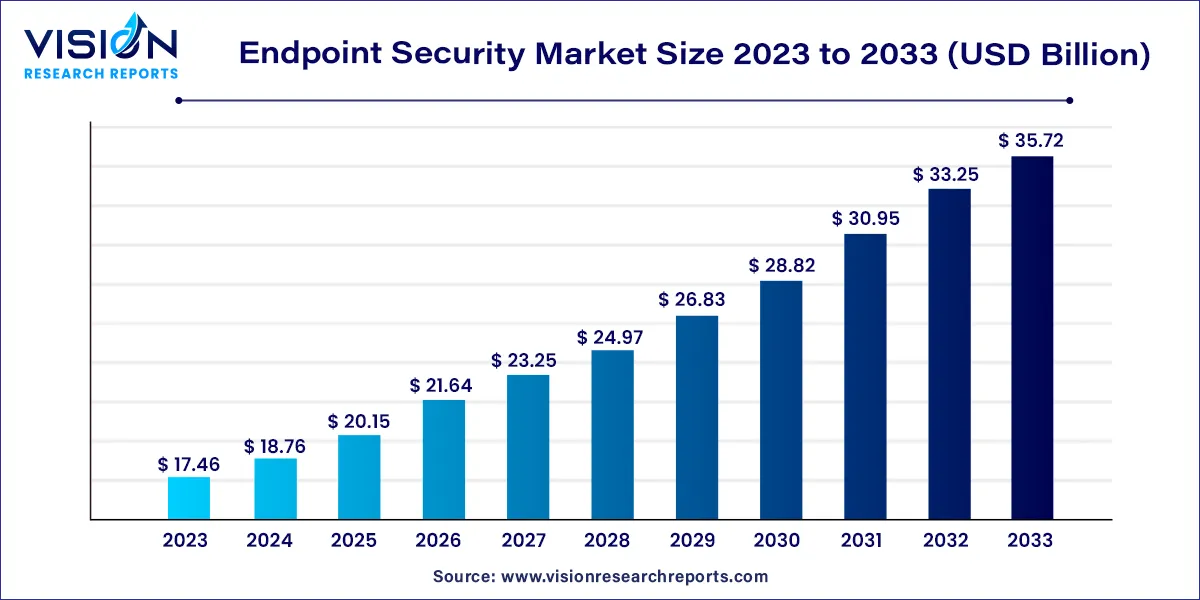

The global endpoint security market size was estimated at USD 17.46 billion in 2023 and it is expected to surpass around USD 35.72 billion by 2033, poised to grow at a CAGR of 7.42% from 2024 to 2033.

The endpoint security market is a dynamic and rapidly evolving sector within the broader cybersecurity landscape. In an era where digital connectivity is ubiquitous, safeguarding endpoints such as computers, smartphones, tablets, and servers from cyber threats is of paramount importance for businesses and individuals alike. Endpoint security solutions serve as the frontline defense, protecting these devices from a multitude of malicious activities, including malware, ransomware, phishing attacks, and data breaches.

The growth of the endpoint security market is propelled by several key factors. First and foremost, the escalating frequency and sophistication of cyber threats across various industries have necessitated robust endpoint security solutions. With cybercriminals constantly innovating their techniques, businesses are investing significantly in advanced security measures to safeguard their endpoints from malware, ransomware, and phishing attacks. Additionally, the rise of remote work and the proliferation of mobile devices have expanded the attack surface, compelling organizations to adopt comprehensive endpoint security strategies.

