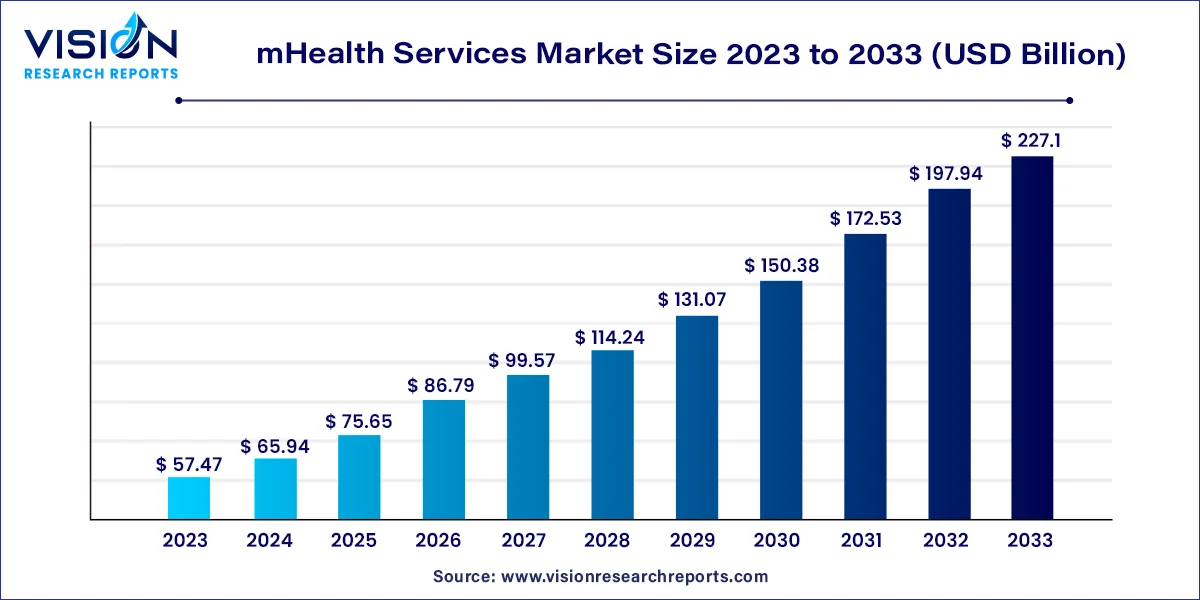

The global mHealth services market was surpassed at USD 57.47 billion in 2023 and is expected to hit around USD 227.1 billion by 2033, growing at a CAGR of 14.73% from 2024 to 2033.

The mHealth services market is a dynamic sector characterized by the convergence of mobile technology and healthcare services. As mobile devices become increasingly integrated into daily life, their potential to revolutionize healthcare delivery is becoming evident. MHealth services encompass a wide range of applications, including remote patient monitoring, health information dissemination, medication adherence support, and telemedicine consultations.

The growth of the mHealth services market is propelled by an increasing prevalence of chronic diseases worldwide is driving the demand for remote patient monitoring and management solutions. Secondly, the widespread adoption of smartphones and wearable devices has expanded the reach of MHealth services, making healthcare more accessible and convenient for users. Additionally, advancements in technology, such as artificial intelligence and data analytics, are enhancing the capabilities of MHealth platforms, enabling more personalized and effective healthcare delivery. Moreover, the growing emphasis on preventive healthcare and wellness promotion is fueling the demand for MHealth solutions that empower individuals to take control of their health.

In 2023, the monitoring services segment held the largest share of 60%. This segment's growth is primarily driven by factors such as the increasing prevalence of chronic and infectious diseases and the demand for remote monitoring platforms in post-acute care settings. Additionally, leading players' heightened investments in inpatient monitoring are expected to further propel segment growth. Furthermore, the rising demand for mHealth apps connected with glucometer devices to monitor glucose levels, driven by the increasing diabetic patient population, is contributing to market expansion. According to the World Health Organization (WHO), approximately 422 million people worldwide have diabetes, resulting in 1.5 million deaths annually.

