Gene Therapy Platform Market Size, Trends, Share, Growth, Report 2025-2034

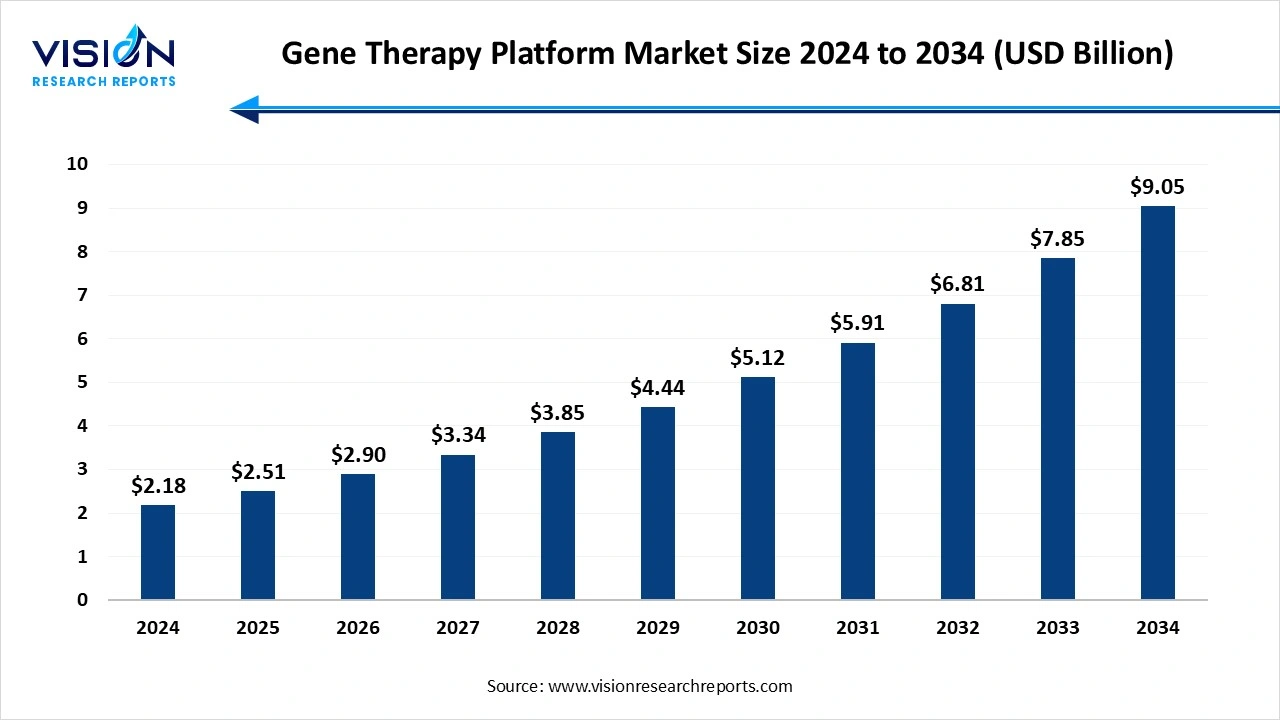

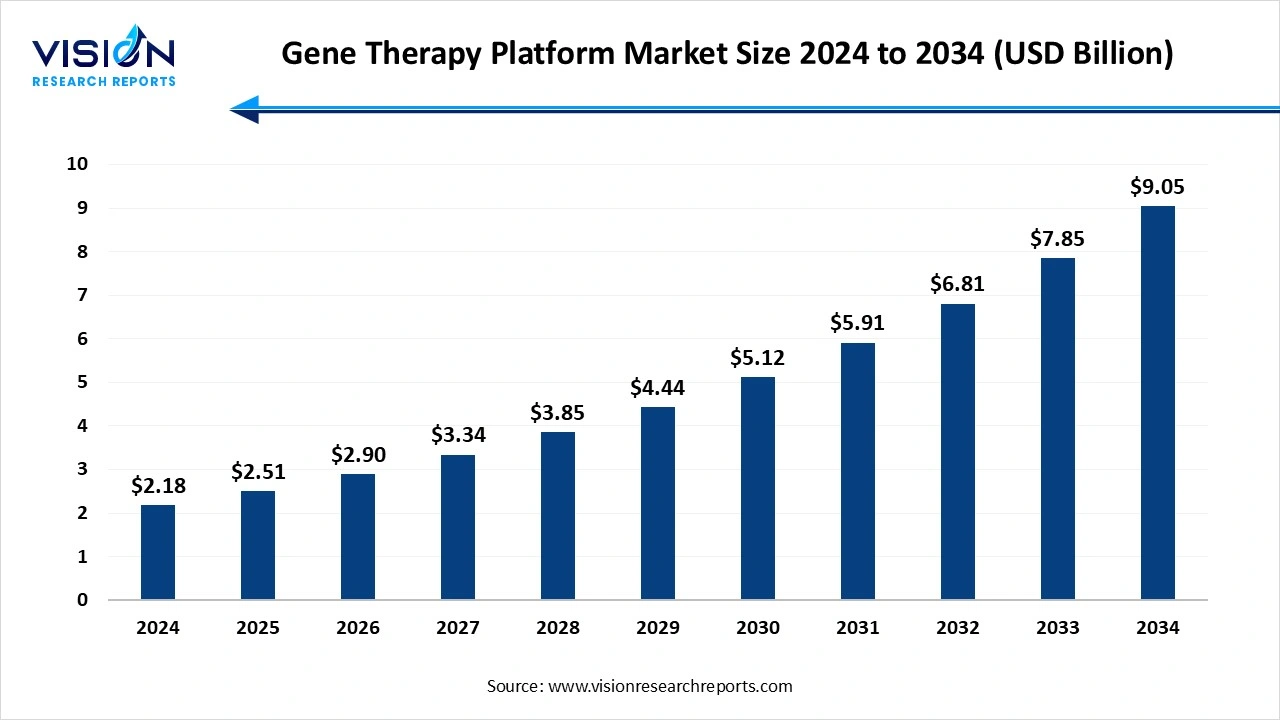

The global gene therapy platform market size was valued at USD 2.18 billion in 2024 and is expected to grow from USD 2.51 billion in 2025 to around USD 9.05 billion by 2034, expanding at a CAGR of 15.3% during the forecast period. The market growth is driven by rising genetic disorders, advancements in gene editing technologies like CRISPR-Cas9, and increasing adoption of personalized medicine, with North America leading and Asia-Pacific growing fastest.

