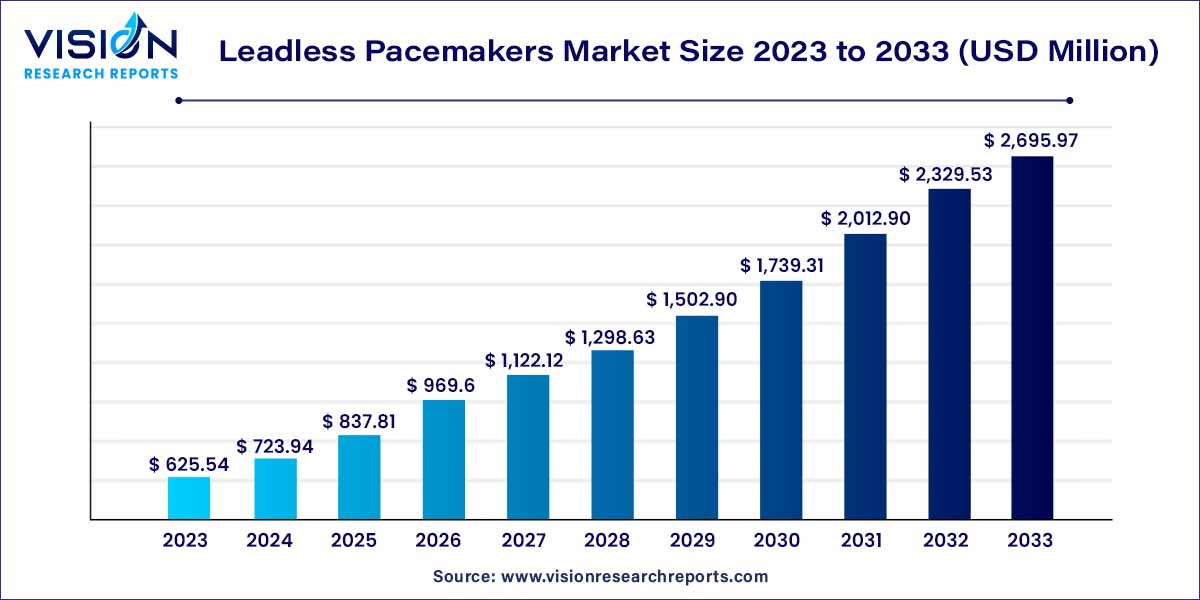

The global leadless pacemakers market size was estimated at around USD 625.54 million in 2023 and it is projected to hit around USD 2,695.97 million by 2033, growing at a CAGR of 15.73% from 2024 to 2033.

The leadless pacemakers market has witnessed remarkable growth and innovation in recent years, revolutionizing the landscape of cardiac healthcare. As a cutting-edge solution for heart rhythm disorders, leadless pacemakers have garnered substantial attention from healthcare providers and patients alike. This overview provides insights into the key aspects shaping the leadless pacemakers market.

The growth of the leadless pacemakers market can be attributed to several key factors. Firstly, the rising prevalence of cardiac arrhythmias and heart-related disorders globally has significantly increased the demand for innovative cardiac pacing solutions. Secondly, advancements in medical technology, particularly in the field of electrophysiology, have led to the development of more efficient and reliable leadless pacemakers. Additionally, the aging population in many countries has contributed to the market expansion, as elderly individuals are more susceptible to heart rhythm disorders. Furthermore, the shift towards minimally invasive procedures in healthcare has boosted the adoption of leadless pacemakers, as these devices offer a safer and more convenient alternative to traditional pacemakers with leads. Lastly, ongoing research and development activities aimed at improving the functionality and durability of leadless pacemakers have bolstered market growth, ensuring a continuous influx of innovative products into the healthcare sector.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 52% |

| CAGR of Asia Pacific from 2024 to 2033 | CAGR of 17.08% |

| Revenue Forecast by 2033 | USD 2,695.97 million |

| Growth Rate from 2024 to 2033 | CAGR of 15.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The single chamber segment dominated the market with a revenue share of 69% in 2023. Single chamber leadless pacemakers are designed to stimulate either the atria or ventricles of the heart. They are compact, self-contained devices that eliminate the need for traditional leads, reducing the risk of lead-related complications. These pacemakers are implanted directly into the heart, ensuring precise and efficient pacing. Single chamber leadless pacemakers are especially suitable for patients with specific heart rhythm disorders, offering a tailored solution that meets their cardiac needs.

The dual chamber segment is expected to grow at the notable CAGR of 17.26% over the forecast period. Dual chamber leadless pacemakers offer more sophisticated pacing options by stimulating both the atria and ventricles of the heart. This dual-chamber functionality allows for synchronized pacing, enhancing the coordination between the heart's chambers and optimizing cardiac performance. Dual chamber leadless pacemakers are equipped with advanced sensors and algorithms, ensuring accurate detection of the heart's electrical signals. This precision in pacing is particularly beneficial for patients with complex arrhythmias, as it mimics the heart's natural rhythm more closely, thereby improving overall cardiac function.

The hospital segment contributed more than 91% of market share in 2023. Hospitals serve as crucial hubs for cardiac care, where patients with various heart rhythm disorders receive diagnosis, treatment, and follow-up care. In hospitals, leadless pacemakers are deployed in specialized cardiac units, ensuring that patients with conditions such as bradycardia or atrial fibrillation receive prompt and expert care. The integration of these innovative devices within hospital environments not only enhances patient outcomes but also streamlines the overall treatment process.

The outpatient facilities segment is predicted to grow at the fastest CAGR of 16.54% over the forecast period. Outpatient facilities, including specialized cardiology clinics and ambulatory care centers, have become increasingly equipped to handle various cardiac procedures, including leadless pacemaker implantations. These facilities offer a more convenient and patient-friendly environment, allowing individuals to receive necessary cardiac interventions without the need for extended hospital stays. The outpatient approach aligns with the global trend towards minimally invasive procedures, providing patients with advanced cardiac solutions while minimizing disruptions to their daily lives.

North America led the global market with the largest market share of 52% in 2023. North America stands as a prominent market leader, driven by its advanced healthcare systems, significant investments in research and development, and a high prevalence of cardiac disorders. The region's robust regulatory framework and early adoption of innovative medical technologies contribute to the widespread use of leadless pacemakers in both the United States and Canada.

Asia-Pacific is expected to witness the fastest CAGR of 17.08% over the forecast period. Asia-Pacific emerges as a rapidly expanding market for leadless pacemakers, driven by increasing healthcare expenditure, rising awareness about advanced cardiac care, and a growing aging population. Countries like China, Japan, and India witness a surge in demand for cardiac devices, including leadless pacemakers, owing to the rising incidence of heart-related disorders. The market in this region is further bolstered by partnerships between international medical device companies and local healthcare providers, enhancing accessibility to innovative cardiac solutions.

By Pacing Chamber

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others