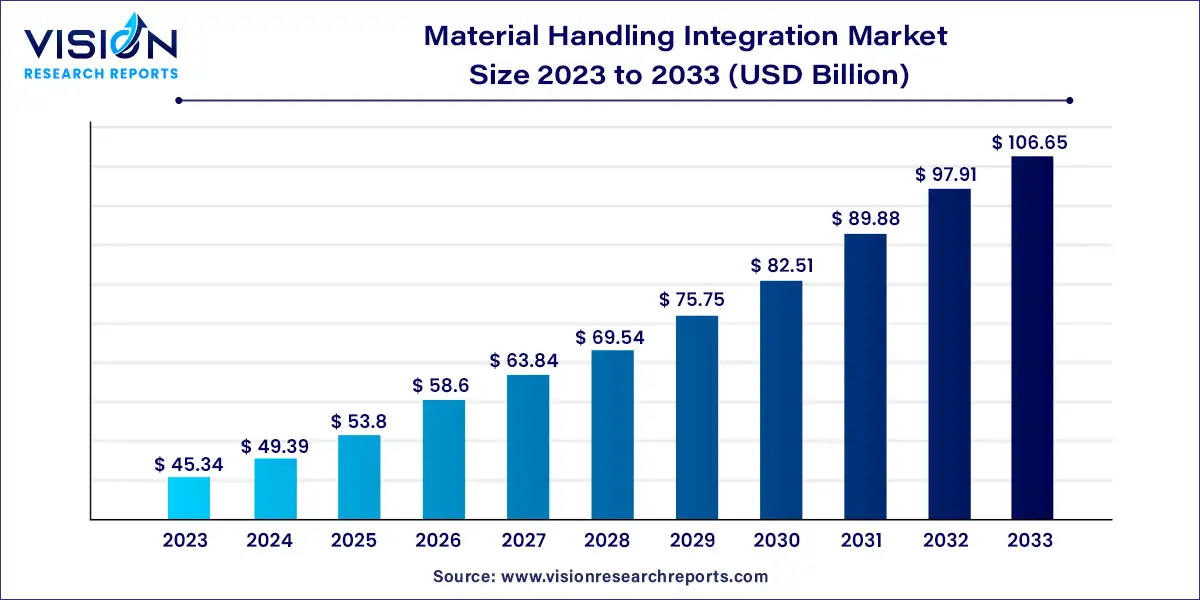

The global material handling integration market size was estimated at around USD 45.34 billion in 2023 and it is projected to hit around USD 106.65 billion by 2033, growing at a CAGR of 8.93% from 2024 to 2033.

The material handling integration market is a dynamic sector driven by the increasing demand for efficient and automated solutions across various industries. With the rapid growth of e-commerce, manufacturing, and logistics sectors, there is a pressing need for streamlined processes to handle goods and materials effectively.

At its core, material handling integration involves the seamless integration of equipment, technologies, and systems to optimize the flow of materials throughout the supply chain. This encompasses a wide range of solutions, including conveyor systems, robotics, automated guided vehicles (AGVs), warehouse management systems (WMS), and software platforms.

The growth of the material handling integration market is propelled by the rising demand for automation across various industries to improve efficiency and reduce operational costs. This demand is particularly evident in sectors such as manufacturing, e-commerce, and logistics, where streamlined processes are essential for handling goods effectively. Secondly, technological advancements, including robotics, AI, and IoT, are driving innovation in material handling systems, enabling greater flexibility and intelligence in handling diverse materials and tasks. Additionally, the surge in e-commerce activities has led to an increased need for efficient order fulfillment and distribution processes, further fueling the adoption of material handling integration solutions. Moreover, the focus on workplace safety and ergonomics has prompted organizations to invest in automated solutions to minimize the risk of injuries and improve worker well-being. Lastly, the optimization of supply chain processes through material handling integration is crucial for reducing lead times, minimizing inventory levels, and enhancing order accuracy, thereby driving market growth.

