raised floors facilitate the management of airflow patterns within data centers, allowing for the implementation of containment strategies such as hot and cold aisle configurations. By preventing the mixing of hot and ambient air, strategic airflow control enhances the overall efficiency of the cooling system. Raised floors also simplify the integration of advanced technologies such as sensors and tracking systems, enabling proactive management of cooling infrastructure through real-time environmental monitoring. These factors are expected to drive growth within the segment.

The containment segment is further divided into raised floor with containment and raised floor without containment. Within the raised floor with containment category, there are two sub-segments: Hot Aisle Containment (HAC) and Cold Aisle Containment (CAC). This segment accounted for a significant share of over 57% in 2023, driven by the increasing adoption of hot and cold aisle containment methods.

Hot aisle containment minimizes the mixing of air particles, leading to higher savings on electrical costs and increased utilization of economizer hours. Additionally, implementing cold aisle containment in existing raised floor data centers is efficient, easily retrofitted, and cost-effective. These features contributed to cold aisle containment holding the largest market share in 2023.

The key sectors with significant data center requirements include IT & telecom, retail, healthcare, BFSI (banking, financial services, and insurance), and energy. In 2023, the IT & telecom sector experienced substantial growth in demand for data center cooling solutions, driven primarily by the effects of the pandemic. The shift towards remote work arrangements resulted in a surge in demand for IT infrastructure, creating opportunities for new cooling solutions.

Moving forward, the retail segment is projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 16.03% from 2024 to 2033. This growth can be attributed to the widespread use of Image Processing Verification Tools (IPVT), social media, smartphones, and tablet computers, leading to an increase in data volume and subsequent demand for data center cooling solutions.

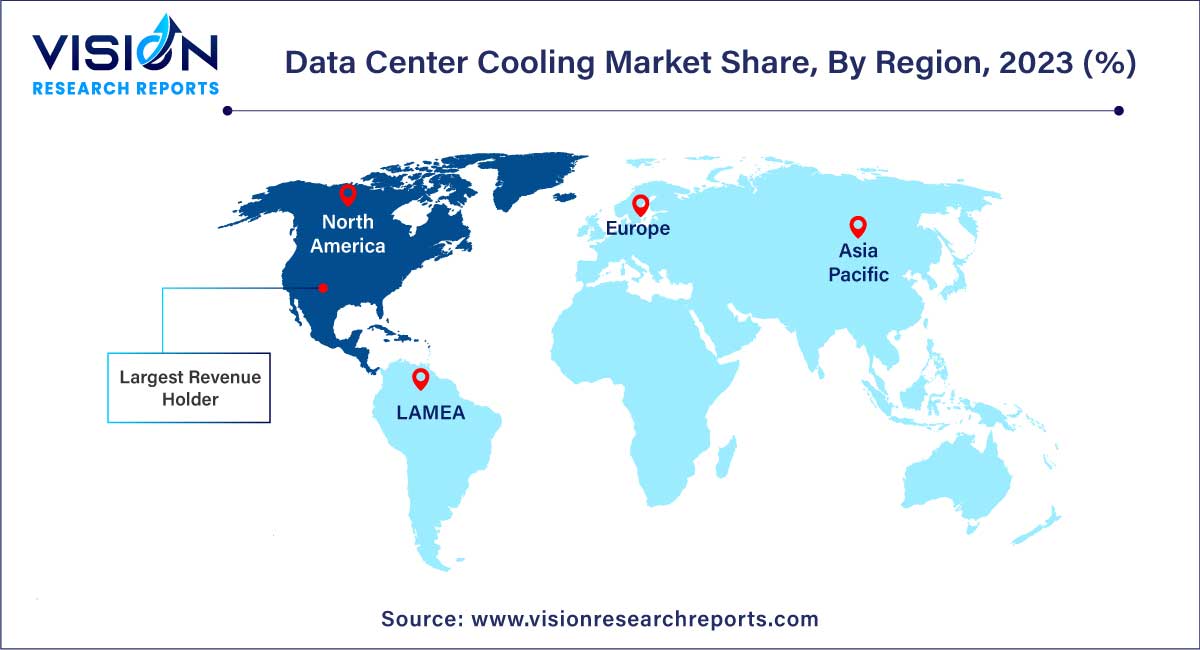

In 2023, North America led the global demand for data center cooling solutions and is projected to grow at an estimated CAGR exceeding 12.03% from 2024 to 2033. The region promises to undergo advanced adoption of new technology-based solutions with the prevalence of technology giants, including Facebook, Amazon Inc., and Google Inc. The region has a substantial number of data centers marked by the presence of several IT companies, creating avenues for the data center cooling solutions industry. Thus, driving market growth in North America.

Asia Pacific is expected to gain prominence from 2024 to 2033 as the applications of data center cooling systems are expected to increase in the telecom segment. This may be attributed to the increasing number of service providers for external IT infrastructure services who operate and manage critical business information and applications.

Data Center Cooling Market Segmentations:

By Component

By Solution

By Services

By Type

By Containment

By Structure

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others