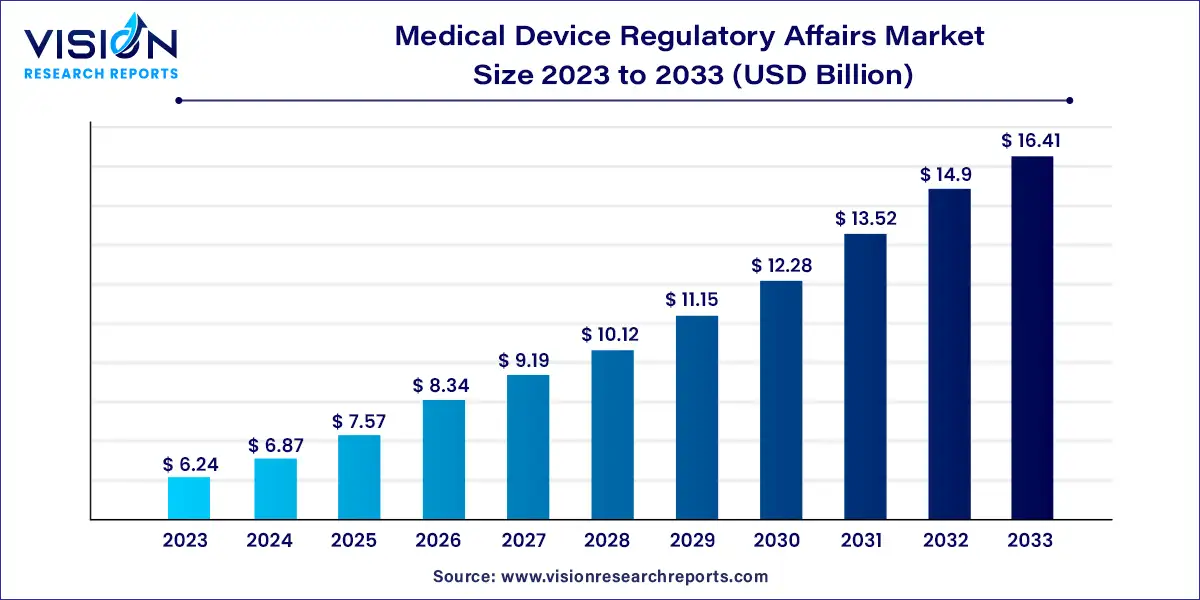

The global medical device regulatory affairs market size was estimated at around USD 6.24 billion in 2023 and it is projected to hit around USD 16.41 billion by 2033, growing at a CAGR of 10.15% from 2024 to 2033.

The global medical device regulatory affairs market plays a pivotal role in ensuring the safety, efficacy, and quality of medical devices worldwide. Regulatory affairs professionals navigate the complex landscape of regulations and standards to facilitate the development, approval, and marketing of medical devices while adhering to stringent compliance requirements. This overview delves into the key aspects and dynamics shaping the medical device regulatory affairs market.

The growth of the medical device regulatory affairs market is driven by an increasing global demand for medical devices driven by aging populations and rising prevalence of chronic diseases fuels the need for robust regulatory oversight to ensure product safety and efficacy. Additionally, technological advancements such as the emergence of innovative medical technologies, including digital health solutions and personalized medicine, necessitate agile regulatory frameworks capable of accommodating rapid innovation cycles. Moreover, expanding market access opportunities in emerging economies coupled with efforts to harmonize regulatory standards globally create new avenues for market growth. Furthermore, heightened focus on patient safety and risk management fosters greater emphasis on regulatory compliance throughout the product lifecycle, driving demand for regulatory expertise and services.

In 2023, the regulatory writing and publishing sector emerged as the market leader, capturing the largest revenue share of 37%. The market is categorized into various services, including regulatory consulting, legal representation, regulatory writing and publishing, product registration and clinical trial applications, and other ancillary services. The substantial share of the regulatory writing and publishing segment is attributed to its provision of crucial services spanning from the early stages of product development to premarket approval. High-quality documentation is indispensable in regulatory affairs to prevent delays in the approval process. Consequently, with the proliferation of products in development, the demand for these services is poised to escalate, thereby bolstering the growth of the medical device regulatory affairs market.

