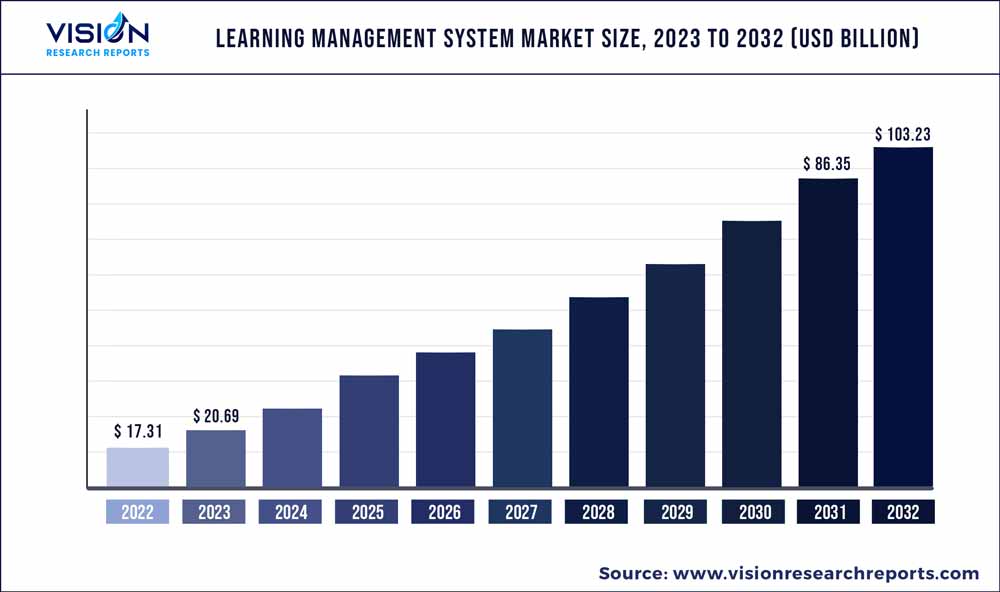

The global learning management system market was estimated at USD 17.31 billion in 2022 and it is expected to surpass around USD 103.23 billion by 2032, poised to grow at a CAGR of 19.55% from 2023 to 2032. The learning management system market in the United States was accounted for USD 9.3 billion in 2022.

Key Pointers

Report Scope of the Learning Management System Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 39% |

| Revenue Forecast by 2032 | USD 103.23 billion |

| Growth Rate from 2023 to 2032 | CAGR of 19.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Cornerstone; Blackboard Inc.; D2L Corporation; PowerSchool; Instructure, Inc.; Adobe; Oracle; SAP; Moodle; McGraw Hill; Xerox Corporation |

The emergence of several new technologies tailored to the COVID-19 impact has fueled the LMS market growth. Development in multimedia graphics, high-speed telecommunication networks, and affordable digital devices contribute to the increasing adoption of LMS. The market showed positive change amid COVID-19 and is expected to witness massive spending and investments led by enterprises, educational institutions, and governments in the coming years.

Strategic alliances with LMS providers are the predominant strategies embraced by the eLearning market players. For instance, in March 2023, Docebo S.p.A., a learning management software company, announced a partnership with ELB Learning, a software company. The partnership will allow for improved learning experiences by integrating both companies' finest solutions and services.

Big data, artificial intelligence (AI), online learning, and mobile learning are vital elements driving market expansion. These new e-learning trends will likely be growing market trends over the forecast period. Across the globe, advanced communication technologies are rapidly altering classroom teaching. Using gamification mechanics in the learning process makes engaging users on a high level easier and enhances retention. The use of badges, quests, and avatars makes users motivated to compete and achieve better results.

Education technologies benefit students and teachers by facilitating interactive and collaborative learning. Currently, the internet is accelerating the adoption of distance learning due to its escalating proliferation across the population. As a result, many companies are expanding their portfolio by acquiring or merging with companies to deliver creative content to expand the market. For instance, in May 2022, Class Technologies Inc. acquired Blackboard Inc., one of the prominent EdTech companies serving higher education, government clients, and businesses. Through this acquisition, the company aims to deliver creative resources to various companies and speed up innovation in its flagship learning management system.

