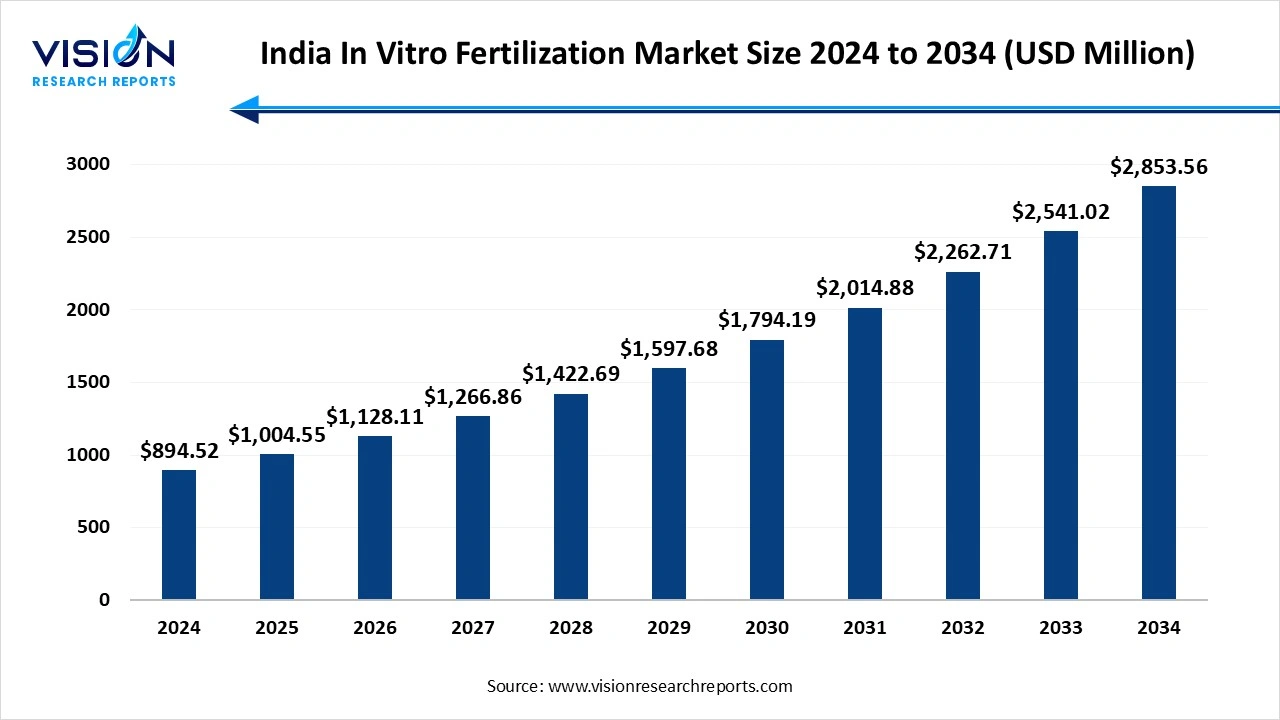

The global India in vitro fertilization market size was estimated at USD 894.52 million in 2024 and is expected to grow to USD 1,004.55 million in 2025, ultimately reaching USD 2,853.56 million by 2034, reflecting a remarkable CAGR of 12.3%. The advancement in reproductive technology, increasing awareness about fertility treatments, the increasing prevalence of infertility cases, and the advancement in medical technology drive the market growth.

India's in vitro fertilization (IVF) is a complex medical process designed to facilitate pregnancy. The procedure is commonly used to address infertility, a condition defined as the inability to conceive after one year of unprotected intercourse. Additionally, IVF can be paired with preimplantation genetic testing to screen for and avoid the transmission of specific hereditary disorders.

A rising trend of delayed marriages and postponing childbirth for career or financial reasons, especially in urban centers, contributes to age-related infertility. A woman's fertility declines naturally after age 32, increasing the need for ART. Sedentary lifestyles, obesity, and an increase in smoking and alcohol consumption among both men and women are contributing to fertility issues. Polycystic Ovarian Syndrome (PCOS) Treatment and other hormonal imbalances are also common contributors to female infertility.

