The pharmaceutical market size stood at USD 1.68 trillion in 2024 and is estimated to reach USD 1.78 trillion in 2025. It is projected to surge past USD 3.07 trillion by 2034, registering a robust CAGR of 6.2% from 2025 to 2034. The increasing inflammatory diseases, strong market position and efficacy, and continuous rollout in new markets, particularly in rapidly growing regions with improving healthcare infrastructure. The increased physician and patient awareness, rising prevalence of Type 2 inflammatory disease, drive the market growth.

The pharmaceutical market comprises a drug substance, a medicine that is used in the diagnosis, prevention, treatment, or cure of disease and medical conditions. The market growth is driven by the growing prevalence of conditions, such as diabetes, cardiovascular disease, cancer, and neurological disorders worldwide is creating a significant and continuous demand for pharmaceutical products, treatments, and therapies.

The increasing aging population and health-related concerns, chronic conditions, rising healthcare awareness, and spending. The increasing advancement in research and development in drug discovery, the development of new therapies, and significant investment in R&D by pharmaceutical companies, expanding market growth.

The demographic shift drives a higher prevalence of age-related chronic diseases, like cardiovascular disorders, arthritis, and neurological conditions, leading to demand for long-term care medications. The rising prevalence of chronic diseases, sedentary lifestyles, and poor dietary habits, particularly in emerging economies, is leading to a disproportionate rise in conditions like diabetes, cancer, and heart disease.

According to the (WHO) World Health Organization reporting that chronic diseases will cause 73% of deaths by 2025, expansion of the market growth. The health consciousness, rising disposable incomes, and expanded health insurance coverage. The government initiatives and supportive government policies promote research and improve healthcare access, driving the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.68 trillion |

| Revenue Forecast by 2034 | USD 3.07 trillion |

| Growth rate from 2025 to 2034 | CAGR of 6.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Takeda Pharmaceutical Co., Ltd., F. Hoffmann-La Roche Ltd, AstraZeneca, Novartis AG, GlaxoSmithKline plc., AbbVie Inc., Sanofi, Johnson & Johnson Services, Inc., Bristol-Myers Squibb Company, Merck & Co., Inc., GSK plc |

Innovation in R&D and Market Access Opportunity for the Pharmaceutical Market

AI and machine learning can analyse complex datasets to predict drug behaviours, significantly accelerating the research and development process. The continuous manufacturing and traditional batch processing methods produce drugs more efficiently, with better quality control, and at lower cost. The increase in contract research, development, and manufacturing. The high-demand therapeutic areas, such as oncology and neurology, rising demand for pet ownership, and demand for livestock care are driving demand in the animal healthcare and veterinary pharmaceutical sectors. The consumers' increasing demand for OTC medicine and the growing preference for online shopping have created opportunities for the pharmaceutical market.

High R&D Cost and Pricing Issues of the Pharmaceutical Market

The development of a new drug can take over a decade and incur high costs, with a high chance of failure in clinical trials. This creates immense financial risk, particularly for smaller biotech firms. There is a significant shortage of specialized talent in science, technology, engineering, and digital roles. The pharmaceutical market is defined by intense competition, both from other innovators and from cheaper generics after patents expire. This constant pressure, combined with public and government demands for more affordable drugs, forces companies to heavily invest in differentiation and adapt their marketing strategies.

