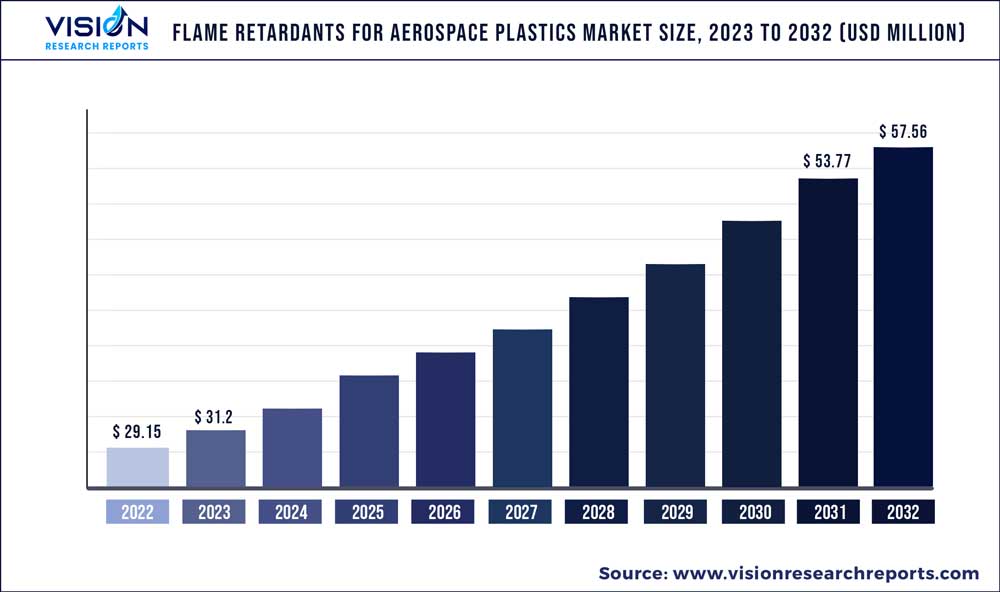

The global flame retardants for aerospace plastics market was surpassed at USD 29.15 million in 2022 and is expected to hit around USD 57.56 million by 2032, growing at a CAGR of 7.04% from 2023 to 2032. The flame retardants for aerospace plastics market in the United States was accounted for USD 6.11 million in 2022.

Key Pointers

Report Scope of the Flame Retardants For Aerospace Plastics Market

| Report Coverage | Details |

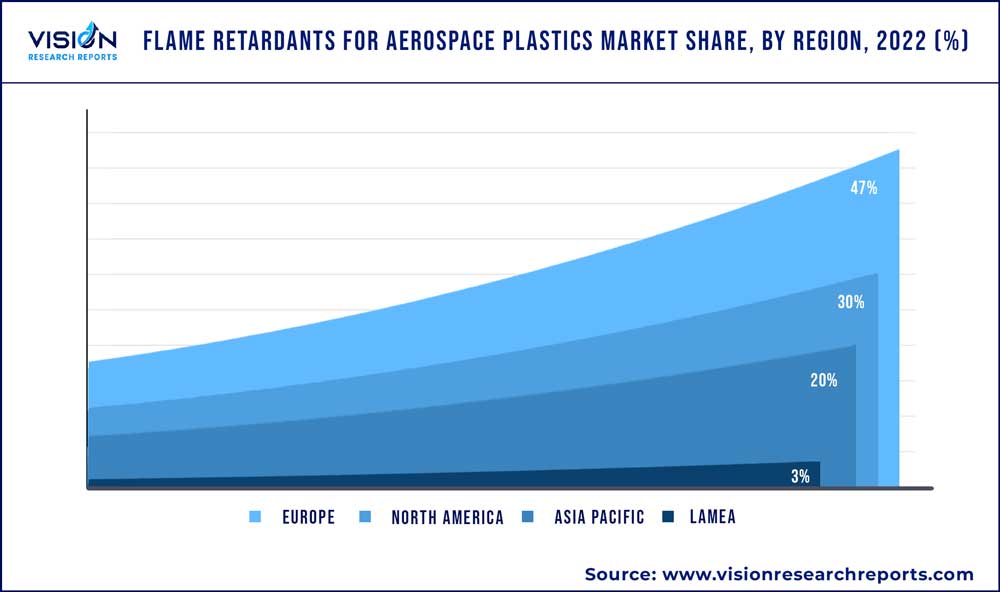

| Revenue Share of Europe in 2022 | 47% |

| Revenue Forecast by 2032 | USD 57.56 million |

| Growth Rate from 2023 to 2032 | CAGR of 7.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Huber Engineered Materials; Clariant Corporation; RTP Company; Italmatch Chemicals; Vantage Specialty Chemicals; Chemtura; Albemarle; Ciba; DIC Corporation; Rio Tinto; Solvay; Royal DSM; Israel Chemicals; BASF SE; Sinochem |

The industry is characterized by rising safety concerns over the flammability of plastic materials and their rapidly increasing usage in the aircraft sector. By incorporating flame retardants into plastics that are quickly replacing most conventional materials in the aerospace industry, it becomes easier to reduce the risk of fire hazards and improve passenger and cargo safety due to the confined spaces in airplanes. Non-halogenated retardants like alumina trihydrate, antimony oxides, and organophosphates have made it possible to expand even in developed markets that are constrained by restrictions. With these composites being used in a variety of airplane parts, from the cockpit to the empennage, carbon fiber reinforced polymers (CFRP) have been a major user of flame retardants.

