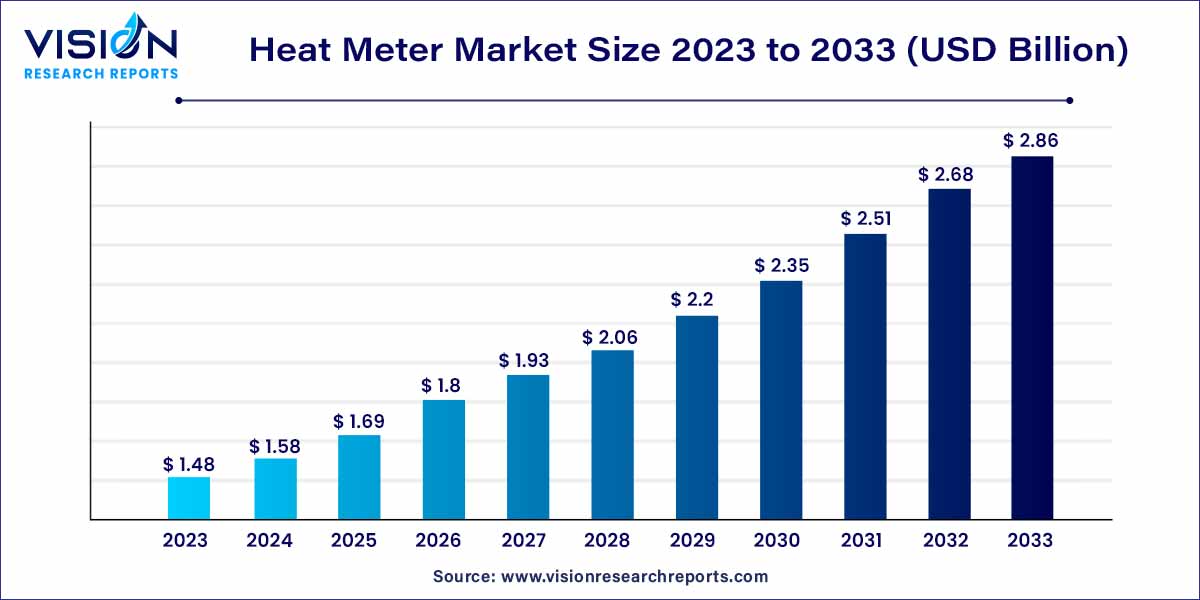

The global heat meter market was surpassed at USD 1.48 billion in 2023 and is expected to hit around USD 2.86 billion by 2033, growing at a CAGR of 6.82% from 2024 to 2033. The heat meter market, a vital segment within the energy sector, is witnessing substantial growth and evolution in response to the increasing demand for energy efficiency and sustainability. Heat meters, sophisticated devices designed to measure thermal energy consumption accurately, have become indispensable tools for various industries, businesses, and households. This overview delves into the key aspects shaping the heat meter market, highlighting its significance, technological advancements, and the driving forces behind its expansion.

The heat meter market is experiencing robust growth driven by several key factors. Increasing awareness about energy conservation and environmental sustainability is compelling industries and consumers to adopt energy-efficient solutions, including heat meters. Regulatory initiatives and government mandates worldwide are further boosting market demand, as businesses strive to comply with energy efficiency standards. Technological advancements, such as smart metering capabilities and wireless connectivity, are enhancing the accuracy and convenience of heat meters, making them attractive choices for various applications. Additionally, the rising demand for fair and transparent billing practices in residential complexes and commercial spaces is fueling the market growth, as heat meters provide precise measurements, ensuring accurate billing and promoting responsible energy consumption.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2.86 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.82% |