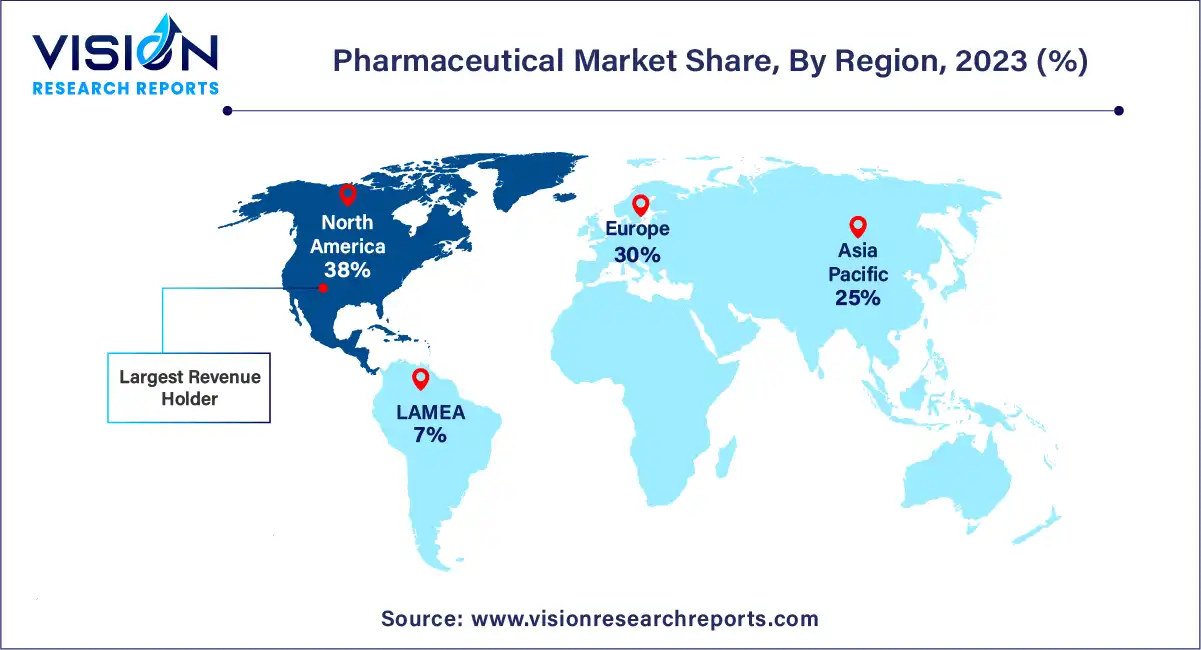

Which Region Dominated the Pharmaceutical Market?

North America dominates the global pharmaceutical market, holding the largest market share with high healthcare expenditure, a strong regulatory context, and an increase in biologics and over-the-counter medicines. In this region, strong R&D investments, easy drug approvals, and a dominant share of hospital pharmacy in retail and online pharmacies expand the market growth. The implementation of various strategic initiatives by both recognized and early-stage pharmaceutical firms further boosts regional growth.

U.S. Pharmaceutical Market Trends

The U.S pharmaceutical market is projected for steady growth, driven by the increasing incidence of chronic diseases, such as cancer and diabetes. According to the Cleveland Clinic, approximately 37.3 million people suffer from type 2 diabetes, which is about11% of the population. The growing elderly demographic leads to increased needs for treatments for age-related diseases, rising innovation, and increasing healthcare expenditure, expanding the market growth.

Why is the Asia Pacific Significantly Growing in the Pharmaceutical Market?

The Asia-Pacific pharmaceutical market is growing due to rising aging population, resulting in a rapidly aging population in this region, resulting in a significant surge in demand for healthcare services and pharmaceuticals. The trends towards urbanization lead to better access to healthcare services and a higher demand for pharmaceuticals. The Asia Pacific region, particularly China and India, has cost-effective manufacturing, making it a worldwide hub for production and attracting investment from international companies. The regions are accelerating technological advancement and R&D innovations, driving market growth.

The biologics & biosimilars (large molecules) and conventional drugs (small molecules) segment held the largest revenue share in the Pharmaceutical market in 2024. The ease of administration, such as small-molecule drugs that are taken orally as pills, improves patient compliance and is cost-effective to produce and distribute. The various factors attributed to market growth like predictable pharmacokinetics and high oral bioavailability.

The conventional drugs (small molecules) segment is the fastest-growing in the market during the forecast period. Their small size allows them to easily penetrate cell membranes and reach intracellular targets; they are effective against various diseases. With its established presence, affordability, broad applications, ongoing innovation, and the increasing burden of chronic diseases globally.

