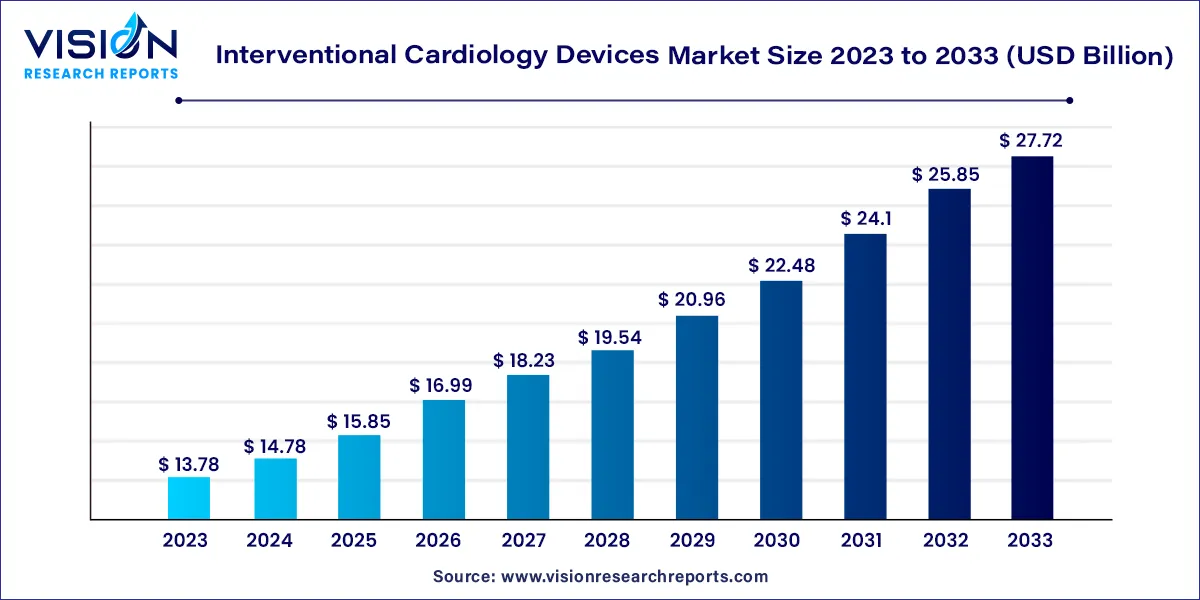

The global interventional cardiology devices market size was valued at USD 13.78 billion in 2023 and it is predicted to surpass around USD 27.72 billion by 2033 with a CAGR of 7.24% from 2024 to 2033.

The interventional cardiology devices market is a dynamic sector within the healthcare industry, dedicated to addressing cardiovascular diseases through innovative medical devices and procedures. Cardiovascular diseases, including coronary artery disease and heart attacks, continue to be a leading cause of morbidity and mortality globally. Interventional cardiology devices play a pivotal role in the diagnosis, treatment, and management of these conditions.

The growth of the interventional cardiology devices market is propelled by several key factors. Firstly, the rising prevalence of cardiovascular diseases worldwide acts as a significant driver, increasing the demand for advanced interventional devices and procedures. Secondly, continuous technological advancements, leading to the development of innovative and more effective devices, fuel market growth. Additionally, the aging global population contributes significantly, as elderly individuals are more susceptible to heart-related ailments. Moreover, the shift towards minimally invasive procedures, preferred by both patients and healthcare professionals, boosts the adoption of interventional cardiology devices. Lastly, increased awareness about early diagnosis and prompt treatment, coupled with improvements in healthcare infrastructure, further stimulates market expansion. These factors collectively contribute to the sustained growth of the interventional cardiology devices market, enhancing patient outcomes and revolutionizing cardiovascular care.

