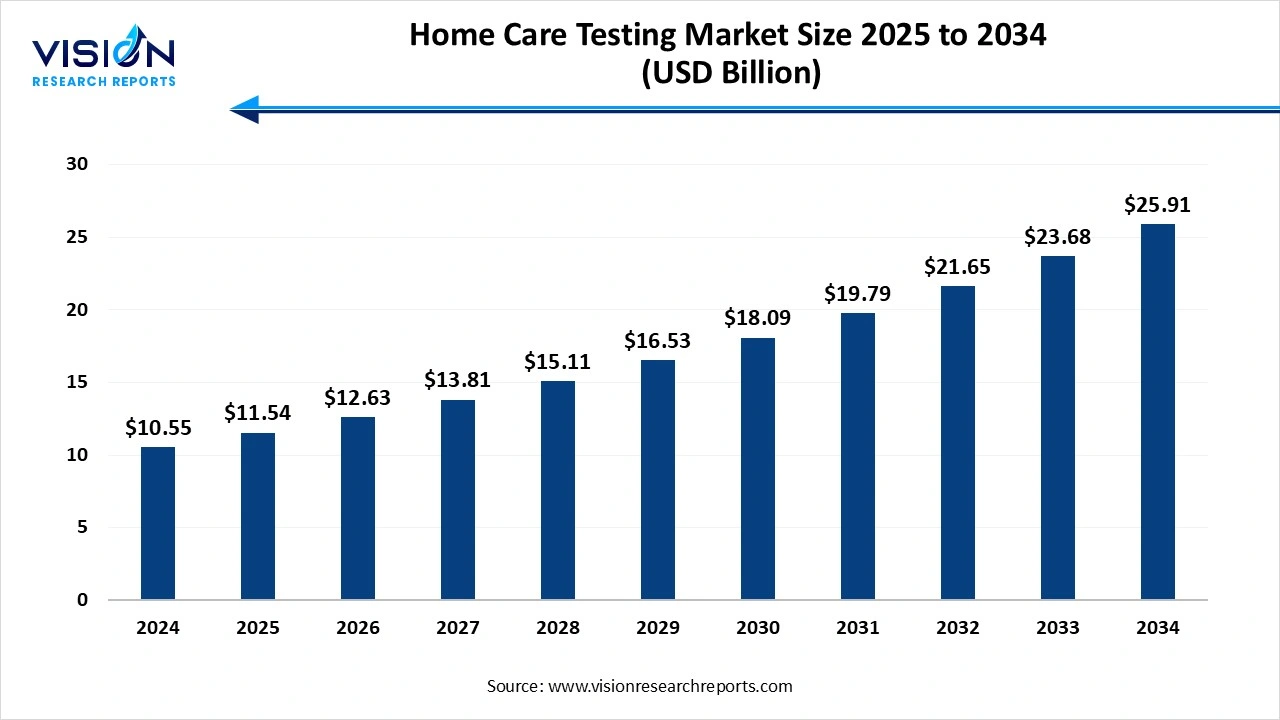

The global home care testing market size was accounted at USD 10.55 billion in 2024 and it is projected to hit around USD 25.91 billion by 2034, growing at a CAGR of 9.4% from 2025 to 2034. The market growth is driven by the rising demand for convenient and rapid diagnostic solutions, the Home Care Testing Market is experiencing significant growth.

| Report Coverage | Details |

| Revenue Share of North America in 2024 | 9.4% |

| Revenue Forecast by 2034 | USD 25.91 billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.34% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Abbott; BD; Quidel Corp.; BioSure; F. Hoffmann-La Roche Ltd.; Nova Biomedical; Siemens Healthcare GmbH; ACON Laboratories, Inc.; OraSure Technologies, Inc.; Chembio Diagnostics, Inc |

The home care testing market has emerged as a vital segment of the healthcare industry, offering convenient and accessible diagnostic solutions for patients outside traditional clinical settings. This market encompasses a wide range of at-home test kits and portable diagnostic devices used for monitoring chronic conditions, detecting infections, and managing overall health. Factors such as the growing elderly population, increasing prevalence of chronic diseases, and rising demand for personalized healthcare are driving the adoption of home testing solutions.

