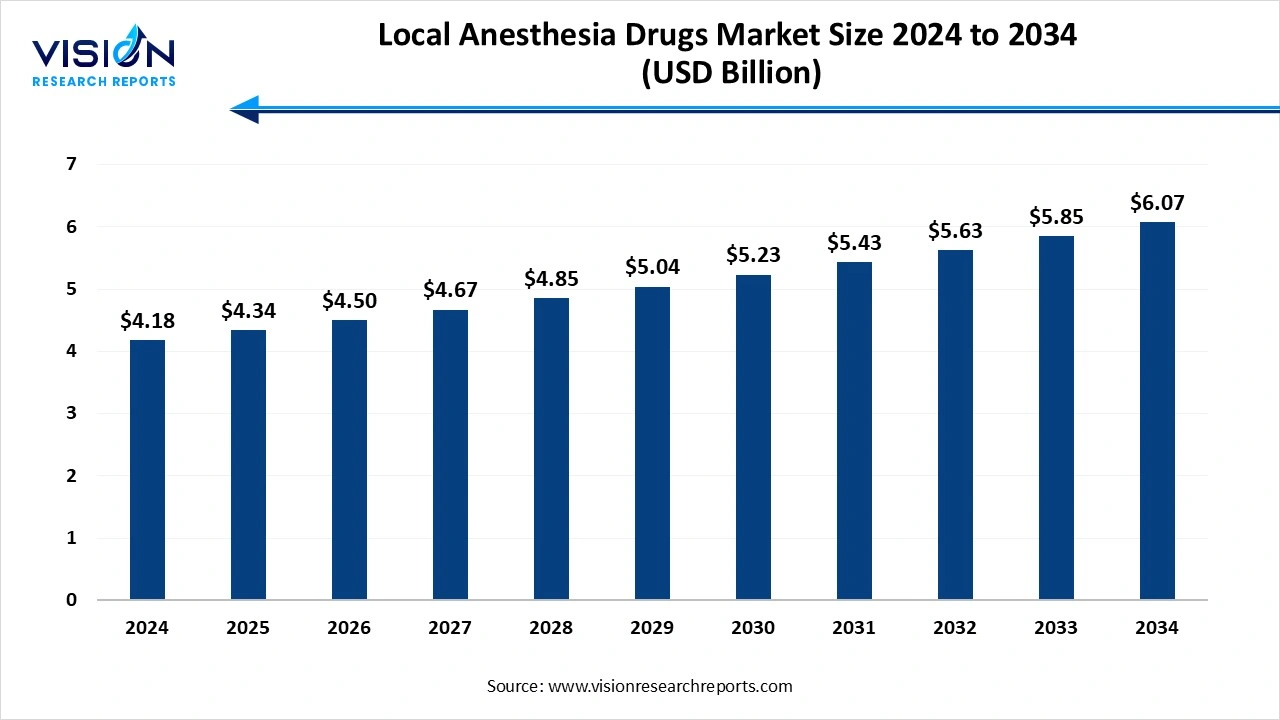

The global local anesthesia drugs market size was estimated at USD 4.18 billion in 2024 and is expected to grow to USD 4.34 billion in 2025 to reach approximately USD 6.07 billion by 2034 reflecting a remarkable CAGR of 3.8% from 2025 to 2034. The market growth is primarily driven by the rising number of surgical and dental procedures worldwide, increasing preference for minimally invasive surgeries, and continuous advancements in anesthetic drug formulations

The local anesthesia drugs market refers to the development, production and distribution of pharmaceutical agents that help to induce reversible loss of sensation in a specific area of the body, allowing medical procedures to be performed without causing any pain to the patient. These agents function by blocking nerve conduction, thus inhibiting the transmission of pain signals to the brain. Local anesthetics are commonly used in various medical settings, including dental procedures, minor surgeries and diagnostic interventions due to their efficacy and safety profile.

The local anesthesia drug market is influenced by several factors. The rising demand for outpatient procedures that require minimal pain management is a significant factor contributing to market growth. Additionally, advancements in medical technology and the development of new anesthetic agents are also enhancing the effectiveness and safety of local anesthesia. Additionally, increased investments in healthcare infrastructure and a growing emphasis on pain management is further propelling market expansion.

The market for local anesthesia medications has grown significantly in recent years due to a number of causes, including the rising incidence of chronic illnesses that require surgery, improvements in medication formulations and a growing desire for minimally invasive procedures.

