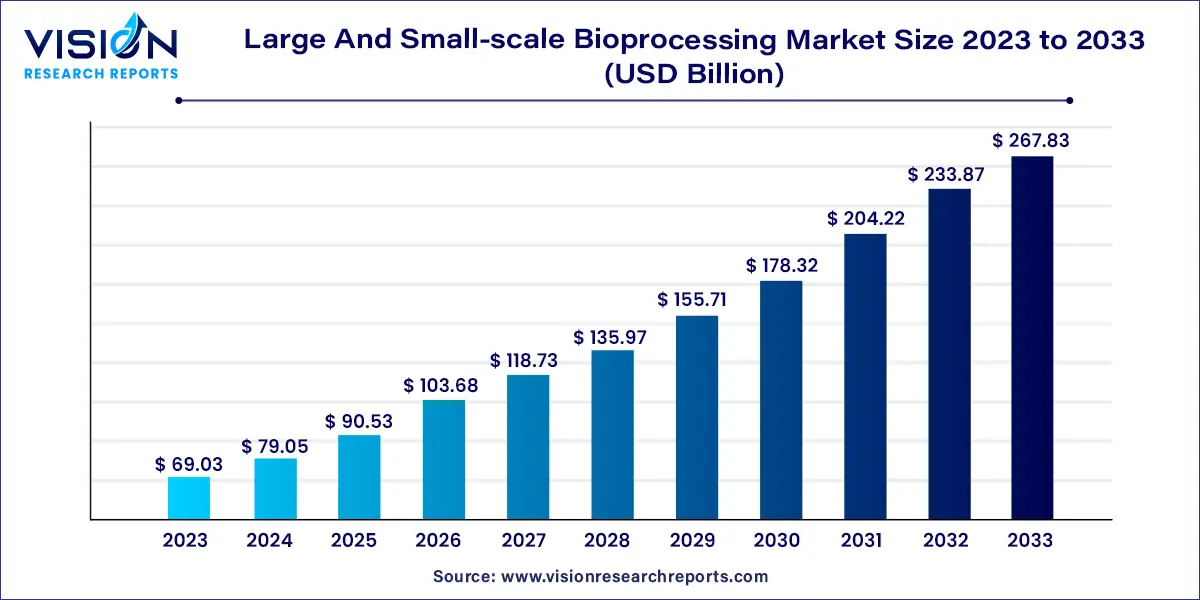

The global large and small-scale bioprocessing market size was estimated at USD 69.03 billion in 2023 and it is expected to surpass around USD 267.83 billion by 2033, poised to grow at a CAGR of 14.52% from 2024 to 2033.

The large and small-scale bioprocessing market has gained significant traction owing to the growing demand for biopharmaceuticals, biotechnology-based products, and biofuels. Large-scale bioprocessing refers to the industrial-scale production of bio-based products, typically carried out by established pharmaceutical and biotechnology companies. On the other hand, small-scale bioprocessing involves more specialized and tailored approaches, often employed by research institutions, startups, and niche biotech firms focusing on specific therapeutic areas or unique bioproducts.

The growth of the large and small-scale bioprocessing market is propelled by several key factors. One significant driver is the escalating demand for biopharmaceuticals, spurred by the prevalence of chronic diseases and the need for targeted therapies. Technological advancements play a pivotal role, with continuous innovations in bioreactor design, automation, and cell culture techniques enhancing efficiency and scalability for both large and small-scale operations. The industry's focus on personalized medicine, tailoring treatments based on individual genetic profiles, fuels research and development efforts in small-scale bioprocessing. Additionally, the sector contributes to sustainability initiatives, producing biofuels and eco-friendly materials, aligning with global environmental goals.

