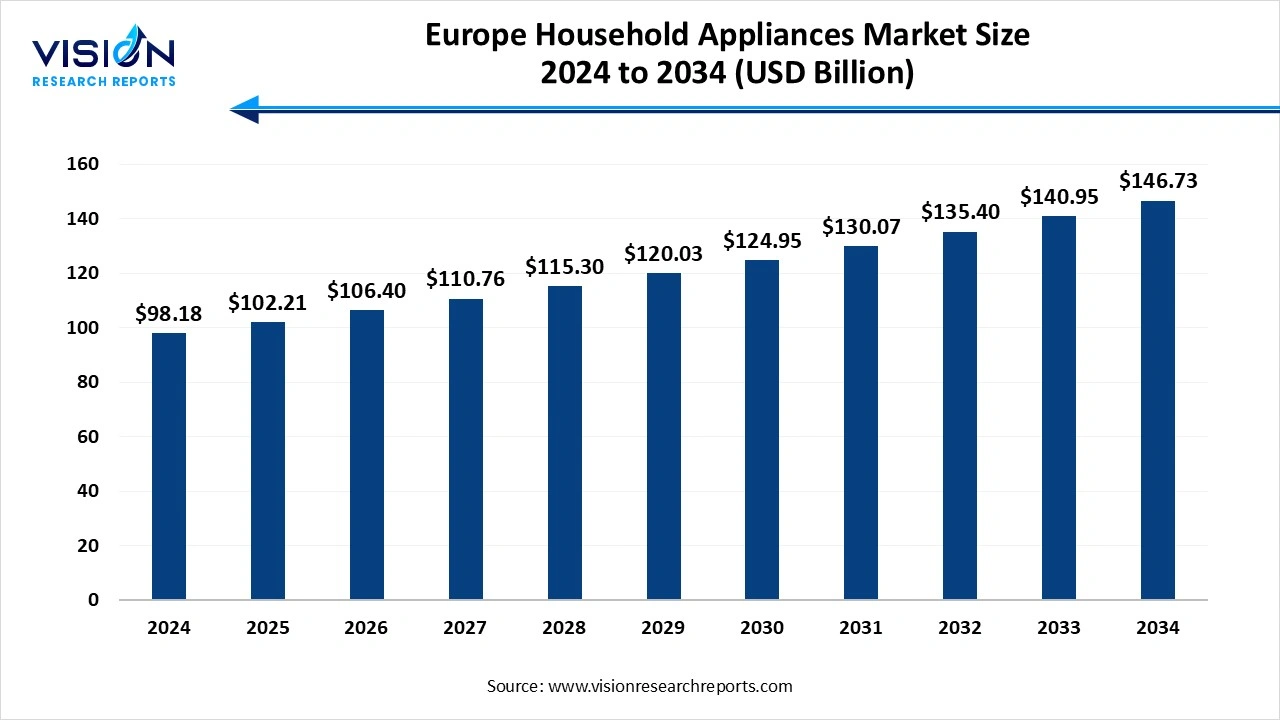

The Europe household appliances market size was estimated at around USD 98.18 billion in 2024 and it is projected to hit around USD 146.73 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034.

The Europe household appliances market is a mature yet evolving sector characterized by technological advancements, energy-efficient innovations, and growing consumer demand for smart home integration. With an increasing focus on sustainability and convenience, manufacturers are introducing appliances that are not only energy-saving but also capable of being remotely operated through smart technologies. Consumers in Europe, especially in countries like Germany, France, and the UK, are showing a growing preference for premium appliances that offer multi-functionality, sleek design, and advanced connectivity features. The market is supported by a strong distribution network, including online and offline retail channels, allowing greater accessibility to a wide range of products. Rising disposable income, urbanization, and lifestyle shifts are further contributing to increased expenditure on high-end home appliances.

One of the primary growth factors driving the Europe household appliances market is the increasing consumer inclination toward energy-efficient and smart appliances. Rising awareness about climate change, combined with stringent energy regulations from the European Union, has encouraged consumers to upgrade to appliances with better energy ratings and reduced environmental impact.

Another key growth driver is the surge in urbanization and the rise of dual-income households across Europe. As more individuals migrate to urban centers, there is a growing demand for compact, multifunctional appliances that suit limited living spaces. Furthermore, the increasing disposable income and changing consumer habits have led to a higher preference for premium and innovative products that offer superior performance and aesthetic appeal. These socioeconomic trends, combined with robust e-commerce growth and expanded retail channels, are significantly contributing to the sustained expansion of the household appliances market in the region.

The Europe household appliances market is currently witnessing a strong shift toward smart and connected appliances. Consumers are increasingly seeking devices that can be integrated with smart home ecosystems, controlled via mobile apps, and monitored remotely. Products such as smart refrigerators, washing machines, and ovens equipped with Wi-Fi and AI-driven functions are gaining traction, as they offer enhanced convenience, real-time monitoring, and personalized usage recommendations. This trend is particularly prominent in Western Europe, where digital adoption and home automation are more widespread.

