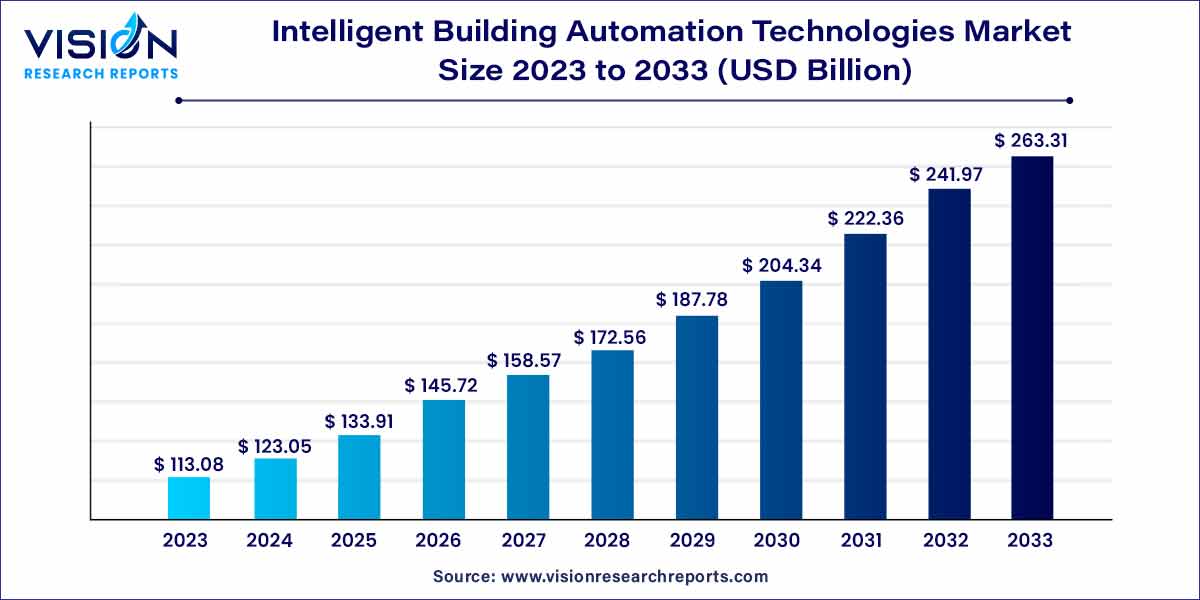

The global intelligent building automation technologies market size was estimated at around USD 113.08 billion in 2023 and it is projected to hit around USD 263.31 billion by 2033, growing at a CAGR of 8.82% from 2024 to 2033.

The intelligent building automation technologies (IBAT) market is experiencing a paradigm shift, with advancements in technology reshaping the landscape of building management. This overview provides a comprehensive insight into the key facets of the IBAT market, including its definition, growth drivers, market segmentation, and notable trends shaping its trajectory.

The intelligent building automation technologies (IBAT) market is experiencing robust growth, propelled by a confluence of key factors. A primary driver is the escalating demand for energy-efficient solutions, fostering a shift towards intelligent systems that optimize resource consumption. The rise of smart cities and the increasing emphasis on environmental sustainability further amplify this demand, pushing the market to innovate and deliver solutions aligned with green building initiatives. The integration of Internet of Things (IoT) technologies is a pivotal growth factor, enabling seamless connectivity and real-time data exchange. Additionally, the market benefits from the ongoing trend of integrating Artificial Intelligence (AI), facilitating predictive analytics, proactive maintenance, and heightened decision-making capabilities. As the market continues to evolve, a focus on sustainability, cloud-based solutions, and strategic partnerships contribute to its expansion, promising a future where intelligent building automation technologies play a central role in shaping the efficiency and sustainability of modern built environments.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 263.31 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.82% |

