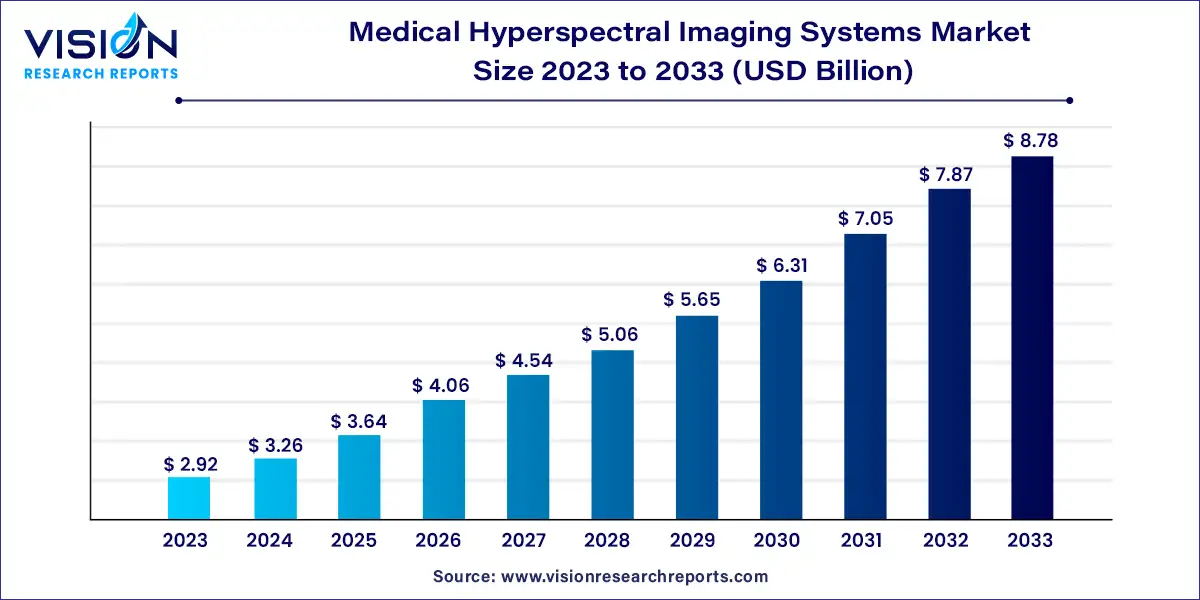

The global medical hyperspectral imaging systems market size was estimated at around USD 2.92 billion in 2023 and it is projected to hit around USD 8.78 billion by 2033, growing at a CAGR of 11.64% from 2024 to 2033.

In the modern medical diagnostics, the integration of cutting-edge technologies has revolutionized the landscape of disease detection and treatment. Among these innovations, hyperspectral imaging systems stand out as a promising tool offering multifaceted capabilities. This article delves into the dynamic landscape of the Medical Hyperspectral Imaging Systems Market, providing a comprehensive overview of its key aspects and emerging trends.

The growth of the medical hyperspectral imaging systems market is driven by several factors. Firstly, the increasing prevalence of chronic diseases, including cancer and cardiovascular disorders, underscores the need for precise diagnostic tools that can facilitate early detection and intervention. Additionally, ongoing technological advancements in hyperspectral imaging technology, such as the development of compact, high-resolution systems and the integration of artificial intelligence algorithms, enhance diagnostic accuracy and efficiency. Furthermore, the expanding applications of hyperspectral imaging across various medical specialties, such as dermatology, neurology, and oncology, contribute to market growth by addressing diverse clinical needs. Overall, these growth factors collectively drive the adoption and utilization of medical hyperspectral imaging systems, positioning the market for continued expansion in the foreseeable future.

The hyperspectral camera segment emerged as the market leader in 2023, commanding the largest share of revenue. Projections indicate it will experience the swiftest Compound Annual Growth Rate (CAGR) of 11.93% from 2024 to 2033. Hyperspectral cameras play a pivotal role in the medical domain, offering advanced imaging capabilities by capturing a wide array of spectral information across the electromagnetic spectrum. These cameras facilitate intricate analysis of biological tissues, organs, and physiological processes, leveraging their distinctive spectral signatures. With the ability to provide high-resolution spatial and spectral data simultaneously, hyperspectral cameras find extensive application in various medical scenarios, including disease diagnosis, tissue characterization, surgical navigation, and wound assessment.