Sustainability is another major trend shaping the market. Eco-friendly appliances with low energy and water consumption are in high demand due to strict EU environmental regulations and growing consumer consciousness about environmental impact. Manufacturers are focusing on designing recyclable, energy-efficient products that meet the EU's labeling standards, such as the Energy Label and Ecodesign Directive. These green innovations not only support environmental goals but also attract a more environmentally aware customer base.

One of the key challenges faced by the Europe household appliances market is the rising cost of raw materials and supply chain disruptions. The volatility in prices of essential components such as steel, plastic, and electronic chips has significantly impacted manufacturing costs. These fluctuations, coupled with logistical delays and shortages exacerbated by geopolitical tensions and post-pandemic recovery issues, have strained production timelines and affected product availability across the region. As a result, companies are under pressure to maintain price competitiveness while managing operational costs and inventory levels.

Another major challenge is the increasing regulatory complexity associated with energy efficiency and environmental compliance. While Europe’s progressive sustainability goals encourage innovation, they also require substantial investment in R&D and adaptation of manufacturing processes. Meeting stringent energy labeling standards, waste reduction norms, and circular economy principles often imposes additional costs on manufacturers. Smaller companies, in particular, may struggle to keep up with these evolving regulations, which could limit their growth or push them out of the market entirely.

The major appliances contributed to 84% of the total revenue generated in the Europe market in 2024. These products are essential components in modern households and are typically characterized by higher price points and longer replacement cycles. In Europe, the demand for energy-efficient and technologically advanced major appliances is rising, driven by growing awareness about environmental impact and compliance with stringent EU energy standards. Features such as smart connectivity, multi-functionality, and space-saving designs are becoming standard in new product lines, particularly in urban areas where compact living is common.

The small appliances market is expected to register a CAGR of 5.6% between 2025 and 2034. These products play a vital role in enhancing everyday convenience and are purchased more frequently compared to major appliances. The growth in this segment is fueled by lifestyle changes, increased consumer focus on personal health and hygiene, and the popularity of home-cooked meals. The trend of smart small appliances is also gaining traction, with features such as automated controls, voice assistance, and programmable settings becoming increasingly desirable.

The electronic stores generated approximately 44% of Europe's household appliance sales revenue in 2024. These stores serve as a vital link between manufacturers and end-users, providing both physical and digital retail experiences. In Europe, electronic retail chains and specialty stores continue to attract a large customer base due to their ability to offer expert guidance, product demonstrations, and after-sales support. Consumers often prefer shopping at these outlets to gain hands-on experience with appliances before making a purchase, especially for high-value or technologically advanced products.

The sales of household appliances via online channels are anticipated to grow at a CAGR of 4.8% between 2025 and 2034. driven by a rising consumer preference for convenience, extensive product variety, and competitive pricing offered by e-commerce platforms. Online shopping enables consumers to easily compare specifications, prices, and customer reviews, facilitating more informed purchasing decisions without the need to visit brick-and-mortar stores. The shift toward digital buying accelerated significantly during the COVID-19 pandemic, which familiarized a broader segment of the population with the benefits of online retail.

The germany held a 24% share of the European household appliances market revenue in 2024. Renowned for its high standards in engineering and energy efficiency, the country consistently demands innovative and sustainable appliances. German consumers prioritize durability, performance, and environmentally responsible features, prompting both domestic and international manufacturers to tailor their offerings accordingly. The presence of well-established local brands, combined with a technologically aware population, has driven the uptake of smart appliances and energy-efficient models. Moreover, the German government's emphasis on eco-friendly regulations, such as stringent energy labeling and recycling norms, has further influenced purchasing behavior.

The UK household appliances market is anticipated to grow at a compound annual growth rate CAGR of 4.8% during the period from 2025 to 2034. British consumers exhibit a strong preference for convenience-oriented and space-efficient appliances, especially given the urban housing landscape. The demand for smart and connected appliances is rising rapidly, fueled by tech-savvy consumers who value digital integration and remote control functionalities. Online retail is particularly strong in the UK, with a high penetration of e-commerce platforms offering competitive pricing, quick delivery, and user-friendly purchasing experiences.

By Product

By Distribution Channel

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Household Appliances Market

5.1. COVID-19 Landscape: Europe Household Appliances Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Household Appliances Market, By Product

8.1. Europe Household Appliances Market, by Product

8.1.1. Major Appliances

8.1.1.1. Market Revenue and Forecast

8.1.2. Small Appliances

8.1.2.1. Market Revenue and Forecast

Chapter 9. Europe Household Appliances Market, By Distribution Channel

9.1. Europe Household Appliances Market, by Distribution Channel

9.1.1. Hypermarkets & Supermarkets

9.1.1.1. Market Revenue and Forecast

9.1.2. Electronic Stores

9.1.2.1. Market Revenue and Forecast

9.1.3. Exclusive Brand Outlets

9.1.3.1. Market Revenue and Forecast

9.1.4. Online

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Europe Household Appliances Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by Distribution Channel

Chapter 11. Company Profiles

11.1. BSH Hausgeräte GmbH (Bosch, Siemens, Neff)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Electrolux AB

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Whirlpool Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Miele & Cie. KG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. LG Electronics Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Samsung Electronics Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Haier Europe (including Candy and Hoover brands)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Gorenje Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Arçelik A.Ş. (Beko, Grundig)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Vestel Group

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others