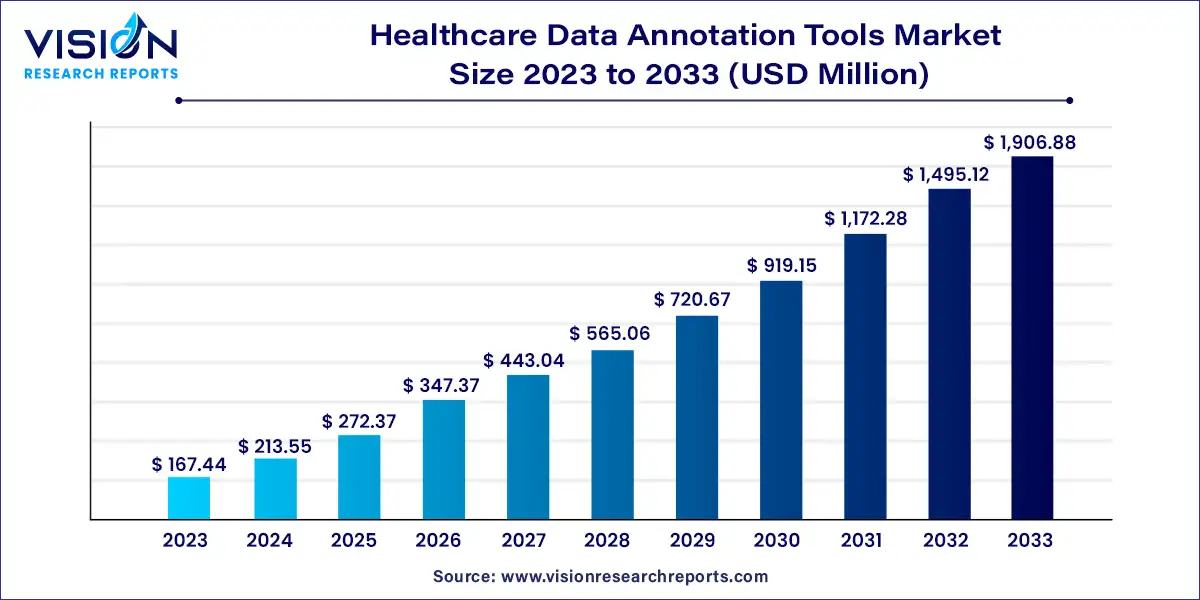

The global healthcare data annotation tools market size was valued at USD 167.44 million in 2023 and is predicted to surpass around USD 1,906.88 million by 2033 with a CAGR of 27.54% from 2024 to 2033.

The healthcare industry is increasingly relying on data annotation tools to enhance the efficiency and accuracy of medical data analysis. These tools play a crucial role in annotating, labeling, and organizing healthcare data, facilitating machine learning algorithms and AI applications in medical research, diagnosis, and treatment. This overview delves into the dynamics of the healthcare data annotation tools market, exploring key trends, drivers, challenges, and opportunities shaping its growth trajectory.

The growth of the healthcare data annotation tools market is propelled by an increasing demand for accurate medical diagnosis and personalized healthcare solutions drives the adoption of data annotation tools that can assist healthcare professionals in analyzing and interpreting medical data effectively. Secondly, the rising investments in artificial intelligence (AI) and healthcare IT infrastructure by healthcare organizations and technology companies fuel the demand for advanced annotation tools as integral components of AI-powered healthcare systems. Additionally, the focus on precision medicine and personalized healthcare approaches necessitates robust data annotation tools capable of annotating and analyzing diverse healthcare data types to support personalized treatment plans and disease management. Moreover, the expansion of research and development activities in areas such as drug discovery and genomics creates a demand for data annotation tools that can accelerate the annotation and analysis of biomedical data for research purposes. These growth factors collectively contribute to the expansion and evolution of the healthcare data annotation tools market, shaping its trajectory in the healthcare industry.