The branded segment held the largest revenue share in the Pharmaceutical market in 2024. The many firms with branded drugs often employ targeted marketing strategies to build brand recognition and trust among healthcare providers and patients. The branded medicine addresses critical health needs and perceived value, and trust. The major key players focus on introducing ground-breaking pharmaceuticals, therapies, fuelling the growth.

The generic segment is experiencing the fastest growth in the market during the forecast period. The generic drugs are more affordable than their branded counterparts, making them accessible to a broader population. The price advantages drive the demand. The governments actively promote generic drug use through policies that favor generic substitution, streamline approval processes, and control drug prices. The increasing innovation and accessibility are improving, such as E-pharmacies, advanced formulations, and digital integrations boost market growth.

The prescription segment dominated the pharmaceutical market in 2024. The rising use of treatment for chronic diseases treatment of prescription medicine. Prescription drugs are essential for managing these complex health issues, forming a core component of modern healthcare systems. Major key players invest heavily in research and development (R&D) to discover and launch novel therapies, especially for complex diseases. These innovative drugs are typically patent-protected, branded, and highly priced, contributing to a large share of the market's revenue.

The over-the-counter (OTC) segment is the fastest-growing in the market during the forecast period. The consumers are more health-conscious and prefer to manage minor illnesses themselves, using OTC medicine. The OTC medication is affordable and cost-saving; consumers are allowed to purchase it easily and conveniently. The increasing awareness towards digital health resources and pharmacists' recommendations empowers consumers to make informed choices about OTC medications and their safety and efficacy, expansion of the market growth.

The cancer segment dominated the Pharmaceutical market in 2024. Cancer's dominance in the pharmaceutical industry is supported by a number of important trends and variables. First off, the rising prevalence of various cancers around the world has increased demand for novel and effective treatments, leading to significant investments and research efforts in this area.

The cancer segment is the fastest-growing in the market during the forecast period. The partnerships between research institutes and pharmaceutical companies have accelerated the creation of innovative cancer medications, creating a strong pipeline of promising therapies. Last but not least, this segment's growth trajectory has increased in recent years, solidifying its dominance within the pharmaceutical market, thanks to the availability of advantageous regulatory procedures and quicker approvals for innovative cancer therapies.

The oral route segment dominated the pharmaceutical market in 2024. Many patients prefer taking a pill or liquid rather than receiving injections. This preference for a non-invasive, painless route leads to better adherence to treatment regimens. The various applications of the oral route of administration, such as convenience, cost-effectiveness, manufacturing efficiency, high physical and chemical stability, and small-molecule prevalence, drive the market growth.

The parenteral route segment is the fastest-growing in the market during the forecast period. The pharmaceutical industry has undergone a substantial transformation due to recent developments in parenteral drug administration. For example, the development of advanced injectable formulations that can transport complex proteins and peptides has been prompted by the rise of biologic medicines. Monoclonal antibodies used in cancer treatments and novel vaccines are noteworthy examples that illustrate how parenteral medication delivery methods are changing.

The tablets segment dominated the pharmaceutical market in 2024. The tablet is an oral route of administration, easy to administer, cost-effective, and has manufacturing efficiency. Their widespread therapeutic applications such as anti-diabetics, anti-inflammatories, antacids, and cardiovascular drugs. The consumers' preference for the consumption of tablets. Tablets are especially straightforward to produce across a broad spectrum of specialisms, encompassing anti-diabetics, anti-inflammatories, antacids, vitamins, and antiallergics.

The spray segment is the fastest-growing in the market during the forecast period. The increasing conditions like allergic rhinitis and sinus infection have fuelled the demand for nasal spray as a treatment option. The consumer's preference for self-medication, painless, and targeted drug delivery. The pharmaceutical companies are increasingly using spray technology for systemic drug delivery (where the drug enters the bloodstream) rather than just local topical effects, which boosts the market growth.

