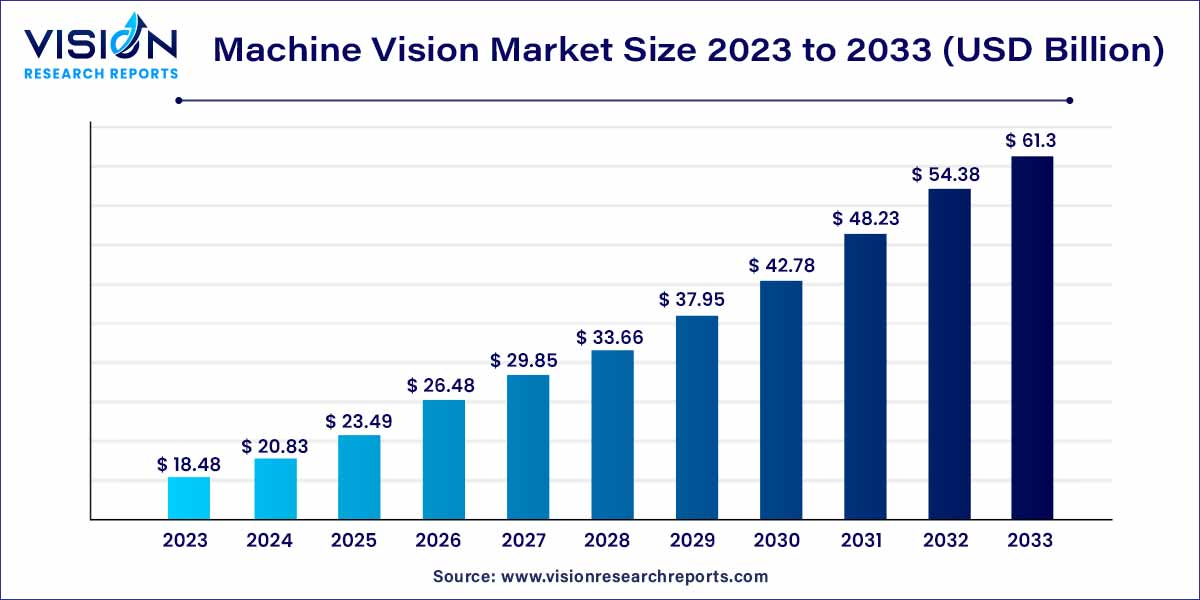

The global machine vision market size was surpassed at USD 18.48 billion in 2023 and is expected to hit around USD 61.3 billion by 2033, growing at a CAGR of 12.74% from 2024 to 2033. The machine vision market is driven by an automation demand, quality assurance requirements, advancements in technology, and industry 4.0 initiatives.

The machine vision market has emerged as a pivotal force driving advancements across industries, revolutionizing manufacturing processes, enhancing quality control, and augmenting automation capabilities. In this comprehensive overview, we delve into the multifaceted landscape of machine vision, exploring its key components, growth drivers, challenges, and future prospects.

The growth of the machine vision market is propelled by a confluence of factors that underscore its significance across industries. Foremost among these is the relentless pursuit of operational efficiency and quality enhancement. As businesses strive to optimize their processes and deliver superior products, the adoption of machine vision systems becomes imperative. Additionally, the rise of Industry 4.0 and the increasing integration of automation technologies drive the demand for advanced machine vision solutions. Furthermore, the advent of artificial intelligence and deep learning algorithms empowers machine vision systems to deliver unprecedented levels of accuracy and reliability, further fueling market growth. Moreover, the expanding application areas of machine vision, spanning automotive, electronics, pharmaceuticals, and logistics, contribute to its robust market trajectory. Overall, the combination of technological innovation, industry demand, and the pursuit of excellence propels the growth of the machine vision market.

In 2023, the hardware segment held the largest share of revenue, accounting for over 63% and is expected to maintain its dominance throughout the forecast period. The market is categorized into hardware, software, and services segments based on offerings.

Hardware components encompass various items including cameras, sensors, processors, frame grabbers, LED lighting, and optics. Cameras contributed the most to revenue in 2023, primarily due to the rising demand for CMOS imaging sensors. Within the hardware segment, further breakdown is observed based on the specific components utilized in machine vision systems, including camera, frame grabber, optics, LED lighting, and processor sub-segments.

