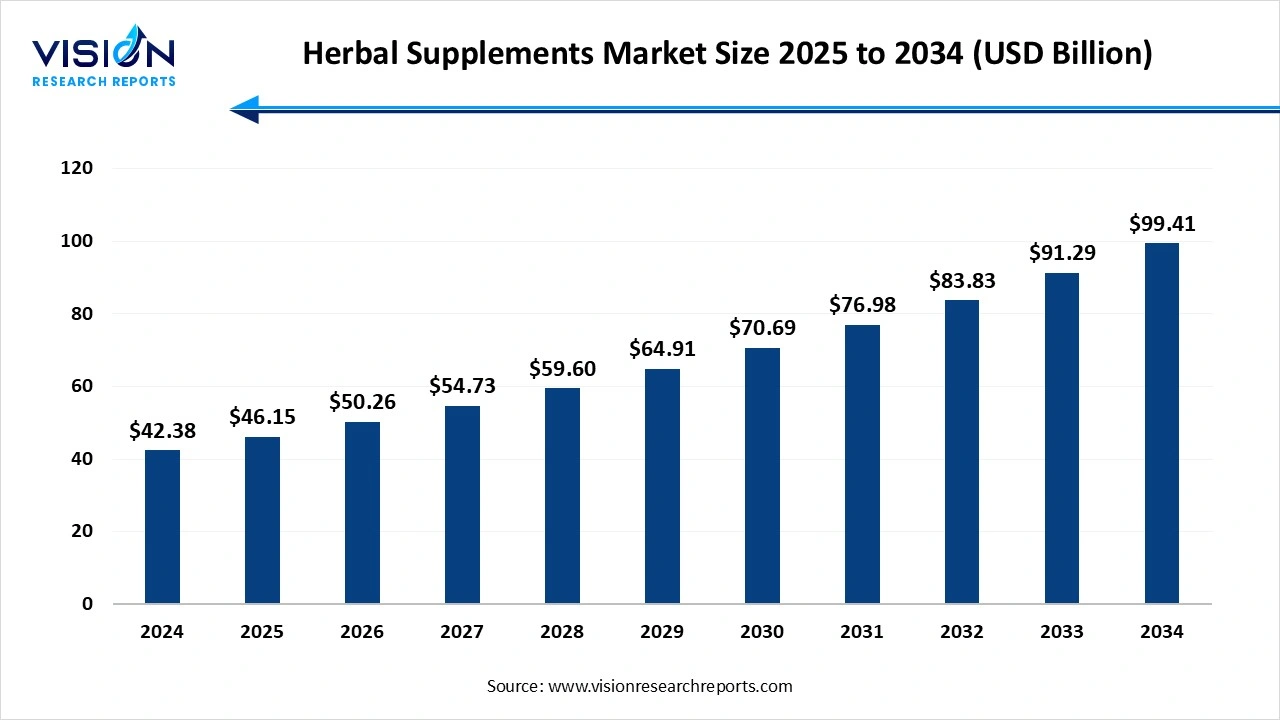

The global herbal supplements market size was estimated at around USD 42.38 billion in 2024 and it is projected to hit around USD 99.41 billion by 2034, growing at a CAGR of 8.90% from 2025 to 2034. The market growth is driven by increasing consumer preference for natural and plant-based products, the herbal supplements market is witnessing significant growth.

The herbal supplements market has witnessed significant growth in recent years, driven by a rising consumer preference for natural and plant-based health solutions. These supplements, derived from herbs, roots, and plant extracts, are widely used to promote general well-being, support immunity, and manage chronic health conditions. Increased awareness about the side effects of synthetic drugs and a growing inclination toward preventive healthcare have further accelerated demand.

One of the key growth drivers of the herbal supplements market is the increasing consumer awareness about the benefits of natural health products. As people become more health-conscious and seek alternatives to synthetic medications, there is a strong shift toward plant-based remedies that are perceived as safer and more sustainable. The rising prevalence of lifestyle-related health conditions such as obesity, diabetes, and stress-related disorders has also fueled the demand for herbal supplements, which are often used to support weight management, improve sleep, and boost energy levels.

In addition, the global expansion of the wellness and fitness industry has played a crucial role in boosting market growth. The growing popularity of Ayurveda, Traditional Chinese Medicine (TCM), and other holistic practices has helped legitimize herbal supplements among modern consumers.

One of the major challenges in the herbal supplements market is the lack of strict regulatory oversight and standardization across regions. Unlike pharmaceutical drugs, herbal supplements often do not undergo rigorous clinical testing or quality checks before reaching consumers. This inconsistency can lead to variations in product efficacy and safety, undermining consumer trust. Additionally, the presence of adulterated or counterfeit herbal products in the market poses a risk to consumer health and hampers the credibility of genuine brands.

