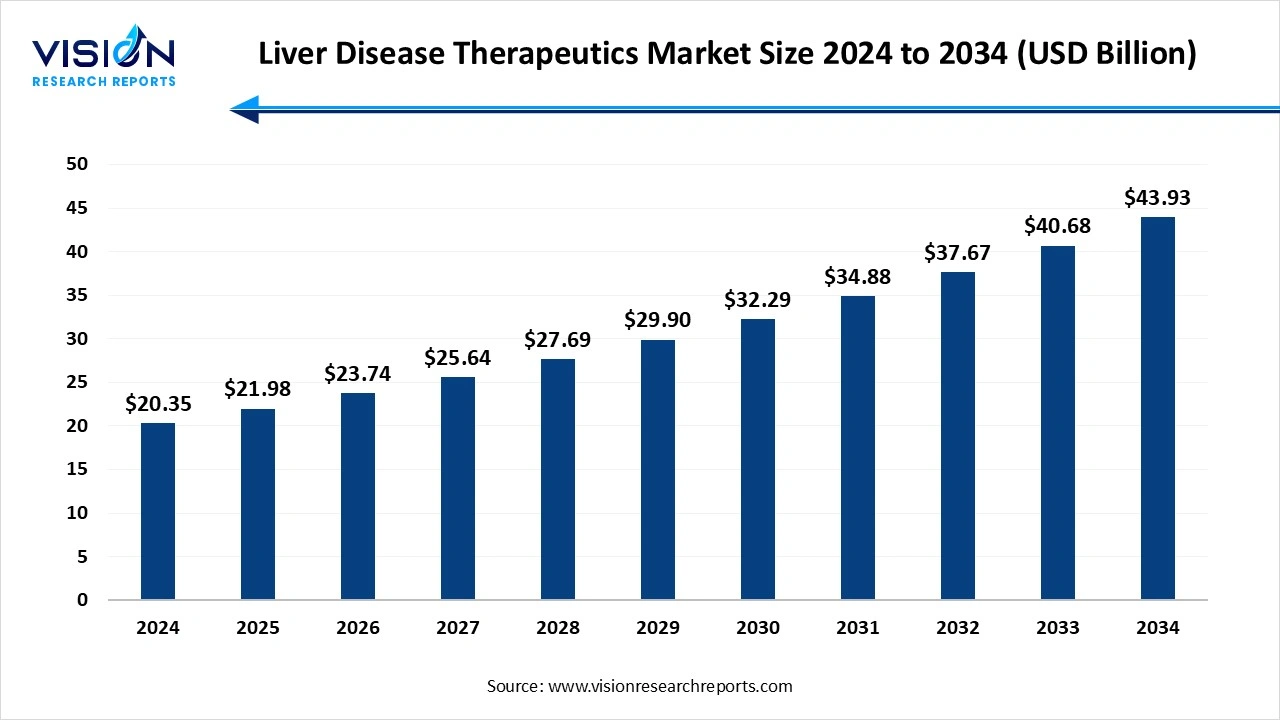

The global liver disease therapeutics market size was estimated at USD 20.35 billion in 2024 and it is expected to surpass around USD 43.93 billion by 2034, poised to grow at a CAGR of 8% from 2025 to 2034.

The global liver disease therapeutics market is witnessing steady growth due to the increasing prevalence of liver-related conditions such as hepatitis, fatty liver disease, liver cirrhosis, and liver cancer. The rising consumption of alcohol, unhealthy dietary habits, and the growing burden of non-alcoholic fatty liver disease (NAFLD) and hepatitis B and C infections are key factors driving demand for effective treatment solutions. Furthermore, the rise in geriatric population, who are more susceptible to chronic liver diseases, is expected to fuel the market over the coming years.

One of the primary growth drivers of the liver disease therapeutics market is the rising global incidence of chronic liver conditions, including hepatitis B and C, non-alcoholic steatohepatitis (NASH), and liver cancer. The increasing adoption of sedentary lifestyles, poor dietary patterns, and growing obesity rates have contributed significantly to the prevalence of non-alcoholic fatty liver disease (NAFLD), especially in developed and emerging economies. As the patient pool expands, so does the demand for advanced diagnostic tools and effective therapeutic interventions, spurring growth across the pharmaceutical and biotechnology sectors.

Another major factor propelling market growth is the advancement in drug development and personalized medicine. Biopharmaceutical companies are heavily investing in R&D to develop more targeted and efficient therapies, including gene therapies, monoclonal antibodies, and antiviral medications.