Key Pointers

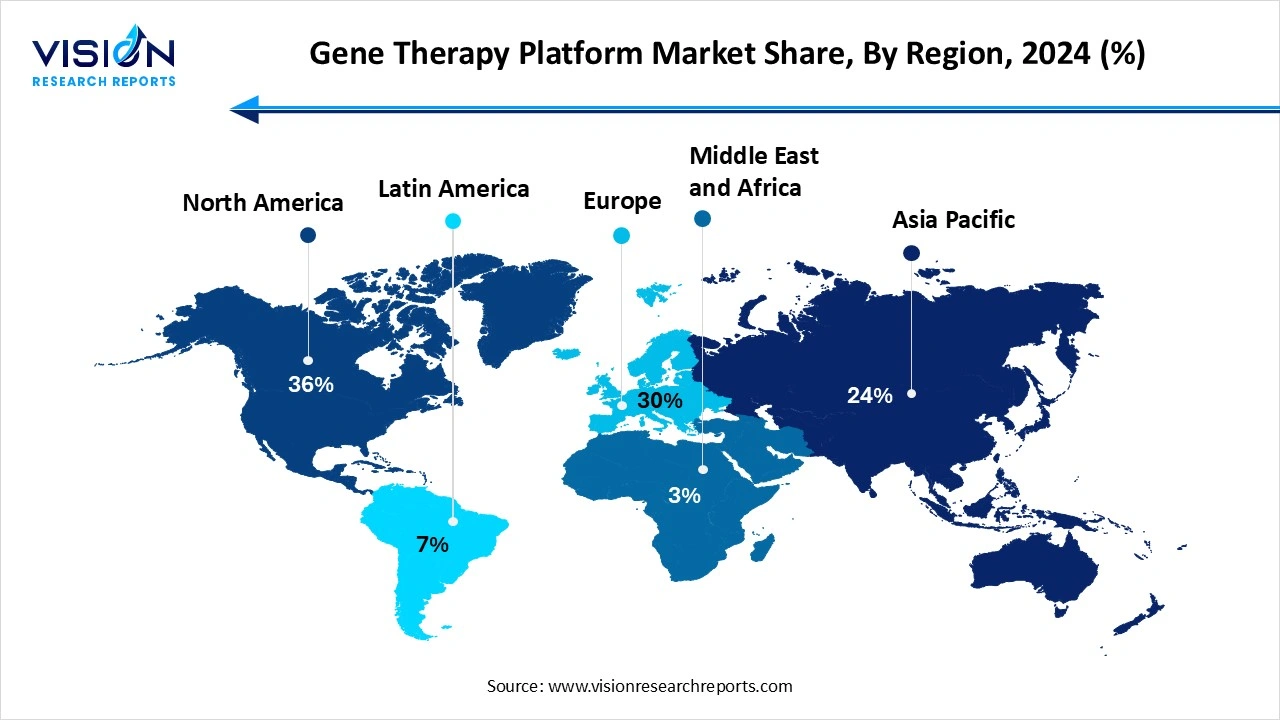

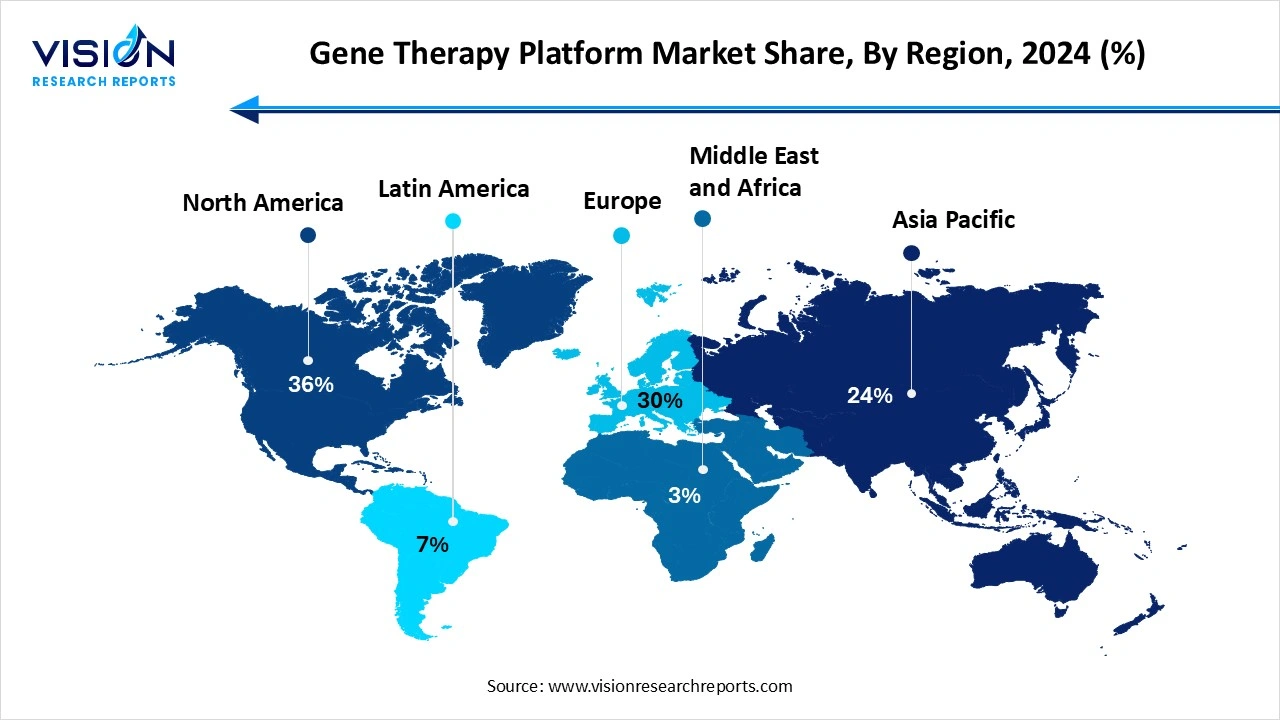

- By region, North America dominated the market share of 36% in 2024.

