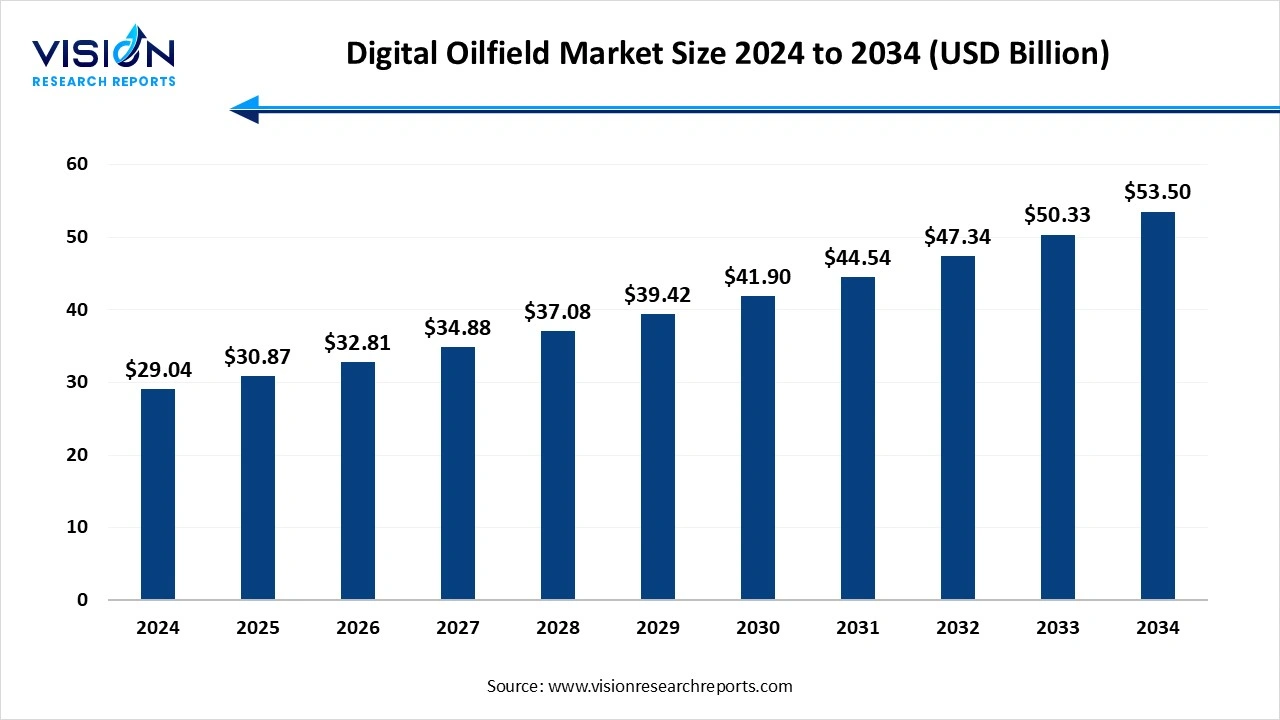

The global digital oilfield market size was surpassed at around USD 29.04 billion in 2024 and it is projected to hit around USD 53.50 billion by 2034, growing at a CAGR of 6.30% from 2025 to 2034.

The digital oilfield market represents a transformative evolution in the oil and gas sector, integrating advanced digital technologies such as automation, data analytics, artificial intelligence (AI), and the Internet of Things (IoT) to optimize operations. These technologies enable real-time monitoring, predictive maintenance, enhanced decision-making, and improved production efficiency across upstream, midstream, and downstream segments. The adoption of digital oilfield solutions is helping companies increase output while reducing operational costs and minimizing environmental impact.

One of the key growth factors driving the digital oilfield market is the increasing demand for operational efficiency and cost reduction in oil and gas operations. With fluctuating oil prices and rising exploration costs, companies are turning to digital technologies to optimize their resources. Advanced solutions such as real-time data analytics, automated drilling, and remote monitoring allow operators to make faster, more accurate decisions, leading to improved productivity and lower downtime. Additionally, digital tools help extend asset lifespans and reduce unplanned maintenance costs, offering a clear return on investment.

Another significant driver is the growing integration of IoT and artificial intelligence in oilfield operations. These technologies facilitate predictive maintenance, enhance reservoir modeling, and improve safety through early risk detection. Governments and industry regulators are also encouraging the adoption of digital technologies to ensure better compliance and environmental monitoring.

The digital oilfield market is witnessing a strong shift towards the adoption of cloud-based platforms and advanced analytics. Cloud computing allows for centralized data storage, seamless collaboration across geographically dispersed teams, and real-time access to operational insights. Combined with big data analytics, it enables companies to analyze vast volumes of operational and geological data to identify patterns, predict equipment failures, and make proactive decisions.

Another emerging trend is the integration of artificial intelligence (AI), machine learning (ML), and robotics to automate complex processes and enhance decision-making. AI-powered systems are being used to optimize drilling operations, forecast production rates, and detect anomalies in equipment behavior.

