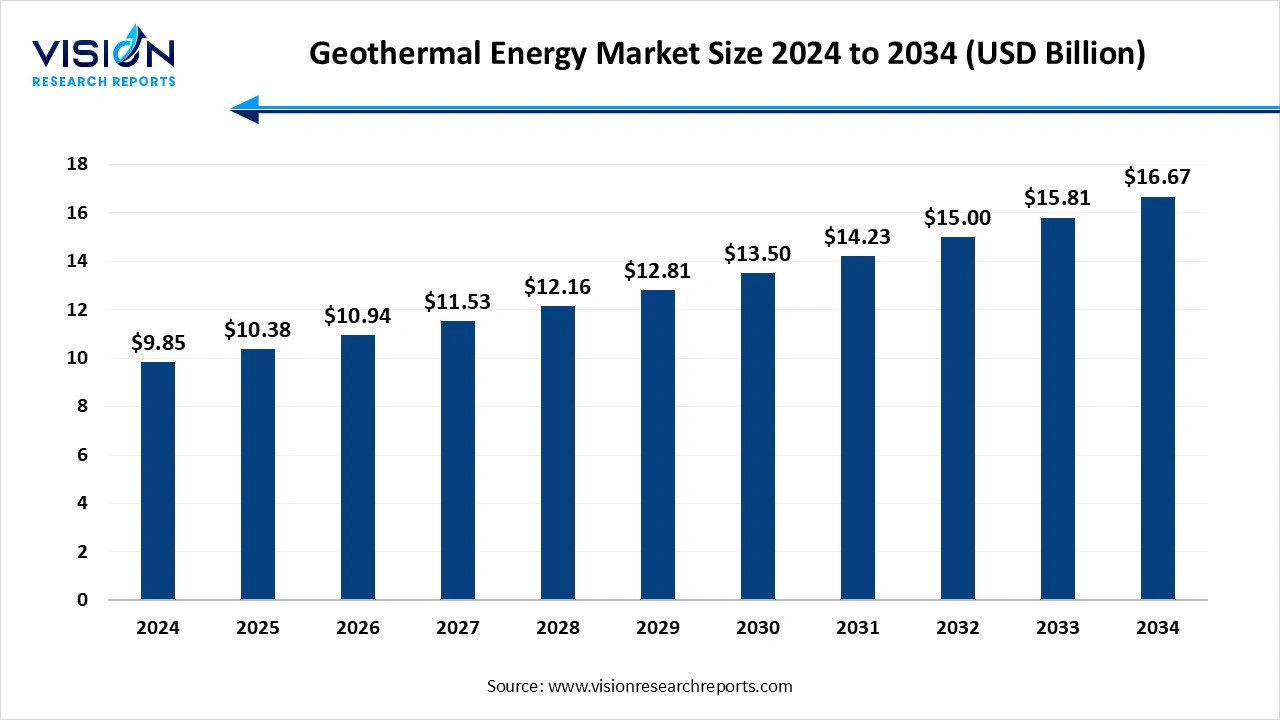

The global geothermal energy market size stood at USD 9.85 billion in 2024 and is estimated to reach USD 10.38 billion in 2025. It is projected to hit USD 16.6 billion by 2034, registering a robust CAGR of 5.4% from 2025 to 2034. This growth is primarily driven by the increasing global emphasis on clean and sustainable energy sources, technological advancements in geothermal exploration and drilling, and supportive government policies promoting renewable energy adoption.

Geothermal energy is a renewable form of energy that is formed due to the flow of heat from the Earth and ensures an unlimited supply of energy for several million years to come. The resources of geothermal energy range from the shallow ground to hot water and hot rock found a few miles beneath the Earth's surface. It can also be used for energy generation and can be used directly, without the need for any power plant or heat pump.

The global geothermal energy market is likely to experience significant growth in the upcoming years due to the rapid depletion of non-renewable energy resources. Currently, the overutilization of non-renewable energy resources has led to the scarcity of fossil fuels and their extracts. Additionally, fossil fuels lead to increased carbon emissions, which contributes to air pollution and global warming.