One of the key trends in the liver disease therapeutics market is the growing emphasis on precision medicine and targeted therapies. With a better understanding of the molecular pathways involved in liver diseases, especially conditions like NASH and hepatocellular carcinoma (HCC), pharmaceutical companies are focusing on the development of drugs tailored to specific genetic or biochemical markers. This shift toward personalized treatment is not only enhancing therapeutic outcomes but also reducing side effects, thereby improving patient compliance.

Another significant trend is the surge in collaborations and strategic partnerships among biopharma companies, research institutions, and healthcare providers. These alliances aim to fast-track the development and commercialization of novel therapeutics through pooled resources and expertise. There is also a noticeable increase in clinical trials focusing on immunotherapies, regenerative medicine, and combination treatments for liver diseases. Moreover, the expansion of telemedicine and digital health platforms is enabling better disease management, early diagnosis, and remote patient care, especially in underserved regions.

One of the primary challenges faced by the liver disease therapeutics market is the high cost of advanced treatments and limited affordability, particularly in low- and middle-income countries. While new therapies, including targeted biologics and antiviral drugs offer improved outcomes, their premium pricing often restricts access for a significant portion of the global population. In addition, liver disease therapies frequently require long-term treatment, adding to the economic burden for patients and healthcare systems. The disparity in healthcare infrastructure and reimbursement policies across regions further exacerbates the issue, making equitable access to care a persistent concern.

Another major hurdle is the complexity of liver diseases themselves, which often present asymptomatically in early stages and are diagnosed only when the condition has progressed significantly. This delay in diagnosis limits the effectiveness of many therapies and reduces survival rates in cases such as liver cancer or cirrhosis. Furthermore, the development of therapeutics for liver diseases, especially for conditions like NASH, remains scientifically challenging due to the lack of validated biomarkers and clearly defined clinical endpoints.