| Report Coverage | Details |

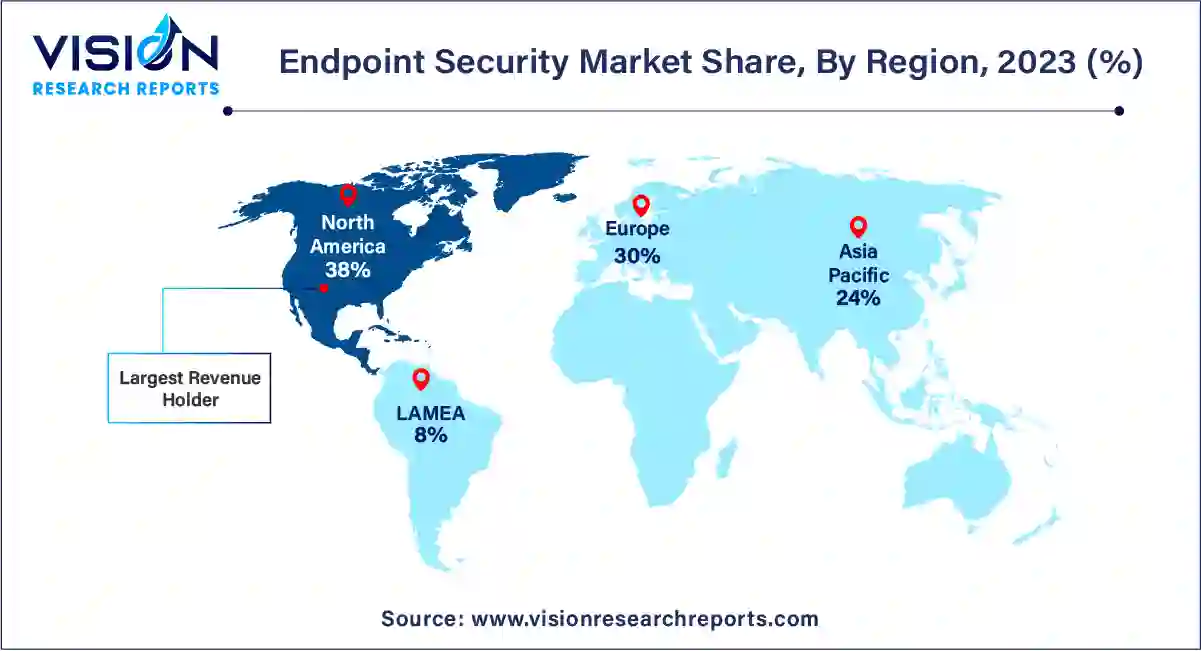

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 12.08% |

| Revenue Forecast by 2033 | USD 35.72 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.42% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The solution held the biggest market share of 68% in 2023. In terms of solutions, endpoint security offerings are comprehensive, ranging from antivirus software and firewalls to intrusion detection and prevention systems. These solutions act as the first line of defense, protecting endpoints such as computers, smartphones, and IoT devices from a myriad of cyber threats, including malware, ransomware, and phishing attacks. Encryption tools and behavioral analysis technologies are also pivotal components, ensuring the confidentiality and integrity of data transmitted between endpoints.

The services segment is projected to register the fastest CAGR of 8.94% during the forecast period. In addition to solutions, services play a crucial role in the global endpoint security market. Managed security services providers offer organizations expert guidance in selecting and implementing the most suitable endpoint security solutions for their specific needs. Security consulting and advisory services assist businesses in developing robust security strategies, addressing vulnerabilities, and ensuring regulatory compliance. Incident response and remediation services are essential for businesses dealing with cybersecurity incidents, providing timely and effective solutions to mitigate potential damages.

The on-premise segment led the global market with the largest market share of 63% in 2023. On-premise deployment, a traditional approach, involves installing and managing endpoint security solutions within an organization's physical infrastructure. This method provides businesses with direct control over their security systems, allowing for customization and fine-tuning according to specific requirements. On-premise deployment is favored by enterprises that prioritize having complete control over their security measures, particularly in highly regulated industries where data sovereignty and compliance are paramount concerns.

The cloud segment is expected to grow at a significant CAGR of 9.06% over the forecast period. Cloud-based deployment has emerged as a flexible and scalable alternative, offering numerous advantages to businesses in today's dynamic environment. Cloud-based endpoint security solutions are hosted and maintained by third-party service providers. This approach eliminates the need for extensive on-site hardware and software, significantly reducing upfront costs and IT complexity. Cloud deployment enables businesses to access cutting-edge endpoint security technologies without the burden of managing and updating infrastructure, ensuring that the security measures are always up-to-date against the latest threats.