| Report Coverage | Details |

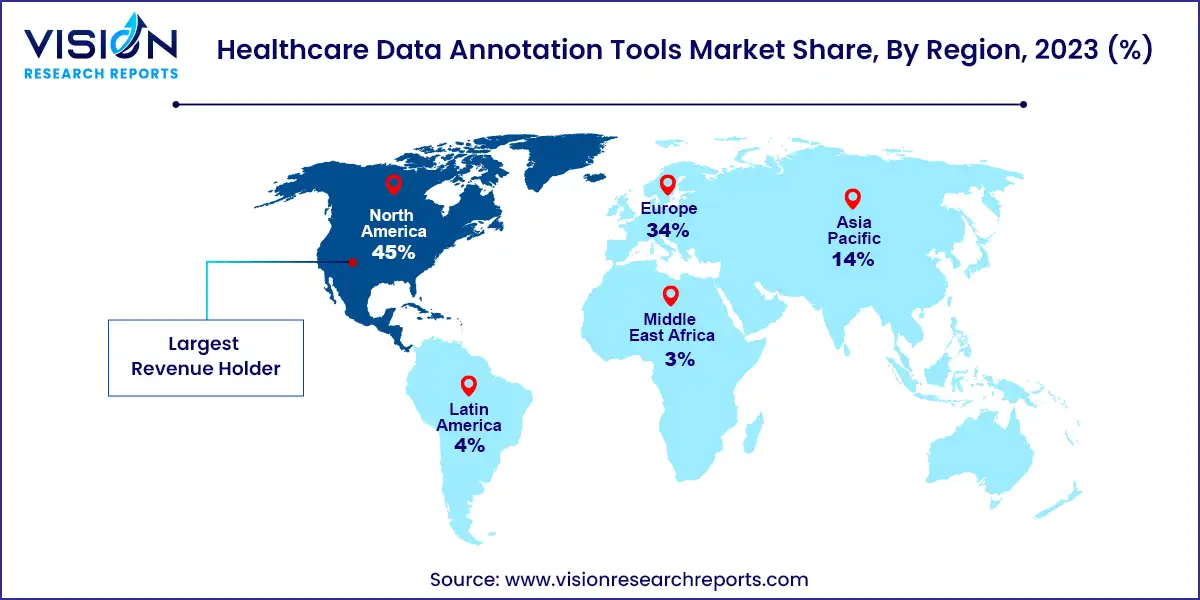

| Revenue Share of North America in 2023 | 45% |

| CAGR of Asia Pacific from 2024 to 2033 | 28.85% |

| Revenue Forecast by 2033 | USD 1,906.88 million |

| Growth Rate from 2024 to 2033 | CAGR of 27.54% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on type, the image/video segment held the largest revenue share of 62% in 2023 and is anticipated to grow at the fastest CAGR of 28.06% from 2024 to 2033. This is attributed to the large scale-adoption of image/video data annotation tools in the medical field along with the increasing requirement for efficient and cost-effective solutions for medical diagnosis. These tools are used in the creation of visualizations of specific organs to diagnose unusual defects in the human body that are unidentifiable with the naked eye.

In cancer, image annotation is used to train AI models to predict cancer using labeled cancer image data. This decreases the possibility of human error and helps in the early detection of various types of cancers. Furthermore, in dental imaging, labeled X-ray image data is used to visualize teeth structure and detect tooth cavities, gum diseases decay, and other abnormalities. Moreover, video data annotation in healthcare facilitates various medical tasks such as surgery, etc.

Automated surgical bots are also trained with video annotation to assist surgical procedures and endoscopies including phase identification and lesion detection. Such capabilities are driving the image/video segment. Key players in the market are continuously launching novel image/video annotation tools for the healthcare industry, thereby propelling the segment. For instance, in April 2023, Encord introduced a DICOM image annotation tool for healthcare AI that allows users to run and train models for automating medical image annotation in 3D for modalities including MRI, CT, and X-ray and eradicating manual data labeling.

In terms of technology, the semi-supervised segment held the largest revenue share of 41% in 2023. Based on technology, the market is categorized into manual, semi-supervised, and automatic. The semi-supervised technology uses a small amount of labelled and a large amount of unlabeled data. This reduces the expenditure on manual data annotation and cuts data preparation time. As unlabeled data is abundant, inexpensive, and easily available, semi-supervised technology is adopted in various applications, thereby boosting the segment.

For instance, early diagnosis of dental caries using semi-supervised technology can enable preventive treatment and prevent invasive treatment. According to an article published by Springer Nature Limited in 2023, the semi-supervised methods have been successful in the detection of dental caries and have provided competitive results compared to fully supervised learning methods.

The automatic segment is anticipated to grow at the fastest CAGR of 28.84% over the forecast period. This is attributed to the increasing prominence of quicker and cost-effective data labeling and delivery of annotated data. AI is becoming vital to this industry as the technology allows the extraction of complex and high-level abstractions from the datasets using a hierarchical learning process. The need for extracting and mining meaningful patterns from voluminous healthcare data is driving the growth of AI, which is expected to further drive the demand for automatic tools during the forecast period.