- By region, Asia-Pacific is expected to grow at the fastest rate throughout the forecast period.

- By product type, the viral vector platforms segment held the largest market share of 59% in 2024.

- By product type, the gene editing platforms segment is segment is expected to grow at the fastest rate throughout the forecast period.

- By application, the oncology segment dominated the market in 2024.

- By application, the hematological disorders segment is estimated to grow at the fastest rate.

- By delivery method, the in vivo gene therapy segment captured the largest share of revenue in 2024.

- By delivery method, the ex vivo gene therapy segment is projected to experience the highest growth rate as of this year.

- By end use, the pharmaceutical and biotechnology companies segment led the market.

- By end use, contract research organizations are the fastest growing segment.

Gene Therapy Platform Market Overview

A gene therapy platform is a comprehensive system or technology that is used to develop, deliver and manufacture gene-based treatments that can modify or even replace faulty genes. It is used to treat or prevent diseases. Investments in gene therapy have surged lately, with several funds and incentives flowing from governments, venture capitalists and pharmaceutical companies into research and development.

The gene therapy platform market is rapidly evolving, driven by advancements in genetic engineering and molecular biology. Innovations such as viral vectors, non-viral delivery systems and genome editing tools like CRISPR-Cas9 have significantly led to market growth.

What are the Growth Factors of Gene Therapy Platform Market?

The gene therapy platform market is witnessing substantial growth driven by several key factors. Foremost among these is the increasing prevalence of genetic disorders and chronic diseases such as cancer, hemophilia, and inherited retinal diseases, which create a strong demand for innovative therapeutic solutions. Advances in gene editing technologies, particularly the development of CRISPR-Cas9 and other precision tools, have significantly improved the ability to target and correct genetic abnormalities with higher accuracy and reduced side effects.

Additionally, supportive regulatory frameworks and expedited approval pathways in major markets like the U.S., Europe, and Asia are fostering faster development and market entry of gene therapy products. The rising adoption of personalized medicine, driven by improved genetic diagnostics and patient-specific treatments, is further fueling market expansion. Furthermore, collaborations and partnerships between biotech companies, academic institutions, and pharmaceutical giants are enhancing innovation and resource sharing, facilitating the development of more effective and accessible gene therapy platforms.

Report Scope of the Gene Therapy Platform Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.18 billion |

| Revenue Forecast by 2034 |

USD 9.05 billion |

| Growth rate from 2025 to 2034 |

CAGR of 15.3% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

Novartis AG, Gilead Sciences (Kite Pharma), Spark Therapeutics (Roche), Bluebird Bio, REGENXBIO, Sarepta Therapeutics, UniQure N.V., Audentes Therapeutics (Astellas Pharma), and Amicus Therapeutics.

|

What are the Trends in Gene Therapy Platform Market?

- The rising prevalence of genetic disorders and chronic diseases worldwide is driving demand for gene based therapies that target disease at the molecular level. Conditions such as cystic fibrosis, hemophilia, spinal muscular atrophy, and various cancers are increasingly treated with gene therapy.

- Changing regulations are significantly shaping the market by ensuring safety, efficacy and ethical standards. This regulatory framework aims to streamline development and manufacturing processes, thus accelerating time to market.

- Companies are increasingly investing in scalable gene therapy platforms that enable the efficient development and manufacturing of personalized treatments. These platforms combine advanced gene editing, vector development and cell engineering tools in order to create tailored therapies for specific genetic conditions.

