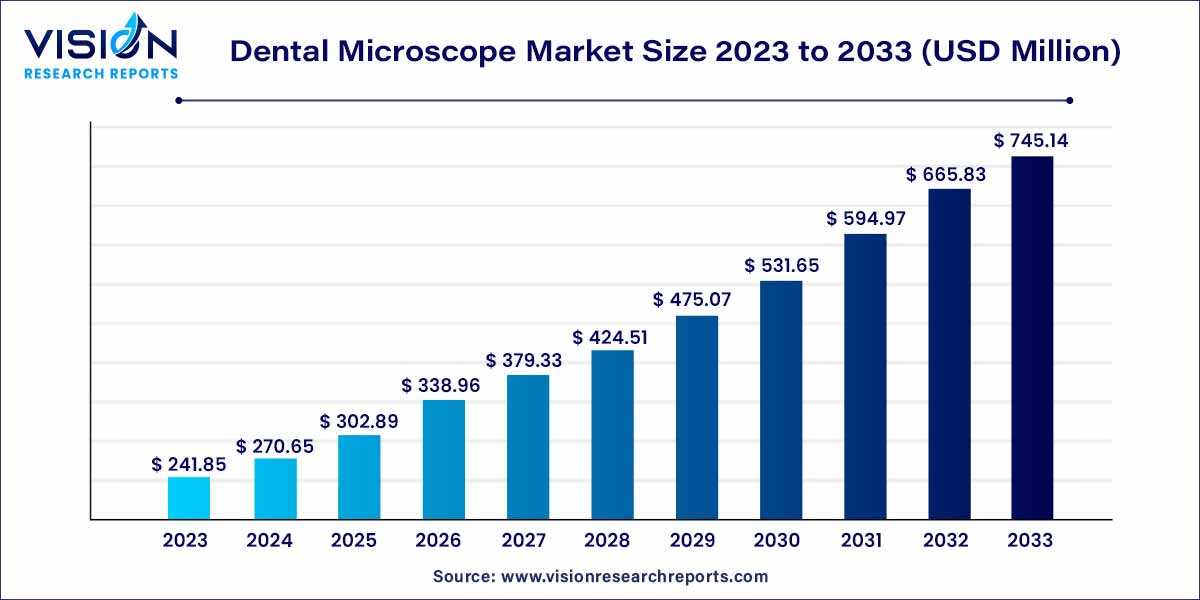

The global dental microscope market size was estimated at USD 241.85 million in 2023 and it is expected to surpass around USD 745.14 million by 2033, poised to grow at a CAGR of 11.91% from 2024 to 2033. The dental microscope market is experiencing a transformative phase, driven by the increasing recognition of the pivotal role played by advanced visualization tools in modern dentistry. Dental microscopes have become indispensable instruments, elevating the standard of diagnostics and treatment precision within the dental industry.

The growth of the dental microscope market is propelled by several key factors. Firstly, the increasing demand for precision dentistry has been a significant driver, with dental professionals recognizing the indispensable role of advanced visualization tools in achieving enhanced accuracy during diagnostic and treatment procedures. Technological advancements play a pivotal role, as ongoing innovations in microscope technology, including the integration of digital features and ergonomic designs, continue to redefine the capabilities of dental microscopes. Additionally, the expanding application spectrum of these instruments across various dental specialties, such as endodontics and restorative dentistry, contributes to their widespread adoption in dental clinics, hospitals, and academic institutions. This versatility ensures that dental microscopes are integral components across diverse facets of oral healthcare. As the market continues to address challenges like high initial costs and specialized training requirements, opportunities emerge for the development of cost-effective solutions and targeted training programs, further fostering growth. Overall, the Dental Microscope market's trajectory is driven by the intersection of precision-focused demands, technological evolution, and the broadening scope of applications within the dental field.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.91% |

| Market Revenue by 2033 | USD 745.14 million |

| Revenue Share of North America in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The surgical microscopes segment dominated the market with the largest share of 69% in 2023. The global Dental Microscope market boasts a diverse array of products, prominently featuring Surgical Microscopes and Operating Microscopes. These precision instruments have become integral components within the dental industry, offering practitioners enhanced visualization capabilities for a range of diagnostic and interventional procedures. Surgical Microscopes, a primary category within the market, are designed to provide magnified and illuminated views of the oral cavity during intricate dental surgeries. With advanced optics and adjustable illumination, these microscopes empower dental surgeons to perform procedures with unprecedented precision, ultimately leading to improved treatment outcomes.