Based on end-user, the hospitals segment led the market with a global revenue share of 42% in 2023 and is projected to witness significant growth over the forecast period. Healthcare data annotation tools are essential in the hospital sector as they streamline the annotation process, making it more efficient and scalable. By annotating healthcare data, hospitals can unlock the potential of machine learning algorithms and other data-driven applications, leading to improved healthcare outcomes and more effective decision support systems.

Machine learning and artificial intelligence have shown great potential in improving healthcare outcomes, diagnosis, and treatment. Furthermore, healthcare data annotation tools are crucial in clinical research studies conducted by hospitals. These tools facilitate the annotation of clinical notes and electronic health records (EHRs), extracting pertinent information related to study parameters, inclusion/exclusion criteria, and study outcomes. Hospitals can efficiently extract, analyze, and report on annotated clinical research data by utilizing healthcare data annotation tools, streamlining the research process and enabling valuable insights for study findings.

Based on the application, the diagnostic support segment held the largest revenue share of 34% in 2023. Data annotation tools in diagnostic support aid in the identification and rectification of human errors in X-rays, ultrasound scans, MRI, and CT. These tools can increase accuracy and speed by lowering costs. For instance, data annotation tools can aid AI models to detect COVID-19 pneumonia and execute embryo classification. In addition, these software tools allow the early diagnosis of various chronic diseases such as cancer by using AI. For instance, thermal sensors with AI can identify breast cancer by visually displaying the amount of infrared energy emitting from the tumor. Thus, diagnostic support offered by healthcare data annotation tools in the diagnosis of various chronic and infectious diseases is boosting the segment.

The virtual assistant segment is anticipated to grow at the fastest CAGR of 28.04% over the forecast period. The virtual assistants in the healthcare system accelerate the detection of illness, raise reminders for medication, monitor health status, and schedule doctor appointments to reduce waiting time. Moreover, virtual assistants provide several advantages such as better patient experience, boosted productivity, decreased employment cost by up to 70%, sustainable growth, and lowered likelihood of becoming burnout. Therefore, several benefits offered by virtual assistants are expected to boost the segment during the study period.

In 2023, North America dominated the market with a revenue share of 45%. This large revenue share can be attributed to the high healthcare expenditure coupled with the growing acceptance of advanced technologies including AI, machine learning, big data, cloud, and IoT. In addition, increased usage of mHealth, e-prescribing, telehealth, and other healthcare IT technologies as a response to COVID-19, as well as increased government support & requirements for advanced AI/ML solutions in healthcare, are the primary growth factors fuelling the market. Moreover, rise in adoption of electronic health records is significantly increasing in the region. According to the Health IT reports until 2021, nearly 9 out of 10 U.S.-based physicians have adopted EHR. Therefore, a high adoption rate also plays a key role in driving market growth in North America.

The Asia Pacific region is anticipated to witness the fastest CAGR of 28.85% over the forecast period. This is due to the increasing healthcare expenditure in emerging Asian economies and the improvement in healthcare capabilities. In addition, the rising adoption of advanced technologies such as AI/ML to lower medical costs & streamline hospital workflow, are the major drivers of healthcare data annotation tools in the region. Furthermore, numerous government initiatives and supportive programs are also driving the adoption of these software solutions in the region. For instance, The National Health & Family Planning Commission (NHFPC) of the People’s Republic of China established the Chinese Jinwei Network Engineer, which promotes the development of telemedicine in the country.

By Type

By Technology

By End-user

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Data Annotation Tools Market

5.1. COVID-19 Landscape: Healthcare Data Annotation Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Data Annotation Tools Market, By Type

8.1. Healthcare Data Annotation Tools Market, by Type, 2024-2033

8.1.1. Text

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Image/Video

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Audio

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Data Annotation Tools Market, By Technology

9.1. Healthcare Data Annotation Tools Market, by Technology, 2024-2033

9.1.1. Manual

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Semi-supervised

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Automatic

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Data Annotation Tools Market, By End-user

10.1. Healthcare Data Annotation Tools Market, by End-user, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diagnostic Imaging Centers

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Healthcare Technology Companies

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Healthcare Data Annotation Tools Market, By Application

11.1. Healthcare Data Annotation Tools Market, by Application, 2024-2033

11.1.1. Virtual Assistants

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Conversational Bots

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Diagnostic Support

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Drug Development Process

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Robotic Surgery

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Medical Documents

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Healthcare Data Annotation Tools Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Infosys Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Shaip

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Innodata

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Ango AI

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Capestart

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lynxcare

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. iMerit

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Anolytics

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. V7

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. SuperAnnotate LLC

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others