Gene Therapy Platform Market Dynamics

Driver

Rise of Hereditary Problems

The key driver for gene therapy market growth is the rising predominance of hereditary problems and ongoing illnesses. Their increasing complexity makes it frequently challenging to treat utilizing customary or traditional treatments processes. As awareness develops, gene therapy is looked at as a helpful tool that offers long haul and even healing, thus attracting more patients who are searching out these types of medicines. Advancements in hereditary exploration, like the discovery of new gene altering devices, are also playing a vital role in driving the market's development. The market is also witnessing progress in the beginning phase gene therapies, such as those used to treat interesting hereditary issues, further speeding up market development.

Restraint

High Expenses Pose as a Challenge

Despite promising growth prospects, the market does have its fair share of challenges. One of the restraints is the significant expense that is related with the assembling and organization of gene therapy items. These treatments require complex innovations like gene altering devices and viral vectors, which are costly to source. Additionally, the expense of treatment can also be quite high, making it challenging for some patients, especially in developing or low resource regions. This can slow down market entry and hinder its growth and development.

Opportunity

Technological Advancements and Personalized Medicine

The gene therapy market share is evolving quickly with the help of technological advancements, more administrative acknowledgment and developing industry ventures. Organizations that work with gene therapy are actively utilizing associations, coordinated efforts and acquisitions to reinforce their market position. This helps create a more extensive pipeline of gene therapy items that can treat a wide scope of sicknesses, from hereditary problems to tumors and even neurological problems. As more gene therapies arrive, their market share keeps on developing.

One more key opportunity is the rising popularity of customized medication. This trend gives rise to powerful and designated treatments, reducing side effects and further developing treatment results. This is prompting the rise of new gene therapies that offer the possibility to address complex disorders and issues at their source.

Regional Analysis

Which Region Dominated the Gene Therapy Platform Market?

North America led the global gene therapy platform market, holding the largest share at 36% in 2024. The US, specifically, plays a crucial role in the market's development because of its robust medical services framework, innovative work and the endorsement of a few gene therapies by the Food and Drug Administration (FDA). The government has additionally supported gene therapy research through financing and public-private associations. This increases the popularity and awareness of cutting edge treatment choices, positions North America as leading force in today’s global market.

What are the advancements in Asia-Pacific?

Asia-Pacific is seen to have the fastest growth rate throughout the forecast period. This growth is due to the rise of hereditary illnesses and ongoing lifestyle circumstances, along with expanding medical services in countries like China, Japan and India. The interest for cutting edge medicines is further developing medical care access. The region further benefits from advancements in clinical research and good government arrangements. The development of the gene therapy market in the region is set to advance rapidly in the upcoming years.

Segmental Insights

Platform Type Insights

Which platform dominated the market in 2024?

The viral vector platforms segment held the dominant position in the market, capturing the highest revenue share of 59% in 2024. These platforms have been the cornerstone of gene delivery systems due to their high efficiency in transferring genetic material into target cells. These platforms utilize modified viruses such as adenoviruses, adeno-associated viruses (AAV), lentiviruses and retroviruses in order to deliver therapeutic genes, thus capitalizing on their natural ability to infect cells. Their widespread adoption is driven by their proven efficacy in clinical applications and ongoing improvements in vector design.

Gene editing platforms are expected to have the fastest rate of growth. Technologies like CRISPR-Cas9, TALENs and zinc finger nucleases enable targeted editing of DNA at specific loci, allowing correction of genetic mutations or regulation of gene expression with greater accuracy. This precision reduces off-target effects and enhances therapeutic outcomes, broadening the scope of treatable diseases. The rapid evolution of gene editing tools is driving increased research activity and investments, propelling these platforms forward.

Application Insights

Which application led the market this year?

The oncology segment held the highest revenue share in 2024, due to the growing demand for targeted and personalized cancer therapies. Techniques such as the insertion of suicide genes, immune-modulating genes and oncolytic viruses are being experimented to selectively attack cancer cells while sparing healthy tissue. The ability to harness the patient’s immune system through gene-modified immune cells, including CAR-T therapies, has revolutionized cancer treatment, leading to improved outcomes for patients.