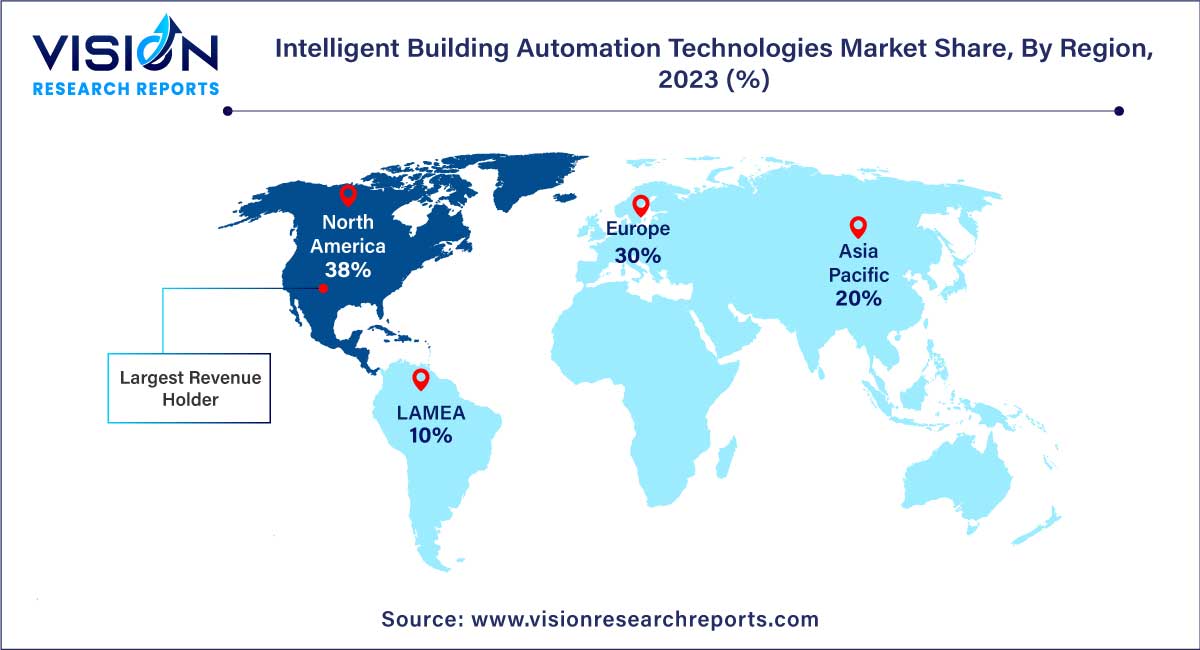

| Revenue Share of North America in 2022 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 12.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Rising Demand for Energy Efficiency:

The surge in awareness and commitment to energy conservation has propelled the adoption of intelligent building automation technologies (IBAT). Organizations and individuals alike are seeking solutions that optimize resource consumption, reduce waste, and enhance overall energy efficiency.

Smart Cities and Urbanization:

The global trend towards urbanization, coupled with the development of smart cities, is a significant driver for IBAT. Intelligent building systems contribute to the creation of smarter, more sustainable urban environments, meeting the demands of modern infrastructure.

Interoperability Issues:

The diverse range of technologies and systems within the IBAT landscape can lead to interoperability challenges. Compatibility issues between different components and devices may arise, limiting the seamless integration of intelligent building solutions and potentially impeding the overall effectiveness of the system.

Concerns Regarding Cybersecurity:

As buildings become more connected through IoT and automation, cybersecurity concerns become a critical restraint. The increased number of entry points for potential cyber threats raises apprehensions about the security of sensitive data and the vulnerability of critical building systems.

Integration of 5G Technology:

The rollout of 5G technology opens new horizons for IBAT. The high-speed, low-latency connectivity provided by 5G enhances the performance of IoT devices and enables real-time data exchange, unlocking opportunities for more responsive and interconnected intelligent building systems.

Advancements in Artificial Intelligence (AI):

Ongoing advancements in AI represent an opportunity for IBAT to further enhance its capabilities. The integration of advanced AI algorithms can lead to more predictive analytics, proactive maintenance, and intelligent decision-making, offering increased efficiency and customization in building management.

The component segment is segmented into hardware, software, and service. The hardware segment held the largest market share of 54% in 2023. Intelligent building automation technologies are an interconnected software and hardware network that controls and monitors the building facility environment. Various hardware equipment used include actuators, controllers, and sensors. These devices collectively ensure that HVAC systems are properly managed through automated control and that the building climate remains within an acceptable range.

The service segment is estimated to exhibit the fastest CAGR of 10.04% over the forecast period. Intelligent building automation technology services comprise engineering services. These engineering services help achieve energy-efficient, safe, and economical operation of building control systems. Implementing smart building services reduces operational expenses, reduces energy usage, and improves performance. It, in turn, is expected to propel the services segment's growth over the forecast period.