The growth of the home care testing market is primarily driven by the rising prevalence of chronic and lifestyle-related diseases such as diabetes, cardiovascular conditions, and respiratory disorders. As patients seek more convenient and cost-effective ways to manage their health, at-home diagnostic solutions have gained popularity for enabling early detection and regular monitoring without frequent hospital visits. The aging global population further amplifies this demand, as older adults often require continuous health assessment but prefer the comfort and privacy of their homes.

Technological advancements in diagnostic devices are another key factor propelling the growth of this market. Innovations such as smartphone-integrated test kits, AI-powered monitoring tools, and wearable biosensors have significantly improved the accuracy, usability, and accessibility of home care diagnostics.

One of the primary challenges in the home care testing market is ensuring the accuracy and reliability of test results. Unlike controlled clinical environments, home settings can introduce variability in how tests are administered, potentially affecting outcomes. Users may not follow instructions correctly, or mishandling of samples can lead to false readings. This raises concerns about misdiagnosis or delayed treatment, which can have serious health implications. Ensuring user-friendly designs and incorporating built-in guidance features are essential but still pose hurdles in achieving consistent accuracy across diverse user groups.

Another significant challenge is the regulatory and reimbursement landscape. Many home testing devices must go through rigorous regulatory approval processes to ensure safety and efficacy, which can delay time-to-market and increase development costs. Additionally, limited insurance coverage and reimbursement policies for at-home tests can restrict their adoption, especially in cost-sensitive markets. Data privacy and security concerns related to connected devices and digital platforms also present obstacles, as safeguarding sensitive health information is critical to maintaining user trust and compliance with health regulations like HIPAA and GDPR.