The growth of the geothermal energy market is driven by the heightened environmental consciousness and the increasing need to mitigate climate change for renewable energy sources. Geothermal energy is clean and sustainable, offering a compelling solution and attracting both public and private investments. Additionally, advancements in geothermal technology, particularly in drilling techniques and reservoir engineering, have expanded the accessibility of geothermal resources, making projects more feasible and cost-effective.

Furthermore, supportive government policies such as incentives, subsidies and renewable energy targets, have further incentivized the development of geothermal projects worldwide. These factors collectively contribute to the robust growth trajectory of the geothermal energy market, positioning it as a vital component of the global energy transition towards a greener and more sustainable future.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.85 billion |

| Revenue Forecast by 2034 | USD 16.67 billion |

| Growth rate from 2025 to 2034 | CAGR of 5.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Alterra Power Corporation, TAS Energy, Atlas Copco Group, Exergy, Toshiba Corporation, Mitsubishi Heavy Industries, General Electric, Ansaldo Energia, Ormat Technologies, Enel Green Power North America Inc., and Gradient Resources. |

Sustainability and Government Initiatives

One of the primary drivers propelling the geothermal energy market forward is the growing need for environmental sustainability. As climate change concerns continue to rise, there is a growing need for reducing carbon emissions and shifting towards more cleaner energy sources. Geothermal energy is a low-carbon alternative and aligns well with global sustainability goals. Governments all over the world have recognized its importance and now strive to include renewable sources like geothermal in an attempt to lower greenhouse gas emissions. This shift towards sustainability is expected to boost market growth in the upcoming years.

The market is also driven by supportive government initiatives and policies that are aimed at promoting renewable energy. Various schemes are being implemented worldwide in order to optimize the development of geothermal resources. Financial support and regulatory frameworks that facilitate investments are also on the rise. These initiatives are designed to reduce reliance on fossil fuels and enhance energy security. It attracts both domestic and foreign investments, driving market growth and development.

Regulatory and Permitting Challenges

Despite promising growth, the market does have its fair share of challenges which could potentially slow down its growth. Geothermal energy projects often face complex regulatory hurdles and long permitting processes, which can delay development. Getting permits for geothermal plants might take several years due to the need for thorough environmental assessments and land access agreements. In several under developed regions, local governments may lack clear regulatory frameworks, which can also slow down project approval. These types of hurdles present a significant challenge for developers, especially in countries where geothermal potential has yet to be fully adopted or where permitting processes are complex and lengthy, thus slowing down market penetration.

Technological Advancements and Investments

Technological advancements in the market are opening up new areas of opportunity, enhancing the efficiency and feasibility of geothermal energy projects. Innovations in drilling techniques, reservoir management processes and energy conversion technologies have made it easier to harness geothermal resources in a more effective manner. These advancements not only help reduce operational costs but also improve the overall viability of geothermal energy as an alternative to traditional energy sources. As technology continues to evolve, the market will see a rise new projects and investments, further solidifying market position.

The market also presents numerous investment opportunities, attracting both domestic and international investors. Investors are increasingly recognizing the long-term benefits of geothermal energy, especially due to the government's supportive policies and the rising demand for renewable energy. This rise of capital is also likely to accelerate the development of geothermal projects.

Asia Pacific dominated the geothermal energy market in 2024. This dominance can be attributed to the high demand for geothermal heat pumps in the region, especially in the residential sector, particularly for space heating and cooling purposes. Additionally, factors such as a rapidly growing population, improving economic conditions and the presence of major key players are expected to further drive market growth in the region even more.

North America is expected to have the fastest growth rate during the forecast period, due to the abundant amount of geothermal resources available in the region. The market is also driven by abundant geothermal resources, strong government incentives and technological advancements in geothermal energy systems. Moreover, the region also benefits from a mature market for geothermal heating and cooling solutions, especially in the residential sector. The growing focus on reducing greenhouse gas emissions and the need for reliable power generation propels the market even further.

Which technology dominated the market in 2024?

The Binary cycle power plants segment dominated the market in 2024. These plants capitalize on lower temperature geothermal resources, which are more widespread globally compared to high temperature ones. Thus, they serve as the most feasible option for regions with moderate to low geothermal heat potential, expanding the geographical scope for geothermal energy development.