Component Insights

The solution segment led the market in 2022, accounting for over 68% share of the global revenue. Market players such as Cornerstone, Oracle, SAP, and others are integrating advanced technologies such as Machine Learning (Ml), Artificial Intelligence (AI), and analytics in the existing learning management system (LMS) platforms. For instance, in 2021, Cornerstone announced new content offerings for the corporate workforce. The company focused on enhancing its curated content through partnerships and investing in original content creation. Cornerstone also offers Skill Pill configurable catalogs, which allow enterprises to select certain courses and tailor their records to meet their specific requirements.

The service segment is anticipated to witness substantial growth over the forecast period. The substantial increase in the service segment is related to the rising demand for installation and technical assistance. Education and learning providers offer various educational services, including implementation, consultancy, and support. Learners can use these services to help with curriculum development and the smooth performance and maintenance of current activities. Integration-as-a-service is a feature of the advanced system that decreases installation time and complexity. Similarly, the business consulting sub-segment will likely lead this market due to improved collaboration and communication between trainers and learners.

Deployment Insights

The on-premise segment led the market in 2022, accounting for over 50% of global revenue share. On-premise deployments have their own features complete control, customization, better integration, and more prolonged deployment. Training and development departments across all businesses are rapidly adopting mobile learning. Most companies adopt technology-assisted learning, allowing employees to create, save, and display innovative ideas in the workplace. Companies that adopt mobile learning solutions have seen productivity increase, creativity, and loyalty among their employees.

The cloud segment is anticipated to witness substantial growth over the forecast period. Most vendors are shifting from an on-premise deployment to cloud-based solutions. Market players release cloud-based software and collaborate with businesses to provide end-users with innovative and premium content. For instance, in August 2021, D2L Corporation acquired Bayfield Design, specializing in writing and designing cloud courses and delivering them to students and employees. Through this acquisition, the company aims to offer trainers and students premium digital curriculum courses by giving access to the premium courses launched by Bayfield Design and giving exceptional services to students and parents.

Enterprise Size Insights

The large enterprise size segment dominated the market with a market share of over 63% in 2022. Companies have accepted using LMS software, which has several advantages, including lower training and development costs, centralized training resources, faster training, and more. The above factors are anticipated to increase the demand for LMS software for corporate and education enterprises in large enterprises. The players are collaborating with enterprises to increase their customer base and innovative content. For instance, in March 2022, Cornerstone acquired EdCast Inc. provider of a learning platform for institutions, enterprises, and governments worldwide. Through this acquisition, the company aims to accelerate the value of customers by providing some innovative learning, skill-building, and content with the help of EdCast Inc.

The small & medium enterprise segment is anticipated to witness substantial growth over the forecast period. Adopting a learning management system has benefited many worldwide institutions, educational organizations, and enterprises, and every business level needs LMS software, as firms require training for safety compliance. Small enterprise size needs LMS for various aspects, including cost-effectiveness, tracking employee progress, employee training, and others. Cloud infrastructure has made the LMS platform affordable and convenient for small firms and startups.

End-user Insights

The academic segment led the market in 2022, accounting for over 60% of the global revenue share. In terms of end-user, the market is categorized into corporate and academic. A learning environment should provide personalized and flexible training programs addressing each learner's needs. E-learning should use a holistic and ecological learning strategy to strengthen learning systems and ensure they can adapt to future developments in education and technology. On the other hand, new technology developments, such as mobile learning and AI and ML in academic learning settings, can give the education industry the resources it needs to create a modernized learning module for the future that is highly focused on digital learning.

The corporate sector's use of the LMS market is expected to rise as it provides flexibility in conducting training, meetings, and onboarding processes. The retail industry has adopted e-learning, trained sales employees, and provided product insights. Corporate LMS software keeps all of your e-Learning content in one place. The LMS software could save the staff time searching multiple drives and devices for content while lowering the risk of losing important training material and data. For instance, in February 2023, Woven Brands, LLC, developer of a workplace management platform designed specifically for franchising, announced the release of a new learning management system (LMS) within its centralized platform. The new platform capabilities allow more engagement and significant employee learning and development.