| Report Coverage | Details |

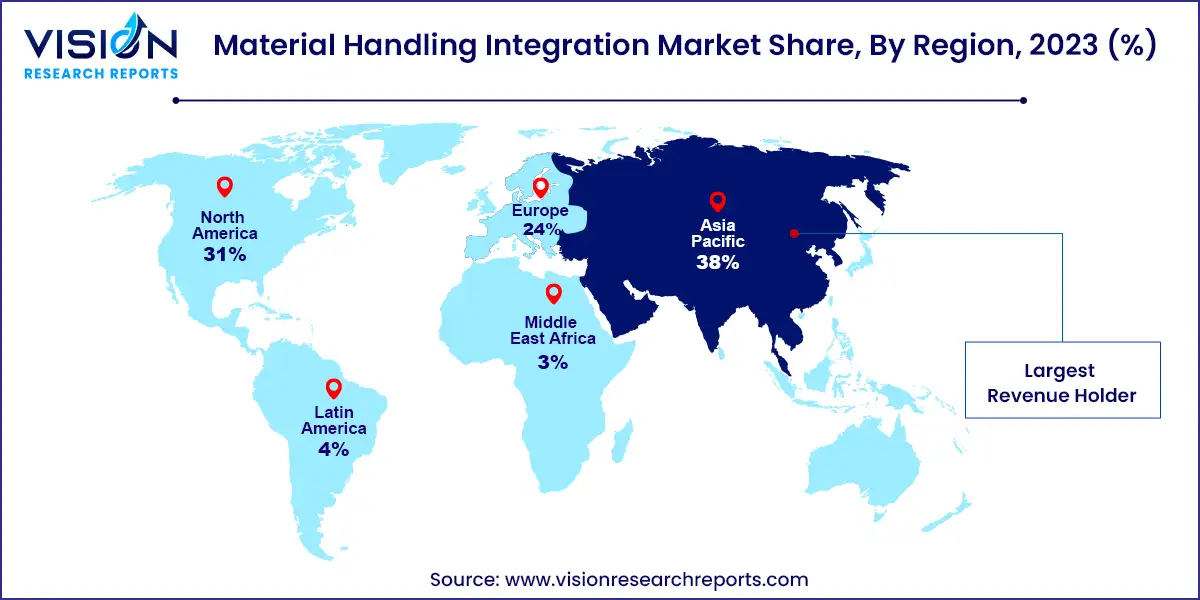

| Revenue Share of Asia Pacific in 2023 | 38% |

| CAGR of North America from 2024 to 2033 | 10.38% |

| Revenue Forecast by 2033 | USD 106.65 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of component, the market is segmented into hardware, software, and services. The hardware segment led the global market in 2023 with a revenue share of more than 70%. The hardware segment is further categorized as Automated Storage and Retrieval Systems (AS/RS), conveyors, Automated Guided Vehicles (AGVs), and robotics. Hardware in the material handling integration industry refers to the physical equipment and devices used to facilitate the movement, storage, and control of materials within various industries.

The hardware is integrated with the material handling integration software solutions to provide a comprehensive view of the material handling process across a warehouse or distribution center. Market players provide hardware solutions, such as AGVs and AMRs, for material handling and launching new products. Increasing automation across multiple industries and the availability of a wide range of material-handling hardware products are likely to drive the growth of the hardware segment.

The services segment is anticipated to witness the fastest CAGR of 9.44% throughout the forecast period. The material handling integration services encompass two main categories: professional and managed services. As businesses across various industries adopt warehouse automation technologies, the demand for material handling integration services is increasing. This demand is primarily driven by the complexities involved in integrating and implementing material handling systems effectively. To enhance customer experience, the majority of the players in the market offer services that cater to their specific needs.

Based on application, the market is segmented into assembly, conveyance, transportation, packaging, and others. Among these, the transportation segment dominated the market in 2023 with a revenue share of more than 27%. Assembly refers to combining separate components to create a final product. For example, fitting tires into cars before shipment involves assembly. In warehouse operations, assembly lines are commonly used, where product parts are passed along the line and assembled at different stages until the final product is completed.

The increasing complexity of products and the need for agile assembly processes drive the adoption of solutions that integrate material handling. Material handling equipment such as conveyors and Automated Storage and Retrieval Systems (AS/RS) are utilized in assembly lines. Conveyors enhance the assembly process flow, while AS/RS systems can store workpiece components during assembly for future production. AccuBilt, Inc., a U.S.-based automation integration service provider, offers a range of assembly and material handling products for various applications, including Pick and Place (PNP).

