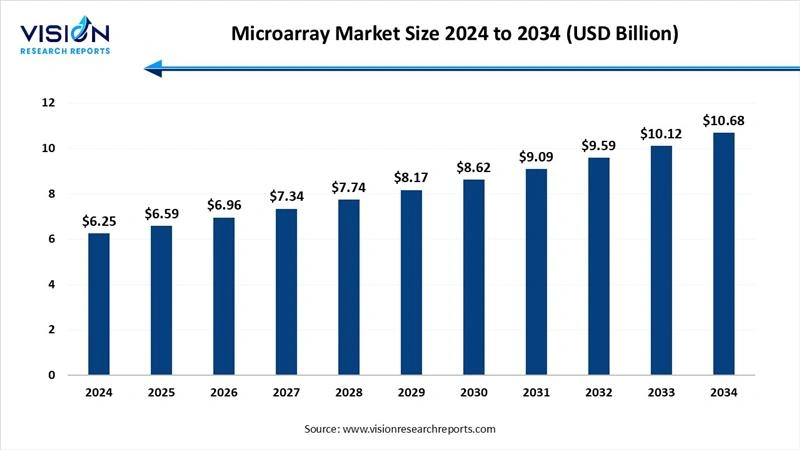

The global microarray market size was worth USD 6.25 billion in 2024 and is projected to reach approximately USD 6,59 billion in 2025. It is expected to grow further to USD 10.68 billion by 2034, with a CAGR of 5.5% over the forecast period. The increased research and development activities in genomics and proteomics, growing applications in oncology and diagnostics, and growing demand for personalized medicine fuel the market growth.

The microarray is a laboratory instrument used to analyze large collections of biological molecules, such as DNA, RNA, or proteins, in a high-throughput and simultaneous manner. The technology includes fixing thousands or millions of known probe molecules onto a solid surface, such as a glass or silicon chip, in an ordered grid pattern.

The rising global burden of chronic and infectious diseases fuels the demand for microarrays, particularly in diagnostics. The increasing incidence of cancer drives the need for microarrays in the detection, classification, and monitoring of disease progression. The rising prevalence of both chronic and infectious diseases, coupled with the increasing demand for accurate and timely diagnoses, personalized treatments, and deeper insights into disease mechanisms, drives the growth of the microarray market. As microarray technology continues to advance, its role in improving healthcare outcomes and accelerating disease research is expected to further solidify its market position.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.25 billion |

| Revenue Forecast by 2034 | USD 10.68 billion |

| Growth rate from 2025 to 2034 | CAGR of 5.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Affymetrix (Thermo Fisher Scientific), Agilent Technologies, Illumina, Inc., Bio-Rad Laboratories, GE Healthcare, PerkinElmer, Inc., Oxford Gene Technology (OGT), Roche Diagnostics, Siemens Healthineers, CapitalBio Corporation. |

The pharmaceutical and biotechnology sectors use microarrays for high-throughput screening of drug candidates. This helps in understanding gene expression patterns and predicting how individuals might respond to a specific drug, which expedites the drug development process.

The sheer volume, high dimensionality, and inherent technical and biological noise in microarray datasets. This complexity increases the cost and difficulty of analysis and interpretation, creating significant challenges that have been exploited by competing technologies like Next-Generation Sequencing (NGS). Microarray experiments generate vast amounts of data, requiring sophisticated analytical tools and skilled personnel for interpretation, which increases overall costs.

North America led the global microarray market, holding a dominant share of 49% in 2024. The region's well-established research institute and academic institutions contribute to microarray technologies. The high investment of the government and private sectors in genomics is a key area for microarray applications. North America's well-developed healthcare infrastructure and presence of major key players in the region drive market growth. Continuous innovation, including higher-density arrays, improved automation, and integration with bioinformatics and AI, keeps the region at the forefront of the market.