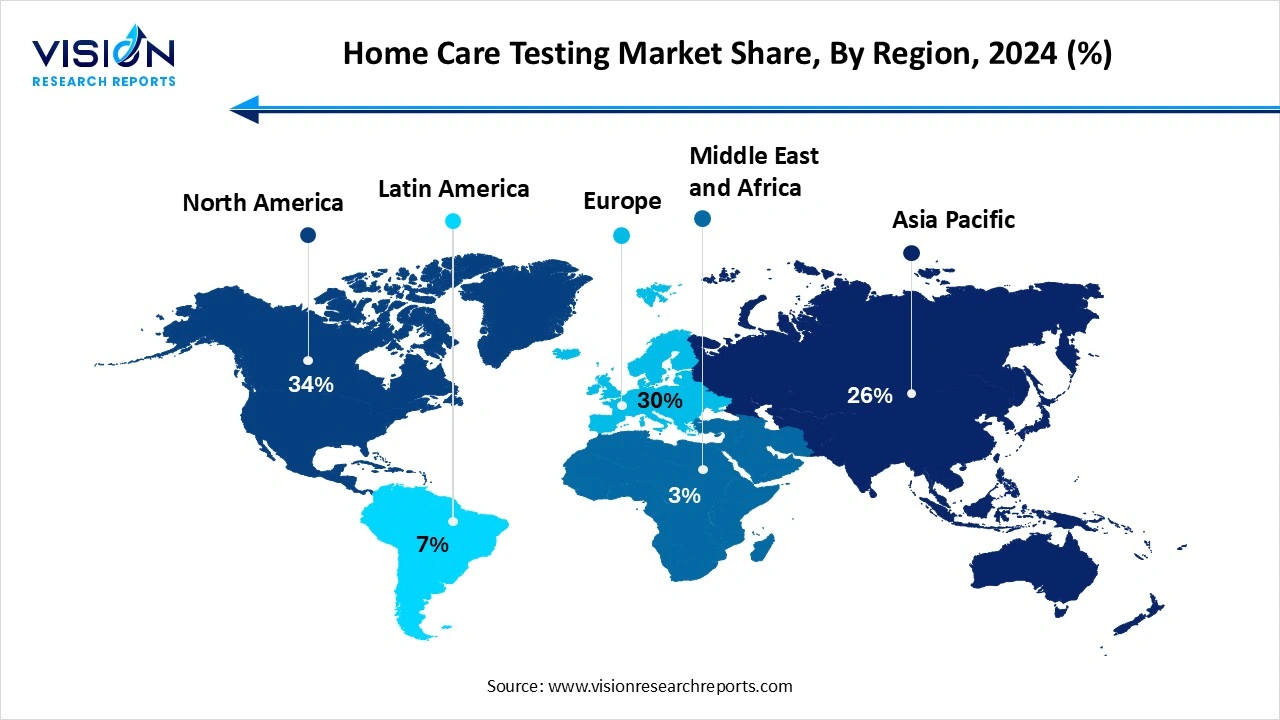

North America held the leading position in the home care testing market, accounting for the largest revenue share of 34% in 2024. The region benefits from widespread adoption of digital health tools, insurance coverage for home diagnostics, and a growing aging population that relies on home-based care. The United States, in particular, has seen a surge in demand for self-testing kits for chronic conditions, infectious diseases, and wellness monitoring, supported by increased telehealth integration and government initiatives promoting preventive care.

Asia Pacific is projected to witness the fastest compound annual growth rate (CAGR) in the home care testing market throughout the forecast period. Rising healthcare expenditure, urbanization, and the increasing penetration of smartphones and internet services are making home testing more viable in countries like China, India, and Japan. Additionally, increasing consumer awareness and government efforts to enhance primary care are creating favorable conditions for market development in this region.

Asia Pacific is projected to witness the fastest compound annual growth rate (CAGR) in the home care testing market throughout the forecast period. Rising healthcare expenditure, urbanization, and the increasing penetration of smartphones and internet services are making home testing more viable in countries like China, India, and Japan. Additionally, increasing consumer awareness and government efforts to enhance primary care are creating favorable conditions for market development in this region.

The geriatric segment dominated the market by age group, capturing the largest revenue share of 61% in 2024. Older adults often face mobility challenges and require continuous health monitoring, making home-based diagnostic solutions a practical and convenient alternative to frequent clinical visits. Home testing devices for managing conditions such as diabetes, hypertension, cardiac disorders, and respiratory issues are increasingly adopted by elderly individuals and their caregivers.

The pediatric segment is anticipated to experience a significant CAGR throughout the forecast period. Parents and caregivers are increasingly turning to home-based diagnostic tools to minimize the stress and discomfort that clinic visits can cause young children. The market is witnessing growing innovation in pediatric-focused testing kits that offer safe, non-invasive, and easy-to-use formats tailored to children's needs. Additionally, the availability of digital platforms that connect home testing data with pediatricians in real-time enhances the ability to provide timely interventions and personalized care.

The urine sample segment held the largest revenue share of 37% in 2024, The market based on sample type. These tests are widely favored for their non-invasive nature, ease of use, and quick results, making them suitable for both routine health checks and chronic disease management. With advancements in test strip technology and digital interpretation tools, urine sample testing at home has become more accurate and accessible.

The blood sample segment is projected to register a significant CAGR during the forecast period. Home blood tests are commonly used for glucose monitoring, cholesterol levels, infectious disease detection, hormone analysis, and genetic screening. The widespread use of portable devices such as glucometers and blood testing kits with finger-prick technology has made it easier for individuals to track their health on a regular basis.

The infectious disease test segment dominated the market, accounting for the highest revenue share of 41% in 2024. The demand for accessible, rapid diagnostic solutions at home has surged as consumers seek convenient methods to detect conditions like influenza, COVID-19, respiratory infections, and sexually transmitted diseases without visiting healthcare facilities. Home-based infectious disease tests have become essential for early detection, timely isolation, and effective treatment, helping to curb the spread of infections within communities.

The diabetes and glucose tests segment is projected to grow at the fastest CAGR during the forecast period. Home glucose monitoring devices such as glucometers and continuous glucose monitors (CGMs) enable individuals to manage their blood sugar levels with precision, improving treatment adherence and reducing the risk of complications. These tests are particularly important for insulin-dependent patients and those managing type 2 diabetes through diet and medication. Technological advancements have introduced Bluetooth-enabled devices and app-connected monitors, making it easier for users to track trends, receive alerts, and share data with healthcare providers.

The retail pharmacies segment held the largest revenue share of 50% based on distribution channel in 2024. These outlets serve as accessible points of purchase for a wide range of home testing kits, including those for glucose monitoring, pregnancy detection, infectious diseases, and more. Consumers often rely on retail pharmacies for immediate availability of products and the added benefit of in-person guidance from pharmacists, especially when selecting suitable diagnostic tools.