The other services segment is projected to experience the fastest CAGR from 2024 to 2033. These services encompass ensuring patient wellness and disease prevention through various mHealth applications. The segment's growth is fueled by factors such as a health-conscious population and a significant increase in the number of fitness apps available. Various apps providing health tips, fitness tracking, nutritional guidance, and substance abuse prevention are driving the development of other services in the industry. For instance, FitStar is a popular video-based mobile app that offers personalized fitness training sessions to its users.

In 2023, the mobile operators segment secured the largest revenue share. This dominance is attributed to a surge in mobile subscribers and advancements in network infrastructure. For example, data from the International Telecommunication Union in November 2022 revealed that approximately 73% of individuals aged 10 and above worldwide owned a mobile phone. Moreover, the proliferation of 4G and 5G technologies, coupled with industry consolidation efforts by key players, is expected to further propel segment growth.

The content players segment is forecasted to exhibit the highest CAGR between 2024 and 2033. This trajectory is driven by content players' active involvement in developing mHealth applications and technologies, handling documentation, facilitating remote patient monitoring, tracking health activities, and scheduling appointments. Additionally, these entities are instrumental in introducing new features to existing health apps, thereby expanding their user base. For instance, in July 2022, Apple, Inc. unveiled strategies aimed at enhancing digital health, emphasizing the provision of health and fitness features to customers while fostering engagement with traditional healthcare systems.

In 2023, the healthcare providers segment commanded the largest revenue share. The widespread availability of mobile phones, even in low- and middle-income countries, has facilitated global virtual screening for chronic conditions and various diseases. Managing chronic diseases entails regular check-ups, lifestyle adjustments, and frequent hospital visits as advised by healthcare professionals. mHealth plays a crucial role in enhancing patient awareness about their conditions, aiding clinical decisions, enabling lifestyle interventions, promoting medication adherence, offering rehabilitation support, and managing screening routines. Patients with chronic diseases increasingly opt for mHealth due to its cost-effectiveness and convenience in managing their health effectively, thus driving segment growth.

Looking ahead, the patients segment is poised for lucrative growth from 2024 to 2033. Factors such as the escalating prevalence of chronic diseases and the growing adoption of mHealth apps for chronic disease management are expected to fuel this growth. For instance, according to the CDC, in the U.S., six out of ten individuals are afflicted with at least one chronic disease, including cancer, diabetes, heart disease, and stroke. Consequently, the rising incidence of chronic diseases has spurred increased utilization of mHealth apps by patients to manage their health proactively.

In 2023, the general healthcare & fitness segment captured the largest revenue share. This dominance can be attributed to several factors, including the increasing prevalence of obesity due to sedentary lifestyles, growing awareness about personal health, and a rise in the number of health-conscious individuals. Consequently, there has been a surge in demand for general healthcare & fitness apps and devices aimed at tracking daily activities. For instance, according to the World Obesity Atlas 2022 report in May 2022, it is projected that by 2033, one billion people globally, comprising 1 in 7 men and 1 in 5 women, will be affected by obesity. Hence, the segment's growth is closely linked to the escalating prevalence of obesity.

Looking forward, the medication information segment is expected to register the fastest compound annual growth rate (CAGR) from 2024 to 2033. This segment typically encompasses details about various aspects of medications within mHealth apps, providing users with assistance and valuable insights into managing their medication regimens. This feature aids patients in adhering to their prescribed schedules, identifying medications accurately, and understanding the potential side effects and precautions associated with each medicine.