The large enterprise segment dominated the market with the highest revenue share of 67% in 2023. Large enterprises, with their extensive digital infrastructures and significant data assets, require sophisticated and scalable endpoint security solutions. These solutions are tailored to meet the complex needs of large organizations, often managing a multitude of endpoints across various departments and geographic locations. Large enterprises prioritize robust security measures to safeguard their sensitive data, intellectual property, and customer information. Their security requirements often include advanced threat detection, real-time monitoring, and seamless integration with existing IT systems.

The SME segment is expected to grow at the fastest CAGR of 9.38% over the forecast period. SMEs form a substantial portion of the global endpoint security market. These businesses, while having smaller-scale operations compared to large enterprises, are not exempt from cybersecurity threats. In fact, the limited resources and budgets of SMEs make them attractive targets for cybercriminals. Endpoint security solutions designed for SMEs focus on simplicity, affordability, and ease of deployment. These solutions offer essential security features such as antivirus protection, firewall, and intrusion detection, tailored to meet the specific needs and constraints of smaller organizations. Cloud-based endpoint security services have gained popularity among SMEs due to their cost-effectiveness and low maintenance requirements.

The government & defense segment led the global market with the largest market share of 24% in 2023. The government and defense, endpoint security solutions are paramount due to the highly confidential nature of the information handled. Government agencies, military institutions, and defense organizations deal with classified data, making them prime targets for cyber-espionage and attacks. Advanced endpoint security applications in these sectors focus on securing communication networks, safeguarding classified documents, and protecting critical infrastructure.

The healthcare segment is anticipated to grow at the CAGR of 10.95% during the forecast period. In the healthcare sector, endpoint security is critical to safeguarding patient records, medical history, and sensitive healthcare information. Healthcare organizations, including hospitals, clinics, and research institutions, rely heavily on digital systems to store and manage patient data efficiently. Protecting this data from unauthorized access, data breaches, and ransomware attacks is paramount.

North America led the market with the largest revenue share of 38% in 2023. In North America, the market is driven by a strong focus on cybersecurity initiatives, stringent regulatory frameworks, and a high adoption rate of advanced technologies. The presence of major endpoint security vendors, coupled with the rising number of cyber-attacks, fuels the demand for robust security solutions in this region. North America remains a key revenue contributor to the global market, with organizations prioritizing investments in cutting-edge endpoint security measures to counter evolving threats effectively.

The Asia Pacific is expected to grow at the fastest CAGR of 12.08% during the forecast period. The Asia-Pacific (APAC) region showcases rapid economic growth and a burgeoning technology sector. As businesses digitize their operations, there is a heightened awareness of cybersecurity threats. Countries like China, India, Japan, and South Korea are witnessing substantial investments in endpoint security solutions. The region is characterized by a growing number of SMEs and startups, driving the demand for cost-effective cloud-based endpoint security services.

By Component

By Deployment

By Organization

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Endpoint Security Market

5.1. COVID-19 Landscape: Endpoint Security Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Endpoint Security Market, By Component

8.1. Endpoint Security Market, by Component, 2024-2033

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Endpoint Security Market, By Deployment

9.1. Endpoint Security Market, by Deployment, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Endpoint Security Market, By Organization

10.1. Endpoint Security Market, by Organization, 2024-2033

10.1.1. Large Enterprise

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. SME

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Endpoint Security Market, By Application

11.1. Endpoint Security Market, by Application, 2024-2033

11.1.1. IT & telecom

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. BFSI

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Industrial

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Education

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Retail

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Government & Defense

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Others

11.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Endpoint Security Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Organization (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Organization (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.3. Market Revenue and Forecast, by Organization (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Organization (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Organization (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Organization (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.3. Market Revenue and Forecast, by Organization (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Organization (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Organization (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Organization (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.3. Market Revenue and Forecast, by Organization (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Organization (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Organization (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Organization (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Organization (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Organization (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Broadcom

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Trend Micro Incorporated

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Sophos Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Microsoft

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. AO Kaspersky Lab

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Panda Security

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. F-Secure

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. IBM Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. McAfee, LLC.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. ESET spol. s r.o.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others