The product segment is segmented into security systems, life safety systems, facility management systems, and building energy management systems (BEMS). Security systems dominated the market with the highest revenue share of 36% in 2023. Security systems include building access control, CCTV, and elevator access control, which help reduce risks and prevent property loss and damage. Facilities management systems are the largest contributor to this market, whereas demand for BEMS is expected to grow significantly.

The life safety systems segment is expected to grow at a significant CAGR of 10.18% over the forecast period. Life safety systems, such as fire detection, emergency evacuation, and security systems, are essential components of any building to ensure the safety and security of occupants. Integrating intelligent technologies makes these systems more efficient and effective in detecting, responding to, and managing emergencies, enhancing overall safety.

The application segment is segmented into residential, commercial, and industrial. The commercial segment held the largest revenue share of 41% in 2023. In large commercial sites, such as industrial zones, office parks, shopping malls, airports, and seaports, intelligent building automation technology helps reduce the cost of energy, spatial management, and maintenance by a large percentage. This application segment is expected to continue its dominance over the forecast period owing to the increasing need to improve commercial building efficiency and stringent regulations regarding energy consumption.

The residential segment is expected to witness the fastest growth of CAGR of 10.47% over the forecast period. Growing concerns for security among homeowners due to rising burglaries and thefts globally are anticipated to drive the residential segment. The need to save energy and curb costs is also a crucial factor boosting the adoption of intelligent building automation technologies. Property owners can use data collected by motion and occupancy sensors at a building level to regulate air-conditioning and lighting in real-time, thereby reducing energy costs and optimizing the internal environment for its intended purpose.

North America dominated the market with the largest revenue share of 38% in 2023. North America has been at the forefront of technological innovation and research. The region is home to numerous tech companies, research institutions, and startups driving advancements in intelligent building automation technologies. This technological leadership fosters the development and adoption of cutting-edge solutions.

The Asia Pacific is expected to grow at the fastest CAGR of 12.05% during the forecast period due to the adoption of intelligent building automation technology in emerging economies such as China and India. Moreover, governments in countries such as India, South Korea, and China are investing in developing smart cities. Besides, enhancing network infrastructure in the region is expected to provide lucrative opportunities for market players in the coming years. The Middle East and Africa are expected to witness significant growth over the forecast period due to huge public infrastructure development investments. Moreover, the growing number of international tourists bodes well for implementing security systems, further fueling the intelligent building automation technologies market.

Buildings IOT and RENEW Energy Partners, LLC joined forces in July 2023 to push the use of property technology, analytics, and controls in the built environment while also quickening the process of decarbonizing buildings. By utilizing Buildings IOT's advanced and intelligent building management technology, onPoint, RENEW's goal of lowering carbon emissions from the built environment will be amplified and expedited. Through this partnership, RENEW's whole audience, including property owners, will be able to access onPoint as a service.

Cohesive Technologies, a communication solutions company, announced in May 2023 that it will be participating in the prestigious Smart Home Expo 2023, the country's premier technological event. During the event, the company will showcase its latest products and solutions in collaboration with Snom, a significant provider in SIP unified communication solutions.

Leader in IoT building automation 75F and open smart building platform supplier J2 Innovations (J2) announced a collaborative relationship in June 2022 with the goal of improving medium-sized commercial properties' energy efficiency. To hasten the adoption of plug-and-play, IoT-driven building automation systems, J2 and 75F combine their powers.

By Component

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Intelligent Building Automation Technologies Market

5.1. COVID-19 Landscape: Intelligent Building Automation Technologies Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Intelligent Building Automation Technologies Market, By Component

8.1. Intelligent Building Automation Technologies Market, by Component, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Service

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Intelligent Building Automation Technologies Market, By Product

9.1. Intelligent Building Automation Technologies Market, by Product, 2024-2033

9.1.1. Security Systems

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Life Safety Systems

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Facility Management Systems

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Building Energy Management Systems

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Intelligent Building Automation Technologies Market, By Application

10.1. Intelligent Building Automation Technologies Market, by Application, 2024-2033

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Intelligent Building Automation Technologies Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. ABB.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. General Electric.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Honeywell International Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Eaton.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hubbell.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Azbil Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Ingersoll Rand.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Johnson Controls

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Rockwell Automation Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Seimens

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others