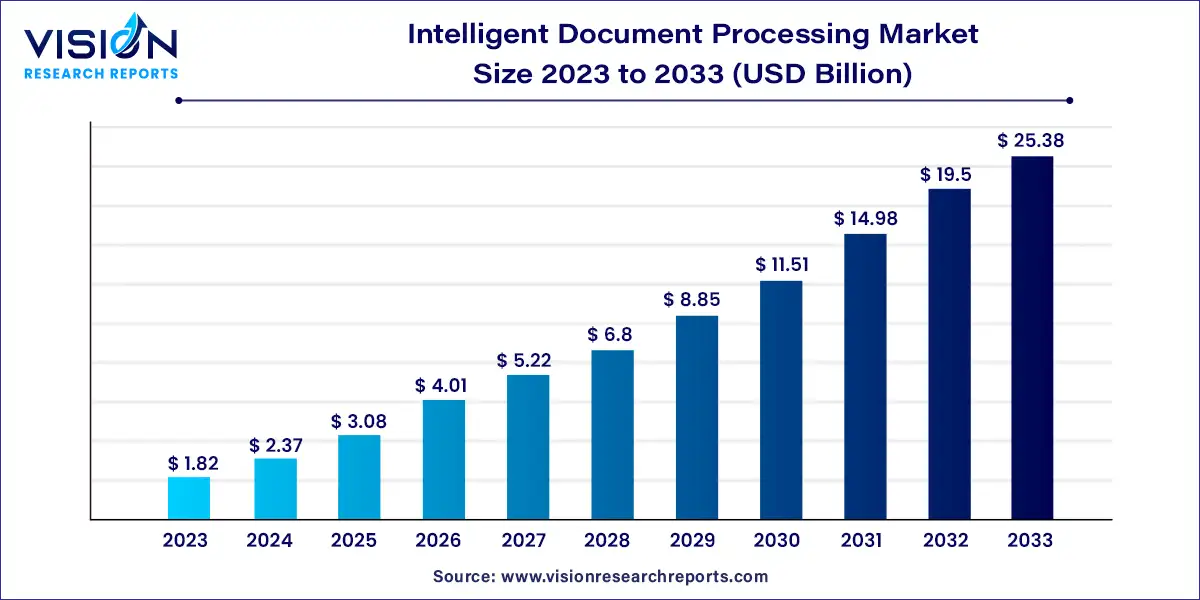

The global intelligent document processing market size was estimated at USD 1.82 billion in 2023 and it is expected to surpass around USD 25.38 billion by 2033, poised to grow at a CAGR of 30.15% from 2024 to 2033.

The growth of the intelligent document processing (IDP) market is driven by an increasing need for operational efficiency and accuracy drives organizations to adopt IDP solutions, automating manual document processing tasks and minimizing errors. Additionally, the cost-saving potential of IDP, achieved through streamlined workflows and reduced reliance on manual labor, is a significant growth driver. Moreover, stringent regulatory requirements necessitate compliance and risk management measures, prompting businesses to invest in IDP technologies to ensure adherence to regulations and mitigate associated risks. Furthermore, as digital transformation becomes imperative across industries, IDP facilitates the digitization of document-centric processes, aligning with organizations' modernization initiatives.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 32% |

| Revenue Forecast by 2033 | USD 25.38 billion |

| Growth Rate from 2024 to 2033 | CAGR of 30.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The solutions segment dominated the market in 2023 and accounted for a revenue share of over 65%. This can be attributed to the availability of various intelligent document processing platforms and software packages offering multiple features, such as fast processing and intelligent data classification. Key players, such as Deloitte, KPMG, PwC Accenture, and other system integration firms, aim to bring all processes, applications, and software into a single integrated environment. Several system integrators have started to offer IDP services because of the surge in demand for AI-determined OCR or IDP solutions in recent years.

The services segment is anticipated to grow significantly in the coming years. This can be attributed to the availability of services offered by market players. IDP services are helping organizations meet these requirements by automating data extraction, classification, and verification processes while ensuring data privacy and security. Service providers in intelligent document processing are propelling the market growth. For instance, Canada-based Open Text Corporation offers training and professional services for its OpenText Intelligent Capture solution.

The cloud segment led the market in 2023, accounting for over 60% share of the global revenue. Significant offerings of cloud deployment in intelligent document processing, such as scalability, accessibility, and cost-effectiveness, are propelling the market growth. Cloud deployment eliminates the need for organizations to invest in and maintain their dedicated infrastructure. Instead, they leverage the pay-as-you-go model offered by cloud service providers. This reduces upfront costs, eliminates the need for hardware/software maintenance, and allows organizations to scale their IDP systems according to their budget and requirements. Moreover, major players like Vision Era and ABBYY offer innovative IDP cloud solutions to fuel market growth over the forecast period.

The on-premise segment is predicted to foresee significant growth during the forecast period. This can be attributed to enhanced security offered by on-premises deployment, especially in industries such as healthcare and banking, financial services, and insurance (BFSI), which are likely to have greater compliance requirements. A significant offering of on-premises deployments, like faster processing times and lower latency compared to cloud-based solutions, propels the market growth. Organizations with large document volumes or those requiring real-time processing find that on-premises deployment allows quicker access to documents and faster processing speeds.