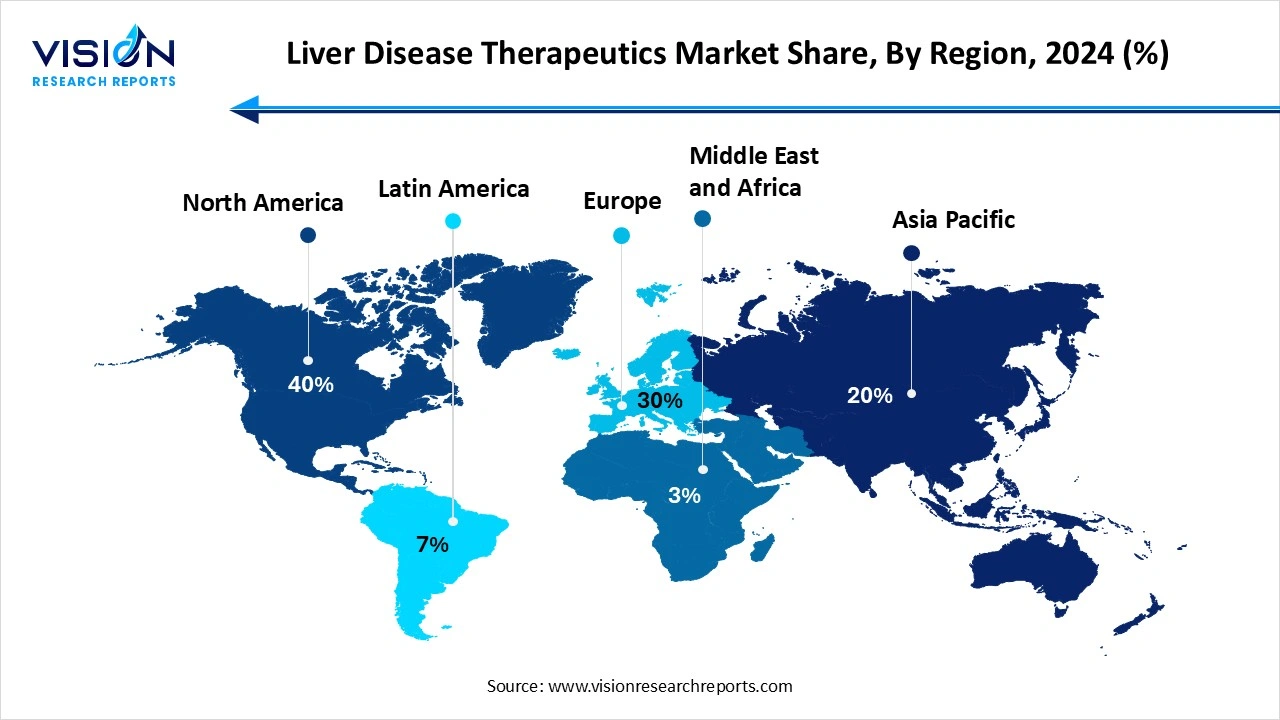

North America currently dominates the market share of 40%in 2024, primarily due to the high prevalence of liver-related disorders such as non-alcoholic fatty liver disease (NAFLD), hepatitis C, and liver cancer. The region benefits from advanced healthcare systems, strong reimbursement frameworks, and the widespread availability of innovative therapies. In addition, active research initiatives and increased awareness about early diagnosis and disease management have further propelled the demand for liver disease treatments in the United States and Canada.

The Asia Pacific liver disease therapeutics market is anticipated to expand at the highest CAGR of 9.20% during the forecast period. The Asia-Pacific region is emerging as a highly lucrative market, driven by the large population base, rising incidence of hepatitis infections, and improvements in healthcare access. Countries such as China, India, and Japan are witnessing increased investments in pharmaceutical R&D and expanding healthcare infrastructure, creating a favorable environment for market growth.

The Asia Pacific liver disease therapeutics market is anticipated to expand at the highest CAGR of 9.20% during the forecast period. The Asia-Pacific region is emerging as a highly lucrative market, driven by the large population base, rising incidence of hepatitis infections, and improvements in healthcare access. Countries such as China, India, and Japan are witnessing increased investments in pharmaceutical R&D and expanding healthcare infrastructure, creating a favorable environment for market growth.

The antiviral drugs segment held the largest revenue share in the market, accounting for 40% in 2024. These drugs work by suppressing the replication of viruses within the liver, reducing the viral load, and minimizing liver inflammation and damage. Over the years, the development of direct-acting antivirals (DAAs) has significantly improved treatment outcomes for patients with chronic hepatitis C, offering high cure rates with fewer side effects and shorter treatment durations.

The targeted therapy segment is expected to register the highest compound annual growth rate (CAGR) of 11.88% throughout the forecast period. Unlike traditional therapies, targeted therapies are designed to interfere with specific molecular pathways involved in disease progression. These include inhibitors that block tumor growth factors, angiogenesis, or specific cellular receptors involved in liver cancer proliferation. The use of targeted agents such as tyrosine kinase inhibitors and monoclonal antibodies has shown considerable success in slowing disease progression and improving survival rates among liver cancer patients.

The hepatitis segment accounted for the highest revenue share in the market, capturing 41% of the total in 2024. These viral infections are responsible for substantial morbidity and mortality, particularly in regions with limited access to vaccines and healthcare infrastructure. Therapeutic approaches for hepatitis have evolved considerably over the years, with the introduction of antiviral medications that effectively suppress viral replication and prevent disease progression.

The NAFLD/NASH segment is expected to witness the fastest growth over the forecast period, with a projected CAGR of 20.21% from 2025 to 2034. Non-alcoholic fatty liver disease (NAFLD) and its more severe form, non-alcoholic steatohepatitis (NASH), are rapidly emerging as leading causes of chronic liver conditions, particularly in developed and urbanized regions. Driven by lifestyle-related factors such as obesity, type 2 diabetes, and sedentary behavior, the incidence of NAFLD/NASH has surged in recent years. Unlike hepatitis, NAFLD and NASH are not caused by viral infections but are linked to metabolic dysfunction, making their management more complex.

By Product

By Disease

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liver Disease Therapeutics Market

5.1. COVID-19 Landscape: Liver Disease Therapeutics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Liver Disease Therapeutics Market, By Product

8.1. Liver Disease Therapeutics Market, by Product, 2024-2033

8.1.1. Antiviral Drugs

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Vaccines

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chemotherapy

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Targeted Therapy

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Immunosuppressants

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Immunoglobulins

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Corticosteroids

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Liver Disease Therapeutics Market, By Disease

9.1. Liver Disease Therapeutics Market, by Disease, 2024-2033

9.1.1. Hepatitis

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Autoimmune Diseases

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Non-alcoholic Fatty Liver Disease (NAFLD)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cancer

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Genetic Disorders

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10 Liver Disease Therapeutics Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Disease (2021-2033)

Chapter 11. Company Profiles

11.1. Gilead Sciences, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. AbbVie Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bristol-Myers Squibb Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. F. Hoffmann-La Roche Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Merck & Co., Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Pfizer Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Novartis AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Intercept Pharmaceuticals, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Eisai Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. GlaxoSmithKline plc

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others