Another significant hurdle is limited scientific validation and clinical backing for many herbal ingredients. While traditional use supports the benefits of herbs, modern consumers and healthcare professionals often demand evidence-based data to support claims. This gap makes it difficult for some herbal products to gain wider acceptance, especially in medical communities.

North America accounted for a substantial share of the herbal supplements market, holding 27% of the total market. The United States, in particular, has witnessed a surge in demand for herbal supplements due to increased interest in preventive healthcare, clean-label products, and plant-based nutrition. The presence of major industry players, a strong distribution network, and continuous innovation in herbal formulations further support market growth in this region.

The Asia Pacific herbal supplements market is projected to expand at the fastest CAGR of 10.34% over the forecast period. Ask ChatGPT Countries like India, China, and Japan are not only major consumers but also key suppliers of herbal ingredients. The rising middle-class population, increasing disposable income, and growing awareness about holistic wellness are expected to propel the herbal supplements market in this region over the coming years.

The turmeric segment led the global herbal supplements market, contributing 24% to the total revenue. Curcumin, the active compound in turmeric, is widely known for its anti-inflammatory, antioxidant, and potential anti-cancer properties. Consumers are turning to turmeric supplements as a natural option for managing joint pain, boosting immunity, and supporting digestive health. The growing popularity of functional foods and natural remedies has further pushed the demand for turmeric in capsule, tablet, and powder forms.

The moringa is projected to record the highest CAGR of 11.75% in the herbal supplements market throughout the forecast period. Known as the "miracle tree," moringa is rich in vitamins, minerals, amino acids, and antioxidants, making it a popular choice for those seeking natural solutions for energy enhancement, immune support, and overall wellness. The demand for moringa supplements is particularly strong in regions focused on combating malnutrition and promoting sustainable agriculture. As consumers increasingly seek organic and ethically sourced products, moringa’s appeal continues to grow in both developing and developed economies.

The capsules accounted for the largest market share of 32% in 2024, driven by their widespread availability and the convenience of pre-measured doses that make consumption easy and user-friendly. This format is particularly preferred by consumers who seek a hassle-free way to incorporate herbal supplements into their daily routines without the taste or preparation time often associated with other forms. Capsules also offer better protection of herbal ingredients from environmental exposure, helping preserve their potency and shelf life. Moreover, manufacturers find capsules beneficial for incorporating standardized herbal extracts, which enhances the consistency and reliability of health outcomes.

The powder form of herbal supplements is anticipated to witness the fastest growth, with a projected CAGR of 11.28% over the forecast period. Herbal powders allow users to customize dosages and mix them into drinks, smoothies, or meals, offering greater flexibility compared to pre-measured formats. This form is especially popular among health-conscious consumers who prefer unprocessed or minimally processed products with no fillers or artificial additives. The powder format also tends to be more cost-effective and is often perceived as more potent due to the minimal processing involved.

The adult segment held the largest market share of 65% in 2024, driven by increasing health awareness among the population. With rising stress levels, busy work schedules, and increasing exposure to environmental pollutants, many adults are turning to herbal supplements to support immunity, enhance energy, and manage common health concerns such as anxiety, digestion, and sleep disorders. The preference for natural, plant-based alternatives to pharmaceuticals has led to higher adoption of herbal supplements like ashwagandha, ginseng, turmeric, and green tea extracts among this demographic.

The geriatric segment is projected to record the fastest CAGR of 11.48% throughout the forecast period. Older adults often face age-related conditions such as joint pain, cognitive decline, weakened immunity, and chronic ailments, prompting the demand for gentle yet effective natural supplements. Herbal formulations that promote memory support, bone health, cardiovascular function, and overall well-being are particularly appealing to this demographic. Furthermore, many elderly consumers prefer herbal supplements due to their lower risk of side effects compared to synthetic drugs.

The offline segment led the herbal supplements market, accounting for a 61% share in 2024. Pharmacies, health food stores, supermarkets, and specialty nutrition outlets remain popular destinations for purchasing herbal supplements, especially among older demographics who prefer in-person shopping and direct product interaction. These channels provide consumers with the opportunity to consult in-store experts, compare various brands, and access personalized recommendations.

The online segment is anticipated to witness the fastest CAGR of 9.98% throughout the forecast period. With the increasing penetration of the internet and smartphones, e-commerce platforms have made it more convenient for consumers to explore, compare, and purchase herbal supplements from the comfort of their homes. Online retail offers a broader product range, competitive pricing, subscription services, and detailed product information, which appeals especially to younger and tech-savvy consumers. The rise of digital health platforms and influencer-driven wellness trends has also fueled the popularity of online sales.

