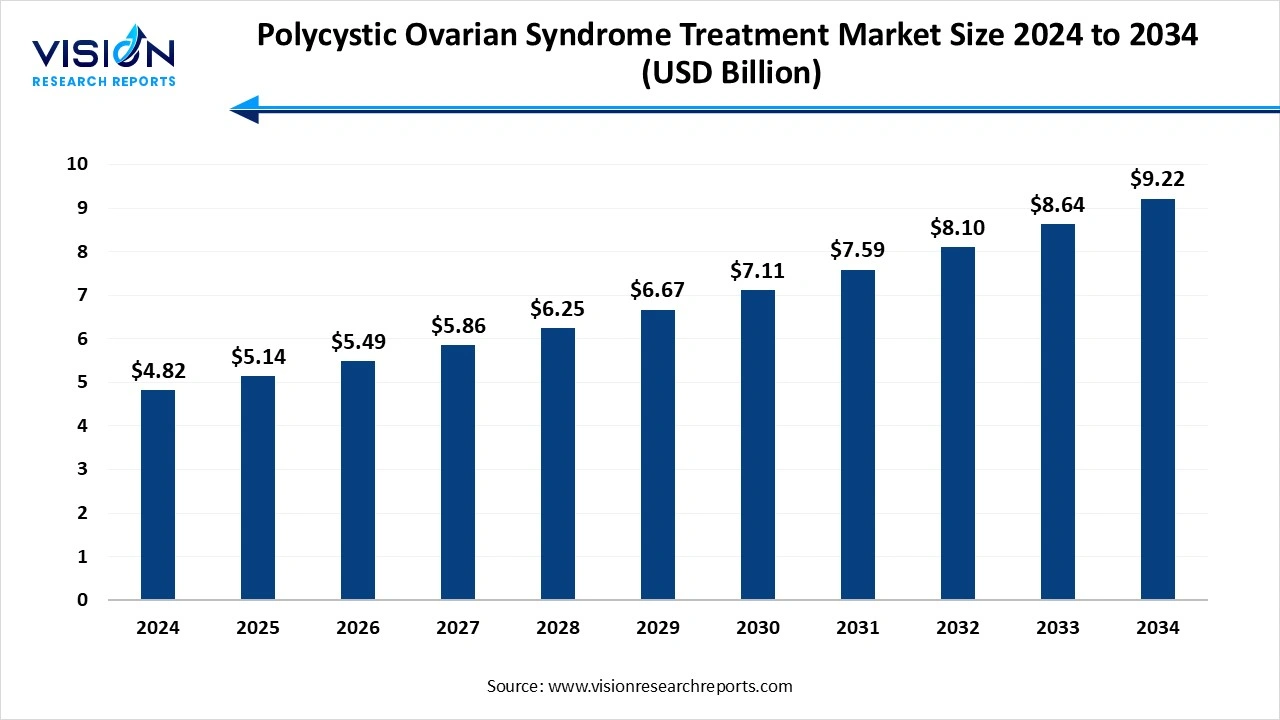

The polycystic ovarian syndrome treatment market size stood at USD 4.82 billion in 2024 and is estimated to reach USD 5.14 billion in 2025. It is projected to hit USD 9.22 billion by 2034, registering a robust CAGR of 6.7% from 2025 to 2034. The market is driven by the rising prevalence of PCOS, increasing awareness of its health risks, and growing investments in healthcare infrastructure and targeted therapies, supported by government initiatives promoting women’s health.

Polycystic ovary syndrome (PCOS) is a hormonal endocrine issue that affects women between the age group 15 to 55 years. In this syndrome, there is cyst formation on the ovaries which leads to lack of ovulation, thus leading to problems in menstruation cycles as well as pregnancy.

The growing awareness about PCOS, along with increased healthcare access has significantly driven demand for effective treatments. As a result, pharmaceutical companies are focusing on developing and marketing drugs that can manage symptoms effectively, regulate hormonal imbalances and reduce the long-term risks of PCOS such as infertility and metabolic disorders.

The growth of the polycystic ovarian syndrome treatment market is primarily driven by the rising prevalence of the disorder all across the world. Lifestyle-related factors such as increasing obesity, poor dietary habits, stress and lack of physical activity are significantly contributing to the growing prevalence of PCOS, with cases mostly found in urban areas. Additionally, greater awareness about the symptoms and complications of PCOS, such as infertility, type 2 diabetes and cardiovascular risks is encouraging early diagnosis and treatment, thus driving market demand.

