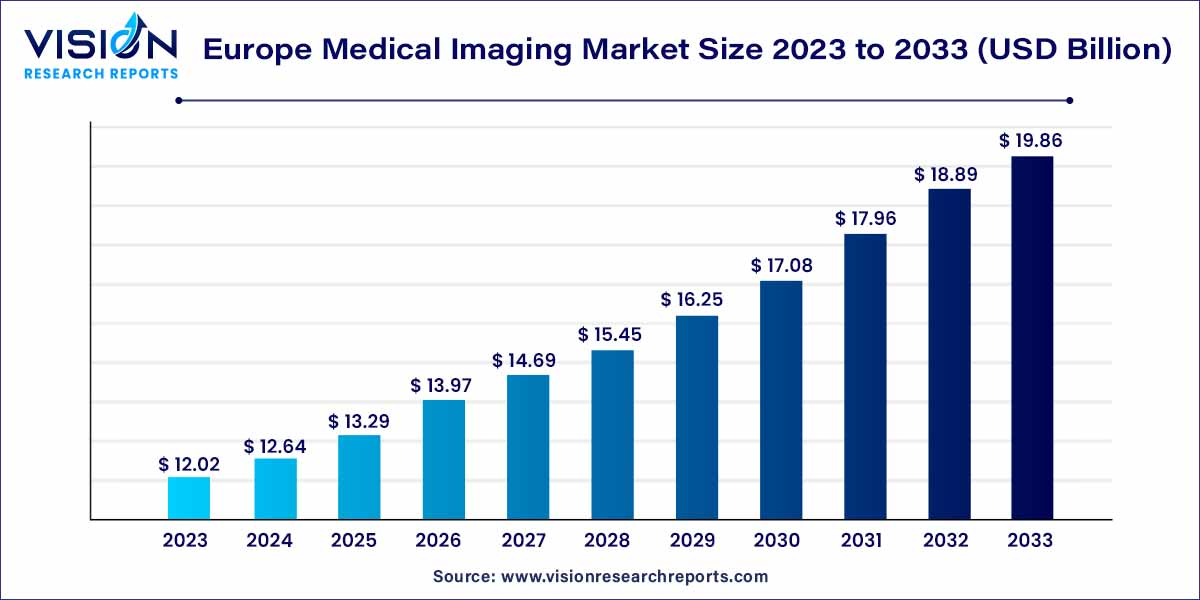

The Europe medical imaging market size was estimated at around USD 12.02 billion in 2023 and it is projected to hit around USD 19.86 billion by 2033, growing at a CAGR of 5.15% from 2024 to 2033.

The medical imaging market in Europe has witnessed significant growth and technological advancements in recent years. As a crucial component of modern healthcare, medical imaging plays a pivotal role in diagnosis, treatment planning, and monitoring of various medical conditions. This overview explores the key trends, challenges, and opportunities shaping the landscape of the medical imaging market in Europe.

The growth of the Europe medical imaging market is propelled by several key factors. Firstly, continuous technological advancements in the field, particularly the integration of artificial intelligence and machine learning, contribute to enhanced diagnostic capabilities and improved patient outcomes. The digitalization of healthcare systems, including the widespread adoption of Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS), further accelerates market growth by streamlining workflows and increasing accessibility to medical imaging data. Additionally, the rising prominence of telemedicine has led to an increased demand for mobile and remote imaging solutions, fostering market expansion. Furthermore, the emerging applications of medical imaging in oncology, particularly in early cancer detection and personalized treatment strategies, present significant growth opportunities. Strategic collaborations and partnerships between medical imaging companies, healthcare providers, and research institutions also play a pivotal role in driving innovation and market development. Despite challenges, these growth factors collectively contribute to the dynamic evolution of the Europe medical imaging market.

In 2023, the magnetic resonance imaging (MRI) segment claimed the largest market share at 34% and is projected to maintain its dominance throughout the forecast period. MRI systems find extensive applications in imaging various organs such as the abdomen, pelvis, brain, spine, heart, breast, and musculoskeletal structures. Particularly notable is their effectiveness in brain imaging, where the scans produced exhibit superior quality compared to those generated by CT scans. This superior quality allows MRI techniques to offer quantitative insights into the biological and physical properties of tissues. Given these advantages, MRI stands out as the preferred modality for scanning and investigating conditions related to the brain and neurological disorders, including brain tumors. Notably, the absence of ionizing radiation in MRI makes it a preferable choice, especially for patients and children requiring multiple imaging examinations.

Concurrently, the computed tomography (CT) segment is anticipated to experience the most rapid growth during the forecast period. This surge is attributed to a heightened demand for point-of-care CT devices and the evolution of high-precision CT scanners facilitated by the integration of artificial intelligence, machine learning, and advanced visualization systems. These advancements are pivotal in driving the growth of the CT segment, reflecting the market's responsiveness to innovative technologies and enhanced imaging capabilities.

In 2023, hospitals dominated the market, capturing the largest share at 43%. The growth of this segment is fueled by an escalating demand for advanced imaging modalities and the incorporation of surgical suits with imaging technologies. Notably, teaching hospitals have experienced a pronounced surge in demand for these modalities compared to general or specialized hospitals, with new healthcare facilities dedicating specific spaces for advanced imaging technologies. The competitive landscape and the growing quest for high-quality healthcare services are anticipated to be key drivers propelling the continual growth of this segment in the coming years.

Concurrently, the diagnostic imaging centers segment is poised for substantial growth in the forecast period. This expansion is attributed to an increased awareness of chronic diseases such as cancer, neurological disorders, and neurodegenerative conditions. The heightened awareness has led to a surge in demand for diagnostic procedures involving computed tomography (CT) and magnetic resonance imaging (MRI) for the diagnosis, treatment planning, and prevention of chronic disorders. The growth of this segment is further supported by the widespread adoption of advanced technologies, improved infrastructure, and significant funding directed towards the development of these specialized centers. Overall, these factors collectively contribute to the noteworthy growth of the diagnostic imaging centers segment in the foreseeable future.

In 2023, the Europe medical imaging market accounted for a substantial market share of 31%. This can be attributed to the region's notable adoption of advanced and high-end medical imaging equipment, facilitated by a favorable reimbursement scenario and significant funding from market players. The confluence of these factors, alongside the increasing aging population, a surge in chronic diseases, and a growing inclination towards preventive diagnostic practices, is poised to propel the medical imaging industry in the region. The commitment to cutting-edge technologies and the strategic support from both financial and healthcare sectors collectively contribute to the sustained growth and prominence of the medical imaging market in Europe.

By Product

By End-use

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Medical Imaging Market

5.1. COVID-19 Landscape: Europe Medical Imaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Medical Imaging Market, By Product

8.1. Europe Medical Imaging Market, by Product, 2024-2033

8.1.1. X-ray Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ultrasound

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Computed Tomography

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Magnetic Resonance Imaging

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Nuclear Imaging

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Medical Imaging Market, By End-use

9.1. Europe Medical Imaging Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Imaging Centers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Medical Imaging Market, Regional Estimates and Trend Forecast

10.1. Europe

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Koninklijke Philips N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Siemens Healthineers

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Canon Medical Systems Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mindray Medical International

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Esaote

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hologic, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Samsung Medison Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Koning Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. PerkinElmer Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others