One of the primary challenges facing the digital oilfield market is the high initial investment and infrastructure requirements. Implementing digital solutions such as IoT sensors, advanced analytics platforms, and automation systems can involve significant capital expenditure, particularly for small and mid-sized oil companies. Additionally, integrating new technologies with legacy equipment often demands specialized expertise and customized solutions, which can increase implementation complexity and cost.

Another major challenge is the concern over data security and cyber threats. As oilfield operations become more connected and reliant on digital systems, they become increasingly vulnerable to cyberattacks and data breaches. The industry handles critical infrastructure and sensitive information, making cybersecurity a top priority. However, many companies lack the in-house capabilities to implement robust cybersecurity measures.

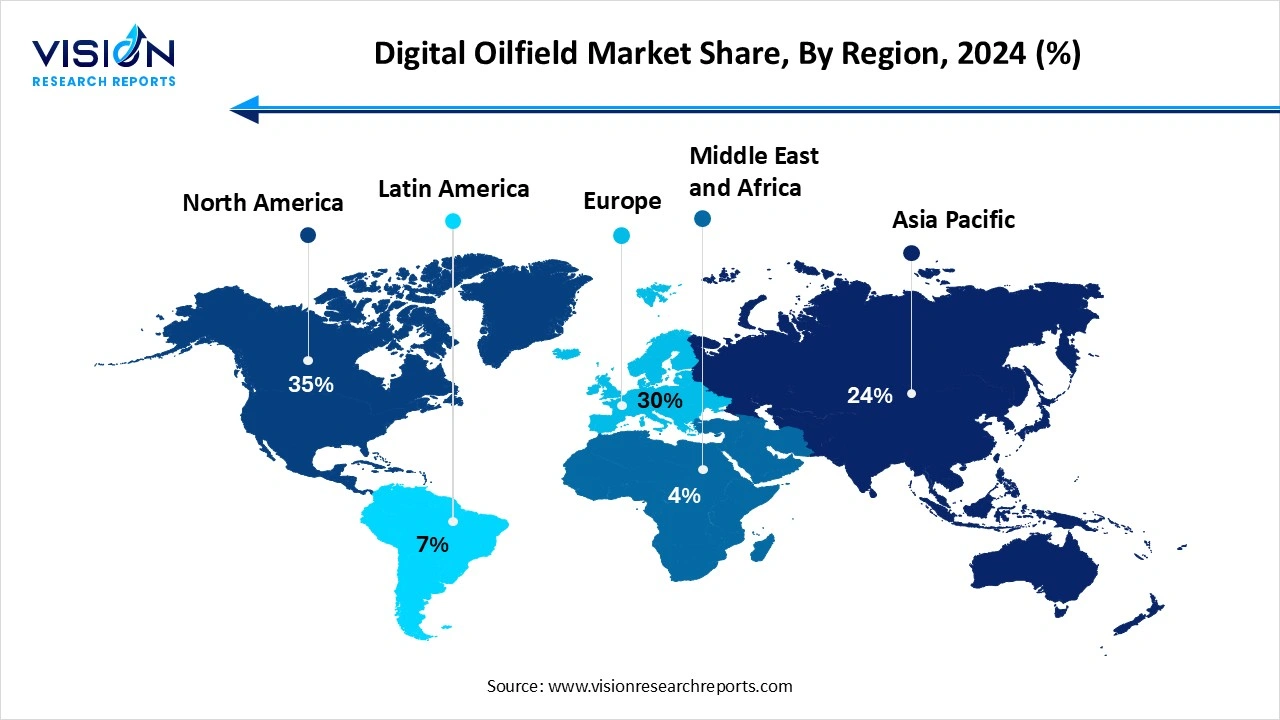

North America led the global digital oilfield market, accounting for a 35% share of the total revenue in 2024. The United States, in particular, is at the forefront of adopting digital oilfield technologies, driven by its extensive shale operations, high exploration activity, and early adoption of automation and analytics. Favorable government policies, a mature energy sector, and investments in digital transformation further support the market’s growth in this region.

The digital oilfield industry in Asia Pacific is projected to witness the fastest growth, with a CAGR of 7.3% over the forecast period. In the Asia-Pacific region, rapid industrialization, rising energy demand, and increasing oil and gas exploration activities in countries like China, India, and Australia are propelling the adoption of digital technologies.

The digital oilfield industry in Asia Pacific is projected to witness the fastest growth, with a CAGR of 7.3% over the forecast period. In the Asia-Pacific region, rapid industrialization, rising energy demand, and increasing oil and gas exploration activities in countries like China, India, and Australia are propelling the adoption of digital technologies.

The Product optimization led the digital oilfield industry in generating a revenue share of 31% in 2024, Through the integration of real-time data analytics, machine learning algorithms, and advanced control systems, oil and gas companies can fine-tune production strategies to improve well performance and reservoir management. Digital tools enable the continuous monitoring of pressure, temperature, flow rates, and other key metrics, allowing operators to make informed decisions and respond swiftly to changes in field conditions.