| Report Coverage | Details |

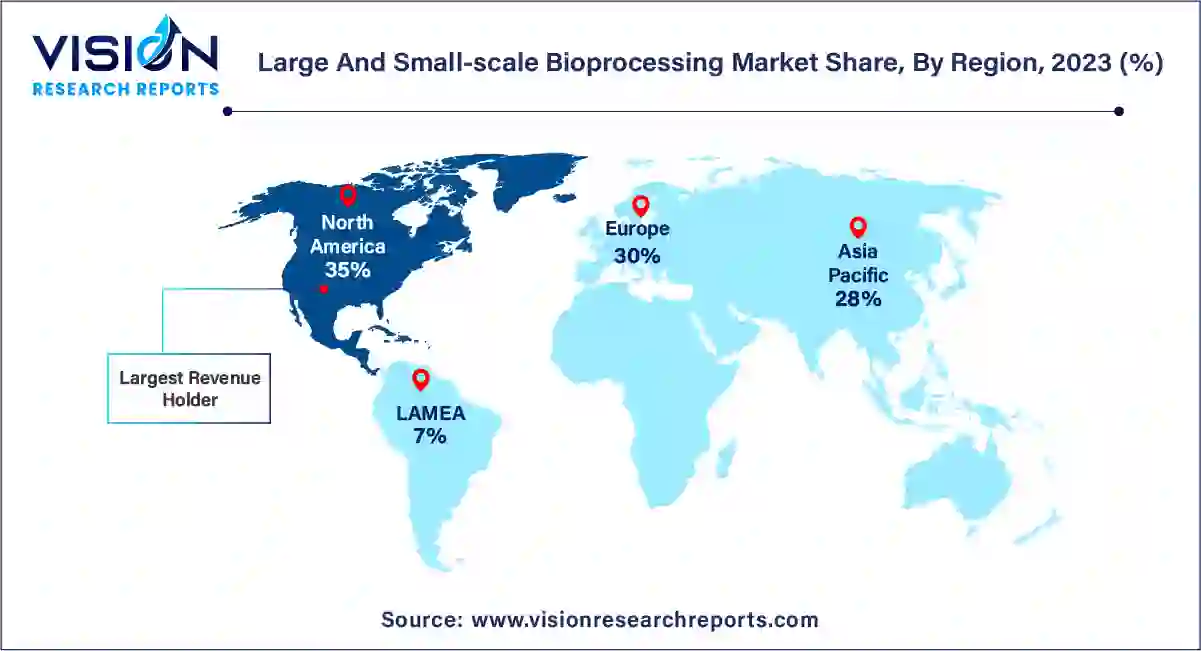

| Revenue Share of North American in 2023 | 35% |

| CAGR of Asia Pacific from 2024 to 2033 | 15.57% |

| Revenue Forecast by 2033 | USD 267.83 billion |

| Growth Rate from 2024 to 2033 | CAGR of 14.52% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Industrial-scale bioprocessing, carried out by established pharmaceutical and biotechnology giants, stands as the cornerstone of mass production within the industry. These facilities, equipped with state-of-the-art bioreactors and purification systems, churn out vast quantities of biopharmaceuticals and bio-based products. Their efficiency, adherence to rigorous quality standards, and compliance with global regulations ensure a stable supply of essential medical products to meet the rising demands of a growing population.

Bioprocessing for pharmaceutical development at the industrial scale has held the biggest share in 2023. Small-scale bioprocessing embodies adaptability and innovation. Carried out by research institutions, startups, and specialized biotech firms, small-scale operations focus on tailored, precision solutions. These facilities play a pivotal role in the development of specialized therapies, particularly in areas like gene and cell-based treatments, where customization based on individual patient profiles is crucial. Small-scale bioprocessing acts as the engine of innovation, allowing for rapid prototyping, experimentation, and adaptation. Moreover, these facilities are at the forefront of personalized medicine, pioneering treatments that are uniquely suited to individual genetic markers and disease profiles.

Downstream processing led the market with a significant revenue share in 2023. Downstream processing, the subsequent phase, is paramount for the purification and isolation of the target biomolecules. This stage involves a series of intricate techniques, such as chromatography, filtration, and centrifugation, to separate and purify the desired product from the complex biological mixture. Large-scale bioprocessing facilities excel in downstream processing, leveraging industrial-grade equipment and automation to ensure efficiency, speed, and scalability. They meticulously refine the products, ensuring high purity and compliance with stringent quality standards.

Upstream processing is expected to grow at the fastest CAGR during the forecast period. Upstream processing, the initial phase of bioproduction, involves the cultivation of cells, microorganisms, or proteins. This phase typically takes place in bioreactors, where optimized growth conditions are maintained to foster the desired biological entities. Small-scale bioprocessing operations excel in this stage, focusing on research and development of novel strains, cell lines, and culture media.