Another major growth factor is the increased investments in healthcare infrastructure and research and development. Pharmaceutical companies and medical research institutions worldwide are developing advanced and targeted therapies in order to address the complex hormonal and metabolic imbalances associated with PCOS. Government and non-governmental health initiatives are also promoting women's health and wellness, further enhancing access to diagnosis and treatment.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.82 billion |

| Revenue Forecast by 2034 | USD 9.22 billion |

| Growth rate from 2025 to 2034 | CAGR of 6.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Bayer AG, Teva Pharmaceutical Industries Ltd., Novo Nordisk A/S, Pfizer Inc., Merck & Co., Inc., Novartis AG, GlaxoSmithKline plc, Eli Lilly and Company, Sanofi S.A., and Cipla Limited. |

Rising Prevalence of PCOS

The increasing prevalence of Polycystic Ovarian Syndrome (PCOS) globally is a key driver in the market. This rising incidence is prompting healthcare providers all over the globe to focus on developing innovative therapies and management strategies. As awareness about PCOS continues to grow, more women are seeking medical advice and treatment, further propelling the market forward.

Awareness of the long-term health risks associated with PCOS has also driven the development of innovative treatment modalities, from pharmacological interventions like metformin and oral contraceptives to holistic approaches such as lifestyle counselling, therapies and fertility treatments. This will in turn increase access to affordable and effective care worldwide and boost the PCOS treatment market.

Limited Awareness and Lack of Resources

Despite growth prospects, the market does have its fair share of challenges. The lack of awareness and late diagnosis in low-income and underdeveloped regions is one such challenge that has hindered the growth of the PCOS treatment market. The factors slowing down growth include cultural stigma, taboo, unavailability of reproductive health education and inadequate diagnostic infrastructure. Many women in such regions often do not have the opportunity to receive gynaecological consultations and hormonal therapies nor have a safe space to openly talk about it, and therefore, they cannot be effectively treated.

The cost of more sophisticated diagnostic equipment and treatments also makes it inaccessible in low-resource settings. The full scope of PCOS care, including hormonal therapy, lifestyle interventions and fertility treatments, remains unaffordable for a majority of the population in developing countries.

Rising Demand for Fertility Treatments and Government Initiatives

The increasing demand for fertility treatments among women with PCOS is a significant factor that is opening up new doors of opportunity for the polycystic ovarian syndrome treatment market. PCOS is a leading cause of infertility in today’s day and age, and as more women delay childbirth, the need for effective fertility solutions becomes more pronounced. Treatments such as ovulation induction and assisted reproductive technologies are gaining popularity. The market is responding to this demand by effectively developing targeted therapies that address the unique challenges faced by women with PCOS. This trend is expected to further drive market growth, and align with the overall expansion of the fertility treatment domain.

Various health organizations are also implementing policies that are aimed at improving healthcare access and funding research of PCOS. These initiatives often include awareness campaigns, subsidized treatment options and support for clinical trials. Such government backing not only helps to enhance the visibility of PCOS but also encourages pharmaceutical companies to invest in the research and development of new treatments. This supportive environment is likely to boost innovation and propel the market forward.