The online pharmacies segment is anticipated to register the fastest CAGR over the forecast period. They offer consumers the convenience of browsing, comparing, and purchasing home testing kits from the comfort of their homes, often with detailed product information and customer reviews. The expansion of online platforms has made it easier for consumers in remote and underserved areas to access diagnostic tools that were previously difficult to obtain. Additionally, the discreet nature of online purchasing appeals to users seeking privacy, especially for tests related to sexual health or chronic conditions.

The strip segment dominated the market, accounting for the largest revenue share of 31% in 2024. These strips are typically utilized for testing glucose levels, urine analysis, and pregnancy detection, among other common health conditions. Their compact design and ease of use make them suitable for routine self-monitoring, especially among patients managing chronic illnesses like diabetes. Technological advancements have improved the sensitivity and accuracy of strip-based tests, allowing users to obtain reliable results within minutes.

The cassette segment is projected to witness substantial CAGR growth throughout the forecast period. These products are commonly used for a variety of diagnostic applications, including infectious disease screening, drug testing, and fertility tracking. Cassette tests typically involve placing a sample such as blood, urine, or saliva into a designated well, offering more controlled testing and often clearer results compared to strip-based alternatives.

By Age

By Sample

By Test Type

By Distribution Channel

By Product

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Care Testing Market

5.1. COVID-19 Landscape: Home Care Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Care Testing Market, By Age

8.1. Home Care Testing Market, by Age, 2023-2034

8.1.1. Pediatric

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Adult

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Geriatric

8.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Home Care Testing Market, By Sample

9.1. Home Care Testing Market, by Sample, 2023-2034

9.1.1. Urine

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Saliva

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Blood

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Home Care Testing Market, By Test Type

10.1. Home Care Testing Market, by Test Type, 2023-2034

10.1.1. HIV Test Kit

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. Diabetes and Glucose Tests

10.1.2.1. Market Revenue and Forecast (2025-2034)

10.1.3. Cholesterol and Triglycerides Tests

10.1.3.1. Market Revenue and Forecast (2025-2034)

10.1.4. Pregnancy Tests

10.1.4.1. Market Revenue and Forecast (2025-2034)

10.1.5. Infectious Diseases Tests

10.1.5.1. Market Revenue and Forecast (2025-2034)

10.1.6. Urinary Tract Infection Tests

10.1.6.1. Market Revenue and Forecast (2025-2034)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Home Care Testing Market, By Distribution

11.1. Home Care Testing Market, by Distribution, 2023-2034

11.1.1. Retail Pharmacies

11.1.1.1. Market Revenue and Forecast (2025-2034)

11.1.2. Supermarket/Hypermarket

11.1.2.1. Market Revenue and Forecast (2025-2034)

11.1.3. Online Pharmacies

11.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 12. Global Home Care Testing Market, By Product

12.1. Home Care Testing Market, by Product, 2023-2034

12.1.1. Strip

12.1.1.1. Market Revenue and Forecast (2025-2034)

12.1.2. Cassette

12.1.2.1. Market Revenue and Forecast (2025-2034)

12.1.3. Test Panel

12.1.3.1. Market Revenue and Forecast (2025-2034)

12.1.4. Midstream

12.1.4.1. Market Revenue and Forecast (2025-2034)

12.1.5. Dip Card

12.1.5.1. Market Revenue and Forecast (2025-2034)

12.1.6. Others

12.1.6.1. Market Revenue and Forecast (2025-2034)

Chapter 13. Global Home Care Testing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Age (2025-2034)

13.1.2. Market Revenue and Forecast, by Sample (2025-2034)

13.1.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.1.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.1.5. Market Revenue and Forecast, by Product (2025-2034)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Age (2025-2034)

13.1.6.2. Market Revenue and Forecast, by Sample (2025-2034)

13.1.6.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.1.6.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.1.7. Market Revenue and Forecast, by Product (2025-2034)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Age (2025-2034)

13.1.8.2. Market Revenue and Forecast, by Sample (2025-2034)

13.1.8.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.1.8.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.1.8.5. Market Revenue and Forecast, by Product (2025-2034)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Age (2025-2034)

