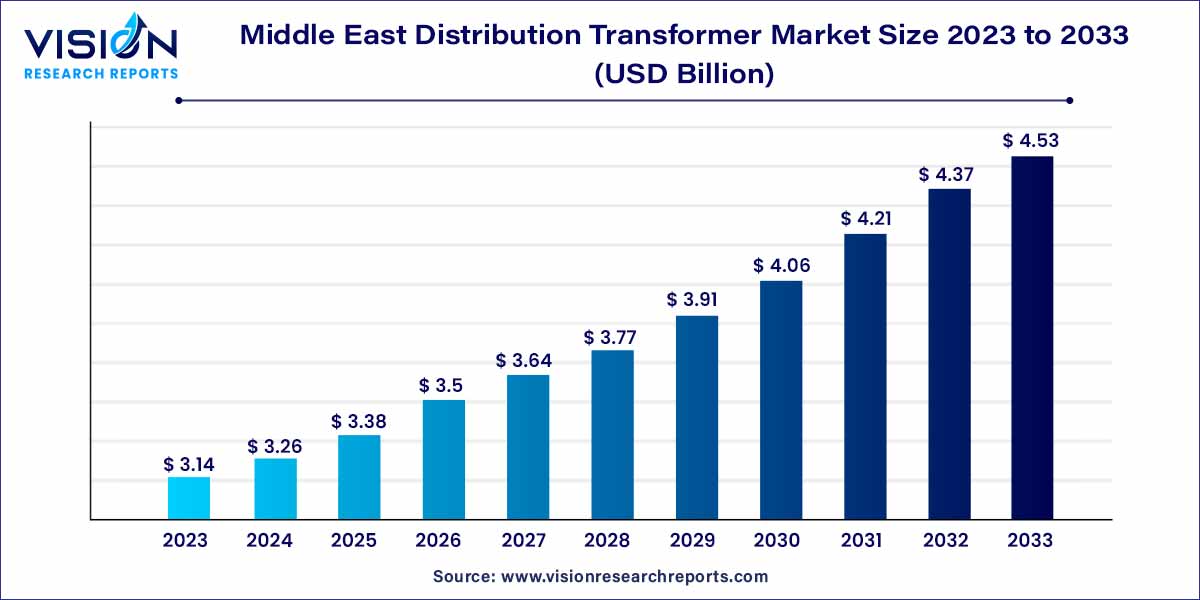

The Middle East distribution transformer market size was estimated at around USD 3.14 billion in 2023 and it is projected to hit around USD 4.53 billion by 2033, growing at a CAGR of 3.73% from 2024 to 2033. The increasing utilisation of smart grid systems could be the reason for the development. Moreover, throughout the course of the projected period, it is anticipated that the growing global requirement for sustainable energy will drive product demand.

The Middle East distribution transformer market stands as a pivotal component within the regional energy infrastructure, navigating a landscape defined by rapid economic growth, urbanization, and increasing energy demands. This overview provides a comprehensive insight into the key features and dynamics that shape the current state of the distribution transformer market in the Middle East.

The growth of the Middle East distribution transformer market is underpinned by a confluence of factors driving demand and shaping the regional energy landscape. The region's burgeoning population and rapid urbanization are significant catalysts, escalating the need for a robust energy distribution infrastructure. Governments in the Middle East are actively investing in the expansion and modernization of their power grids to meet the escalating energy demands arising from industrialization and increased urban living. Moreover, the integration of renewable energy sources and the adoption of smart grid technologies are pivotal growth factors, fostering a need for advanced distribution transformers to enhance efficiency and reliability. As sustainability becomes a focal point, the market is witnessing a shift towards eco-friendly and energy-efficient transformer solutions. These factors collectively propel the growth of the Middle East distribution transformer market, presenting opportunities for innovation and strategic advancements within the sector.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.14 billion |

| Revenue Forecast by 2033 | USD 4.53 billion |

| Growth rate from 2024 to 2033 | CAGR of 3.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Medium distribution Transformers, typically within a range of 316 kVA to 2,499 kVA, accounted for the largest revenue share of 45% in 2023 and is expected to grow at the fastest CAGR of 3.85% during the forecast period. It is attributed to the growing population in cities including Riyadh, Dubai, and Abu Dhabi. The high population migration rate in the cities above is also expected to spur regional market demand. Advancements in sustainable development have resulted in the adoption of advanced products with copper-silver alloy windings to prevent them from self-annealing.

The small transformers segment is anticipated to grow at a significant CAGR of 3.75% during the forecast period. Small distribution transformers have a power rating of 0- 315kVA and are primarily used in an area with low population density. Increasing substitution of traditional overhead products with smart grid compatible pole mounted small devices is expected to surge demand over the next seven years. The product suits several diversified powers and light industrial or commercial applications.

