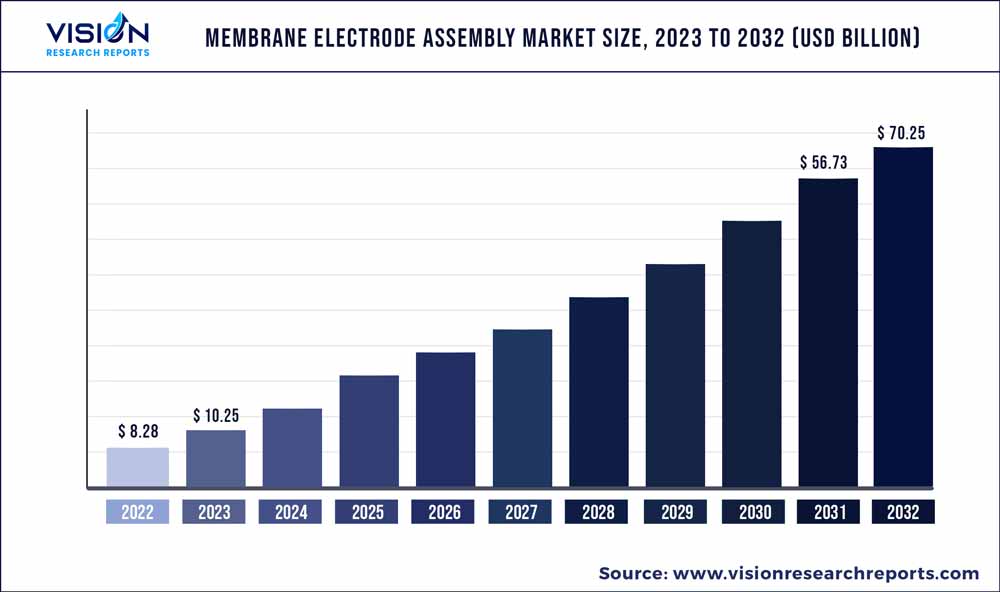

The global membrane electrode assembly market was surpassed at USD 8.28 billion in 2022 and is expected to hit around USD 70.25 billion by 2032, growing at a CAGR of 23.84% from 2023 to 2032. The membrane electrode assembly market in the United States was accounted for USD 2034.8 million in 2022.

Key Pointers

Report Scope of the Membrane Electrode Assembly Market

| Report Coverage | Details |

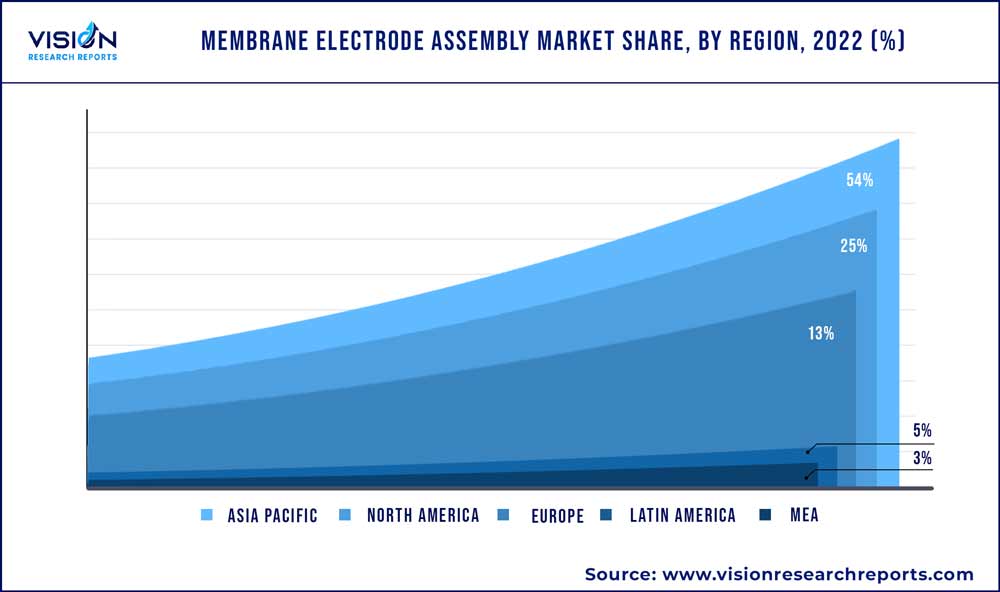

| Revenue Share of Asia Pacific in 2022 | 54% |

| Revenue Forecast by 2032 | USD 70.25 billion |

| Growth Rate from 2023 to 2032 | CAGR of 23.84% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Ballard Power Systems; W. L. Gore & Associates; Inc.; Danish Power Systems; BASF SE; Giner Inc.; FuelCellsEtc; IRD Fuel Cells; Greenrity GmBH; Plug Power Inc.; Hyplat; The Chemours Company; Sainergy; Yangtze Energy Technologies; Inc.; Wuhan WUT New Energy Co. Ltd; YuanBo Engineering Co., Ltd |

Increasing demand for clean and renewable energy sources is driving the membrane electrode assembly (MEA) market. MEAs are one the major materials in electricity generation through a clean and efficient electrochemical process, emitting only water and heat as byproducts. This makes MEAs a desirable solution for reducing greenhouse gas emissions and mitigating the impacts of climate change, which is a top priority for many countries and industries. As a result of the growing global demand for fuel cells, governments around the world are investing in fuel cell research and development and implementing policies and incentives to promote the use of fuel cells. This, in turn, is stimulating investment and growth in the MEAs market, leading to the development of new applications and the commercialization of existing technologies.