Delivery Mode Insights

The distance learning size segment dominated the market with a market share of over 42% in 2022. Further, the instructor-led training (ILT) segment is anticipated to portray the highest CAGR during the forecast period. The instructor-led training program encourages discussion and interaction of instructors with learners and employees, delivering a seamless learning experience. The demand for LMS in academics has increased since it manages educational content, online course administration, and student work assessment. Distance learning will likely show moderate growth in the coming years, and employees and students will likely adopt instructor-led training over distance learning.

The instructor-led training segment is anticipated to witness the highest CAGR over the forecast period. Furthermore, the blended learning segment held a significant share of the global revenue in 2022. Blended learning incorporates more educational advancements such as virtual classrooms, mobile learning, and webinars. These methods combine various levels of interaction and content delivery via digital mediums. The primary purpose of blended learning is to improve the teaching experience, and it can also include personalized teaching methods for better learning outcomes. Blended learning is primarily joint in higher academic and K-12 schools. Blended learning offers flexibility, improved education, corporate training, and improved return on investment (ROI).

Regional Insights

North America accounted for the highest share, with over 39% of the global revenue in 2022. North America is anticipated to dominate the LMS market due to rising Ed-tech activities. The U.S. has the highest number of universities and colleges, which is likely to create opportunities for LMS providers to expand their businesses in this country. Several drivers, restraints, and opportunities influence North America's market. The increasing demand for effective and high-quality education or learning is critical to North America's market success. North America has accepted the rapid adoption of innovative learning, boosting the region's LMS market share. On the other hand, the relinquishment of cloud-based services among associations will likely bring immense openings for the growth of the North America market.

Asia Pacific is anticipated to witness significant growth over the forecast period. India, China, Japan, and other countries of Asia Pacific are investing in and adopting learning management system platforms to promote learning and development. Market players in the region are emphasizing expanding business footprints. For instance, in March 2021, LTG PLC acquired Bridge, a learning management system platform that enhances skills and performance and helps managers and employees transform their company with the help of alignment, connection, and growth. As a part of the acquisition, the company intends to combine the businesses that allow the customers to solve the critical and fast-moving challenges leaders face in the workplace.

Learning Management System Market Segmentations:

By Component

By Deployment

By Enterprise Size

By Delivery Mode

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Learning Management System Market

5.1. COVID-19 Landscape: Learning Management System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Learning Management System Market, By Component

8.1. Learning Management System Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Learning Management System Market, By Deployment

9.1. Learning Management System Market, by Deployment, 2023-2032

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Learning Management System Market, By Enterprise Size

10.1. Learning Management System Market, by Enterprise Size, 2023-2032

10.1.1. Small & Medium Enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Learning Management System Market, By Delivery Mode

11.1. Learning Management System Market, by Delivery Mode, 2023-2032

11.1.1. Distance learning

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Instructor-led training

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Blended learning

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Learning Management System Market, By End-user

12.1. Learning Management System Market, by End-user, 2023-2032

12.1.1. Academic

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Corporate

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Learning Management System Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.1.5. Market Revenue and Forecast, by End-user (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.1.7. Market Revenue and Forecast, by End-user (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-user (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.2.5. Market Revenue and Forecast, by End-user (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.7. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.2.8. Market Revenue and Forecast, by End-user (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.10. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.2.11. Market Revenue and Forecast, by End-user (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.2.13. Market Revenue and Forecast, by End-user (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.2.15. Market Revenue and Forecast, by End-user (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.3.5. Market Revenue and Forecast, by End-user (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.3.7. Market Revenue and Forecast, by End-user (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.3.9. Market Revenue and Forecast, by End-user (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-user (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.4.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.4.7. Market Revenue and Forecast, by End-user (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.4.9. Market Revenue and Forecast, by End-user (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-user (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.5.5. Market Revenue and Forecast, by End-user (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.5.7. Market Revenue and Forecast, by End-user (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Delivery Mode (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 14. Company Profiles

14.1. Cornerstone

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Blackboard Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. D2L Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. PowerSchool

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Instructure, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Adobe

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Oracle

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. SAP

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Moodle

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. McGraw Hill

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others