United States Microarray Market Trends

The innovation in microbiology technology, including high-density biochips, automation, and AI-driven data analysis, is enhancing sensitivity through output and efficiency, leading to broader applications. The rising demand for tailored medical treatments based on individual genomic makeup is boosting the adoption of microarray technology. Microarrays facilitate high-throughput screening and accelerate the discovery of new therapies. The increasing prevalence of conditions like cancer drives the need for advanced diagnostic tools and personalized treatment approaches.

Asia Pacific expects significant growth in the microarray market during the forecast period. The rising trends towards personalized medicine and the rising prevalence of genetic and chronic diseases in the regions advanced diagnostic methods of microarrays for effective diagnosis and treatment. Both government and private sectors are providing substantial funding for research in proteomics and genomics. This funding boosts the adoption of microarrays in academic institutions and research centers.

Why did the Consumables Segment Dominate the Microarray Market?

The consumables accounted for the largest share of the market, capturing 50% in 2024. Consumables, which include microarray slides, reagents, probes, and kits, represent a significant portion of the market. These components are essential for the preparation, hybridization, and detection processes involved in microarray experiments. As the demand for high-quality and reliable consumables increases, manufacturers are focusing on enhancing the sensitivity and specificity of these products to improve experimental outcomes.

The Instruments segment is the fastest-growing in the microarray market during the forecast period. The technological innovations are leading to greater automation, precision, and efficiency. Demand is further driven by the increasing need for high-throughput analysis in clinical diagnostics, especially for personalized medicine and chronic disease detection. This expansion is supported by significant R&D funding and advancements in bioinformatics for interpreting complex data. Major market players are capitalizing on these trends through strategic acquisitions and product development.

How the DNA Microarrays Segment hold the Largest Share in the Microarray Market?

The DNA microarrays segment held the largest revenue share in the microarray market in 2024. The DNA microarrays are a long-established and versatile technology for analyzing genes and DNA sequences, making them a preferred tool in scientific research. The technology is widely used to identify disease-related biomarkers, with significant adoption in fields such as oncology. They are used to identify specific gene mutations associated with cancer and other genetic diseases. Pharmaceutical and biotechnology companies use DNA microarrays to screen potential drug candidates and analyze their effects on gene expression, which helps in the development of new therapeutics. It has cost-effectiveness, widespread adoption in both research and clinical diagnostics, and broad applications.

The protein microarrays segment is experiencing the fastest growth in the market during the forecast period. It has a critical role in proteomics, which informs drug discovery and disease diagnostics. Technological advancements have enhanced efficiency, enabling high-throughput analysis for biomarker identification and personalized medicine. While other microarray types still hold significant market share, the increasing focus on protein function and therapeutic targets fuels accelerated expansion within the protein segment. This upward trend is expected to continue as research and clinical applications for protein arrays expand.

How the Research Application Segment hold the Largest Share in the Microarray Market?

The research application segment held the largest revenue share in the microarray market in 2024. The microarrays are used in various research fields to study gene expression, identify disease-related genes, and identify complex biological systems. There are many facilities for the identification of biomarkers associated with diseases and other biological states, which are crucial for both research and diagnostics. The microarrays play a crucial role in enabling personalized medicine by facilitating the identification of genetic variations that influence disease susceptibility, progression, and response to drug treatment.

The disease diagnostics segment is experiencing the fastest growth in the market during the forecast period. The rising worldwide burden of chronic diseases, including cancer and genetic disorders, rising demand for effective diagnostic tools. The trends towards personalized medicine and precision diagnostics, microarrays play a major role in identifying genetic variations and tailoring treatments for individual patients. The continuous technological advancement in microarray platforms and genomic research is enhancing their accuracy, sensitivity, and cost-effectiveness.

How the Research and Academic Institutions Segment hold the Largest Share in the Microarray Market?

The research and academic institutions segment held the largest revenue share in the microarray market in 2024. The continuous engagement in fundamental and advanced research, significant funding from government bodies, and grants allow these institutions to invest in the use of microarrays for basic and applied research. Academic institutions are early adopters of technologies like microarrays for genomic studies, drug discovery, and diagnostics. The large-scale use in gene expression profiling, genetic variation studies, and biomarker discovery.