Forecasts suggest that the legal representation segment is poised for the swiftest growth, projected at 10.93% over the forecast period. This surge is likely fueled by the burgeoning need for legal representation services globally, propelled by the globalization of medical devices. Regulatory regulations are intricate and perpetually evolving, necessitating expert legal guidance. The shifting regulatory terrain, particularly in regions such as Asia Pacific, the Middle East & Africa, and Latin America, amplifies the demand for local experts adept at securing regulatory approvals and facilitating customs clearance. These factors collectively underpin the surging demand for legal representation services on a global scale.

In 2023, the therapeutics segment dominated the market with a commanding share of 56%. The market is categorized into therapeutics and diagnostics based on type, with the therapeutics segment projected to witness the swiftest compound annual growth rate (CAGR) of 10.43% during the forecast period. This accelerated growth can be attributed to the escalating prevalence of various chronic ailments such as cancer, diabetes, cardiovascular disorders, and respiratory ailments, spurring demand for advanced therapeutic devices. For instance, the increasing need for cutting-edge products like auto-injectors or pen needles to facilitate efficient insulin delivery in diabetic patients is driving growth within this segment.

Conversely, the diagnostics segment accounted for a share of 45% in 2023. The surge in chronic and infectious diseases is fostering demand for diagnostic solutions, thus bolstering the market for technologically advanced diagnostic devices. Furthermore, the past five years have witnessed a substantial number of diagnostic device launches. For instance, in July 2023, Canon Medical introduced the MRI machine Vantage Fortian, boasting enhanced scan technology and image quality. These developments are anticipated to spur demand for regulatory services catering to diagnostic devices

In 2023, the outsourcing segment emerged as the market leader, commanding a significant share of 58%. This dominance is primarily attributed to the prevalent absence of an in-house regulatory team among businesses. Moreover, the allure of advantages such as cost efficiency and time savings associated with outsourcing regulatory services further propels the growth of this segment. Additionally, the emergence of new regulatory hurdles, such as the European Medical Device Regulation (MDR) and In Vitro Diagnostic Device Regulation (IVDR), along with increased scrutiny on regulatory cybersecurity, complicates market launch timelines and recertification processes. Managing such challenges with inadequately skilled personnel poses immense difficulties for businesses, thus driving the demand for outsourced regulatory services.

Conversely, the in-house segment is forecasted to expand at a compound annual growth rate (CAGR) of 7.95% throughout the forecast period. Large biotechnology and medical device firms boast robust in-house regulatory affairs teams, owing to their diverse product portfolios, extensive pipelines, and the capacity to recruit skilled and experienced professionals. These factors underpin the strength of the in-house segment. However, there is a notable shift among these firms towards outsourcing regulatory services to concentrate on core competencies and alleviate capacity constraints. Consequently, the demand for in-house services is anticipated to witness a decline in the forthcoming years

