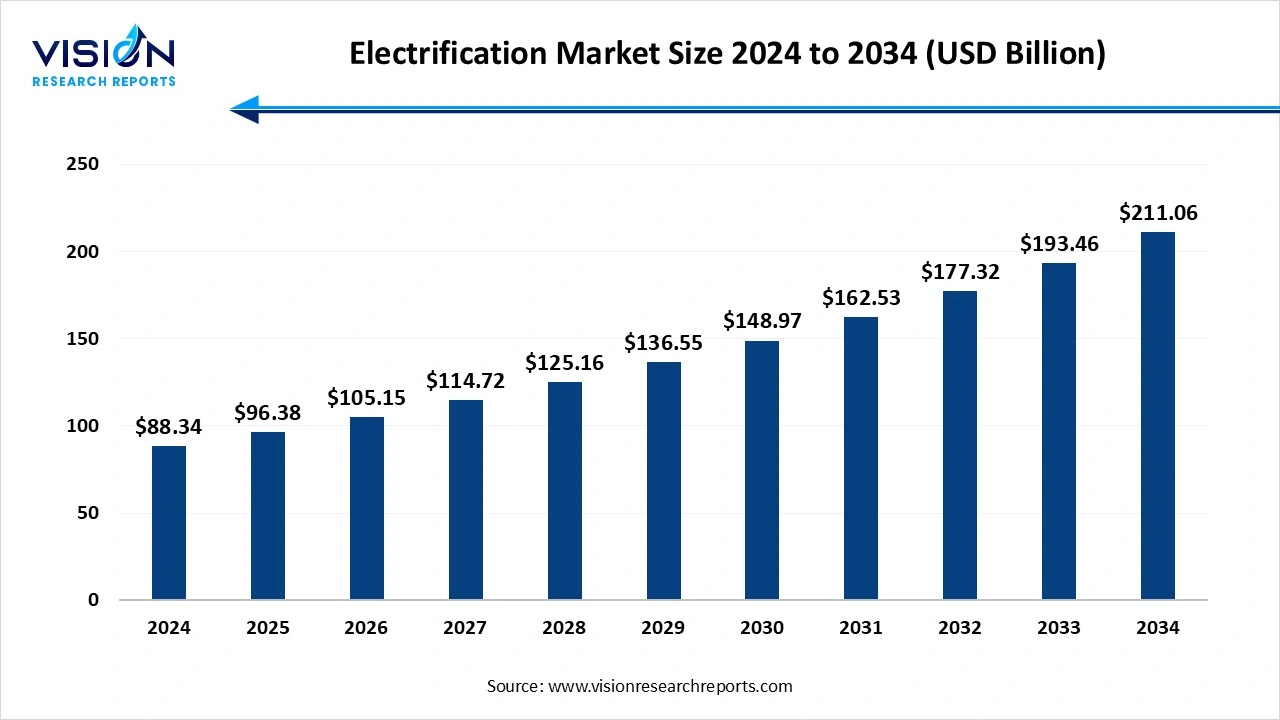

The global electrification market was evaluated at USD 88.34 billion in 2024 and USD 96.38 billion in 2025, and is projected to hit USD 211.06 billion by 2034, growing at a CAGR of 9.1% from 2025 to 2034. The electrification market is a dynamic and rapidly evolving sector, driven by the global transition toward sustainable energy solutions and the modernization of infrastructure.

Electrification is the process of conversion of any non-electric energy source to electricity at its point of final consumption. It is a major emerging trend in today’s global energy market. A combination of newer electric end-use technologies, manufacturers and a variety of policy objectives in various domains is driving the market forward. Electrification is an important process which is used to achieve net zero goals since it has the potential to reduce emissions as well as decarbonize energy supply chains.

The growing inclination towards electrified sources, especially in the transportation sector is anticipated to optimize the growth of the market throughout the forecast period. This growth is largely due to rising global concerns over pollution and rapid climate change. Moreover, electrification can be utilized in several industries and sectors, including commercial and residential buildings, smart transportation and industrial manufacturing.

The electrification market is experiencing robust growth driven by the global push for sustainability and reduced carbon emissions is a primary catalyst. Governments and organizations are implementing policies that favor cleaner energy sources, propelling the demand for electrification across various sectors. Technological advancements also play a crucial role, as innovations in electric vehicles, energy storage, and smart grid enhance the feasibility and efficiency of electrification.

Additionally, the decreasing costs of renewable energy technologies and the expanding availability of financial incentives make electrification more accessible and economically viable. Finally, increased awareness of environmental issues and consumer preference for greener solutions further accelerate market growth, as both residential and commercial entities seek to adopt sustainable practices.

| Report Coverage | Details |

| Market Size in 2024 | USD 88.34 Billion |

| Revenue Forecast by 2034 | USD 211.06 Billion |

| Growth rate from 2025 to 2034 | CAGR of 9.10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

Global Shift Towards Decarbonization

One of the primary drivers pushing the electrification market forward is the global shift towards decarbonization. Governments and organizations all over the world are increasingly becoming aware about ecological concerns and are taking necessary steps to reduce greenhouse gas emissions. This shift necessitates a transition from fossil fuels to electrified processes. This transition is more evident in sectors such as manufacturing and transportation, where electrification can substantially lower carbon footprint and align with global sustainability goals.

