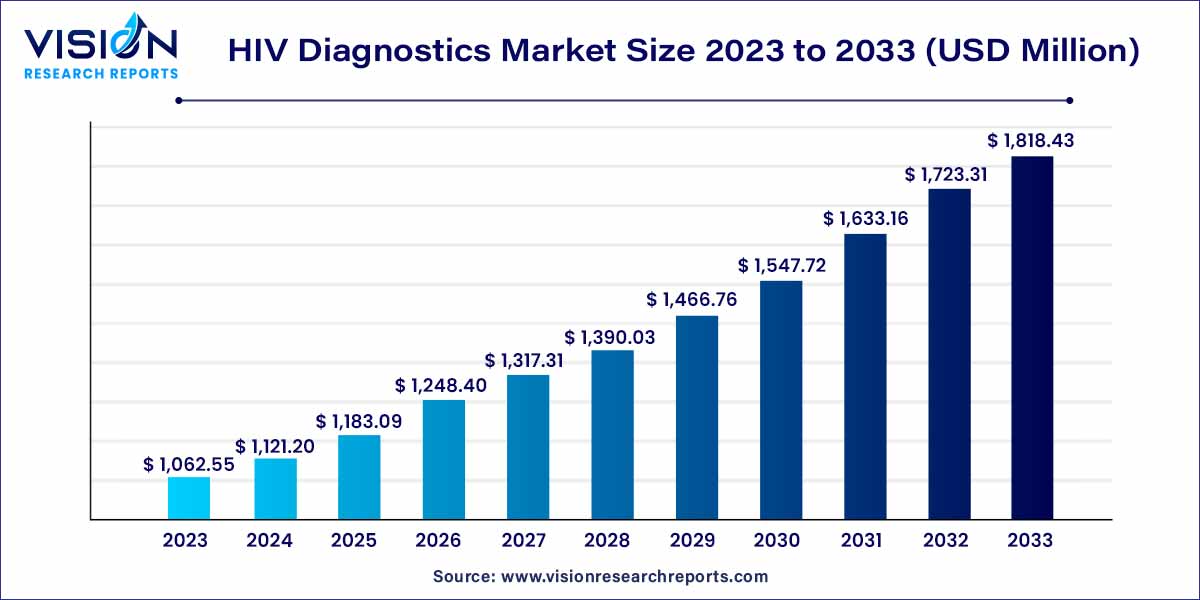

The global HIV diagnostics market was estimated at USD 1,062.55 million in 2023 and it is expected to surpass around USD 1,818.43 million by 2033, poised to grow at a CAGR of 5.52% from 2024 to 2033. The HIV diagnostics market is a critical component of the broader healthcare landscape, dedicated to the detection and monitoring of Human Immunodeficiency Virus (HIV) infections. This overview provides a comprehensive look at the key elements that define the market, including its scope, major players, testing methods, and the driving factors influencing its dynamics.

The growth of the HIV diagnostics market is propelled by several key factors. Firstly, the persistent global prevalence of HIV/AIDS underscores the ongoing demand for robust diagnostic solutions. Advances in technology, particularly the integration of molecular diagnostics and Point-of-Care testing, contribute significantly to heightened accuracy and accessibility, further expanding the market. Government initiatives and increased awareness campaigns advocating for widespread testing have played a pivotal role in driving market growth, fostering a proactive approach to HIV detection and management. Additionally, the evolving trend towards decentralized testing models aligns with the imperative to reach underserved populations, promoting inclusivity and comprehensive healthcare. These growth factors collectively underscore the dynamic nature of the HIV diagnostics market, positioning it as a vital player in global public health efforts.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 1,818.43 million |