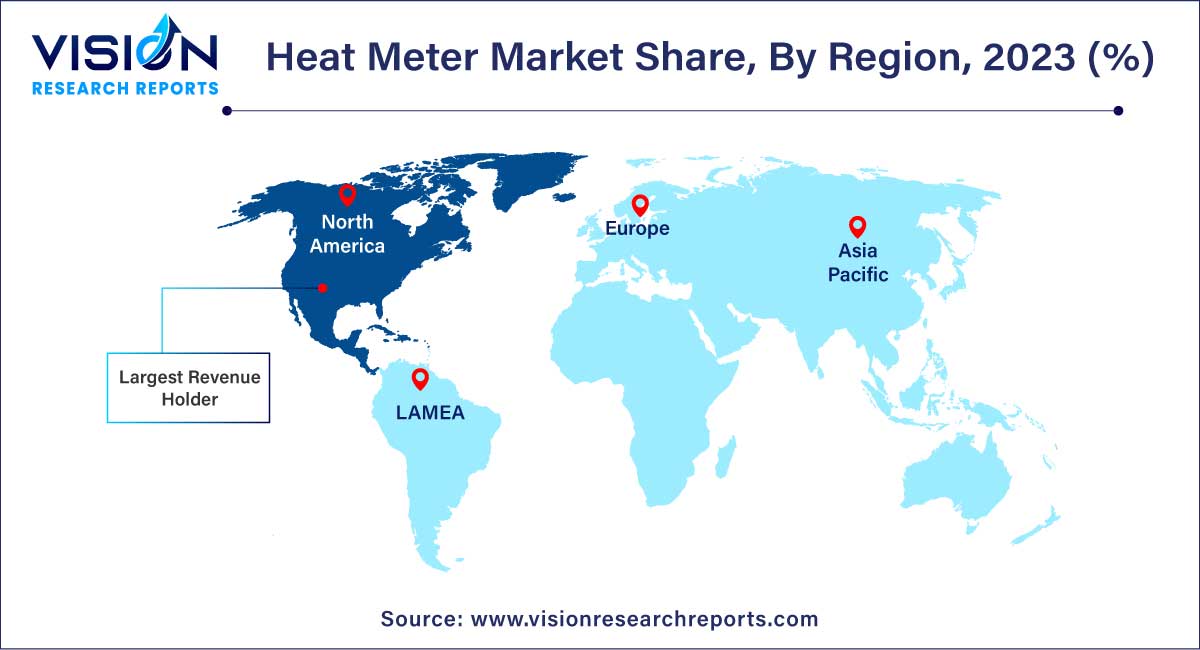

| Revenue Share of North America in 2023 | 23% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The static segment led the market with a revenue share in 2023. Static heat meters, also known as ultrasonic heat meters, operate on the principle of ultrasonic technology, measuring the velocity of the fluid flow in the heating system. These meters are highly accurate and offer non-intrusive measurements, making them suitable for a wide array of applications, including residential, commercial, and industrial heating systems. Static heat meters have gained popularity due to their reliability and precise measurement capabilities, ensuring accurate billing and promoting energy efficiency among end-users.

Mechanical heat meters rely on mechanical components to measure the heat energy transferred within a fluid. These meters use mechanical principles such as the rotation of impellers or pistons to quantify the volume of fluid passing through the system, along with temperature sensors to calculate the thermal energy. Mechanical heat meters are known for their robustness and durability, making them suitable for harsh operating conditions. They find applications in industrial settings where accurate measurement of heat energy is essential for process optimization and cost management.

Wired connectivity involves the use of physical cables to transmit data between heat meters and central monitoring systems. This method ensures stable and reliable data transmission, making it suitable for applications where consistent and uninterrupted connectivity is essential. Wired heat meter systems are commonly deployed in industrial settings and large commercial complexes, where the infrastructure allows for the installation of cables without hindrance. The reliability of wired connectivity provides users with real-time data access, enabling precise monitoring and control of thermal energy usage in various applications.

Wireless connectivity has emerged as a revolutionary technology in the heat meter market. Wireless heat meter systems utilize radio frequency or cellular networks to transmit data, eliminating the need for physical cables. This wireless approach offers unparalleled flexibility and scalability, making it ideal for residential, small commercial spaces, and retrofit projects. Wireless heat meters facilitate easy installation without the constraints of wiring, allowing for quick deployment and minimizing disruptions to existing infrastructures. Moreover, these systems enable remote monitoring, empowering users with the convenience of accessing real-time data and analytics through web-based platforms or mobile applications.

The residential application segment registered the maximum market share of 47% in 2023. In residential settings, heat meters play a crucial role in multi-unit buildings, ensuring fair and accurate distribution of heating costs among residents. These meters provide individualized heat consumption data, enabling precise billing based on actual usage, thereby promoting transparency and equitable payment practices. Residential heat meters also encourage energy conservation by making residents more aware of their heating patterns and encouraging responsible usage, aligning with the global push for energy efficiency and sustainability in housing developments.

In the commercial sector, heat meters find extensive use in various establishments, including offices, hotels, shopping centers, and educational institutions. These meters are instrumental in optimizing heating and cooling systems, ensuring comfortable environments for occupants while minimizing energy wastage. Commercial spaces often have complex heating requirements due to fluctuating occupancy and diverse usage patterns. Heat meters enable precise measurement and control of thermal energy usage, allowing businesses to make informed decisions, reduce operational costs, and enhance overall energy efficiency. Furthermore, in industries where process heating is a critical component, such as manufacturing and food processing, heat meters are essential tools for monitoring energy consumption, enabling efficient production processes and contributing to cost savings.

North America region led the market with the largest market share of 23% in 2023. In North America, the market is characterized by a growing awareness of energy conservation and the adoption of smart technologies. Heat meters are increasingly finding applications in both residential and commercial sectors, with a focus on integrating these devices into smart home systems. The demand for precise billing and the rising importance of individual energy management contribute to the market's growth in this region. Moreover, the implementation of energy efficiency programs by governments and utilities further boosts the deployment of heat meters, fostering a competitive market landscape.

In Europe, stringent regulations and policies promoting energy efficiency have propelled the widespread use of heat meters, particularly in residential complexes and commercial buildings. The region's commitment to reducing carbon emissions and embracing sustainable energy solutions has driven continuous innovation in heat meter technologies, making Europe a leading market for these devices. Additionally, the emphasis on district heating systems in several European countries further fuels the demand for heat meters, ensuring efficient distribution and utilization of thermal energy.

By Type

By Connectivity

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Heat Meter Market

5.1. COVID-19 Landscape: Heat Meter Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Heat Meter Market, By Type

8.1. Heat Meter Market, by Type, 2024-2033

8.1.1 Static

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mechanical

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Heat Meter Market, By Connectivity

9.1. Heat Meter Market, by Connectivity, 2024-2033

9.1.1. Wired

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Wireless

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Heat Meter Market, By End-use

10.1. Heat Meter Market, by End-use, 2024-2033

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Heat Meter Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Sycous Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Zenner International GmbH & Co. KG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kamstrup.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Danfoss.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Apator S.A..

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. BMETERS Srl

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ITRON.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Diehl

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Siemens AG.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Trend Control Systems Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others