Several industries worldwide are actively investing in electrification technologies in order to comply with regulatory frameworks. This decarbonization not only enhances corporate responsibility but also opens new areas for innovation and investments, thus propelling market growth and development.

High Cost of Electrification Solutions

Despite promising growth prospects, the electrification market does have its fair share of challenges that could hinder its growth. One such challenge is the high cost of electrification solutions, particularly for electric vehicles and charging infrastructure. The initial investment required for the development and deployment of electrification solutions pose to be a barrier for consumers and industries. Additionally, the lack of standardization and interoperability of charging infrastructure can limit widespread adoption. This makes it difficult for small scale and medium scale companies to keep up with the market, thus slowing down market penetration.

Increased Investments and Technological Advancements

Rising investments in infrastructure are opening up new areas of opportunity in the electrification market. As industries increasingly shift to electrified processes, there is a growing need for robust electrical infrastructure. This includes the development of charging stations, grid enhancements and reliable energy management systems. Such investments are essential for ensuring reliable energy supply and facilitating the integration of renewable energy sources.

Technological advancements are also shaping the market. Innovations in electric motors, power electronics and control systems are enhancing the performance and reliability of electrified industrial processes. The introduction of smart grid technologies allows for better integration of renewable energy sources, thus optimizing energy distribution and usage. In addition to that, the development of advanced sensors and automation technologies enables real-time monitoring and control of energy consumption, leading to improved operational efficiency. As industries increasingly adopt these cutting-edge technologies, the electrification of processes is expected to accelerate even more.

North America dominated the global electrification market in 2024. This is due to the rapid adoption of technologies in the region. Additionally, the region benefits from numerous policies and strong regulatory frameworks such as the Clean Power Plan, catalyzing demand for electrification solutions across various sectors, including manufacturing and transportation. The push for sustainability and energy efficiency is further enhancing North America’s market growth, making it a global leader and competitor.

Asia-Pacific is expected to have the fastest growth rate. This growth is fueled by increasing industrialization, urbanization and government initiatives that are aimed at enhancing energy efficiency. Countries like China and India are leading the regional market, with significant investments being made in electrification infrastructure and renewable energy projects. Robust regulatory support and a growing focus on sustainability is further driving demand in the market.

Which source segment dominated the market this year?

The renewable energy segment dominated the market in 2024. This dominance is driven by rising concerns about climate change and the urgent need to lower greenhouse gas emissions. Environmental regulations in both developed as well as developing nations are expected to boost growth in this segment. Moreover, technological advancements in solar photovoltaic (PV) systems and energy storage solutions are anticipated to provide various growth opportunities for renewable energy.

The fossil fuels segment is projected to experience the fastest growth during the forecast period. Rising global populations and the consequent increase in energy demand, particularly in emerging economies contribute to this growth. Additionally, the growing middle-class population in the world is driving higher energy consumption and supporting the expansion of this segment.

Which application held the largest market share in 2024?

The transportation segment held the largest market share in 2024. This is due to increasing awareness about air pollution and climate change. Electrification, mainly through electric vehicles is a key solution to this environmental challenge. Furthermore, many countries all over the world are implementing policies and incentives in order to encourage EV adoption, including tax credits and emission requirements for automakers.

The building segment is seen to be the fastest growing segment throughout the forecast period. This growth is driven due to the technological possibilities that are well developed in the construction industry, as well as the heat pumps that are currently the most popular heating system in lately constructed residential places.

By Source

By Application

By Region

Electrification Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electrification Market

5.1. COVID-19 Landscape: Electrification Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electrification Market, By Source

8.1. Electrification Market, by Source, 2025-2034

8.1.1. Renewable Energy

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Nuclear Power

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Fossil Fuel-based

8.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Electrification Market, By Application

9.1. Electrification Market, by Application, 2025-2034

9.1.1. Transportation

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Buildings

9.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Electrification Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by January

11.1.2. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by January

11.1.4.2. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by January

11.1.5.2. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by January

11.2.2. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by January

11.2.4.2. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by January

11.2.5.2. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by January

11.2.6.2. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by January

11.2.7.2. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by January

11.3.2. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by January

11.3.4.2. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by January

11.3.5.2. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by January

11.3.6.2. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by January

11.3.7.2. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by January

11.4.2. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by January

11.4.4.2. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by January

11.4.5.2. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by January

11.4.6.2. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by January

11.4.7.2. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by January

11.5.2. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by January

11.5.4.2. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by January

11.5.5.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. ABB

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ZAPI GROUP

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Powersys Solutions

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Siemens

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Enel Spa

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Schneider Electric

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Duke Energy Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. General Electric

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Enel X S.r.l.

11.9. Evoqua Water Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. ICF International Inc.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others