Their remarkable capacity to detect subtle alterations in tissue properties enhances diagnostic precision and treatment effectiveness, heralding significant strides in personalized healthcare and clinical investigation. Noteworthy is the breakthrough showcased by imec, a leading research and innovation hub specializing in nanoelectronics and digital technologies, at the SPIE Photonics West biomedical optics and biophotonics exhibition in January 2023. imec introduced a promising advancement in the in-vivo detection of low-grade gliomas, a form of slow-growing brain tumors. This milestone was achieved by integrating Imec's SNAPSCAN VNIR 150 hyperspectral camera onto a standard OR-approved surgical microscope. The camera furnishes surgeons with precise clinical data, aiding them in accurately delineating intrinsic boundaries of brain tumors without necessitating labeling.

In 2023, the snapshot segment emerged as the market leader, securing the largest share of revenue. Projections indicate that it will experience the fastest Compound Annual Growth Rate (CAGR) of 12.23% from 2024 to 2033. Snapshot technology represents a significant advancement in hyperspectral imaging, capturing comprehensive hyperspectral datacubes in a single snapshot. This innovation offers instantaneous and detailed spectral information across a scene without the need for scanning, revolutionizing medical imaging practices.

For instance, in 2024, the Optica Publishing Group introduced a groundbreaking concept of a snapshot hyperspectral camera specifically tailored for retinal imaging. This camera design is particularly well-suited for ophthalmology, as it captures a broad spectral range and high-resolution images in a single snapshot. This capability minimizes motion artifacts while providing a comprehensive dataset suitable for analysis by human experts and machine algorithms.

In 2023, the medical diagnostics segment emerged as the market leader, capturing the largest share of revenue. Projections indicate that it will also achieve the fastest Compound Annual Growth Rate (CAGR) of 12.04% from 2024 to 2033. Medical hyperspectral imaging systems play a crucial role in diagnostics across diverse medical fields. For instance, in dermatology, they contribute to early detection of skin cancer by analyzing spectral signatures of lesions. In gastroenterology, they assist in identifying abnormal tissue growths within the gastrointestinal tract, while ophthalmology benefits from the detection of retinal diseases like diabetic retinopathy. These systems furnish detailed spectral information essential for precise diagnosis, guiding treatment decisions, and ultimately, improving patient outcomes.

These findings underscore the effectiveness of hyperspectral imaging in diagnosing and differentiating gastric cancer types, highlighting its potential for enhancing medical diagnosis and treatment. With their non-invasive nature and high accuracy, medical hyperspectral imaging systems are revolutionizing medical diagnostics, providing clinicians with powerful tools for detecting and managing various diseases and conditions. Furthermore, these advanced imaging systems offer detailed spectral analysis capabilities, enabling precise identification and characterization of pharmaceutical products and ingredients. In quality assurance, hyperspectral imaging contributes to the detection of contaminants, impurities, or defects in medications, thereby ensuring product safety and efficacy.

The hospitals & clinics end-use segment dominated the market in 2023, accounting for the largest share of 49% of the overall revenue. These healthcare facilities extensively utilize hyperspectral imaging systems across various diagnostic and therapeutic applications spanning multiple medical specialties. Hospitals rely on these systems for precise disease diagnosis, including cancer, dermatological conditions, and gastrointestinal disorders. Furthermore, clinics integrate hyperspectral imaging into surgical procedures to enable real-time tissue characterization and identification of pathological tissues.

The versatility and accuracy of hyperspectral imaging systems render them invaluable tools for enhancing patient outcomes and driving medical research in hospitals & clinics worldwide. Conversely, the pharmaceutical & biotechnology companies segment is poised to exhibit the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. These companies leverage hyperspectral imaging systems to analyze pharmaceutical formulations, evaluate drug efficacy, and explore cellular & molecular interactions. By harnessing hyperspectral imaging technology, they streamline the drug discovery process, optimize manufacturing operations, and ensure the quality and safety of pharmaceutical products.