13.2.2. Market Revenue and Forecast, by Sample (2025-2034)

13.2.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.2.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.2.5. Market Revenue and Forecast, by Product (2025-2034)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Age (2025-2034)

13.2.6.2. Market Revenue and Forecast, by Sample (2025-2034)

13.2.6.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.2.7. Market Revenue and Forecast, by Distribution (2025-2034)

13.2.8. Market Revenue and Forecast, by Product (2025-2034)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Age (2025-2034)

13.2.9.2. Market Revenue and Forecast, by Sample (2025-2034)

13.2.9.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.2.10. Market Revenue and Forecast, by Distribution (2025-2034)

13.2.11. Market Revenue and Forecast, by Product (2025-2034)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Age (2025-2034)

13.2.12.2. Market Revenue and Forecast, by Sample (2025-2034)

13.2.12.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.2.12.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.2.13. Market Revenue and Forecast, by Product (2025-2034)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Age (2025-2034)

13.2.14.2. Market Revenue and Forecast, by Sample (2025-2034)

13.2.14.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.2.14.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.2.15. Market Revenue and Forecast, by Product (2025-2034)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Age (2025-2034)

13.3.2. Market Revenue and Forecast, by Sample (2025-2034)

13.3.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.3.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.3.5. Market Revenue and Forecast, by Product (2025-2034)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Age (2025-2034)

13.3.6.2. Market Revenue and Forecast, by Sample (2025-2034)

13.3.6.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.3.6.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.3.7. Market Revenue and Forecast, by Product (2025-2034)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Age (2025-2034)

13.3.8.2. Market Revenue and Forecast, by Sample (2025-2034)

13.3.8.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.3.8.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.3.9. Market Revenue and Forecast, by Product (2025-2034)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Age (2025-2034)

13.3.10.2. Market Revenue and Forecast, by Sample (2025-2034)

13.3.10.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.3.10.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.3.10.5. Market Revenue and Forecast, by Product (2025-2034)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Age (2025-2034)

13.3.11.2. Market Revenue and Forecast, by Sample (2025-2034)

13.3.11.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.3.11.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.3.11.5. Market Revenue and Forecast, by Product (2025-2034)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Age (2025-2034)

13.4.2. Market Revenue and Forecast, by Sample (2025-2034)

13.4.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.4.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.4.5. Market Revenue and Forecast, by Product (2025-2034)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Age (2025-2034)

13.4.6.2. Market Revenue and Forecast, by Sample (2025-2034)

13.4.6.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.4.6.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.4.7. Market Revenue and Forecast, by Product (2025-2034)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Age (2025-2034)

13.4.8.2. Market Revenue and Forecast, by Sample (2025-2034)

13.4.8.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.4.8.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.4.9. Market Revenue and Forecast, by Product (2025-2034)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Age (2025-2034)

13.4.10.2. Market Revenue and Forecast, by Sample (2025-2034)

13.4.10.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.4.10.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.4.10.5. Market Revenue and Forecast, by Product (2025-2034)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Age (2025-2034)

13.4.11.2. Market Revenue and Forecast, by Sample (2025-2034)

13.4.11.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.4.11.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.4.11.5. Market Revenue and Forecast, by Product (2025-2034)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Age (2025-2034)

13.5.2. Market Revenue and Forecast, by Sample (2025-2034)

13.5.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.5.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.5.5. Market Revenue and Forecast, by Product (2025-2034)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Age (2025-2034)

13.5.6.2. Market Revenue and Forecast, by Sample (2025-2034)

13.5.6.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.5.6.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.5.7. Market Revenue and Forecast, by Product (2025-2034)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Age (2025-2034)

13.5.8.2. Market Revenue and Forecast, by Sample (2025-2034)

13.5.8.3. Market Revenue and Forecast, by Test Type (2025-2034)

13.5.8.4. Market Revenue and Forecast, by Distribution (2025-2034)

13.5.8.5. Market Revenue and Forecast, by Product (2025-2034)

Chapter 14. Company Profiles

14.1. Abbott

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. BD

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Quidel Corp.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. BioSure

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. F. Hoffmann-La Roche Ltd.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Nova Biomedical

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Siemens Healthcare GmbH

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. ACON Laboratories, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. OraSure Technologies, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Chembio Diagnostics, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others