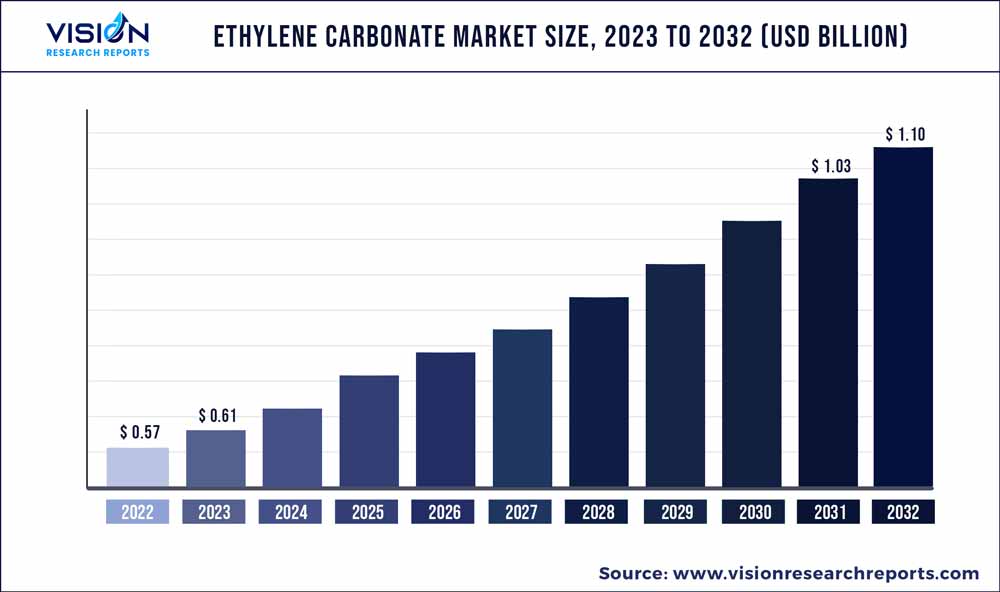

The global ethylene carbonate market size was estimated at around USD 0.57 billion in 2022 and it is projected to hit around USD 1.10 billion by 2032, growing at a CAGR of 6.77% from 2023 to 2032. The ethylene carbonate market in the United States was accounted for USD 92.4 million in 2022.

Key Pointers

Report Scope of the Ethylene Carbonate Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 37% |

| Revenue Forecast by 2032 | USD 1.10 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.77% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Mitsubishi Chemical Corporation; OUCC; FUJIFILM Wako Pure Chemical Corporation; TAOGOSEI CO.LTD.; Huntsman International LLC; Empower Materials |

The growth in demand for ethylene carbonate can be attributed to the increasing adoption of electric vehicles and the rising demand for energy storage systems. It is a critical component in the formulation of electrolytes for lithium-ion batteries which are widely used in electric vehicles, portable electronics, and renewable energy storage. The product finds application beyond batteries such as in the production of plastics, coatings, adhesives, and pharmaceuticals. The expansion of these industries in emerging economies is contributing to the market growth.

Also, growing awareness about environmental issues and the implementation of stringent regulations have led to a shift towards more eco-friendly alternatives. Ethylene carbonate is preferred due to its lower toxicity and environmental impact compared to other solvents and additives.

The primary raw materials required for ethylene carbonate production are ethylene oxide and carbon dioxide. Ethylene oxide is typically produced from ethylene, which is derived from petroleum or natural gas. Carbon dioxide can be obtained from various sources, including industrial waste streams or through purification from the atmosphere. The manufacturing process takes place in a controlled reactor system. The reactor is designed to handle the reaction conditions, ensure safety, and optimize production efficiency.

Form Insights

The solid form dominated the market with a revenue share of over 53% in 2022. This is attributed to its longer shelf life and ability to withstand higher temperatures without undergoing chemical changes. Solid ethylene carbonate finds extensive usage in various end-use industries including automotive, chemical, medical, and industrial sectors. It serves as an additive in the production of cosmetics, pharmaceuticals, and soldering fluxes. Additionally, in the oil and gas industry, it acts as a solvent to decrease viscosity during high-temperature or high-pressure drilling operations, especially when other fluids are insufficiently effective due to their low viscosity.

The product in its liquid form finds application in lubricants and polymers. It is extensively utilized in the production of high-density plastics that exhibit excellent resistance to impact and chemical degradation. By combining liquid ethylene carbonate with substances such as diethyl carbonate, ethene oxide, and propylene oxide, specialized materials can be created to meet specific requirements. Furthermore, the liquid form of the product plays a crucial role in the manufacturing process of lithium-ion battery electrolytes.