The diagnostic laboratories segment is experiencing the fastest growth in the market during the forecast period. The rising prevalence of chronic and infectious diseases, particularly cancer and genetic disorders, is fueling the demand for accurate and timely diagnostic tools like microarrays. The need for comprehensive genetic information, cost-effectiveness, and enhanced accuracy and sensitivity. Their various application in clinical diagnostics, prenatal screening, autoimmune disease detection, cancer diagnosis, and infectious disease diagnostics fuel the growth.

By Product & services

By Type

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microarray Market

5.1. COVID-19 Landscape: Microarray Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microarray Market, By Product & services

8.1. Microarray Market, by Product & services

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast

8.1.2. Software and Services

8.1.2.1. Market Revenue and Forecast

8.1.3. Instruments

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Microarray Market, By Type

9.1. Microarray Market, by Type

9.1.1. DNA Microarrays

9.1.1.1. Market Revenue and Forecast

9.1.2. Protein Microarrays

9.1.2.1. Market Revenue and Forecast

9.1.3. Other Microarrays

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Microarray Market, By Application

10.1. Microarray Market, by Application

10.1.1. Research Applications

10.1.1.1. Market Revenue and Forecast

10.1.2. Drug Discovery

10.1.2.1. Market Revenue and Forecast

10.1.3. Disease Diagnostics

10.1.3.1. Market Revenue and Forecast

10.1.4. Other Applications

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Microarray Market, By End-use

11.1. Microarray Market, by End-use

11.1.1. Research & Academic Institutes

11.1.1.1. Market Revenue and Forecast

11.1.2. Pharmaceutical & Biotechnology Companies

11.1.2.1. Market Revenue and Forecast

11.1.3. Diagnostic Laboratories

11.1.3.1. Market Revenue and Forecast

11.1.4. Other End Users

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Microarray Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product & services

12.1.2. Market Revenue and Forecast, by Type

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End-use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product & services

12.1.5.2. Market Revenue and Forecast, by Type

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End-use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product & services

12.1.6.2. Market Revenue and Forecast, by Type

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End-use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product & services

12.2.2. Market Revenue and Forecast, by Type

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End-use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product & services

12.2.5.2. Market Revenue and Forecast, by Type

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End-use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product & services

12.2.6.2. Market Revenue and Forecast, by Type

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End-use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product & services

12.2.7.2. Market Revenue and Forecast, by Type

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End-use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product & services

12.2.8.2. Market Revenue and Forecast, by Type

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End-use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product & services

12.3.2. Market Revenue and Forecast, by Type

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End-use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product & services

12.3.5.2. Market Revenue and Forecast, by Type

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End-use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product & services

12.3.6.2. Market Revenue and Forecast, by Type

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End-use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product & services

12.3.7.2. Market Revenue and Forecast, by Type

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End-use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product & services

12.3.8.2. Market Revenue and Forecast, by Type

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End-use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product & services

12.4.2. Market Revenue and Forecast, by Type

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End-use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product & services

12.4.5.2. Market Revenue and Forecast, by Type

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End-use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product & services

12.4.6.2. Market Revenue and Forecast, by Type

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End-use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product & services

12.4.7.2. Market Revenue and Forecast, by Type

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End-use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product & services

12.4.8.2. Market Revenue and Forecast, by Type

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End-use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product & services

12.5.2. Market Revenue and Forecast, by Type

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End-use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product & services

12.5.5.2. Market Revenue and Forecast, by Type

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End-use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product & services

12.5.6.2. Market Revenue and Forecast, by Type

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End-use

Chapter 13. Company Profiles

13.1. Affymetrix (Thermo Fisher Scientific)

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Agilent Technologies

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Illumina, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bio-Rad Laboratories

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. GE Healthcare

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. PerkinElmer, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Oxford Gene Technology (OGT)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Roche Diagnostics

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Siemens Healthineers

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. CapitalBio Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others