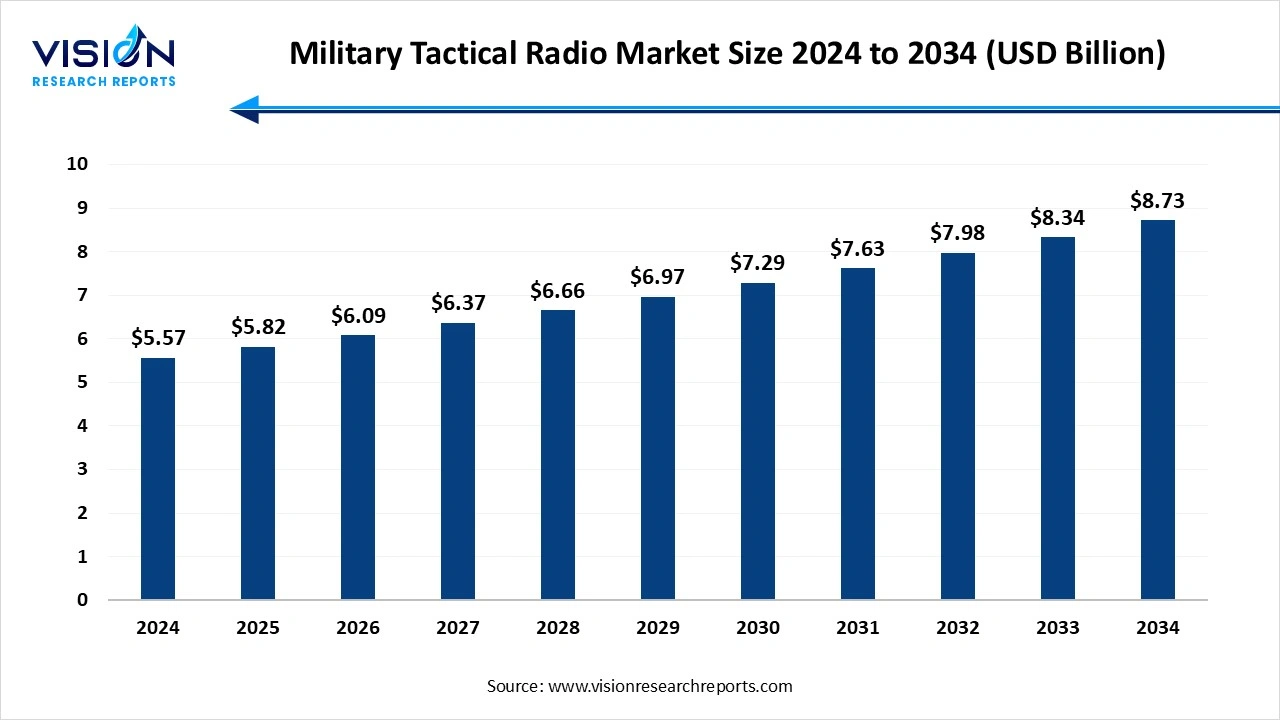

The global military tactical radio market size was estimated at around USD 5.57 Billion in 2024 and it is projected to hit around USD 8.73 Billion by 2034, growing at a CAGR of 4.60% from 2025 to 2034.

The military tactical radio market is witnessing steady growth driven by the rising demand for secure, reliable, and real-time communication systems across defense forces worldwide. These radios are essential for ensuring seamless coordination during combat operations, reconnaissance missions, and disaster response efforts. As modern warfare increasingly depends on network-centric capabilities, tactical radios have evolved to support voice, data, and video transmission across diverse terrains and operational conditions. The integration of advanced technologies such as Software-Defined Radio (SDR), encryption standards, and satellite connectivity is further enhancing their strategic importance.

The growth of the military tactical radio market is primarily driven by the increasing need for secure and efficient communication in modern combat scenarios. As military operations become more complex and data-intensive, the demand for radios that can transmit encrypted voice, video, and data in real time is rising sharply. Technologies such as Software-Defined Radios (SDRs) offer enhanced interoperability, allowing different military units and allied forces to communicate seamlessly even when using varied communication platforms.

Another major growth factor is the surge in global defense spending, particularly in countries prioritizing modernization of their armed forces. Ongoing geopolitical tensions and cross-border conflicts have led to increased procurement of advanced communication equipment to support mobility, situational awareness, and command-and-control capabilities. In addition, advancements in satellite communication, miniaturization.