The hematological disorders segment is seen to have the fastest growth in 2024. This growth is driven by the advancements in gene editing and vector technologies that correct genetic defects at their source, reducing or eliminating the need for lifelong management through conventional therapies like blood transfusions or clotting factor replacement. This application not only improves the patient’s quality of life but also reduces healthcare costs, making this segment popular.

Delivery Method Insights

Which delivery method dominated the market as of this year?

The in vivo gene therapy segment captured the largest share of revenue in 2024. This therapy involves the direct delivery of genetic material into a patient's body, using viral vectors or other carriers to target specific tissues or cells. This method is increasingly applied in hematological conditions where the therapeutic gene can be introduced systemically or targeted directly to blood-forming organs such as the bone marrow. Its simplicity, potential for broad distribution and the ability to administer therapy without extensive manipulation of cells outside the body makes it a promising segment.

The ex vivo gene therapy segment is projected to experience the highest growth rate during the forecast period. This method involves extracting a patient’s stem or blood cells, genetically modifying them in a laboratory, and then reintroducing these corrected cells back into the patient. It is particularly effective for diseases such as beta-thalassemia and sickle cell anemia, where targeted correction of genetic mutations in hematopoietic stem cells can result in long-term or potentially curative outcomes.

End Use Insights

Which end user held the largest market share in 2024?

The pharmaceutical and biotechnology companies segment held the highest market share in 2024. Pharmaceutical and biotechnology firms are at the forefront of developing novel gene therapies as they invest heavily in research and development in order to harness cutting-edge technologies such as viral vectors and gene editing tools. These companies leverage their extensive expertise and resources to bring new treatments from concept to market, often focusing on high-impact therapeutic areas including genetic disorders, oncology and rare diseases.

Contract research organizations are estimated to grow at the fastest rate. This growth is because they offer specialized services that help to accelerate the development timeline and reduce costs for gene therapy developers. They provide critical support across various stages of the drug development process, including preclinical research, clinical trial management and regulatory consulting. Their expertise enables pharmaceutical and biotechnology companies to outsource complex activities, thus enhancing efficiency and focus on core competencies such as innovation and commercialization.

Recent Developments

- In August 2025, a newly FDA-approved gene therapy treatment was surgically implanted in the eye for the first time outside a clinical trial. The treatment is called Revakinage tarortcel-lwey (EnceltoTM) and is sold by Neurotech Pharmaceuticals. It is an allogeneic encapsulated cell-based gene therapy indicated for the treatment of adults with idiopathic macular telangiectasia type 2 (MacTel). (Source: Science Based Medicine)

- In October 2025, JCR Pharmaceuticals Co., Ltd. presented non-clinical data demonstrating the ability of its proprietary JUST-AAV capsid engineering platform to achieve efficient delivery of adeno-associated virus (AAV) gene therapy to the central nervous system (CNS) and muscle while reducing liver exposure. JUST-AAV encompasses a range of vector types optimized for various target tissues, including liver-sparing, muscle-targeting, and brain-targeting variants. (Source: finance/yahoo)

Top Companies in Gene Therapy Platform Market

Gene Therapy Platform Market Segmentation

By Platform Type

- Viral Vector Platforms

- Adeno-associated Virus (AAV)

- Lentivirus

- Retrovirus

- Adenovirus

- Herpes Simplex Virus (HSV)

- Non-Viral Vector Platforms

- Lipid Nanoparticles (LNPs)

- Electroporation & Microinjection Platforms

- Polymer-based Delivery Systems

- Naked DNA/RNA Delivery

- Gene Editing Platforms

- CRISPR-Cas Systems

- TALENs

- ZFNs

By Application

- Oncology

- Rare Genetic Disorders

- Cardiovascular Diseases

- Neurological Disorders

- Ophthalmic Diseases

- Hematological Disorders (e.g., Hemophilia, Sickle Cell)

- Musculoskeletal Disorders

- Infectious Diseases (e.g., HIV, COVID-19 adjunct therapies)

By Delivery Mode

- In Vivo Gene Therapy

- Ex Vivo Gene Therapy

- Autologous Cell-Based Gene Therapy

- Allogeneic Cell-Based Gene Therapy

- Others (In-situ Gene therapy)

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Contract Development & Manufacturing Organizations (CDMOs)

- Hospitals & Gene Therapy Centers

By Regional

- North America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Kuwait

Frequently Asked Questions

The global gene therapy platform market size was reached at USD 2.18 billion in 2024, and it is projected to hit around USD 9.05 billion by 2034.