The adult segment dominated the pharmaceutical market in 2024. The increasing prevalence accounts for the majority of chronic and lifestyle diseases, such as diabetes, hypertension, and cardiovascular issues. The increasing disposable income, in developed and emerging markets, allows for greater spending on high-quality medication and health supplements. With the changing lifestyle and stress-related conditions, the working-age population drives preventive and specialty care.

The children and adolescent segment is the fastest-growing in the market during the forecast period. The increasing number of medication approvals tailored for the pediatric population. The rising prevalence of pediatric diseases like chronic illness, infectious disease, mental health disorders, and pediatric cancers. The supportive regulatory policies and incentives, innovation in pediatric drug development, increased awareness and healthcare access, and expansion of the market growth.

By Molecule Type

By Product

By Type

By Disease

By Route of Administration

By Formulation

By Age Group

By End User

By Region

Pharmaceutical Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Pharmaceutical Market, By Molecule Type

7.1. Pharmaceutical Market, by Molecule Type, 2024-2034

7.1.1. Biologics & Biosimilars (Large Molecules)

7.1.1.1. Market Revenue and Forecast (2025-2034)

7.1.2. Conventional Drugs (Small Molecules)

7.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 8. Global Pharmaceutical Market, By Product

8.1. Pharmaceutical Market, by Product, 2024-2034

8.1.1. Branded

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Generics

8.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Pharmaceutical Market, By Type

9.1. Pharmaceutical Market, by Type, 2024-2034

9.1.1. Prescription

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. OTC

9.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Pharmaceutical Market, By Disease

10.1. Pharmaceutical Market, by Disease, 2024-2034

10.1.1. Cardiovascular diseases

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. Cancer

10.1.1.2. Market Revenue and Forecast (2025-2034)

10.1.3. Diabetes

10.1.1.3. Market Revenue and Forecast (2025-2034)

10.1.4. Infectious diseases

10.1.4.1. Market Revenue and Forecast (2025-2034)

10.1.5. Neurological disorders

10.1.5.1. Market Revenue and Forecast (2025-2034)

10.1.6. Respiratory diseases

10.1.6.1. Market Revenue and Forecast (2025-2034)

10.1.7. Autoimmune diseases

10.1.7.1. Market Revenue and Forecast (2025-2034)

10.1.8. Mental health disorders

10.1.8.1. Market Revenue and Forecast (2025-2034)

10.1.9. Gastrointestinal disorders

10.1.9.1. Market Revenue and Forecast (2025-2034)

10.1.10. Women’s health Diseases

10.1.10.1. Market Revenue and Forecast (2025-2034)

10.1.11. Genetic and rare genetic diseases

10.1.11.1. Market Revenue and Forecast (2025-2034)

10.1.12. Dermatological conditions

10.1.12.1. Market Revenue and Forecast (2025-2034)

10.1.13. Obesity

10.1.13.1. Market Revenue and Forecast (2025-2034)

10.1.14. Liver conditions

10.1.14.1. Market Revenue and Forecast (2025-2034)

10.1.15. Renal diseases

10.1.15.1. Market Revenue and Forecast (2025-2034)

10.1.16. Hematological disorders

10.1.16.1. Market Revenue and Forecast (2025-2034)

10.1.17. Infertility conditions

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.18. Endocrine disorders

10.1.18.1. Market Revenue and Forecast (2025-2034)

10.1.19. Allergies

10.1.19.1. Market Revenue and Forecast (2025-2034)

10.1.20. Others

10.1.20.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Pharmaceutical Market, By Route of Administration

11.1. Pharmaceutical Market, by Route of Administration, 2024-2034

11.1.1. Oral

11.1.1.1. Market Revenue and Forecast (2025-2034)

11.1.2. Topical

11.1.2.1. Market Revenue and Forecast (2025-2034)

11.1.3. Parenteral

11.1.3.1. Market Revenue and Forecast (2025-2034)

11.1.4. Inhalations

11.1.4.1. Market Revenue and Forecast (2025-2034)

11.1.5. Other

11.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 12. Global Pharmaceutical Market, By Formulation