| Report Coverage | Details |

| Market Size in 2024 | USD 894.52 million |

| Revenue Forecast by 2034 | USD 2,853.56 million |

| Growth rate from 2025 to 2034 | CAGR of 12.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | CK Birla Healthcare Pvt. Ltd., Babies and Us Fertility and IVF Centre (Ind) Pvt Ltd, Nova IVF, Morpheus IVF, Indira IVF Hospital Private Limited, Cloudnine Hospitals, Apollo Fertility (Apollo Specialty Hospitals Pvt. Ltd.), BACC Healthcare Private Limited, Max Healthcare, Bloom Fertility Centre, Manipal Health Enterprises Pvt. Ltd. |

According to the Indian Council of Medical Research, roughly 10–15% of couples in India experience infertility. This rate is higher in urban areas and is fueled by changing lifestyles, stress, obesity, and an increase in conditions like Polycystic Ovarian Syndrome (PCOS). The increasing career ambitions and later marriages, especially among urban women, have led to a rise in the average age of first-time pregnancies, which fuels the market growth.

IVF can be expensive for many Indian families, particularly outside major cities, with the financial burden exacerbated by the possibility of multiple cycles and limited insurance. The process requires a high-tech lab with specialized equipment and consumables, such as culture media and freezing media, which add to the overall expenses. Many fertility issues require more complex and expensive techniques beyond standard IVF, which increases the total bill.

Why did the Culture Media Segment Dominate the India In Vitro Fertilization Market?

The culture media segment dominated the India in vitro fertilization market in 2024. It is essential for embryo development and affects treatment success rates. The segment's growth is driven by ongoing R&D and technological advancements that enhance fertilization outcomes. Increased awareness, rising infertility rates, and expanding fertility clinics across India also fuel demand for high-quality culture media. This combination of scientific necessity and market growth makes culture media a critical and dominant component.

The disposable devices segment is the fastest-growing in the India in vitro fertilization market during the forecast period. The disposable devices deliver a streamlined environment, significantly reducing the risk of contamination and ensuring patient safety during IVF procedures. The rising adoption of disposable equipment reduces the risk of human error and cross-contamination, which is crucial for the success of delicate IVF processes. The advancement and innovation in disposables have led to the integration of some disposable devices to integrate with advanced technologies, like AI-powered embryo selection and time-lapse imaging systems, enhancing precision and success rates.

How the Frozen Non-Donor Segment hold the Largest Share in the India In Vitro Fertilization Market?

The frozen on-donor segment held the largest revenue share in the India in vitro fertilization market in 2024. This method is generally more affordable than fresh embryo transfers or cycles involving donor eggs, as they do not require repeated ovarian stimulation and egg retrieval. Modern cryopreservation techniques, particularly vitrification, have significantly improved the success rates of frozen embryo transfers, making them a viable and increasingly popular option. The rising public awareness of infertility and the effectiveness of IVF, along with the trend of fertility preservation where individuals freeze their embryos for future use, further fuels demand for frozen non-donor IVF.

The fresh donor segment is experiencing the fastest growth in the market during the forecast period. These are the preferred choice of many couples seeking an immediate and effective fertility solution; they are linked with better embryo quality and subsequently, higher success rates in achieving pregnancy. Increased awareness and acceptance of donor programs in India are encouraging more couples to consider fresh donor treatments. India's vast population provides a large pool of potential egg and sperm donors, offering a wide range of options for couples seeking fresh donors. Fever legal hurdles and a supportive environment, and a desire for immediate and effective solutions, fuel growth.

How the Fertility Clinics Segment hold the Largest Share in the India In Vitro Fertilization Market?

The fertility clinics segment held the largest revenue share in the India in vitro fertilization market in 2024. They offer a superior, specialized patient experience compared to general hospitals. Their dominance is driven by a focus on comprehensive services, higher success rates due to advanced technology, and personalized care. Additionally, increased affordability and growing public awareness have shifted market preference away from hospitals toward these dedicated fertility centers. This specialization provides a more supportive and effective path to parenthood for couples seeking IVF treatments.