The safety management is another vital aspect of digital oilfield processes, where technology is leveraged to mitigate risks and ensure compliance with health, safety, and environmental regulations. Advanced monitoring systems, including IoT-enabled sensors and predictive analytics, help detect anomalies and hazardous conditions before they escalate into critical failures. Remote operations and automated safety protocols reduce the need for human intervention in high-risk environments, thereby minimizing the likelihood of workplace accidents.

The hardware solutions accounted for the largest market share at 50% in 2024. Key hardware components include sensors, control systems, industrial computers, distributed control systems (DCS), programmable logic controllers (PLCs), and field instruments that are strategically deployed across drilling sites and production facilities. These devices facilitate the continuous monitoring of parameters such as pressure, temperature, flow, and equipment performance.

The data storage solutions segment is projected to record the fastest CAGR of 7.4% throughout the forecast period. The oil and gas sector generates massive amounts of data daily from various sources such as sensors, seismic surveys, drilling logs, and production equipment. Efficient storage solutions, including cloud-based systems and on-premise data centers, are essential for capturing, organizing, and securing this information. Cloud storage, in particular, enables scalability, remote accessibility, and collaboration across multiple teams and geographic locations.

The onshore application segment led the digital oilfield market, capturing a revenue share of 66% in 2024. Digital technologies are increasingly being adopted across onshore fields to enhance production efficiency, reduce operational costs, and improve asset management. Onshore operations benefit from the deployment of real-time monitoring systems, automated drilling technologies, and predictive maintenance solutions, which collectively enable better resource allocation and improved decision-making.

The offshore application is expected to register the fastest CAGR of 6.7% during the forecast period. Offshore platforms rely heavily on real-time data analytics, remote monitoring, and automated control systems to manage complex operations, ensure safety, and reduce human intervention in hazardous areas. The use of digital twins, robotics, and subsea sensors allows for efficient management of deepwater drilling and production activities, minimizing downtime and optimizing reservoir performance.

By Process

By Solution

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Process Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Oilfield Market

5.1. COVID-19 Landscape: Digital Oilfield Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Oilfield Market, By Process

8.1. Digital Oilfield Market, by Process

8.1.1 Product Optimization

8.1.1.1. Market Revenue and Forecast

8.1.2. Drilling Optimization

8.1.2.1. Market Revenue and Forecast

8.1.3. Reservoir Optimization

8.1.3.1. Market Revenue and Forecast

8.1.4. Safety Management

8.1.4.1. Market Revenue and Forecast

8.1.5. Asset Management

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Digital Oilfield Market, By Solution

9.1. Digital Oilfield Market, by Solution

9.1.1. Hardware Solutions

9.1.1.1. Market Revenue and Forecast

9.1.2. Software & Service Solutions

9.1.2.1. Market Revenue and Forecast

9.1.3. Data Storage Solutions

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Digital Oilfield Market, By Application

10.1. Digital Oilfield Market, by Application

10.1.1. Onshore

10.1.1.1. Market Revenue and Forecast

10.1.2. Offshore

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Digital Oilfield Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Process

11.1.2. Market Revenue and Forecast, by Solution

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Process

11.1.4.2. Market Revenue and Forecast, by Solution

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Process

11.1.5.2. Market Revenue and Forecast, by Solution

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Process

11.2.2. Market Revenue and Forecast, by Solution

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Process

11.2.4.2. Market Revenue and Forecast, by Solution

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Process

11.2.5.2. Market Revenue and Forecast, by Solution

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Process

11.2.6.2. Market Revenue and Forecast, by Solution

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Process

11.2.7.2. Market Revenue and Forecast, by Solution

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Process

11.3.2. Market Revenue and Forecast, by Solution

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Process

11.3.4.2. Market Revenue and Forecast, by Solution

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Process

11.3.5.2. Market Revenue and Forecast, by Solution

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Process

11.3.6.2. Market Revenue and Forecast, by Solution

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Process

11.3.7.2. Market Revenue and Forecast, by Solution

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Process

11.4.2. Market Revenue and Forecast, by Solution

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Process

11.4.4.2. Market Revenue and Forecast, by Solution

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Process

11.4.5.2. Market Revenue and Forecast, by Solution

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Process

11.4.6.2. Market Revenue and Forecast, by Solution

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Process

11.4.7.2. Market Revenue and Forecast, by Solution

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Process

11.5.2. Market Revenue and Forecast, by Solution

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Process

11.5.4.2. Market Revenue and Forecast, by Solution

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Process

11.5.5.2. Market Revenue and Forecast, by Solution

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Schlumberger Limited.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Halliburton Company.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baker Hughes Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Weatherford International plc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Siemens AG.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ABB Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Emerson Electric Co..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8 Honeywell International Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Rockwell Automation, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Kongsberg Gruppen ASA

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others