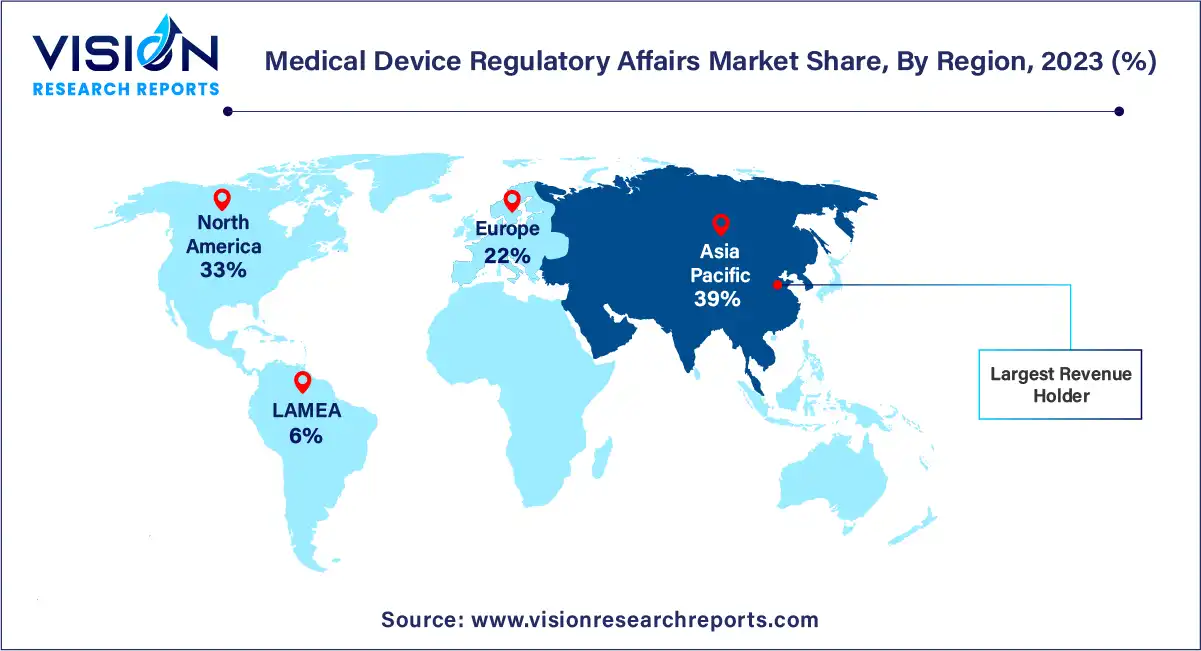

In 2023, Asia Pacific emerged as the dominant force in the medical device regulatory affairs market, commanding the largest revenue share of 39%. This supremacy can be attributed to several factors including an enhanced regulatory landscape, cost efficiencies, an upsurge in clinical trials conducted within the region, and a growing influx of medical device companies venturing into Asia Pacific. Moreover, the region benefits from a skilled workforce available at a lower cost compared to the U.S., further fueling market growth. Additionally, the escalating geriatric population, increasing prevalence of chronic diseases, and heightened government support for the healthcare sector are anticipated to drive demand for cost-effective medical devices in the region. Consequently, this surge in demand is expected to attract more market entrants, thereby heightening the need for regulatory services.

North America and Europe are poised to remain key players in the medical device regulatory affairs market. Both regions boast major international regulatory agencies—the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA)—which collectively regulate over half of all medical devices globally. The FDA, in particular, issues a myriad of guidelines for medical device manufacturers to facilitate compliance. Furthermore, North America is home to a plethora of medical device companies, many of which are outsourcing regulatory functions to service providers, thereby contributing to the growth of the regional market.

By Services

By Type

By Service Provider

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Device Regulatory Affairs Market

5.1. COVID-19 Landscape: Medical Device Regulatory Affairs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Device Regulatory Affairs Market, By Services

8.1. Medical Device Regulatory Affairs Market, by Services, 2024-2033

8.1.1 Regulatory Consulting

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Legal Representation

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Regulatory Writing & Publishing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Product Registration & Clinical Trial Applications

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other Services

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Medical Device Regulatory Affairs Market, By Type

9.1. Medical Device Regulatory Affairs Market, by Type, 2024-2033

9.1.1. Diagnostic

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Therapeutic

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Medical Device Regulatory Affairs Market, By Service

10.1. Medical Device Regulatory Affairs Market, by Service, 2024-2033

10.1.1. Outsource

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. In-house

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Medical Device Regulatory Affairs Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Services (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Service (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Service (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Services (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Service (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Service (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Services (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Service (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Services (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Service (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Services (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Service (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Service (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Services (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Service (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Services (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Service (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Service (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Services (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Service (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Services (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Service (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Service (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Services (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Service (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Services (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Service (2021-2033)

Chapter 12. Company Profiles

12.1. ICON, Plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Emergo

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Freyr

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Laboratory Corporation of America Holdings

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. IQVIA, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Intertek Group plc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SGS Société Générale de Surveillance SA

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Promedica International

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Integer Holdings Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Medpace

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others