The global Gene therapy platform market is growing at a compound annual growth rate (CAGR) of 15.3% from 2025 to 2034.

The North America region has accounted for the largest gene therapy platform market share in 2024.

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gene Therapy Platform Market

5.1. COVID-19 Landscape: Gene Therapy Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gene Therapy Platform Market, By Platform Type

8.1. Gene Therapy Platform Market, by Platform Type

8.1.1. Viral Vector Platforms

8.1.1.1. Market Revenue and Forecast

8.1.2. Non-Viral Vector Platforms

8.1.2.1. Market Revenue and Forecast

8.1.3. Gene Editing Platforms

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Gene Therapy Platform Market, By Application

9.1. Gene Therapy Platform Market, by Application

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Rare Genetic Disorders

9.1.2.1. Market Revenue and Forecast

9.1.3. Cardiovascular Diseases

9.1.3.1. Market Revenue and Forecast

9.1.4. Neurological Disorders

9.1.4.1. Market Revenue and Forecast

9.1.5. Ophthalmic Diseases

9.1.5.1. Market Revenue and Forecast

9.1.5. Hematological Disorders (e.g., Hemophilia, Sickle Cell)

9.1.5.1. Market Revenue and Forecast

9.1.5. Musculoskeletal Disorders

9.1.5.1. Market Revenue and Forecast

9.1.5. Infectious Diseases (e.g., HIV, COVID-19 adjunct therapies)

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Gene Therapy Platform Market, By Delivery Mode

10.1. Gene Therapy Platform Market, by Delivery Mode

10.1.1. In Vivo Gene Therapy

10.1.1.1. Market Revenue and Forecast

10.1.2. Ex Vivo Gene Therapy

10.1.2.1. Market Revenue and Forecast

10.1.3. Others (In-situ Gene therapy)

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Gene Therapy Platform Market, By End Use

11.1. Gene Therapy Platform Market, by End Use

11.1.1. Pharmaceutical & Biotechnology Companies

11.1.1.1. Market Revenue and Forecast

11.1.2. Academic & Research Institutions

11.1.2.1. Market Revenue and Forecast

11.1.3. Contract Development & Manufacturing Organizations (CDMOs)

11.1.3.1. Market Revenue and Forecast

11.1.4. Hospitals & Gene Therapy Centers

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Gene Therapy Platform Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Platform Type

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Delivery Mode

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Platform Type

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Delivery Mode

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Platform Type

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Delivery Mode

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Platform Type

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Delivery Mode

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Platform Type

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Delivery Mode

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Platform Type

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Delivery Mode

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Platform Type

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Delivery Mode

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Platform Type

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Delivery Mode

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Platform Type

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Delivery Mode

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Platform Type

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Delivery Mode

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Platform Type

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Delivery Mode

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Platform Type

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Delivery Mode

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Platform Type

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Delivery Mode

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Platform Type

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Delivery Mode

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Platform Type

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Delivery Mode

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Platform Type

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Delivery Mode

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Platform Type

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Delivery Mode

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Platform Type

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Delivery Mode

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Platform Type

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Delivery Mode

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Platform Type

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Delivery Mode

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Platform Type

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Delivery Mode

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Novartis AG

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Gilead Sciences, Inc. (Kite Pharma)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Spark Therapeutics, Inc. (a Roche company)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bluebird Bio, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Regenxbio Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Sarepta Therapeutics, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. UniQure N.V.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Audentes Therapeutics, Inc. (a subsidiary of Astellas Pharma)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. REGENXBIO Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Amicus Therapeutics, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments