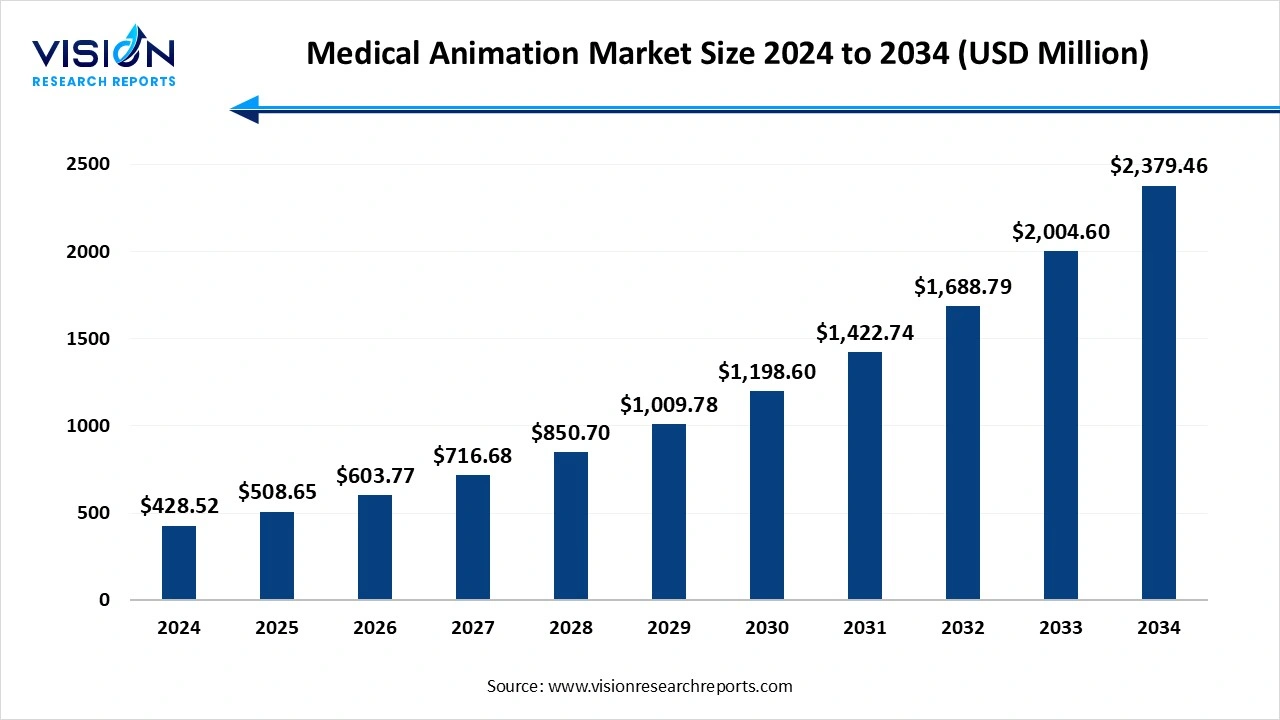

The global medical animation market size stood at USD 428.52 million in 2024 and is estimated to reach USD 508.65 million in 2025. It is projected to surge past USD 2,379.46 million by 2034, registering a robust CAGR of 18.7% from 2025 to 2034. The growing need for effective medical education and communication has increased adoption by pharmaceutical and life sciences companies. Rising demand for patient education and advanced research use.

A medical animation is a creation of scientifically accurate, computer-generated visuals that explain complex medical concepts, procedures, and products for a professional audience. Designed for healthcare professionals, surgeons, and medical equipment manufacturers, these detailed animations are used for international presentations, product demonstrations, investor pitches, and surgical and anatomical training.

Improvements in animation software and tools are leading to more detailed, realistic, and interactive medical animations. The 3D animation studios are creating visually rich 3D animations that accurately depict diseases and cellular pathways, making complex concepts easier to grasp for various audiences. Augmented and virtual reality are being used to create immersive experiences, such as exploring the human brain in real time or providing training for surgical procedures. AI is integrated to improve workflow, automate tasks, and speed up production while maintaining scientific accuracy.

| Report Coverage | Details |

| Market Size in 2024 | USD 428.52 million |

| Revenue Forecast by 2034 | USD 2,379.46 million |

| Growth rate from 2025 to 2034 | CAGR of 18.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | INFUSE MEDIA GROUP, LLC., DG INTERACTIVE, LLC, Medmovie.com, Intervoke, Nucleus Medical Media, Ghost Productions, Inc., Radius Digital Science, XVIVO, Scientific Animations, Epic Systems Corporation, Trinsic Animation, MAKE. |

The increasing complexity of medical information and the industry's shift towards digital-first communication strategies. Medical animations effectively simplify intricate concepts for both healthcare professionals and patients, improving understanding and engagement. This rise is further fueled by the proven effectiveness of visuals in marketing and education, enhancing audience retention and building brand trust.

Creating high-quality medical animations requires specialized skills and software, leading to significant costs for premium content. This can be a barrier for smaller organizations or those with limited budgets.

North America dominated the Medical Animation market in 2024, and the region is expected to sustain the position during the forecast period. The region's strong healthcare infrastructure includes advanced healthcare facilities that have the financial resources to adopt high-quality medical animation. The North America region is home to many of the world's largest and most innovative life science companies, medical device manufacturers, and pharmaceutical corporations. High investment in research and development in drug mechanisms of action, innovation in complex fields. Proactive adoption of advanced technologies, such as AI integration and mobile platforms, fuels the market growth.

United States Medical Animation Market Trends

The shift towards highly detailed and realistic visualization, particularly for demonstrating complex medical procedures, drug mechanisms of action, and anatomical structure, drives the market growth. Medical animations are highly effective in explaining complex medical information to patients, improving understanding and adherence to treatments. Improved medical training and education, innovations in 3D animation software, visualization tools, and emerging technologies like augmented reality (AR) and virtual reality (VR) are enhancing content realism and user engagement, and integration in medical marketing fuels the market growth.

Asia Pacific expects significant growth in the medical animation market during the forecast period. The rise in the use of sophisticated animation types, such as 3D animation and realistic visuals, helps demonstrate intricate anatomical structures and complex surgical procedures, while 4D is used in medical simulation. The increasing demand for effective medical education and training, such as increasing medical complexity, e-learning and digital health platforms, and growth in academic and research institutions. There are various applications in pharmaceutical and biotech marketing, patient engagement and education, and surgical planning and training that drive the market growth.

Why did the 3D Animations Segment Dominate the Medical Animation Market?

The 3D animations segment dominated the medical animation market in 2024. The 3D animation creates a dynamic and accurate representation of anatomical structures, surgical procedures, and physiological processes. This offers a multi-perspective view of complex systems that is impossible to achieve with 2D models or static images. Life science and pharmaceutical companies use 3D animation to showcase products to potential investors, regulators, and sales teams. The format is particularly effective at explaining the detailed mechanism of action (MoA) for a new drug at the cellular and molecular levels.

The 4D animation segment is the fastest-growing in the medical animation market during the forecast period. The 4D animation can illustrate surgical procedures and dynamic physiological processes, such as blood flow or breathing mechanics, in real-time, greatly improving medical simulation and training. Companies like 4D Medical are developing 4D X-ray imaging technology that provides a real-time, four-dimensional view of lung motion, which can lead to earlier and more accurate disease detection. In cancer treatment, 4D imaging helps track tumor movement during breathing for more precise radiation therapy.

How the Oncology Segment hold the Largest Share in the Medical Animation Market?

The oncology segment held the largest revenue share in the medical animation market in 2024. Cancer involves a highly complex biological process, such as tumor growth and the integration of the immune system. Rising cancer prevalence and research in oncology. Oncology animations are essential tools for educating oncologists, medical students, and other healthcare professionals about intricate cancer treatment mechanisms, surgical techniques, and ongoing research.

The plastic surgery segment is experiencing the fastest growth in the market during the forecast period. The rising demand for minimally invasive procedures and aesthetic enhancements. A growing aging population and focus on aesthetic appearance, enhanced patient communication and education, and advanced surgical training and planning drive the market growth. Medical animations serve as powerful marketing tools for plastic surgery clinics and specialists. Visually demonstrating successful procedures and the expertise of surgeons through animations helps attract new patients and build a strong brand presence in a competitive market.

How the Drug Mechanism of Action (MoA) Segment hold the Largest Share in the Medical Animation Market?