The increasing number of surgical procedures worldwide is propelling the local anesthesia drugs market forward. The increasing prevalence of chronic diseases and advancements in minimally invasive surgeries have also boosted the demand for surgeries that require local anesthesia. In addition to that, procedures like dental work, cosmetic surgeries, orthopaedic interventions and ophthalmic operations increasingly rely on local anesthetics due to their safety, efficacy and faster recovery times compared to general anesthesia, thus leading to more growth and development.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.18 billion |

| Revenue Forecast by 2034 | USD 6.07 billion |

| Growth rate from 2025 to 2034 | CAGR of 3.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Pfizer Inc., Aspen Pharmacare Holdings Limited, Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Novartis AG, Mylan N.V. (now part of Viatris), Pacira BioSciences, Inc., AbbVie Inc., Septodont Holding, and Teva Pharmaceutical Industries Ltd. |

Rise in Aging Population

The increasing aging population is a key driver, directly propelling the local anesthesia drugs market. Older adults frequently need surgical and non-surgical interventions, due to health complications associated with their age, including arthritis, cardiovascular problems or dental issues. Most of these medical procedures rely on local anesthesia during pain management and certain patients whose risk of general anesthesia is comprised by their underlying health issues.

Additionally, the aging population is more likely to undergo outpatient and minimally invasive procedures, where local anesthetics are the preferred choice for safe, effective analgesia. The shift in this demographic has placed an increased demand for advanced long-action anesthetic formulations suitable for elderly people, pushing the market forward.

Lack of Adequately Trained Personnel

Despite promising growth, the market does have its fair share of challenges. The lack of adequately trained anesthesiologists is one such restraint that affects the local anesthesia drugs market. Administering local anesthesia requires precise knowledge of dosage, patient-specific factors and potential complications. In regions that lack of trained professionals, the risk of improper administration increases, leading to potential side effects like toxicity, nerve damage or ineffective anesthesia. This shortage reduces patient confidence and limits the adoption of local anesthesia procedures. Additionally, healthcare systems face challenges in providing training programs and retaining skilled personnel, further slowing down market growth.

Technological Advancements and Regulatory Support

Technological innovations in anesthesia delivery systems have significantly improved the market and opened up new areas of opportunities. The introduction of advanced devices such as computer-controlled local anesthetic delivery systems helps to enhance precision and also reduces the risk of complications. These advancements not only improve patient outcomes but also streamline the administration process for healthcare providers, thus driving market growth.

Regulatory bodies also play a vital role in shaping the local anesthesia drug market by establishing guidelines and standards for the use of anesthetic agents. Supportive regulations help facilitate the approval and availability of new local anesthetics, ensuring that healthcare providers have constant access to safe and effective options. This regulatory environment encourages innovation and the development of novel anesthetic formulations, which can further enhance patient care.