The large enterprise segment led the market in 2023, accounting for over 73% share of the global revenue. Large enterprises deal with a massive volume of documents across various departments and business processes. IDP automates document processing tasks such as data extraction, classification, and validation, enabling faster and more efficient handling of documents. This streamlines workflow, reduces manual effort, and enhances productivity across the organization. Due to the increasing need to assess the structured and unstructured data amassed over time, the large enterprise segment is one of the top consumers of intelligent document processing solutions and services.

The small & medium enterprises segment is predicted to foresee significant growth during the forecast period. The growth of this segment can be attributed to the growing interest of SMEs in adopting digital technologies post-COVID-19 pandemic. Moreover, IDP solutions can help SMEs save costs by reducing the need for manual labor and streamlining document processing workflows. According to World Economic Forum's December 2021 white paper, SMEs represent over 90% of all enterprises worldwide and are interested in technologies such as artificial intelligence (AI) and cloud computing.

The BFSI segment held the largest revenue share of over 26% in 2023. This can be attributed to a large number of documents processed in the BFSI sector to provide products and services. The BFSI sector utilizes intelligent document processing technology to improve operational efficiency, enhance customer experiences, and ensure compliance. IDP extracts relevant information from bank statements, pay stubs, and tax returns to assess creditworthiness and eligibility. These benefits augment the use of IDP technology in the BFSI industry.

The government & public sector segment is predicted to foresee significant growth in the forecast period. IDP technology is used to improve the efficiency and effectiveness of government and public sector operations. By automating document processing and extracting data from documents, IDP helps to streamline workflows, reduce errors, and improve compliance. For instance, the United States Department of Defense is using IDP to automate the processing of military contracts. This has helped to save the DoD millions of dollars and reduce the risk of fraud.

The machine learning segment led the market in 2023, accounting for over 47% share of the global revenue. This is attributed to the significant use of ML techniques to automate the extraction and processing of information from various documents, such as invoices, purchase orders, contracts, and forms, augmenting market growth. Machine learning is a crucial component that leverages the growth of Intelligent Document Processing (IDP). machine learning algorithms are trained on large volumes of labeled data to extract information from documents accurately. These models learn from patterns, context, and structures within the documents, improving accuracy in data extraction, reducing errors, and increasing reliability. For instance, ML models learn to distinguish between invoices, receipts, and contracts, allowing the IDP system to handle each document type appropriately.

The natural language processing (NLP) segment is predicted to foresee significant growth during the forecast period. IDP heavily relies on NLP technology that can comprehend and analyze human language. NLP also allows for extracting and analyzing data from unstructured sources like emails, reports, and articles. IDP tools like NLTK, SpaCy, and Stanford NLP propel market growth. For instance, MALTA, an Accenture NLP-based solution, automates the analysis and classification of textual data to make it simple for insurers to obtain crucial information. Accenture asserts that the technology offers a 30% more accurate classification than when the procedure is carried out manually.

North America dominated the intelligent document processing market with a share of over 32% in 2023. Factors such as high digitization and technology adoption and the presence of prominent players such as U.S.-based ABBYY, Appian, and Canada-based Open Text Corporation are driving the regional market growth. The U.S. and Canada comprise the North American market. Leading intelligent document processing vendors in the region drive the adoption of intelligent document processing solutions in the U.S. In contrast, early adoption of automation-based technologies drives market growth in Canada. Emerging mergers & acquisitions by key players are augmenting the regional growth.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The growth can be attributed to improving technology infrastructure and the presence of intelligent document processing solution vendors such as India-based HCL Technologies Limited, Datamatics Global Services Limited, and Singapore-based AntWorks. Countries in the region are increasingly embracing advanced technologies such as AI, machine learning, big data analytics, and cloud computing. These technologies are integral to decision intelligence solutions, enabling organizations to process and analyze vast amounts of data efficiently. The growing technology adoption in APAC acts as a catalyst for the expansion of the decision intelligence market in the region.

By Component

By Technology

By Deployment

By Organization Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Intelligent Document Processing Market

5.1. COVID-19 Landscape: Intelligent Document Processing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Intelligent Document Processing Market, By Component

8.1. Intelligent Document Processing Market, by Component, 2024-2033

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Intelligent Document Processing Market, By Technology

9.1. Intelligent Document Processing Market, by Technology, 2024-2033

9.1.1. Machine Learning

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Natural Language Processing (NLP)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Computer Vision

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Intelligent Document Processing Market, By Deployment

10.1. Intelligent Document Processing Market, by Deployment, 2024-2033

10.1.1. Cloud

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. On-premise

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Intelligent Document Processing Market, By Organization Size

11.1. Intelligent Document Processing Market, by Organization Size, 2024-2033

11.1.1. Small and Medium Sized Enterprises (SMEs)

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Large Size Enterprises

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Intelligent Document Processing Market, By End-use

12.1. Intelligent Document Processing Market, by End-use, 2024-2033

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Healthcare

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Manufacturing

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Retail

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Government & Public Sector

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Transportation & Logistics

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. IT & Telecom

12.1.7.1. Market Revenue and Forecast (2021-2033)

12.1.8. Others

12.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Intelligent Document Processing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.7. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.10. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Technology (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Technology (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Technology (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. ABBYY

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Automation Anywhere, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Kofax Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. WorkFusion, Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. UiPath

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. IBM

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Appian

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. HCL Technologies Limited

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. HYPERSCIENCE

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. AntWorks

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others