The flash steam segment is projected to have the fastest growth rate during the forecast period. This growth can be attributed to the efficient utilization of natural steam that is produced in underground reservoirs, directly converting it into electrical power. These energy plants offer reliable and sustainable energy solutions with minimal environmental impact, making them appealing options for countries which are aiming to diversify their energy mix.

Which power segment led the market this year?

The above 5 MW segment led the market as of this year. This dominance can be attributed to the rising demand for large-scale power plants capable of generating significant amounts of electricity for commercial and industrial applications. Additionally, the increasing recognition of geothermal energy as a dependable and sustainable source of baseload power further drives the demand for this segment.

The up to 5 MW segment is seen to have the fastest growth rate. The advantage of this segment lies in its scalability, efficiency and cost-effectiveness, thus making them an attractive option for both developed as well as developing countries. As countries worldwide prioritize the transition to clean energy sources in residential applications, the demand for up to 5MW geothermal power plants is anticipated to rise steadily over the forecast period.

Which application segment held the largest market share?

The residential segment held the largest market share this year in 2024. This dominance is driven by the substantial demand for residential cooling and heating applications, offering homeowners a renewable alternative to traditional HVAC systems. Geothermal heat pumps, apart from space conditioning, can also provide domestic hot water. Equipped with a desuperheater, these systems can utilize surplus heat from the compressor to heat water, particularly during summer months, thus making them a popular choice.

The industrial segment is estimated to grow at the fastest rate over the forecast period. This growth is attributed to the increasing ground temperature, which adversely affects system efficiency and capacity. Industrial environments consume significant energy, resulting in continuous heat production that needs to be dissipated. Installing geothermal heat pumps in these industrial facilities leads to continuous heat rejection into the ground, consequently elevating ground temperature and diminishing system efficiency and capacity.

By Technology

By Power

By Application

By Region

Geothermal Energy Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Geothermal Energy Market

5.1. COVID-19 Landscape: Geothermal Energy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Geothermal Energy Market, By Technology

8.1. Geothermal Energy Market, by Technology

8.1.1 Flash Steam

8.1.1.1. Market Revenue and Forecast

8.1.2. Dry Steam

8.1.2.1. Market Revenue and Forecast

8.1.3. Binary Cycle Power Plants

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Geothermal Energy Market, By Power

9.1. Geothermal Energy Market, by Power

9.1.1. Upto 5MW

9.1.1.1. Market Revenue and Forecast

9.1.2. Above 5 MW

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Geothermal Energy Market, By Application

10.1. Geothermal Energy Market, by Application

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Geothermal Energy Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology

11.1.2. Market Revenue and Forecast, by Power

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology

11.1.4.2. Market Revenue and Forecast, by Power

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology

11.1.5.2. Market Revenue and Forecast, by Power

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology

11.2.2. Market Revenue and Forecast, by Power

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology

11.2.4.2. Market Revenue and Forecast, by Power

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology

11.2.5.2. Market Revenue and Forecast, by Power

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology

11.2.6.2. Market Revenue and Forecast, by Power

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology

11.2.7.2. Market Revenue and Forecast, by Power

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology

11.3.2. Market Revenue and Forecast, by Power

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology

11.3.4.2. Market Revenue and Forecast, by Power

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology

11.3.5.2. Market Revenue and Forecast, by Power

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology

11.3.6.2. Market Revenue and Forecast, by Power

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology

11.3.7.2. Market Revenue and Forecast, by Power

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology

11.4.2. Market Revenue and Forecast, by Power

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology

11.4.4.2. Market Revenue and Forecast, by Power

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology

11.4.5.2. Market Revenue and Forecast, by Power

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology

11.4.6.2. Market Revenue and Forecast, by Power

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology

11.4.7.2. Market Revenue and Forecast, by Power

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology

11.5.2. Market Revenue and Forecast, by Power

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology

11.5.4.2. Market Revenue and Forecast, by Power

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology

11.5.5.2. Market Revenue and Forecast, by Power

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1 Alterra Power Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. TAS Energy

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Atlas Copco Group

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Exergy

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Toshiba Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mitsubishi Heavy Industries

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Electric

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Ansaldo Energia

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ormat Technologies

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Enel Green Power North America Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others