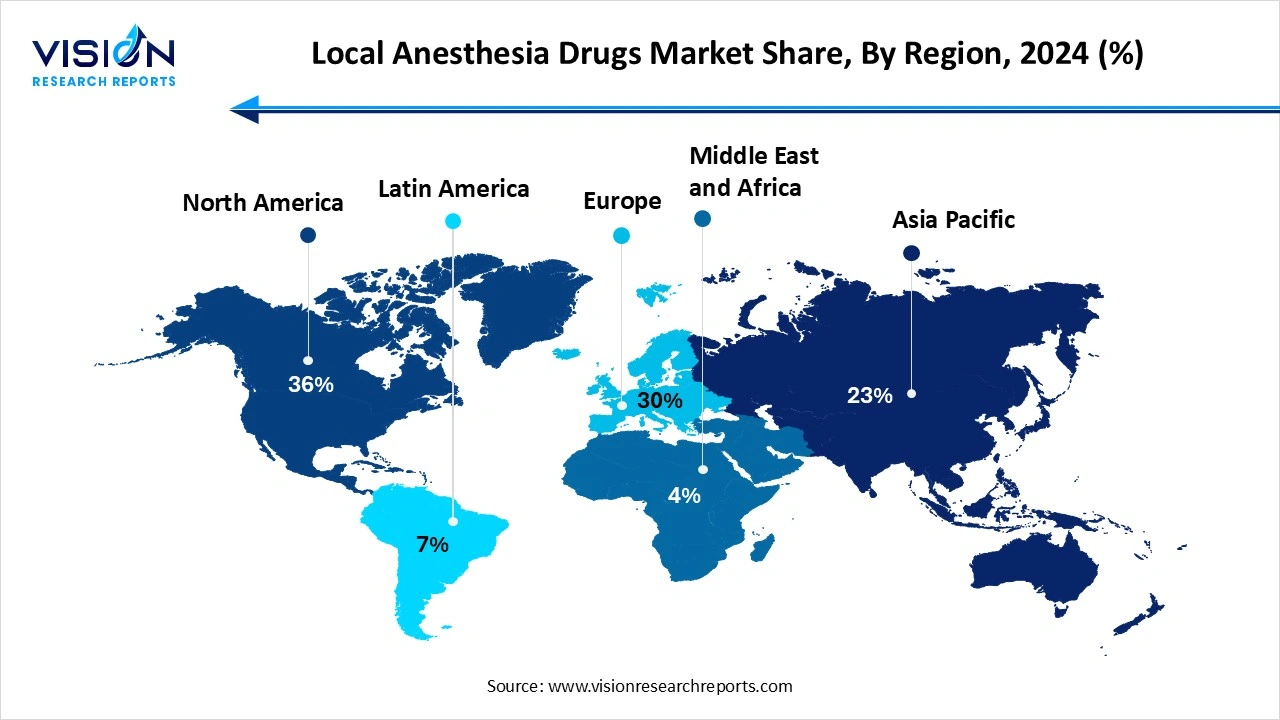

North America accounted for the largest share of global revenue in the local anesthesia drugs industry, representing 36% of the total market. This is due to the advancements in surgical procedures and the rising prevalence of chronic conditions in the region. The region also witnesses increased in outpatient surgeries, strong health infrastructure and continuous research and development into safer long-acting anesthetics, along with heightened patient and clinician awareness of non-opioid pain relief solutions among patients and clinicians. Continuous innovation, strategic collaborations and expanding healthcare access particularly in emerging markets are key drivers leading to future growth.

Asia Pacific is the fastest-growing region as of this year. This growth is due to the rising geriatric population, rise in chronic disease and lower use of opioid-based drugs. The rising senior population and the increase in medical tourism also contributes to market growth. Increasing awareness and advancements in anesthetic drug formulations further support the region’s market expansion. Countries such as China, India and Japan are investing heavily in hospital modernization and medical education, leading to wider adoption of local anesthetic drugs.

Which drug segment dominated the market in 2024?

The lidocaine held the largest market share of 29% in 2024, primarily due to its widespread application in both injectable and topical anesthetic formulations. Lidocaine is one of the most widely used drugs in the global local anesthesia drugs market. Its advantage lies in its rapid onset of action, reliable efficacy and broad applicability across various medical procedures. It is commonly used in dental surgeries, minor skin procedures and during the management of post-operative pain. Lidocaine's versatility, availability in multiple formulations such as injections, topical creams, gels as well as its relatively low toxicity profile further cements its position in the market.

The ropivacaine segment is anticipated to have the fastest growth rate throughout the forecast period. Its advantage lies in its lower cardiotoxicity and neurotoxicity than compared to any other anesthetic, making it suitable for prolonged procedures and post-surgical pain control. It is frequently used in epidural anesthesia, nerve blocks and regional anesthesia for orthopedic and obstetric surgeries, making it a popular choice.

Which application segment held the largest market share?

The injectables captured the highest revenue share of 60%, fueled by their increasing application in surgical procedures and ongoing advancements in drug delivery technologies. These anesthetics are widely used in surgical, dental and diagnostic procedures where immediate and localized pain control is essential. The rising number of outpatient surgeries and emergency room interventions has increased the demand for this segment as it offers better control over dosage and duration compared to others.

The surface anesthetics segment is seen to have the growth rate during the forecast period. These anesthetics are widely used in dermatological procedures, minor wound care and mucosal surface applications in fields such as dentistry and ophthalmology. Surface anesthetics provide effective temporary relief from pain and discomfort without the need for injections, making them ideal for pediatric, geriatric, and needle-phobic patients. Moreover, products like lidocaine creams, sprays and gels are in high demand across both hospital and home care settings, pushing this segment even more.

By Drug

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Local Anesthesia Drugs Market

5.1. COVID-19 Landscape: Local Anesthesia Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Local Anesthesia Drugs Market, By Drug

8.1. Local Anesthesia Drugs Market, by Drug , 2024-2033

8.1.1. Bupivacaine

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ropivacaine

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Lidocaine

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Prilocaine

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Chloroprocaine

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Benzocaine

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Local Anesthesia Drugs Market, By Application

9.1. Local Anesthesia Drugs Market, by Application, 2024-2033

9.1.1. Injectable

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Surface Anesthetic

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Drug (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Pfizer Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Aspen Pharmacare Holdings Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Hikma Pharmaceuticals PLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Fresenius Kabi AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Novartis AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mylan N.V. (now part of Viatris)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Pacira BioSciences, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. AbbVie Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Septodont Holding

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Teva Pharmaceutical Industries Ltd.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others