12.1. Pharmaceutical Market, by Formulation, 2024-2034

12.1.1 Tablets

12.1.1.1. Market Revenue and Forecast (2025-2034)

12.1.2. Capsules

12.1.2.1. Market Revenue and Forecast (2025-2034)

12.1.3. Injectable

12.1.3.1. Market Revenue and Forecast (2025-2034)

12.1.4. Sprays

12.1.4.1. Market Revenue and Forecast (2025-2034)

12.1.5. Suspensions

12.1.5.1. Market Revenue and Forecast (2025-2034)

12.1.6. Powders

12.1.6.1. Market Revenue and Forecast (2025-2034)

12.1.7. Other Formulations

12.1.7.1. Market Revenue and Forecast (2025-2034)

Chapter 13. Global Pharmaceutical Market, By Age Group

13.1. Pharmaceutical Market, by Age Group, 2024-2034

13.1.1. Children & Adolescents

13.1.1.1. Market Revenue and Forecast (2025-2034)

13.1.2. Adults

13.1.2.1. Market Revenue and Forecast (2025-2034)

13.1.3. Geriatric

13.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 14. Global Pharmaceutical Market, By End User

14.1. Pharmaceutical Market, by End User, 2024-2034

14.1.1. Hospitals

14.1.1.1. Market Revenue and Forecast (2025-2034)

14.1.2. Clinics

14.1.2.1. Market Revenue and Forecast (2025-2034)

14.1.3. Others

14.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 15. Global Pharmaceutical Market, Regional Estimates and Trend Forecast

15.1. North America

15.1.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.1.2. Market Revenue and Forecast, by Product (2025-2034)

15.1.3. Market Revenue and Forecast, by Type (2025-2034)

15.1.4. Market Revenue and Forecast, by Disease (2025-2034)

15.1.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.1.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.1.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.1.8. Market Revenue and Forecast, by End User (2025-2034)

15.1.8. U.S.

15.1.8.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.1.8.2. Market Revenue and Forecast, by Product (2025-2034)

15.1.8.3. Market Revenue and Forecast, by Type (2025-2034)

15.1.8.4. Market Revenue and Forecast, by Disease (2025-2034)

15.1.8.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.1.8.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.1.8.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.1.8.8. Market Revenue and Forecast, by End User (2025-2034)

15.1.9. Rest of North America

15.1.9.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.1.9.2. Market Revenue and Forecast, by Product (2025-2034)

15.1.9.3. Market Revenue and Forecast, by Type (2025-2034)

15.1.9.4. Market Revenue and Forecast, by Disease (2025-2034)

15.1.9.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.1.9.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.1.9.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.1.9.8 Market Revenue and Forecast, by End User (2025-2034)

15.2. Europe

15.2.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.2.2. Market Revenue and Forecast, by Product (2025-2034)

15.2.3. Market Revenue and Forecast, by Type (2025-2034)

15.2.4. Market Revenue and Forecast, by Disease (2025-2034)

15.2.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.2.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.2.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.2.8. Market Revenue and Forecast, by End User (2025-2034)

15.2.8. UK

15.2.8.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.2.8.2. Market Revenue and Forecast, by Product (2025-2034)

15.2.8.3. Market Revenue and Forecast, by Type (2025-2034)

15.2.8.4. Market Revenue and Forecast, by Disease (2025-2034)

15.2.8.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.2.8.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.2.8.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.2.8.8. Market Revenue and Forecast, by End User (2025-2034)

15.2.9. Germany

15.2.9.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.2.9.2. Market Revenue and Forecast, by Product (2025-2034)

15.2.9.3. Market Revenue and Forecast, by Type (2025-2034)

15.2.9.4. Market Revenue and Forecast, by Disease (2025-2034)

15.2.9.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.2.9.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.2.9.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.2.9.8. Market Revenue and Forecast, by End User (2025-2034)

15.2.10. France

15.2.10.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.2.10.2. Market Revenue and Forecast, by Product (2025-2034)