Software offerings are divided into barcode reading, standard algorithm, and deep learning software sub-categories. Barcode reading involves the assessment of barcode image quality before and after printing. Machine vision software establishes parameters and standards aligned with International Organization for Standardization (ISO) guidelines to ensure barcode verification quality. Barcodes consist of bars and spaces, with scanners interpreting the code for accuracy. The barcode reading segment is projected to witness substantial growth from 2024 to 2033, registering a significant CAGR

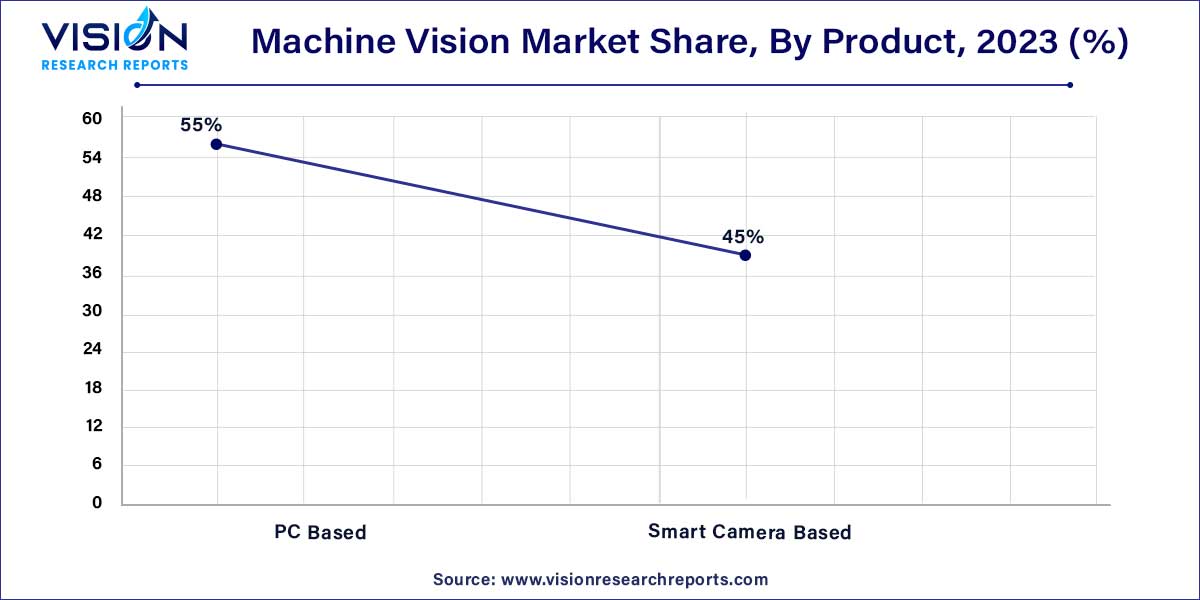

The product segment is further divided into PC-based and smart camera-based systems. In 2023, the PC-based segment held a market share exceeding 55% globally and is expected to grow at a CAGR of nearly 12.45% from 2024 to 2033. This segment is poised to maintain its growth trajectory and remain the market leader in terms of revenue during the forecast period.

On the other hand, smart camera-based systems are anticipated to demonstrate a robust growth rate over the forecast period, with the segment expected to experience the fastest growth from 2024 to 2033. This significant expansion is primarily attributed to the increasing adoption of cameras in 3D imaging applications.

Machine vision systems, also known as vision systems, comprise multiple cameras that are often mounted above assembly lines to observe, inspect, and capture data on products as needed. This trend is driving the growing adoption of smart cameras within these systems

In 2023, the quality assurance and inspection segment captured the largest market share, surpassing 52% globally, and is projected to maintain a robust CAGR of 12.4% from 2024 to 2033. Regarding application, the market is segmented into quality assurance and inspection, positioning and guidance, measurement, identification, and predictive maintenance.

These systems play a crucial role in scanning and identifying labels, barcodes, and texts, particularly within the packaging sector. This automation streamlines packaging processes, saving time, minimizing errors, and enhancing overall efficiency.