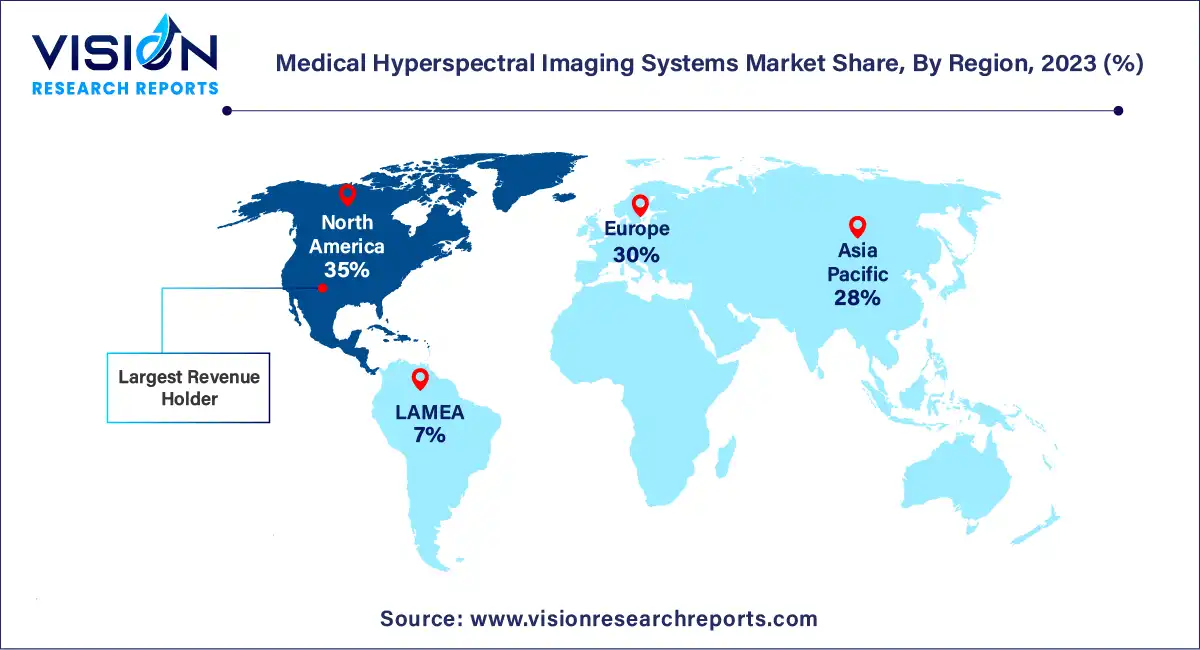

In 2023, the North America medical hyperspectral imaging systems market dominated with the largest share of 35%. This was primarily attributed to the region's well-established healthcare infrastructure and widespread adoption of advanced medical technologies. Additionally, the large patient population in the region drove demand for sophisticated diagnostic solutions. Supportive government initiatives aimed at fostering Research and Development (R&D) in the healthcare sector further propelled investments in the market.

Conversely, the Asia Pacific medical hyperspectral imaging systems market is anticipated to showcase the fastest Compound Annual Growth Rate (CAGR) of 12.75% from 2024 to 2033. This growth trajectory can be attributed to the escalating incidence of chronic diseases, coupled with the easy availability of non-invasive diagnostic techniques and advancements in imaging technology within the region. Moreover, governments in countries such as Japan, India, and China are heavily investing in healthcare infrastructure and technological advancements, which is expected to bolster regional market expansion.

By Product

By Technology

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Hyperspectral Imaging Systems Market

5.1. COVID-19 Landscape: Medical Hyperspectral Imaging Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Hyperspectral Imaging Systems Market, By Product

8.1. Medical Hyperspectral Imaging Systems Market, by Product, 2024-2033

8.1.1. Hyperspectral Camera

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Accessories

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Medical Hyperspectral Imaging Systems Market, By Technology

9.1. Medical Hyperspectral Imaging Systems Market, by Technology, 2024-2033

9.1.1. Snapshot

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Push Broom

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

Chapter 10. Global Medical Hyperspectral Imaging Systems Market, By Application

10.1. Medical Hyperspectral Imaging Systems Market, by Application, 2024-2033

10.1.1. Medical Diagnostics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Quality Assurance & Drug Testing

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Medical Hyperspectral Imaging Systems Market, By End Use

11.1. Medical Hyperspectral Imaging Systems Market, by End Use, 2024-2033

11.1.1. Hospitals & Clinics

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Research & Academic Institutes

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pharmaceutical and Biotechnology Companies

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Medical Hyperspectral Imaging Systems Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 13. Company Profiles

13.1. Imec

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Specim (Konica Minolta, Inc.)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. BaySpec, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Resonon Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Headwall Photonics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. HyperMed Imaging, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. XIMEA GmbH

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Cubert

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Diaspective Vision

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. ClydeHSI

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others