15.2.10.3. Market Revenue and Forecast, by Type (2025-2034)

15.2.10.4. Market Revenue and Forecast, by Disease (2025-2034)

15.2.10.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.2.10.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.2.10.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.2.10.8. Market Revenue and Forecast, by End User (2025-2034)

15.2.11. Rest of Europe

15.2.11.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.2.11.2. Market Revenue and Forecast, by Product (2025-2034)

15.2.11.3. Market Revenue and Forecast, by Type (2025-2034)

15.2.11.4. Market Revenue and Forecast, by Disease (2025-2034)

15.2.11.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.2.11.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.2.11.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.2.11.8. Market Revenue and Forecast, by End User (2025-2034)

15.3. APAC

15.3.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.3.2. Market Revenue and Forecast, by Product (2025-2034)

15.3.3. Market Revenue and Forecast, by Type (2025-2034)

15.3.4. Market Revenue and Forecast, by Disease (2025-2034)

15.3.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.3.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.3.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.3.8. Market Revenue and Forecast, by End User (2025-2034)

15.3.8. India

15.3.8.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.3.8.2. Market Revenue and Forecast, by Product (2025-2034)

15.3.8.3. Market Revenue and Forecast, by Type (2025-2034)

15.3.8.4. Market Revenue and Forecast, by Disease (2025-2034)

15.3.8.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.3.8.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.3.8.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.3.8.8. Market Revenue and Forecast, by End User (2025-2034)

15.3.9. China

15.3.9.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.3.9.2. Market Revenue and Forecast, by Product (2025-2034)

15.3.9.3. Market Revenue and Forecast, by Type (2025-2034)

15.3.9.4. Market Revenue and Forecast, by Disease (2025-2034)

15.3.9.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.3.9.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.3.9.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.3.9.8. Market Revenue and Forecast, by End User (2025-2034)

15.3.10. Japan

15.3.10.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.3.10.2. Market Revenue and Forecast, by Product (2025-2034)

15.3.10.3. Market Revenue and Forecast, by Type (2025-2034)

15.3.10.4. Market Revenue and Forecast, by Disease (2025-2034)

15.3.10.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.3.10.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.3.10.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.3.10.8. Market Revenue and Forecast, by End User (2025-2034)

15.3.11. Rest of APAC

15.3.11.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.3.11.2. Market Revenue and Forecast, by Product (2025-2034)

15.3.11.3. Market Revenue and Forecast, by Type (2025-2034)

15.3.11.4. Market Revenue and Forecast, by Disease (2025-2034)

15.3.11.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.3.11.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.3.11.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.3.11.8. Market Revenue and Forecast, by End User (2025-2034)

15.4. MEA

15.4.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.4.2. Market Revenue and Forecast, by Product (2025-2034)

15.4.3. Market Revenue and Forecast, by Type (2025-2034)

15.4.4. Market Revenue and Forecast, by Disease (2025-2034)

15.4.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.4.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.4.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.4.8. Market Revenue and Forecast, by End User (2025-2034)

15.4.9. GCC

15.4.9.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.4.9.2. Market Revenue and Forecast, by Product (2025-2034)

15.4.9.3. Market Revenue and Forecast, by Type (2025-2034)

15.4.9.4. Market Revenue and Forecast, by Disease (2025-2034)

15.4.9.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.4.9.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.4.9.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.4.9. 8. Market Revenue and Forecast, by End User (2025-2034)

15.4.9. North Africa

15.4.10.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.4.10.2. Market Revenue and Forecast, by Product (2025-2034)

15.4.10.3. Market Revenue and Forecast, by Type (2025-2034)

15.4.10.4. Market Revenue and Forecast, by Disease (2025-2034)

15.4.10.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.4.10.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.4.10.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.4.10. 8. Market Revenue and Forecast, by End User (2025-2034)

15.4.11. South Africa

15.4.11.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.4.11.2. Market Revenue and Forecast, by Product (2025-2034)