The drug mechanism of action (MoA) segment held the largest revenue share in the medical animation market in 2024. The indispensable role in simplifying complex pharmaceutical processes for diverse audiences. By providing clear, visual explanations of how drugs work at the cellular and molecular levels, MoA animations enhance understanding and communication for healthcare professionals, investors, and patients. This application is crucial for securing regulatory approvals and successfully marketing new therapeutic products.

The patient education segment is experiencing the fastest growth in the market during the forecast period. Animations simplify complex medical concepts into digestible visual formats that enhance patient comprehension and engagement. This visual clarity boosts patient understanding and adherence to treatment plans, leading to improved health outcomes. Technological advancements, such as 3D and AR/VR, also enable more engaging, immersive, and accessible educational content for a wide audience through digital platforms.

How the Hospitals Segment hold the Largest Share in the Medical Animation Market?

The hospitals segment held the largest revenue share in the medical animation market in 2024. The medical animations are widely used in hospitals to train doctors, nurses, and medical students. They offer a visually engaging and immersive learning experience for mastering anatomical structures, surgical techniques, and the use of medical devices. Hospitals utilize animations in their marketing initiatives and for patient outreach, simplifying complex medical concepts and promoting better health literacy within the community. Their various uses, such as patient education, surgical planning and training, and research communication, drive the market growth.

The life science companies segment is experiencing the fastest growth in the market during the forecast period. The increase in research and development activities for drugs and treatments directly translates to a higher need for medical animation of complex biological mechanisms, clinical trial data, and disease progression. Medical animations, especially 3D animations, provide a dynamic and visually realistic way to depict these complex concepts, improving comprehension for researchers, healthcare professionals, and patients alike.

By Type

By Therapeutic Area

By Application

By End-Use

By Region

Medical Animation Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Animation Market

5.1. COVID-19 Landscape: Medical Animation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Animation Market, By Type

8.1. Medical Animation Market, by Type

8.1.1. 3D Animation

8.1.1.1. Market Revenue and Forecast

8.1.2. 2D Animation

8.1.2.1. Market Revenue and Forecast

8.1.3. 4D Animation

8.1.3.1. Market Revenue and Forecast

8.1.4. Flash Animation

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Medical Animation Market, By Therapeutic Area

9.1. Medical Animation Market, by Therapeutic Area

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Cardiology

9.1.2.1. Market Revenue and Forecast

9.1.3. Plastic Surgery

9.1.3.1. Market Revenue and Forecast

9.1.4. Dental

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Medical Animation Market, By Application

10.1. Medical Animation Market, by Application

10.1.1. Drug MoA

10.1.1.1. Market Revenue and Forecast

10.1.2. Patient Education

10.1.2.1. Market Revenue and Forecast

10.1.3. Surgical Training & Planning

10.1.3.1. Market Revenue and Forecast

10.1.4. Cellular & Molecular Studies

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Medical Animation Market, By End-Use

11.1. Medical Animation Market, by End-Use

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast

11.1.2. Life Science Companies

11.1.2.1. Market Revenue and Forecast

11.1.3. Academic Institutes

11.1.3.1. Market Revenue and Forecast

11.1.4. Medical Device Manufacturers

11.1.4.1. Market Revenue and Forecast

11.1.5. Others

11.1.5.1. Market Revenue and Forecast

Chapter 12. Global Medical Animation Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Therapeutic Area

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End-Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Therapeutic Area

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End-Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Therapeutic Area

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End-Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Therapeutic Area

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End-Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Therapeutic Area

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End-Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Therapeutic Area

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End-Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Therapeutic Area

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End-Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Therapeutic Area

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End-Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Therapeutic Area

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End-Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Therapeutic Area

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End-Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Therapeutic Area

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End-Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Therapeutic Area

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End-Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Therapeutic Area

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End-Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Therapeutic Area

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End-Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Therapeutic Area

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End-Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Therapeutic Area

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End-Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Therapeutic Area

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End-Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Therapeutic Area

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End-Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End-Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End-Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Therapeutic Area

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End-Use

Chapter 13. Company Profiles

13.1. INFUSE MEDIA GROUP, LLC.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DG INTERACTIVE, LLC

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Medmovie.com

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Nucleus Medical Media

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Ghost Productions, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Radius Digital Science

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. XVIVO

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Scientific Animations

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Epic Systems Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Trinsic Animation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others