The U.S. is the largest consumer of the product in North America with a revenue share of more than 75% in 2022. High demand from the automotive & packaging industries is expected to drive market advancement in North America. Furthermore, the continuous strengthening of food, environmental, and medical regulations by regulatory bodies, including the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), is expected to further contribute to high market demand in the coming years.

The rising awareness regarding the protection of combustible materials from fire hazards is another factor driving product demand. Decks, airframes, wings, cabins, cushion foams, rotor blades, and other interior parts of aeronautical vehicles frequently employ plastic. Because of their lightweight, adaptability, flexibility, low maintenance requirements, high resistance to chemicals and pressure, and versatility, high-performance engineered products such as polyimides, polycarbonates, glass-reinforced plastics (GRP), and even epoxies are overtaking traditional materials like metal and wood in terms of importance.

Product Insights

The aluminum trihydrates segment dominated the global flame retardants for aerospace plastics market with a revenue share of more than 43% in 2022. The significant demand for this product is attributed to the fact that aluminum trihydrate is an inexpensive substance that is frequently used in polymers for aerospace purposes since it is abundant in nature.

The increased demand for intumescent coatings, polyamides, and other aerospace plastic applications, has meant that red phosphorous, ammonium polyphosphate and other organophosphates have become the products with the fastest growth rates. Ammonium polyphosphate (APP) is primarily employed in intumescent systems, such as paints and coatings, to protect materials like steel and combustible plastics.

For aerospace plastic applications, antimony oxides are mostly employed as synergists with phosphorous- or nitrogen-based chemicals. The substance aids in fire prevention and control by delaying the decomposition process and preventing the release of flammable gases. Over the projection period, there will likely be a steady rise in the need for plastics and items that are fire-safe on airplanes to prevent mistakes and accidents.

There is a sizable market demand for other flame retardants made from materials like nitrogen, magnesium hydroxide, and molybdenum. Molybdenum compounds are most frequently utilized as smoke suppressants in cellulosic materials, although they recently became more common in many polymers as condensed-phase flame retardants. Due to its inherent stability at temperatures above 300 °C, magnesium hydroxide is a very acceptable alternative to ATH. The substance is also adaptable to processing across a variety of polymers, which encourages its use in aircraft plastics.

Application Insights

The carbon fiber reinforced plastic (CFRP) application segment dominated the market with a revenue share of 34% in 2022. This growth is attributed to the fact that CFRP contributes to a significant reduction in the weight of an aircraft and, as a result, a 20-30% reduction in fuel costs. Due to the material's strong impact resistance, defense jets are using it more and more frequently, mostly in armor shields to prevent unintentional damage to engine pylons. Due to these improved product qualities, Boeing, Airbus, and other international airlines are creating carbon fiber commercial aircraft more frequently.

Glass Reinforced Plastic (GRP) PA 66 is frequently used to create engine intake manifolds. Benefits include a decrease in weight of up to 60%, increased aerodynamics due to better surface quality, and general product flexibility. These fibers can be molded as single units and employed as reinforcement against high stress, thus enhancing aircraft safety and durability. Up to 12% GRP is used in the European "Eurofighter" to lighten, boost strength, and prolong the durability of this aircraft.

With regards to North America, the use of various types of plastics and advanced composite materials by NASA, NORAD, and other aerospace agencies to improve the efficiency of military, stealth, and space exploration vehicles is predicted to increase product demand in the U.S. and Canada. Increasing industrialization and rising consumer disposable income in Mexico are two additional important elements fostering the expansion of the regional market.

Regional Insights

Europe dominated the market with a revenue share of 47% in 2022. This growth is attributed to the presence of notable airline firms such as Airbus and Boeing, as well as others like the Safran Group and Rolls Royce Holding, in the region. The rigorous regulation of the manufacturing and aviation sectors in Europe has slowed the construction of halogenated retardants and made it difficult for other additives to expand.

The development of the aviation business in India, China, Thailand, and other emerging nations has been aided by the rising consumer disposable income in these countries and a sharp growth in interest in travel and tourism activities. In Asia Pacific, the use of flame retardants for plastics used in the production of aircraft is rising steadily.

Flame Retardants For Aerospace Plastics Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Flame Retardants For Aerospace Plastics Market

5.1. COVID-19 Landscape: Flame Retardants For Aerospace Plastics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Flame Retardants For Aerospace Plastics Market, By Product

8.1. Flame Retardants For Aerospace Plastics Market, by Product, 2023-2032

8.1.1. Antimony Oxide

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Aluminum Trihydrate

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Organophosphates/Phosphorous Compounds

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Boron Compounds

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Flame Retardants For Aerospace Plastics Market, By Application

9.1. Flame Retardants For Aerospace Plastics Market, by Application, 2023-2032

9.1.1. Carbon Fiber Reinforced Plastic (CFRP)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Glass Reinforced Plastic (GRP)

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Acrylonitrile Butadiene Styrene (ABS)

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Thermoset Polyimide

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Acrylonitrile Butadiene Styrene (ABS)

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Acetal/Polyoxymethylene (POM)

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Epoxies

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Flame Retardants For Aerospace Plastics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Huber Engineered Materials

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Clariant Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. RTP Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Italmatch Chemicals

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Vantage Specialty Chemicals

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Chemtura

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Albemarle

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ciba

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. DIC Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Rio Tinto

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others