Bioreactors segment contributed the largest market share in 2023. Bioreactors and fermenters are the heartbeat of bioprocessing, serving as the vessels where biological materials are cultured, nurtured, and transformed into valuable products. Large-scale bioprocessing facilities employ industrial-grade bioreactors, characterized by their massive capacity and sophisticated control systems. These facilities leverage these specialized vessels to cultivate microorganisms, cells, or proteins at scale, ensuring consistent and efficient production of biopharmaceuticals, enzymes, and other bio-based products.

Small-scale bioprocessing operations often rely on versatile and innovative bioreactors. These operations focus on research and development, utilizing bench-scale and pilot-scale bioreactors that offer flexibility and customization. Small-scale bioreactors facilitate experimentation with various strains, cell lines, and culture conditions.

Biopharmaceuticals held the largest share owing to the commercial success of biologics & biosimilars for clinical use in the current scenario. Bioreactors and fermenters are the heartbeat of bioprocessing, serving as the vessels where biological materials are cultured, nurtured, and transformed into valuable products. Large-scale bioprocessing facilities employ industrial-grade bioreactors, characterized by their massive capacity and sophisticated control systems. These facilities leverage these specialized vessels to cultivate microorganisms, cells, or proteins at scale, ensuring consistent and efficient production of biopharmaceuticals, enzymes, and other bio-based products.

Moreover, companies are involved in enhancing their manufacturing capacity for biopharmaceutical development, which is expected to provide avenues of lucrative growth. Other market applications include microbial biomass, enzymes, metabolites, biofuels, bioremediation, and bio-refineries.

Multiple-use products for bioprocessing dominated the 2023 market in terms of revenue generation. These systems, such as stainless steel bioreactors and purification columns, undergo rigorous cleaning and sterilization processes, ensuring their longevity and cost-effectiveness. Multi-use technologies are ideal for high-volume production, where the initial investment in durable equipment pays off over numerous production cycles. They offer the advantage of scale and reliability, making them the preferred choice for continuous, large-scale manufacturing of biopharmaceuticals and other bio-based products.

The adoption of single-use technologies has gained substantial traction, especially in small-scale bioprocessing and specialized applications. Single-use systems, comprising disposable bioreactors, filtration units, and tubing assemblies, offer unparalleled flexibility and convenience. These tools eliminate the need for extensive cleaning and validation processes, reducing the risk of cross-contamination and expediting changeovers between different production runs. Single-use technologies are particularly valuable in research, development, and production scenarios where versatility and adaptability are paramount.

The in-house segment led the global market with the largest market share of 61% in 2023. In-house bioprocessing refers to the practice of establishing and maintaining dedicated facilities within the organization, allowing for full control over the production processes. Large-scale biopharmaceutical companies often invest heavily in in-house bioprocessing capabilities, ensuring comprehensive oversight, quality control, and proprietary confidentiality. In-house operations provide these companies with the flexibility to adjust production schedules, optimize processes, and swiftly respond to changing market demands.

The outsourced manufacturing model is predicted to grow at the fastest CAGR of 14.85% over the forecast period. Outsourcing bioprocessing activities to specialized contract manufacturing organizations (CMOs) has emerged as a strategic choice, especially for smaller companies, startups, and research institutions. Outsourcing allows these entities to leverage the expertise, infrastructure, and regulatory compliance of established bioprocessing service providers. By partnering with CMOs, organizations gain access to state-of-the-art facilities and specialized knowledge without the need for significant upfront investments. This approach streamlines the production process, enabling companies to focus on their core competencies, such as research, product development, and market expansion.

North America dominated the market with a revenue share of 35% in 2023. North America, as a leading hub for pharmaceutical and biotechnology innovation, holds a significant share in the global bioprocessing market. The region boasts advanced research infrastructure, a robust regulatory environment, and substantial investments in bioprocessing technologies. The presence of major biopharmaceutical companies and research institutions fuels innovation and drives market growth.

Asia Pacific is expected to grow at the fastest CAGR of 15.57% during the forecast period. Asia-Pacific emerges as a rapidly growing market in the bioprocessing sector, driven by the increasing demand for biopharmaceuticals and advancements in healthcare infrastructure. Countries like China, India, and South Korea invest substantially in bioprocessing research and production facilities, leveraging their skilled workforce and cost-effective manufacturing capabilities. The region's booming biotechnology industry, coupled with a large patient population, fuels the demand for bioprocessing technologies, both at the industrial and research levels.

By Scale

By Workflow

By Product

By Application

By Use Type

By Mode

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others