Machine vision technology finds extensive applications in sectors such as consumer goods, pharmaceuticals, and packaging. Its adoption in these industries has notably reduced the prevalence of counterfeit products, contributing significantly to the market's growth and fostering increased adoption across various sectors

In 2023, the automotive sector emerged as the dominant end-use industry, commanding over 20% of the global market share, with expectations of a noteworthy CAGR from 2024 to 2033. The market is segmented based on end-use industries, including automotive, pharmaceuticals and chemicals, electronics and semiconductors, pulp and paper, printing and labeling, food and beverage (packaging and bottling), glass and metal, postal and logistics, and others. Currently, the automotive sector stands as the largest adopter of machine vision systems worldwide and is poised for steady growth throughout the forecast period.

The food and beverage industry is anticipated to witness the highest growth rate during the forecast period. Machine vision systems play a significant role in packaging and bottling operations within this sector. Following closely behind the food and beverage segment, substantial growth is expected in the pharmaceuticals and chemicals, printing and labeling, and other industry verticals, encompassing agriculture, rubber and plastic processing, solar paneling, machinery and equipment, as well as security and surveillance.

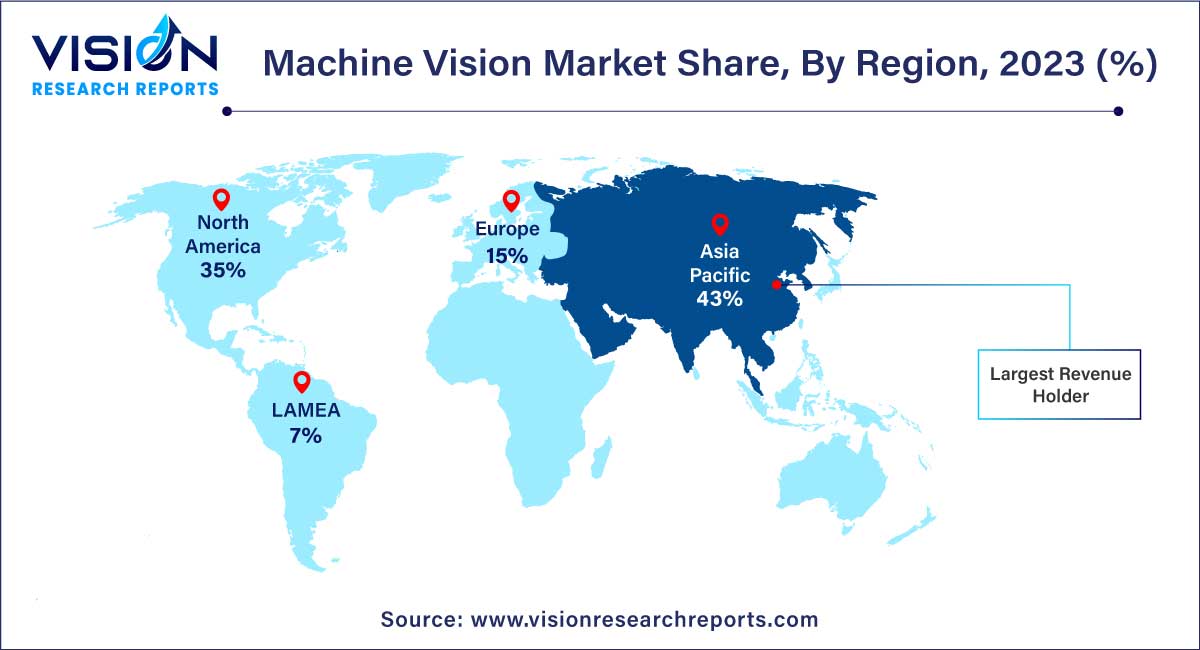

In 2023, Asia Pacific emerged as the dominant force in the market, commanding a substantial revenue share of over 43%. The region is poised for robust growth from 2024 to 2033, driven by lucrative opportunities in automotive, packaging, pharmaceutical, and various other industrial applications.

The significant market share and growth in the Asia Pacific region can be attributed to its burgeoning status as a global manufacturing hub. This trajectory is expected to propel the adoption of machine vision technology significantly throughout the forecast period. Countries like China and Japan stand out as key players, offering extensive opportunities for both emerging and mature technologies such as machine vision. The diverse range of manufacturing industries within these nations plays a pivotal role in driving regional economic growth and prosperity.

By Offering

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others