| Growth Rate from 2024 to 2033 | CAGR of 5.52% |

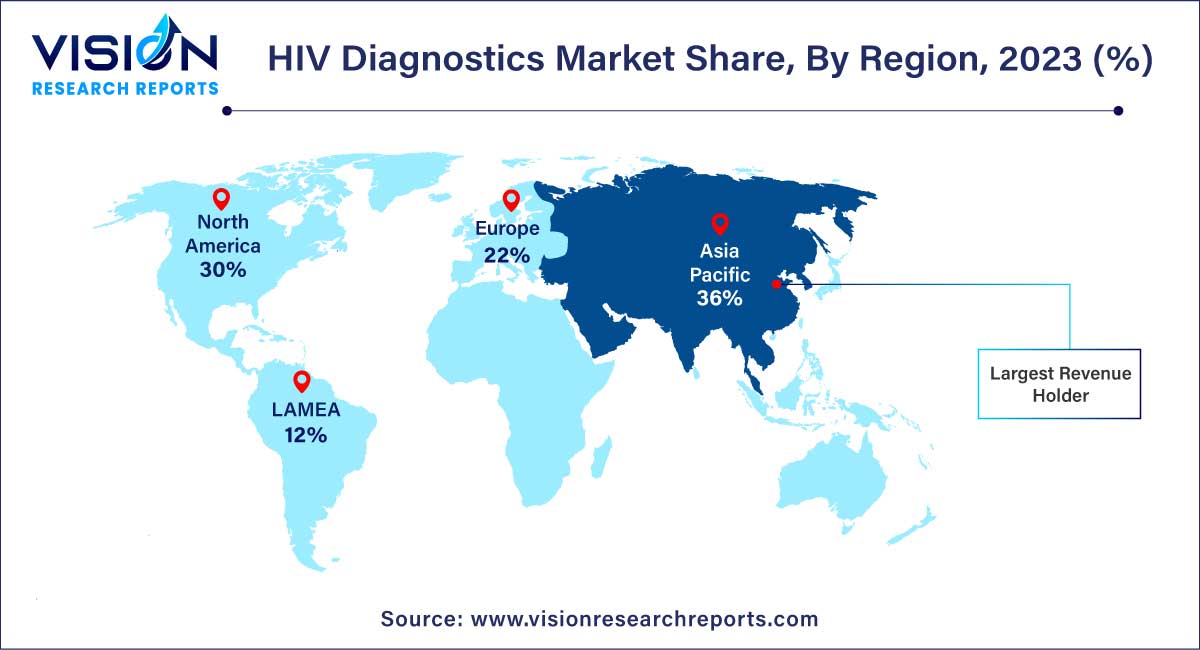

| Revenue Share of Asia Pacific in 2023 | 36% |

| CAGR of Latin America from 2024 to 2033 | 6.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The market is segmented into consumables, instruments, and software & services. The consumables segment accounted for the largest revenue share of 48% in 2023 owing to the prevalence of HIV cases and the need to improve the accuracy of the results. Various screening and confirmatory tests are conducted for the diagnosis of HIV-1, HIV-2, and group O incidences. These tests have primary applications to screen and differentiate between the various groups and subtypes of human immunodeficiency virus. Therefore, accurate consumables need to be used to improve the quality of results and treatments.

Moreover, the software & services segment is expected to grow at the fastest CAGR of 6.93% over the forecast period due to technological advancements and increasing awareness regarding HIV and AIDS. Various government campaigns to create awareness and reduce the stigma around these diseases can also be attributed to this growth. For instance, Let’s Stop HIV Together (Together) is a campaign by the Centers for Disease Control and Prevention, which aims to raise awareness regarding HIV, promote diagnostics & testing, and reduce stigma around it.

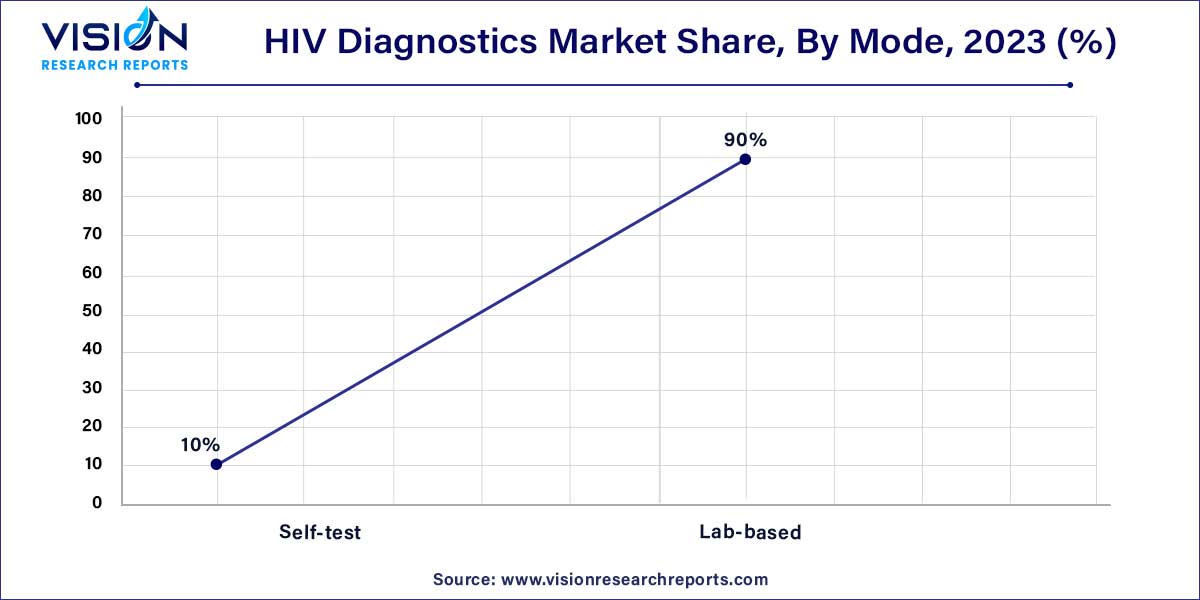

On the basis of mode, the market is further segmented into self-testing and lab-based testing. The lab-based testing segment contributed the largest market share of 90% in 2023 owing to the accuracy of their results. Lab-based tests are performed in diagnostic laboratories or healthcare facilities by skilled professionals using advanced equipment. It gives accurate results, allows for prolonged monitoring, and is essential for confirmatory testing and complex analysis. Rapid and point-of-care testing technologies also allow for early intervention and reduce the time between testing and the start of the treatment. The market has enormous potential to increase accessibility, accuracy, and efficiency, ultimately leading to better outcomes for HIV patients and global disease-fighting efforts.