| Report Coverage | Details |

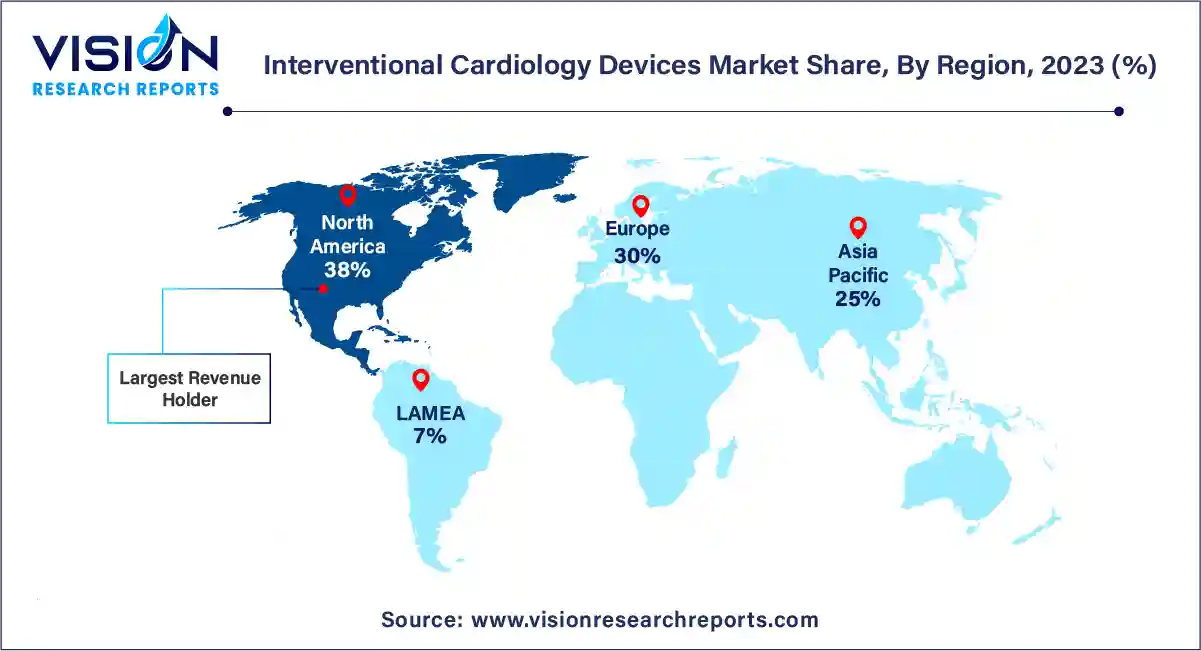

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 7.96% |

| Revenue Forecast by 2033 | USD 27.72 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.24% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The coronary stents segment led the global market with the largest market share of 66% in 2023. Among these, coronary stents hold a pivotal role. These tiny, mesh-like structures, often made of metal or bioresorbable materials, are inserted into narrowed or weakened arteries to maintain blood flow. As technological advancements continue, the market witnesses the emergence of innovative stent designs, such as drug-eluting stents and bioresorbable stents, enhancing their efficacy and reducing complications.

The intravascular imaging catheters and pressure guidewires segment is expected to expand at the fastest CAGR of 8.55% during the forecast period. Intravascular imaging catheters, another crucial segment, offer real-time visualization of blood vessels' interiors. These catheters equipped with miniature cameras or ultrasound devices enable cardiologists to assess the severity of blockages and guide interventions with precision. High-resolution imaging ensures accurate diagnosis and optimal placement of interventional devices, contributing significantly to improved patient outcomes.

North America dominated the market with the maximum revenue share of 38% in 2023. In North America, the market is driven by a robust healthcare infrastructure, substantial research and development activities, and high healthcare expenditure. The region boasts advanced technological capabilities, enabling the rapid adoption of cutting-edge interventional cardiology devices. Moreover, the presence of key market players and a proactive regulatory environment further fuels market growth in North America.

The Asia Pacific region is expected to grow at the notable CAGR of 7.96% over the forecast period. In the Asia-Pacific region, rapid economic development, increasing healthcare investments, and rising awareness about cardiovascular diseases propel market growth. Countries like China and India, with their vast populations, offer substantial market potential. The adoption of interventional cardiology devices is facilitated by growing healthcare infrastructure and a focus on preventive healthcare measures. However, market expansion in these regions also faces challenges related to regulatory complexities and varying healthcare standards across countries.

By Product

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others