Rising demand for fuel cell systems owing to growing environmental concerns and strict regulations, specifically in North America and Europe to tackle increasing carbon emissions is expected to foster demand for the membrane electrode assembly market.

The U.S. is among the early endorser of clean energy solutions in the power generation and transportation sectors owing to the growing importance being given to clean energy solutions as per the energy act introduced by the government of the country. The increasing adoption of fuel cell vehicles in the United States is creating new opportunities for the MEA market, particularly in the transportation sector, as governments and consumers demand more sustainable and efficient modes of transportation.

Most of the states in the U.S., including California and New York, have set mandates to limit the carbon emissions from their commercial and industrial end users. This has resulted in end users opting for clean energy technologies to comply with these mandates and limit their carbon footprint. Bloom Energy, one of the major proton exchange fuel cell vendors in the U.S., provides its bloom energy servers for power generation applications to aid commercial and industrial end users limit their carbon footprint.

Governments across the region are anticipated to increase the expansions by offering support in numerous forms, including suitable financing programs and funding research activities. The impact of COVID-19 pandemic has affected the PEMFC market by disrupting the supply chain and affected the demand and production segment.

Product Insights

Based on the product segment, the membrane electrode assembly market has been segmented into 3-Layer Membrane Electrode Assembly, 5-Layer Membrane Electrode Assembly, and others. 3-Layer Membrane Electrode Assemblies accounted for the largest market of 49% in 2022 owing to major application in proton exchange membrane electrolyzers which facilitate the electrochemical reactions in hydrogen production. 3-Layer Membrane Electrode Assemblies consist of platinum cathode and iridium anode which are applied in the membrane for increasing hydrogen production.

5-Layer Membrane Electrode Assembly is also expected to grow at a significant rate due to the adaptability of its catalyst which allows quicker MEA functioning and fabrication. Others segment include custom membrane electrode assemblies which are manufactured according to the electrochemical cell’s specifications in terms of shape and size.

Application Insights

Based on application, the membrane electrode assembly market has been segmented into PEMFC, DMFC, Electrolyzers, and Hydrogen / Oxygen Fuel Cells. In terms of revenue, PEMFC accounted for the largest share of 33% in the market in 2022. The product is broadly used in automobiles, forklifts, telecommunications, backup power systems, and primary systems. High efficiency and product versatility are expected to allow the PEMFC segment to maintain the foremost position.

The demand for fuel-cell vehicles in the automotive industry has been increasing owing to the rise in environmental pollution caused by fossil fuel-based vehicles. Fuel cell vehicles only emit water as a byproduct resulting which leads to zero harmful emissions.

The increasing sale and popularity of fuel cell vehicles are one of the major drivers aiding the growth of the MEAs market. The increasing inclination towards the usage of clean fuel key car manufacturers such as Nissan, Toyota, Hyundai, and Hydrogen / Oxygen Fuel Cells are moving towards fuel cell EVs that will enhance the trends of the PEMFC market in the future. Additionally, growing government policies and initiatives to control carbon emissions are anticipated to create profitable sales prospects for the industry.

This demand is projected to be generated by the successful trials conducted by automobile manufacturers such as Nissan, Honda, and Toyota on fuel cell-based cars in the market to the end users. Some of the highest-selling fuel cell vehicle models include Hyundai Nexo, Toyota Mirai, and Honda Clarity Fuel Cell.

Government authorities from various countries have implemented numerous policies to develop hydrogen-based fuel cell vehicles. The development of refueling facilities for automobiles is anticipated to boost the growth of the PEMFC application segment.

Regional Insights

The Asia Pacific accounted for 54% market share in the global membrane electrode assembly industry in 2022. Favorable government regulations in developed countries and eco-friendly objectives to remove the rate of emission will boost the demand for H2 power farms during the projection period.

Regulations to support the expansion of the fuel cell market are still being developed in nations like India, Australia, Singapore, and Malaysia. The primary source of fuel cell demand in India, Thailand, and Singapore is small-scale pilot studies and testing by research institutions and government entities. these factors are expected to fuel the growth of the MEA market during the forecast period.

The contribution of the PEMFC across the Asia Pacific is majorly owed to its extensive-ranging application in the DMFC segment. Apart from the commercial sectors, PEMFC sector is one of the key boulevards for MEA demand in the region.

The adoption of electrolyzers worldwide is likely to increase due to the rising demand for such vehicles. Additionally, rising investments in the APAC region to produce electricity using renewable sources are anticipated to support the expansion of the global electrolyzer market over the forecast period

Membrane Electrode Assembly Market Segmentations:

By Application

By Product

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Membrane Electrode Assembly Market

5.1. COVID-19 Landscape: Membrane Electrode Assembly Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Membrane Electrode Assembly Market, By Application

8.1. Membrane Electrode Assembly Market, by Application, 2023-2032

8.1.1. PEMFC

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. DMFC

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Electrolyzers

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Hydrogen / Oxygen Fuel Cells

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Membrane Electrode Assembly Market, By Product

9.1. Membrane Electrode Assembly Market, by Product, 2023-2032

9.1.1. 3-Layer Membrane Electrode Assemblies

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 5-Layer Membrane Electrode Assemblies

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Membrane Electrode Assembly Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by Product (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Product (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.2. Market Revenue and Forecast, by Product (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Product (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Product (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.2. Market Revenue and Forecast, by Product (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Product (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.2. Market Revenue and Forecast, by Product (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Product (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Product (2020-2032)

Chapter 11. Company Profiles

11.1. Ballard Power Systems

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. W. L. Gore & Associates

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Danish Power Systems

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. BASF SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Giner Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. FuelCellsEtc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. IRD Fuel Cell

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Plug Power Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Greenrity GmBH

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others