Application Insights

The lubricants segment dominated the market with a revenue share of over 33% in 2022. This is attributed to the extensive usage of lubricants in multiple industries including oil & gas, automotive, industrial, and others. The product is used as an additive or co-solvent in lubricant formulations to enhance their performance and properties. Additionally, it improves the lubricity and film-forming capabilities of the lubricant, reducing friction and wear between moving parts. Ethylene carbonate helps to prevent metal-to-metal contact and minimize the risk of surface damage and component failure by forming a protective film on the metal surfaces.

Lithium battery electrolyte was the second largest application segment accounting for a revenue share of more than 31% in 2022. The product is widely used in lithium battery electrolytes, particularly in lithium-ion batteries. It serves as a key component in the formulation of the electrolyte solution, which is responsible for facilitating the movement of ions between the battery's positive and negative electrodes.

Ethylene carbonate finds applications in the pharmaceutical industry. It can be used as a solvent or co-solvent in drug formulations and as a component in controlled-release systems. Additionally, it is employed in the production of coatings and adhesives. It can enhance the film-forming properties, adhesion, and durability of the coatings and adhesives.

End-use Insights

The automotive end-use dominated the market with a revenue share of more than 44% in 2022. This is attributed to increasing usage of the product in the automotive industry particularly in the manufacturing of components like ignition cable sets, spark plugs, and battery terminals. This is primarily due to the high dielectric strength of ethylene carbonate, which enhances safety and provides protection against electric shock in automotive applications.

Oil & gas was the second largest end-use segment accounting for a revenue share of more than 20% in 2022. This is attributed to its increasing utilization as a solvent in various extraction processes within the oil and gas industry. It can effectively dissolve certain substances such as aromatic hydrocarbons, and aid in their separation from the desired products. Additionally, the product is used as a component in drilling fluids. It can help reduce viscosity and enhance the lubricity of the mud, improving the drilling efficiency and reducing friction between the drill bit and the wellbore.

Ethylene carbonate is employed as a solvent or co-solvent in the formulation of pharmaceutical drugs. It can dissolve and solubilize various active pharmaceutical ingredients (APIs) or other components, aiding in the development of drug formulations with improved bioavailability and stability. It can act as a stabilizer, plasticizer, or viscosity modifier, enhancing the performance and functionality of the final drug product.

Regional Insights

Asia Pacific dominated the market with a revenue share of more than 37% in 2022. The growth is attributed to the growing adoption of electric vehicles and the increasing demand for energy storage systems in the region. Additionally, factors such as a strong industrial base, supportive government policies, and the availability of cost-effective labor incentivize major industry players to invest in the region. Moreover, the region holds a prominent position in the production of lithium-ion battery electrolytes and EV lithium-ion batteries. This is expected to drive the market growth in the coming years.

China's thriving automotive industry, driven by the growing demand for electric vehicles (EVs), has significantly contributed to the increased consumption of ethylene carbonate. China has emerged as one of the leading manufacturers of EVs and lithium-ion batteries, further boosting the demand for the product. Additionally, the electronics industry in the country is witnessing substantial growth, driven by the increasing adoption of consumer electronics and advancements in technology. Ethylene carbonate is widely used in the production of electronic components, such as capacitors and printed circuit boards, which has led to a surge in its consumption.

The automotive industry in North America, particularly in the U.S., has witnessed significant growth in the production and adoption of electric vehicles. The U.S. has been focusing on reducing its dependence on fossil fuels and transitioning towards clean and renewable energy sources. This has led to the expansion of the energy storage sector, including grid-scale energy storage systems. Ethylene carbonate is used in the manufacturing of lithium-ion batteries for energy storage applications, driving its consumption in the region.

Ethylene Carbonate Market Segmentations:

By Form

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Form Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ethylene Carbonate Market

5.1. COVID-19 Landscape: Ethylene Carbonate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ethylene Carbonate Market, By Form

8.1. Ethylene Carbonate Market, by Form, 2023-2032

8.1.1 Solid

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Liquid

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Ethylene Carbonate Market, By Application

9.1. Ethylene Carbonate Market, by Application, 2023-2032

9.1.1. Lubricants

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Surface Coatings

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Lithium Battery Electrolyte

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Plasticizers

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Ethylene Carbonate Market, By End-use

10.1. Ethylene Carbonate Market, by End-use, 2023-2032

10.1.1. Automotive

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Oil & Gas

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Medical

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Ethylene Carbonate Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Form (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Form (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Form (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Form (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Form (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Form (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Form (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Form (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Form (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Form (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Form (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Mitsubishi Chemical Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. OUCC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. FUJIFILM Wako Pure Chemical Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. TAOGOSEI CO.LTD.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Huntsman International LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Empower Materials

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others