The packaging segment is anticipated to witness the fastest CAGR of 10.46% throughout the forecast period. Packaging is crucial to safeguarding materials during storage, distribution, and transportation. It encompasses various components, such as pallets, dunnage, unitizers, and containers, employed in manufacturing and warehouse settings. These packaging components come in diverse sizes, shapes, and materials. With the rise of e-commerce, businesses are increasingly offering customized packaging options to provide optimal shopping experiences for customers.

Based on vertical, the market is divided into retail & e-commerce, automotive, healthcare, food & beverages, transportation & logistics, manufacturing, and others. The retail & e-commerce segment led the market in 2023 with a revenue share of more than 24%. The retail and e-commerce segment involves the sale of goods or services to end-consumers, either through physical brick-and-mortar stores or online marketplaces. This sector has experienced significant disruptions in recent years, with a booming online retail industry and increasing adoption of omnichannel distribution.

Retailers encounter various challenges, such as meeting customer expectations for a seamless experience across channels, faster order-to-delivery cycles, and a rise in returns due to the surge in e-commerce. In response to these challenges, there is a high demand for efficient, error-free order processing in the retail and e-commerce sectors. This has driven the adoption of solutions that integrate material handling to manage changing consumer behavior and support the growth of e-commerce. Material handling integration solutions provide businesses with cost reduction and efficiency improvement opportunities.

The food & beverages segment is anticipated to grow at a considerable CAGR of 11.27% throughout the forecast period. The food and beverage industry encompasses businesses involved in processing, packaging, and distributing raw food materials. This industry handles a wide range of products, including packaged, fresh, prepared foods and non-alcoholic and alcoholic beverages. To ensure product quality and freshness, the industry strongly emphasizes spoilage prevention and the use of multi-temperature environments. In addition, handling fresh products and managing the replenishment of essential items present complexities within this sector.

Asia Pacific led the overall market in 2023, with a revenue share of 38%. Asia Pacific is a region with significant potential, accounting for approximately 60% of the global population and hosting several developing economies with a promising technology infrastructure. The increasing penetration of the internet and smartphones in the region has resulted in a significant boost in e-commerce sales. Countries such as Australia, Singapore, South Korea, and Japan exhibit high levels of technology adoption.

Several national governments in the region are actively taking initiatives to promote automation across industries. For example, the Singapore government introduced the Integrated Robotics & Automation Solutions initiative. This initiative aimed to provide financial support to construction companies adopting robotics and automation solutions to address workforce shortages in Singapore. The region is witnessing growing investments in technology and automation, alongside the rapid expansion of the e-commerce sector. These factors are expected to drive the growth of the material handling integration industry in the Asia Pacific.

North America is anticipated to grow at the fastest CAGR of 10.38% during the forecast period. North America stands as a highly technologically advanced region, characterized by a vibrant presence of numerous technology companies and widespread internet and smartphone usage. The region is also home to a considerable number of solution providers specializing in integrating material handling systems. Governments, particularly in the United States and Canada, actively support developments in this field by investing in research and development (R&D) to drive innovation. As per the Association for Advancing Automation (A3), North American companies witnessed an approximately 11% increase in robot orders in 2023, with a total of 44,196 units ordered.

By Component

By Application

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Material Handling Integration Market

5.1. COVID-19 Landscape: Material Handling Integration Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Material Handling Integration Market, By Component

8.1. Material Handling Integration Market, by Component, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Material Handling Integration Market, By Application

9.1. Material Handling Integration Market, by Application, 2024-2033

9.1.1. Assembly

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Conveyance

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Transportation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Packaging

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Material Handling Integration Market, By Vertical

10.1. Material Handling Integration Market, by Vertical, 2024-2033

10.1.1. Retail & E-commerce

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Automotive

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Transportation & Logistics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Food & Beverages

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Manufacturing

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Material Handling Integration Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Vertical (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 12. Company Profiles

12.1. Daifuku Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Jungheinrich AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cargotec.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. KION GROUP AG.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Honeywell International Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SSI SCHAEFER

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. KNAPP AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. TGW Logistics Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Fives.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. FORTNA Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others