By Instrument

By Procedure Type

By Providers

India In Vitro Fertilization Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Instrument Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India In Vitro Fertilization Market

5.1. COVID-19 Landscape: India In Vitro Fertilization Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global India In Vitro Fertilization Market, By Instrument

8.1. India In Vitro Fertilization Market, by Instrument

8.1.1 Disposable Devices

8.1.1.1. Market Revenue and Forecast

8.1.2. Culture Media

8.1.2.1. Market Revenue and Forecast

8.1.3. Equipment

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global India In Vitro Fertilization Market, By Procedure Type

9.1. India In Vitro Fertilization Market, by Procedure Type

9.1.1. Fresh Donor

9.1.1.1. Market Revenue and Forecast

9.1.2. Frozen Donor

9.1.2.1. Market Revenue and Forecast

9.1.3. Fresh Non-donor

9.1.3.1. Market Revenue and Forecast

9.1.4. Frozen Non-donor

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global India In Vitro Fertilization Market, By Providers

10.1. India In Vitro Fertilization Market, by Providers

10.1.1. Fertility Clinics

10.1.1.1. Market Revenue and Forecast

10.1.2. Hospitals & Others Setting

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global India In Vitro Fertilization Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Instrument

11.1.2. Market Revenue and Forecast, by Procedure Type

11.1.3. Market Revenue and Forecast, by Providers

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Instrument

11.1.4.2. Market Revenue and Forecast, by Procedure Type

11.1.4.3. Market Revenue and Forecast, by Providers

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Instrument

11.1.5.2. Market Revenue and Forecast, by Procedure Type

11.1.5.3. Market Revenue and Forecast, by Providers

11.2. Europe

11.2.1. Market Revenue and Forecast, by Instrument

11.2.2. Market Revenue and Forecast, by Procedure Type

11.2.3. Market Revenue and Forecast, by Providers

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Instrument

11.2.4.2. Market Revenue and Forecast, by Procedure Type

11.2.4.3. Market Revenue and Forecast, by Providers

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Instrument

11.2.5.2. Market Revenue and Forecast, by Procedure Type

11.2.5.3. Market Revenue and Forecast, by Providers

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Instrument

11.2.6.2. Market Revenue and Forecast, by Procedure Type

11.2.6.3. Market Revenue and Forecast, by Providers

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Instrument

11.2.7.2. Market Revenue and Forecast, by Procedure Type

11.2.7.3. Market Revenue and Forecast, by Providers

11.3. APAC

11.3.1. Market Revenue and Forecast, by Instrument

11.3.2. Market Revenue and Forecast, by Procedure Type

11.3.3. Market Revenue and Forecast, by Providers

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Instrument

11.3.4.2. Market Revenue and Forecast, by Procedure Type

11.3.4.3. Market Revenue and Forecast, by Providers

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Instrument

11.3.5.2. Market Revenue and Forecast, by Procedure Type

11.3.5.3. Market Revenue and Forecast, by Providers

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Instrument

11.3.6.2. Market Revenue and Forecast, by Procedure Type

11.3.6.3. Market Revenue and Forecast, by Providers

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Instrument

11.3.7.2. Market Revenue and Forecast, by Procedure Type

11.3.7.3. Market Revenue and Forecast, by Providers

11.4. MEA

11.4.1. Market Revenue and Forecast, by Instrument

11.4.2. Market Revenue and Forecast, by Procedure Type

11.4.3. Market Revenue and Forecast, by Providers

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Instrument

11.4.4.2. Market Revenue and Forecast, by Procedure Type

11.4.4.3. Market Revenue and Forecast, by Providers

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Instrument

11.4.5.2. Market Revenue and Forecast, by Procedure Type

11.4.5.3. Market Revenue and Forecast, by Providers

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Instrument

11.4.6.2. Market Revenue and Forecast, by Procedure Type

11.4.6.3. Market Revenue and Forecast, by Providers

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Instrument

11.4.7.2. Market Revenue and Forecast, by Procedure Type

11.4.7.3. Market Revenue and Forecast, by Providers

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Instrument

11.5.2. Market Revenue and Forecast, by Procedure Type

11.5.3. Market Revenue and Forecast, by Providers

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Instrument

11.5.4.2. Market Revenue and Forecast, by Procedure Type

11.5.4.3. Market Revenue and Forecast, by Providers

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Instrument

11.5.5.2. Market Revenue and Forecast, by Procedure Type

11.5.5.3. Market Revenue and Forecast, by Providers

Chapter 12. Company Profiles

12.1. CK Birla Healthcare Pvt. Ltd..

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Babies and Us Fertility and IVF Centre (Ind) Pvt Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Nova IVF.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Morpheus IVF.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Indira IVF Hospital Private Limited..

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Cloudnine Hospitals

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Apollo Fertility (Apollo Specialty Hospitals Pvt. Ltd.).

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. BACC Healthcare Private Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Max Healthcare.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Bloom Fertility Centre

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others