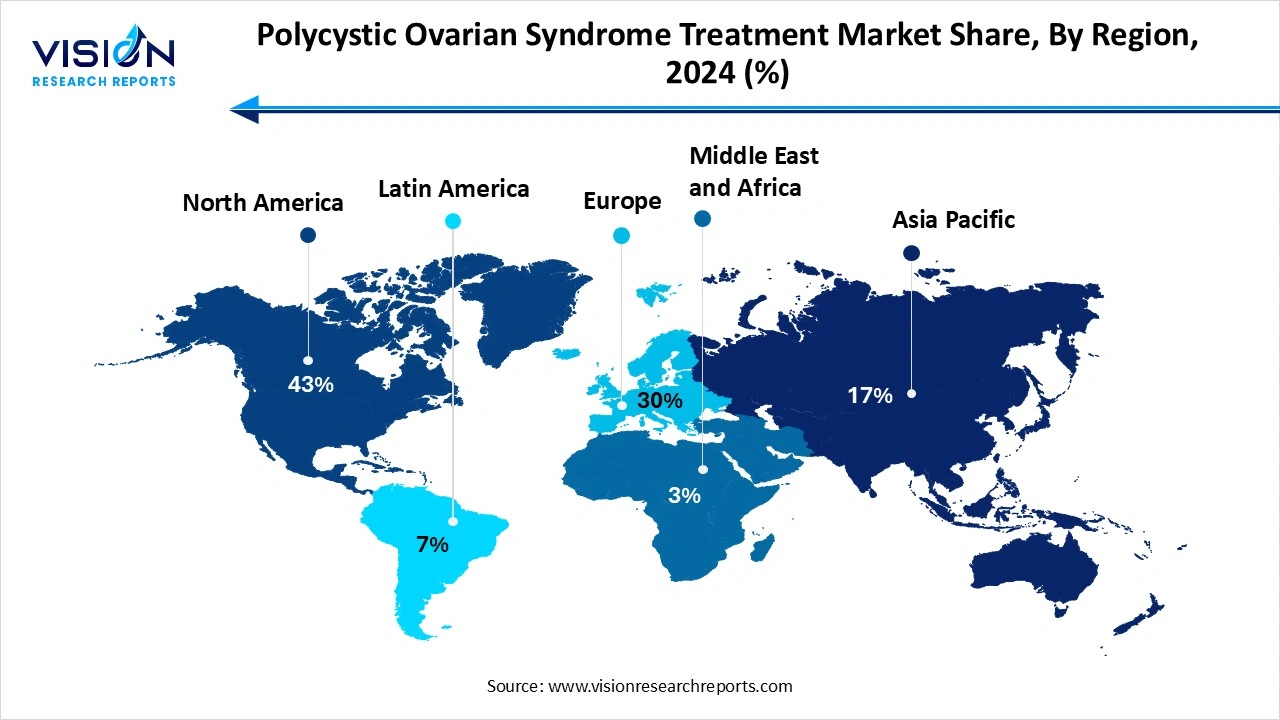

North America led the polycystic ovarian syndrome treatment market share 43% in 2024. due to its strong healthcare structure, high awareness levels and a large number of women affected with the disease. The country also has a wide cover of insurance and the use of modern therapies, including agents sensitisers for insulin, anti-androgen agents and individual hormonal therapies, which explains the dominance of this market.

The region also had as an active platform of awareness campaigns that focus on educating the public about symptoms, early diagnosis and treatment options, thus driving the demand for innovative therapeutic solutions. Moreover, the market is strengthened by the availability of specialists and advanced diagnostic tools and by research collaborations between academic institutions and pharmaceutical companies. Through all these factors, we can see how the region has successfully positioned itself as a global leader in today’s market.

The Asia-Pacific region is seen to have the fastest growth in the PCOS treatment market. This growth is due to its large population base, rising urbanization and increasing prevalence of lifestyle disorders that are contributing to PCOS. Dietary change is another cause of the rising cases coupled with by stress and sedentary lifestyles, creating a major demand for effective treatments. Governments in the region are investing in healthcare infrastructure and launching awareness campaigns in order to deal with the complications of PCOS.

This region's high population base and increase in demand for PCOS medicines also contributes to the market growth. The region has witnessed an increase in the number of hospitals and diagnostic centers that are equipped with cutting-edge medical technology, and an improvement in the general level of health awareness.

Which drug class dominated the market in 2024?

The insulin-sensitizing agents held the largest market share, accounting for 37% in 2024. Medications such as metformin are widely prescribed by healthcare professionals to improve insulin sensitivity, which not only helps regulate blood glucose levels but also assists in restoring normal menstrual cycles and ovulation in women affected by PCOS. These agents are especially beneficial for patients who suffer from metabolic complications such as prediabetes or type 2 diabetes along with PCOS.

The oral contraceptives are projected to have the fastest growth rate throughout the forecast period. These types of medications help regulate the menstrual cycle by providing a consistent level of estrogen and progestin, suppressing excess androgen production and promoting endometrial health. Oral contraceptives are often the first line of treatment for women who are not seeking pregnancy, offering both symptomatic relief and long-term health benefits. The advantage of this market lies in its widespread availability and clinical familiarity.

Which surgery segment dominated the market in 2024?

The laparoscopic ovarian drilling captured the highest market revenue share of 69% in 2024. This is because it is a minimally invasive procedure and involves the use of electrocautery or laser to puncture the thickened ovarian cortex, which then helps lower androgen levels and restore ovulation. This treatment offers a relatively safe and effective alternative to hormonal treatments, especially for women who do not respond well to medications. Its benefits include improved fertility outcomes and reduced risk of multiple pregnancies compared to other conventional ovulation-inducing drugs.

The ovarian wedge resection is expected to witness the fastest growth over the forecast period. Although largely replaced by more advanced and less invasive techniques, this method is still used in selective cases, especially where other treatments have failed or where laparoscopic options are not feasible. This procedure can help reduce ovarian volume and improve hormonal balance, leading to the restroration of regular menstrual cycles.

The hospital pharmacy segment held the highest market revenue share at 66% in 2024. Hospitals have a well-established healthcare infrastructure and offer a cohesive environment where diagnosis, consultation and treatment can all be managed under one roof. This integrated approach ensures that patients receive personalized care, including prescription fulfillment, monitoring of drug interactions and access to specialized therapies. They are also fully equipped with skilled personnel and advanced tools, making the patient feel safe and secure.

The online providers are anticipated to experience the fastest growth rate over the forecast period. E-pharmacies and telemedicine platforms are on the rise as they offer patients the ease of ordering medications from home, coupled with the benefit of virtual consultations with healthcare specialists. This channel is especially significant for women in remote or underserved areas where physical access to specialized care and pharmacies is limited. The rise of digitization and the increasing prevalence of PCOS in young women is further leading to the segment’s growth.