By Product

By Formulation

By Consumer

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Herbal Supplements Market

5.1. COVID-19 Landscape: Herbal Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Herbal Supplements Market, By Product

8.1. Herbal Supplements Market, by Product

8.1.1. Moringa

8.1.1.1. Market Revenue and Forecast

8.1.2. Echinacea

8.1.2.1. Market Revenue and Forecast

8.1.3. Flaxseeds

8.1.3.1. Market Revenue and Forecast

8.1.4. Turmeric

8.1.4.1. Market Revenue and Forecast

8.1.5. Ginger

8.1.5.1. Market Revenue and Forecast

8.1.6. Ginseng

8.1.6.1. Market Revenue and Forecast

8.1.7. Others

8.1.7.1. Market Revenue and Forecast

Chapter 9. Global Herbal Supplements Market, By Formulation

9.1. Herbal Supplements Market, by Formulation

9.1.1. Tablets

9.1.1.1. Market Revenue and Forecast

9.1.2. Capsules

9.1.2.1. Market Revenue and Forecast

9.1.3. Liquid

9.1.3.1. Market Revenue and Forecast

9.1.4. Powder

9.1.4.1. Market Revenue and Forecast

9.1.5. Soft Gels

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Herbal Supplements Market, By Consumer

10.1. Herbal Supplements Market, by Consumer

10.1.1. Pregnant Women

10.1.1.1. Market Revenue and Forecast

10.1.2. Adults

10.1.2.1. Market Revenue and Forecast

10.1.3. Pediatric

10.1.3.1. Market Revenue and Forecast

10.1.4. Geriatric

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Herbal Supplements Market, By Distribution Channel

11.1. Herbal Supplements Market, by Distribution Channel

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast

11.1.2. Pharmacies & Drug Stores

11.1.2.1. Market Revenue and Forecast

11.1.3. Hypermarkets/Supermarkets

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

11.1.5. Online

11.1.5.1. Market Revenue and Forecast

Chapter 12. Global Herbal Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Formulation

12.1.3. Market Revenue and Forecast, by Consumer

12.1.4. Market Revenue and Forecast, by Distribution Channel

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Formulation

12.1.5.3. Market Revenue and Forecast, by Consumer

12.1.5.4. Market Revenue and Forecast, by Distribution Channel

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Formulation

12.1.6.3. Market Revenue and Forecast, by Consumer

12.1.6.4. Market Revenue and Forecast, by Distribution Channel

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Formulation

12.2.3. Market Revenue and Forecast, by Consumer

12.2.4. Market Revenue and Forecast, by Distribution Channel

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Formulation

12.2.5.3. Market Revenue and Forecast, by Consumer

12.2.5.4. Market Revenue and Forecast, by Distribution Channel

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Formulation

12.2.6.3. Market Revenue and Forecast, by Consumer

12.2.6.4. Market Revenue and Forecast, by Distribution Channel

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Formulation

12.2.7.3. Market Revenue and Forecast, by Consumer

12.2.7.4. Market Revenue and Forecast, by Distribution Channel

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Formulation

12.2.8.3. Market Revenue and Forecast, by Consumer

12.2.8.4. Market Revenue and Forecast, by Distribution Channel

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Formulation

12.3.3. Market Revenue and Forecast, by Consumer

12.3.4. Market Revenue and Forecast, by Distribution Channel

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Formulation

12.3.5.3. Market Revenue and Forecast, by Consumer

12.3.5.4. Market Revenue and Forecast, by Distribution Channel

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Formulation

12.3.6.3. Market Revenue and Forecast, by Consumer

12.3.6.4. Market Revenue and Forecast, by Distribution Channel

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Formulation

12.3.7.3. Market Revenue and Forecast, by Consumer

12.3.7.4. Market Revenue and Forecast, by Distribution Channel

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Formulation

12.3.8.3. Market Revenue and Forecast, by Consumer

12.3.8.4. Market Revenue and Forecast, by Distribution Channel

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Formulation

12.4.3. Market Revenue and Forecast, by Consumer

12.4.4. Market Revenue and Forecast, by Distribution Channel

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Formulation

12.4.5.3. Market Revenue and Forecast, by Consumer

12.4.5.4. Market Revenue and Forecast, by Distribution Channel

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Formulation

12.4.6.3. Market Revenue and Forecast, by Consumer

12.4.6.4. Market Revenue and Forecast, by Distribution Channel

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Formulation

12.4.7.3. Market Revenue and Forecast, by Consumer

12.4.7.4. Market Revenue and Forecast, by Distribution Channel

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Formulation

12.4.8.3. Market Revenue and Forecast, by Consumer

12.4.8.4. Market Revenue and Forecast, by Distribution Channel

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Formulation

12.5.3. Market Revenue and Forecast, by Consumer

12.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Formulation

12.5.5.3. Market Revenue and Forecast, by Consumer

12.5.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Formulation

12.5.6.3. Market Revenue and Forecast, by Consumer

12.5.6.4. Market Revenue and Forecast, by Distribution Channel

Chapter 13. Company Profiles

13.1. Nature’s Bounty Co.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Gaia Herbs

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Schwabe Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. NOW Foods

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Bio-Botanica Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Herbalife Nutrition Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nutraceutical Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. GNC Holdings LLC

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Arkopharma Laboratories

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others