15.4.11.3. Market Revenue and Forecast, by Type (2025-2034)

15.4.11.4. Market Revenue and Forecast, by Disease (2025-2034)

15.4.11.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.4.11.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.4.11.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.4.11.8. Market Revenue and Forecast, by End User (2025-2034)

15.4.12. Rest of MEA

15.4.12.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.4.12.2. Market Revenue and Forecast, by Product (2025-2034)

15.4.12.3. Market Revenue and Forecast, by Type (2025-2034)

15.4.12.4. Market Revenue and Forecast, by Disease (2025-2034)

15.4.12.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.4.12.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.4.12.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.4.12.8. Market Revenue and Forecast, by End User (2025-2034)

15.5. Latin America

15.5.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.5.2. Market Revenue and Forecast, by Product (2025-2034)

15.5.3. Market Revenue and Forecast, by Type (2025-2034)

15.5.4. Market Revenue and Forecast, by Disease (2025-2034)

15.5.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.5.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.5.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.5.8. Market Revenue and Forecast, by End User (2025-2034)

15.5.8. Brazil

15.5.8.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.5.8.2. Market Revenue and Forecast, by Product (2025-2034)

15.5.8.3. Market Revenue and Forecast, by Type (2025-2034)

15.5.8.4. Market Revenue and Forecast, by Disease (2025-2034)

15.5.8.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.5.8.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.5.8.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.5.8.8. Market Revenue and Forecast, by End User (2025-2034)

15.5.9. Rest of LATAM

15.5.9.1. Market Revenue and Forecast, by Molecule Type (2025-2034)

15.5.9.2. Market Revenue and Forecast, by Product (2025-2034)

15.5.9.3. Market Revenue and Forecast, by Type (2025-2034)

15.5.9.4. Market Revenue and Forecast, by Disease (2025-2034)

15.5.9.5. Market Revenue and Forecast, by Route of Administration (2025-2034)

15.5.9.6. Market Revenue and Forecast, by Age Group (2025-2034)

15.5.9.7. Market Revenue and Forecast, by Formulation (2025-2034)

15.5.9.8. Market Revenue and Forecast, by End User (2025-2034)

Chapter 16. Company Profiles

16.1. Takeda Pharmaceutical Co., Ltd.

16.1.1. Company Overview

16.1.2. Product Offerings

16.1.3. Financial Performance

16.1.4. Recent Initiatives

16.2. F. Hoffmann-La Roche Ltd

16.2.1. Company Overview

16.2.2. Product Offerings

16.2.3. Financial Performance

16.2.4. Recent Initiatives

16.3. AstraZeneca.

16.3.1. Company Overview

16.3.2. Product Offerings

16.3.3. Financial Performance

16.3.4. Recent Initiatives

16.4., Novartis AG

16.4.1. Company Overview

16.4.2. Product Offerings

16.4.3. Financial Performance

16.4.4. Recent Initiatives

16.5. GlaxoSmithKline plc.

16.5.1. Company Overview

16.5.2. Product Offerings

16.5.3. Financial Performance

16.5.4. Recent Initiatives

16.6. AbbVie Inc.

16.6.1. Company Overview

16.6.2. Product Offerings

16.6.3. Financial Performance

16.6.4. Recent Initiatives

16.7. Sanofi

16.7.1. Company Overview

16.7.2. Product Offerings

16.7.3. Financial Performance

16.7.4. Recent Initiatives

16.7. Johnson & Johnson Services, Inc.

16.7.1. Company Overview

16.8.2. Product Offerings

16. 8.3. Financial Performance

16. 8.4. Recent Initiatives

16.9. Bristol-Myers Squibb Company

16.9.1. Company Overview

16.9.2. Product Offerings

16.9.3. Financial Performance

16.9.4. Recent Initiatives

Chapter 17. Research Methodology

17.1. Primary Research

17.2. Secondary Research

17.3. Assumptions

Chapter 18. Appendix

18.1. About Us

18.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others