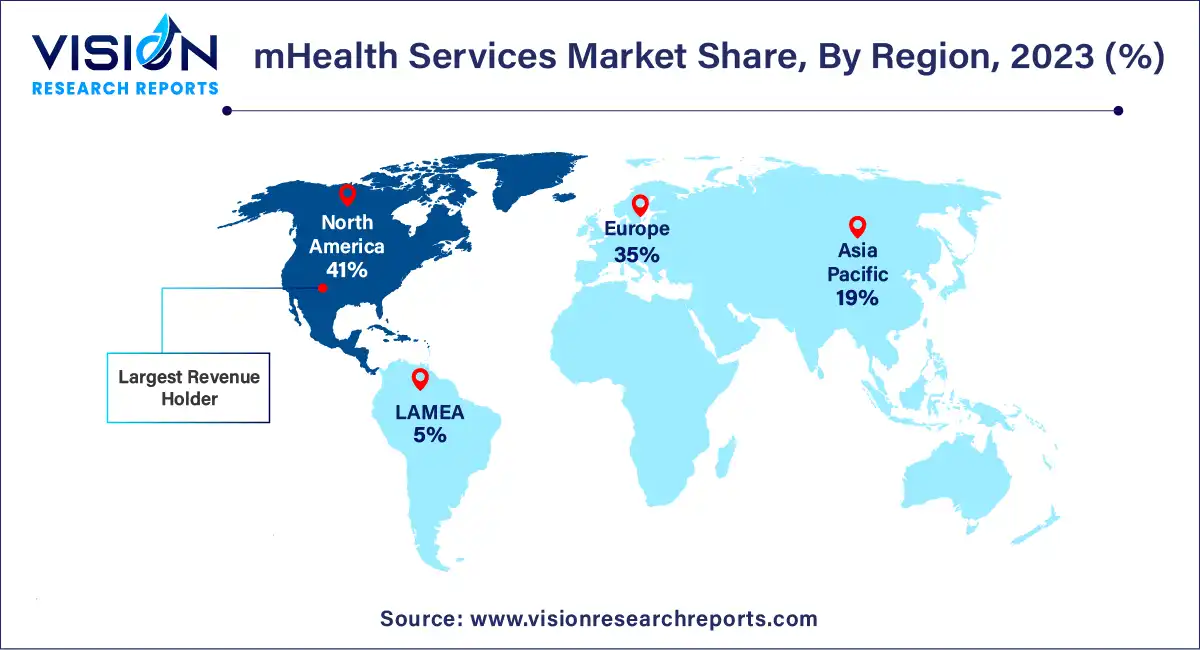

In 2023, the North America mHealth services market held a dominant position in the global industry, boasting a revenue share of 41%. This stronghold can be attributed to several factors, including the region's high healthcare expenditure, increasing incidences of chronic diseases, a burgeoning geriatric population, and its highly developed network infrastructure. Further expansion of the market is anticipated, driven by favorable government initiatives, a surge in FDA approvals for wearable devices, and a growing adoption of mobile healthcare applications. Additionally, the escalating burden of cardiovascular diseases in the region is propelling the demand for real-time monitoring solutions. The availability of mHealth apps capable of providing instantaneous information on cardiovascular health holds promise in averting major health crises and reducing mortality rates due to sudden cardiac arrest. For example, in November 2022, Apple, Inc. obtained FDA approval for its watch-based app, developed by H2o Therapeutics, aimed at monitoring Parkinson's disease.

Asia Pacific mHealth services market is poised to exhibit the fastest compound annual growth rate (CAGR) from 2024 to 2033. Increasing affordability is fostering the adoption of smartphones for accessing various mHealth applications. Additionally, factors such as rising healthcare expenditure, a surge in chronic and infectious diseases, challenges in hospital service management, and a growing aging population are prompting governments and healthcare providers to devise new healthcare delivery models. Government entities are actively promoting advancements in mHealth technology by enhancing 3G and 4G network infrastructure, developing eHealth and telehealth roadmaps, and formulating policies aimed at attracting investments in the region. For instance, the Indian government introduced a digital health ecosystem under the Ayushman Bharat Digital Health Mission (ABDM) during the 2022 budget session.

By Service

By Participants

By Application

By End-user

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others