By Drug Class

By Surgery

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drug Class Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Polycystic Ovarian Syndrome Treatment Market

5.1. COVID-19 Landscape: Polycystic Ovarian Syndrome Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Polycystic Ovarian Syndrome Treatment Market, By Drug Class

8.1. Polycystic Ovarian Syndrome Treatment Market, by Drug Class

8.1.1 Oral Contraceptives

8.1.1.1. Market Revenue and Forecast

8.1.2. Antiandrogens

8.1.2.1. Market Revenue and Forecast

8.1.3. Insulin-sensitizing Agent

8.1.3.1. Market Revenue and Forecast

8.1.4. Antidepressant

8.1.4.1. Market Revenue and Forecast

8.1.5. Anti-obesity

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Polycystic Ovarian Syndrome Treatment Market, By Surgery

9.1. Polycystic Ovarian Syndrome Treatment Market, by Surgery

9.1.1. Ovarian Wedge Resection

9.1.1.1. Market Revenue and Forecast

9.1.2. Laparoscopic Ovarian Drilling

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Polycystic Ovarian Syndrome Treatment Market, By Distribution Channel

10.1. Polycystic Ovarian Syndrome Treatment Market, by Distribution Channel

10.1.1. Hospital Pharmacy

10.1.1.1. Market Revenue and Forecast

10.1.2. Drug Store & Retail Pharmacy

10.1.2.1. Market Revenue and Forecast

10.1.3. Online Providers

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Polycystic Ovarian Syndrome Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drug Class

11.1.2. Market Revenue and Forecast, by Surgery

11.1.3. Market Revenue and Forecast, by Distribution Channel

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drug Class

11.1.4.2. Market Revenue and Forecast, by Surgery

11.1.4.3. Market Revenue and Forecast, by Distribution Channel

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drug Class

11.1.5.2. Market Revenue and Forecast, by Surgery

11.1.5.3. Market Revenue and Forecast, by Distribution Channel

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drug Class

11.2.2. Market Revenue and Forecast, by Surgery

11.2.3. Market Revenue and Forecast, by Distribution Channel

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drug Class

11.2.4.2. Market Revenue and Forecast, by Surgery

11.2.4.3. Market Revenue and Forecast, by Distribution Channel

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drug Class

11.2.5.2. Market Revenue and Forecast, by Surgery

11.2.5.3. Market Revenue and Forecast, by Distribution Channel

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drug Class

11.2.6.2. Market Revenue and Forecast, by Surgery

11.2.6.3. Market Revenue and Forecast, by Distribution Channel

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drug Class

11.2.7.2. Market Revenue and Forecast, by Surgery

11.2.7.3. Market Revenue and Forecast, by Distribution Channel

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drug Class

11.3.2. Market Revenue and Forecast, by Surgery

11.3.3. Market Revenue and Forecast, by Distribution Channel

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drug Class

11.3.4.2. Market Revenue and Forecast, by Surgery

11.3.4.3. Market Revenue and Forecast, by Distribution Channel

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drug Class

11.3.5.2. Market Revenue and Forecast, by Surgery

11.3.5.3. Market Revenue and Forecast, by Distribution Channel

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drug Class

11.3.6.2. Market Revenue and Forecast, by Surgery

11.3.6.3. Market Revenue and Forecast, by Distribution Channel

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drug Class

11.3.7.2. Market Revenue and Forecast, by Surgery

11.3.7.3. Market Revenue and Forecast, by Distribution Channel

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drug Class

11.4.2. Market Revenue and Forecast, by Surgery

11.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drug Class

11.4.4.2. Market Revenue and Forecast, by Surgery

11.4.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drug Class

11.4.5.2. Market Revenue and Forecast, by Surgery

11.4.5.3. Market Revenue and Forecast, by Distribution Channel

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drug Class

11.4.6.2. Market Revenue and Forecast, by Surgery

11.4.6.3. Market Revenue and Forecast, by Distribution Channel

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drug Class

11.4.7.2. Market Revenue and Forecast, by Surgery

11.4.7.3. Market Revenue and Forecast, by Distribution Channel

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drug Class

11.5.2. Market Revenue and Forecast, by Surgery

11.5.3. Market Revenue and Forecast, by Distribution Channel

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drug Class

11.5.4.2. Market Revenue and Forecast, by Surgery

11.5.4.3. Market Revenue and Forecast, by Distribution Channel

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drug Class

11.5.5.2. Market Revenue and Forecast, by Surgery

11.5.5.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. Bayer AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Teva Pharmaceutical Industries Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Novo Nordisk A/S.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Pfizer Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Merck & Co., Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Novartis AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GlaxoSmithKline plc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Eli Lilly and Company

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sanofi S.A.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cipla Limited

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others