Rapid industrialization is expected to be a key factor that drives the larger transformer demand across the regional market. However, lack of transportation facilities in remote areas may pose a challenge owing to the bulky design of these products. Unit substations may also grow steadily due to low installation and maintenance costs.

The industry is expected to grow due to technologically advanced electrical equipment development. Developing various core materials and reducing core flux density is expected to reduce noise.

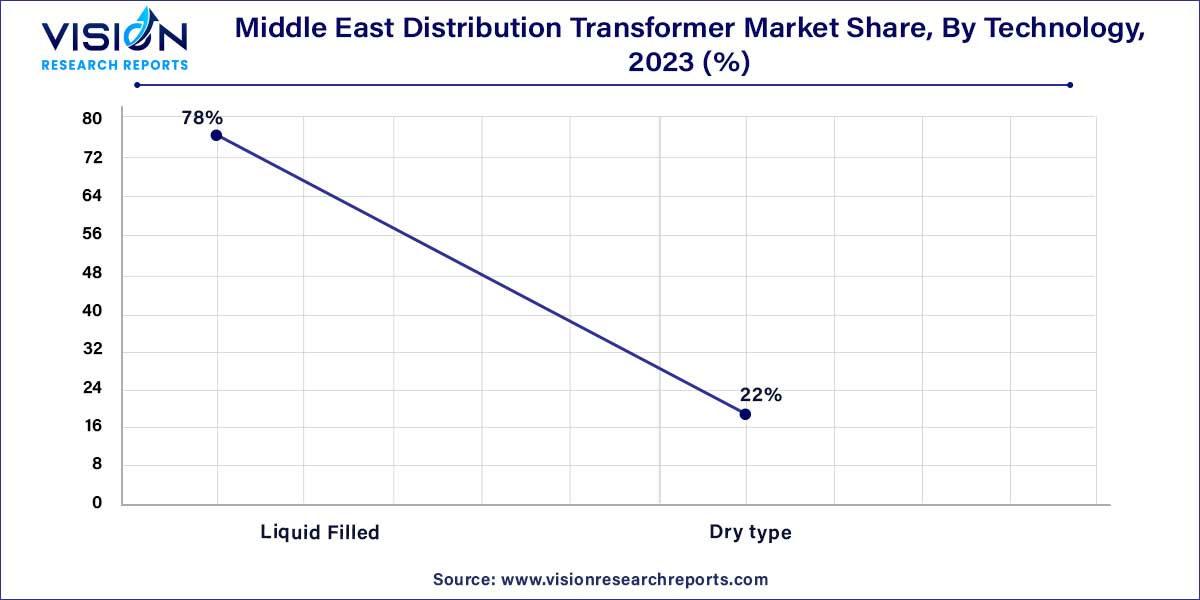

The liquid filled segment held the largest revenue share of 78% in 2023 and is anticipated to witness the fastest CAGR of 3.87% over the forecast period. It is attributed to advanced functional capabilities and efficient design. Pad mounted has numerous utility applications across the industrial, commercial, and residential sector and is expected to drive demand over the foreseeable future. Dry type technology is used particularly in rough environments with high fire safety requirements, such as mining sites, marine, and oil & gas industries.

The dry type segment is expected to grow at a significant CAGR of 3.58% during the forecast period. The increasing focus on energy efficiency and sustainability has propelled the region's demand for dry-type distribution transformers. Dry-type transformers offer advantages such as lower energy losses, reduced environmental impact, and improved fire safety compared to their oil-filled counterparts. It has prompted governments and utilities in the Middle East to prioritize the adoption of dry-type transformers to achieve their energy efficiency and sustainability goals.

By Product

By Technology

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Middle East Distribution Transformer Market

5.1. COVID-19 Landscape: Middle East Distribution Transformer Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Middle East Distribution Transformer Market, By Product

8.1. Middle East Distribution Transformer Market, by Product, 2024-2033

8.1.1. Small Transformer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Medium Transformer

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Large Transformer

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Unit substations

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Middle East Distribution Transformer Market, By Technology

9.1. Middle East Distribution Transformer Market, by Technology, 2024-2033

9.1.1. Liquid Filled

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Dry type

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Middle East Distribution Transformer Market, Regional Estimates and Trend Forecast

10.1. Middle East

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Technology (2021-2033)

Chapter 11. Company Profiles

11.1. Abaft Middle East Transformer Ind. LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ABB

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. alfanar Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Bawan Co.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. EUROGULF TRANSFORMERS

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. General Electric

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Intact Controls Transformer Industries LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Matelec Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Al-Ojaimi Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. SGB SMIT

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others