The self-testing segment is anticipated to grow at the fastest CAGR of 10.63% over the forecast period due to their user-friendliness and convenience. Self-testing allows individuals to run diagnostic tests at home using a self-collection kit and interpret the results independently. It offers ease, and anonymity, and facilitates early detection. Self-test kits have become more accessible with higher accuracy and faster turnaround times. It has given people the ability to take control of their health and overcome challenges, such as stigma and inconvenience with traditional testing techniques. Both self-testing and lab-based testing approaches aid in HIV diagnosis by catering to different needs and preferences, promoting awareness, and enabling effective viral control.

On the basis of test types, the global market has been further categorized into antibody tests, viral load tests, CD4 tests, and others. The antibody test type segment dominated the industry with largest revenue share of 54% in 2023. The segment is projected to remain dominant growing at the fastest CAGR of 5.95% during the forecast period. The growth of this segment can be attributed to the presence of several antibody tests.

These tests include HIV-1 screening, confirmatory HIV-2, and Group-O tests, which can be further divided into 3rd- and 4th-generation ELISA tests, POC and non-POC dried blood spot tests, western blot, and line immunoassays. These tests are increasingly being used in disease subtyping, screening, and confirmation. The confirmatory western blot test is regarded as 100% accurate post-antibody screening. The high utilization rates and accuracy of these tests are further expected to drive the antibody testing segment growth.

On the basis of end-use, the market has been further segmented into diagnostic laboratories, hospitals & clinics, home settings, and others. The diagnostic laboratories segment held the largest revenue share of 37% in 2023 as diagnostic laboratories conduct rigorous testing and analysis using advanced technology and qualified personnel, resulting in accurate results. The home settings segment is expected to register the fastest CAGR of 8.3% over the forecast period.

The market is reliant on collaboration among all segments, including diagnostic laboratories, hospitals & clinics, and home settings to work together to ensure that people have access to accurate testing, counseling, and appropriate care to assist in the improvement of public health worldwide. The growth of this segment can be attributed to the privacy and convenience offered by home-based HIV testing kits, which allow individuals to administer tests and receive results in the privacy of their own homes.

Asia Pacific dominated the market with the largest revenue share of 36% in 2023 owing to technological advancement, an increase in the number of people suffering from HIV and AIDS, and increasing awareness regarding the same in this region. According to an article published by The Indian Express in August 2022, approximately 24.01 lakh people in India are diagnosed with HIV. The increasing health expenditure and efforts by governments in these regions to increase awareness and promote treatment are likely to boost market growth in the years to come.

Latin America is expected to grow at the fastest CAGR of 6.93% during the forecast period owing to the increasing awareness about diagnostic testing in the region. According to the article published by the Pan American Health Organization, in November 2020, HIV infection cases in Latin America have increased by 20% in the last decade. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities.

By Product

By Mode

By Test Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on HIV Diagnostics Market

5.1. COVID-19 Landscape: HIV Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global HIV Diagnostics Market, By Product

8.1. HIV Diagnostics Market, by Product, 2024-2033

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software and Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global HIV Diagnostics Market, By Mode

9.1. HIV Diagnostics Market, by Mode, 2024-2033

9.1.1. Self-test

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Lab-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global HIV Diagnostics Market, By Test Type

10.1. HIV Diagnostics Market, by Test Type, 2024-2033

10.1.1. Antibody Test

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Viral Load Test

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. CD4 Test

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global HIV Diagnostics Market, By End-use

11.1. HIV Diagnostics Market, by End-use, 2024-2033

11.1.1. Diagnostic Laboratories

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospitals & Clinics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Home Settings

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global HIV Diagnostics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Mode (2021-2033)

12.1.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Mode (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Mode (2021-2033)

12.2.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Mode (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Mode (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Mode (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Mode (2021-2033)

12.3.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Mode (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Mode (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Mode (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Mode (2021-2033)

12.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Mode (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Mode (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Mode (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Mode (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Mode (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Alere Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Abbott

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Bristol-Myers Squibb Company

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Janssen Global Services, LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Gilead Sciences, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Merck & Co. Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. VIIV Healthcare

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. BD

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Beckman Coulter, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Sysmex Europe SE

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others