The operating microscope segment is expected to grow significantly over the forecast period. Operating Microscopes represent another essential facet of the dental microscope market, catering to a broader spectrum of dental procedures beyond surgery. These microscopes are characterized by their adaptability across various disciplines within dentistry, including endodontics, restorative dentistry, and prosthodontics. The versatility of Operating Microscopes lies in their ability to facilitate detailed examinations and precise interventions across different dental specialties. The integration of advanced technologies, such as digital imaging systems, enhances their functionality, allowing for real-time visualization and documentation of dental procedures.

The portable segment led the market with the largest share of 69% in 2023. Portable Dental Microscopes offer practitioners a flexible and mobile solution, enabling them to carry out detailed examinations and procedures with ease. These microscopes, equipped with advanced optics and illumination, provide a high degree of magnification and clarity, making them suitable for use in various dental settings. The portability factor is particularly advantageous for dental professionals who require on-the-go access to enhanced visualization tools, facilitating efficient and precise treatments.

The fixed segment is expected to grow at the fastest CAGR of 12.44% during the forecast period. Fixed Dental Microscopes are designed for more stationary and dedicated use within dental clinics or operating rooms. These microscopes are integrated into specific locations, offering a stable and ergonomic platform for intricate dental procedures. Fixed microscopes often come equipped with features tailored to the specific needs of the dental setting, including adjustable stands and lighting systems that enhance visibility. The stationary nature of these microscopes ensures a consistent and reliable tool for practitioners who prioritize a dedicated workspace with optimal visualization capabilities.

The hospital segment contributed the largest market share of 53% in 2023. Hospitals, as integral components of the healthcare ecosystem, leverage Dental Microscopes to enhance their diagnostic and surgical capabilities. These institutions utilize microscopes in various dental specialties, ranging from oral surgeries to endodontic procedures, facilitating precise interventions and contributing to improved patient outcomes. The incorporation of Dental Microscopes in hospital settings underscores a commitment to advanced technology and heightened standards of care within the broader healthcare infrastructure.

The clinics segment is expected to grow at the fastest CAGR of 12.25% over the forecast period. Clinics, on the other hand, represent a pivotal segment in the Dental Microscope market, embodying the frontline of dental practice. Dental clinics of various sizes and specializations integrate microscopes into their daily operations to perform detailed examinations, intricate surgeries, and restorative procedures with enhanced accuracy. The versatility of Dental Microscopes aligns seamlessly with the diverse range of services offered by dental clinics, allowing practitioners to address a myriad of dental conditions while maintaining a commitment to minimally invasive techniques. The adoption of microscopes in clinics contributes significantly to the ongoing evolution of dental practices, emphasizing precision and patient-centric care.

North America dominated the market with the largest share of 36% in 2023. In North America, a robust healthcare infrastructure and a high prevalence of dental disorders contribute to the significant demand for Dental Microscopes. The region is characterized by a proactive embrace of technological advancements in dentistry, driving innovation and adoption among dental professionals. North America stands as a key player in shaping the global landscape of dental microscopy, with a focus on precision and advanced diagnostic capabilities.

Asia Pacific is expected to grow at the fastest growth over the forecast period. Asia-Pacific represents a region with significant growth potential in the Dental Microscope market. The increasing awareness of dental health, coupled with rising disposable incomes in emerging economies, is driving the demand for advanced dental technologies. The dental industry in Asia-Pacific is witnessing a shift toward more sophisticated treatment modalities, spurring the adoption of Dental Microscopes across clinics and hospitals. As technology becomes more accessible, Asia-Pacific stands as a burgeoning market for dental microscopy solutions.

By Product

By Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dental Microscope Market

5.1. COVID-19 Landscape: Dental Microscope Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dental Microscope Market, By Product

8.1. Dental Microscope Market, by Product, 2024-2033

8.1.1 Surgical Microscope

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Operating Microscope

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Dental Microscope Market, By Type

9.1. Dental Microscope Market, by Type, 2024-2033

9.1.1. Portable

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Fixed

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Dental Microscope Market, By End-use

10.1. Dental Microscope Market, by End-use, 2024-2033

10.1.1. Hospital

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Dental Microscope Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Carl Zeiss AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Leica Microsystems (Danaher Corporation).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zumax Medical Co., Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Global Surgical Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Seiler Instrument .

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Labo America, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Karl Kaps GmbH & Co. KG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Foshan SOCO Precision Instrument Co., Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ARI Medical Technology Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Alltion (Wuzhou) Co., Ltd

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others