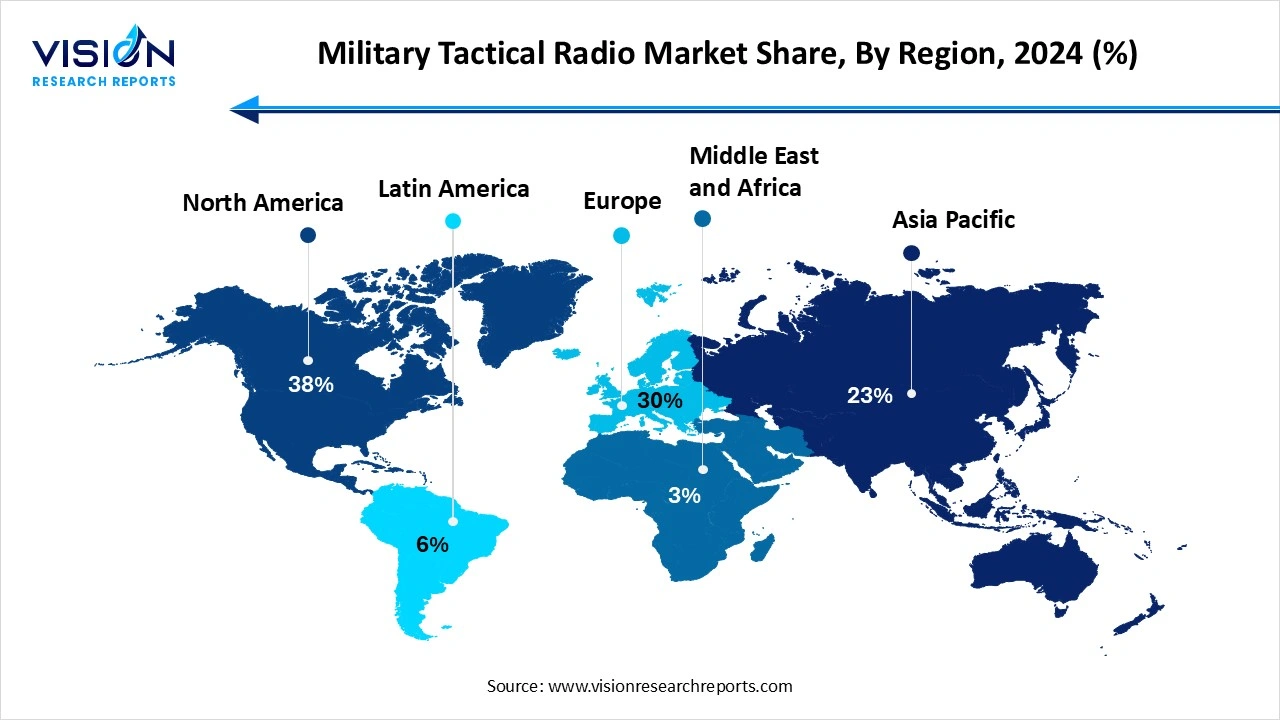

The North America military tactical radio market held the largest share, representing over 38% of the market in 2024. North America remains a dominant player in this market, largely due to the substantial defense budgets of the United States and Canada, coupled with ongoing investments in modernizing military communication infrastructure. The U.S. military's focus on adopting advanced software-defined radios and enhancing battlefield network capabilities fuels robust demand in the region. Collaborations between government agencies and leading defense contractors contribute to sustained innovation and market growth.

The Asia Pacific military tactical radio market is projected to expand at the fastest CAGR of 6.1% between 2025 and 2034. This growth is fueled by rising geopolitical tensions and continuous increases in defense spending, positioning the region as a rapidly developing market for tactical radios. Governments are actively promoting the development of indigenous defense technologies, leading to substantial investments in local production of radio systems. The surge in demand for software-defined radios (SDRs) to facilitate efficient battlefield communication is transforming procurement strategies. Additionally, the need for interoperable systems to support joint military exercises is driving wider adoption among regional armed forces.

The manpack radio segment captured the largest market share, exceeding 30% in 2024. These radios are favored for their ability to support complex voice and data transmissions over long distances, making them ideal for vehicle-mounted setups or for command units coordinating large-scale operations. They are also equipped with advanced features like frequency hopping, satellite connectivity, and encryption, which enhance situational awareness and command effectiveness across dispersed units. Their robust design and extended battery life allow for uninterrupted communication in harsh and remote operational environments.

The handheld radio segment is projected to experience the highest CAGR of over 6.1% between 2025 and 2034. These devices are built for mobility and ease of use, ensuring reliable short-range communication in dynamic and high-pressure combat scenarios. Handheld tactical radios are essential for small-unit coordination, real-time tactical decisions, and last-mile connectivity. Recent advancements have enabled these radios to support data communication, GPS integration, and interoperability with broader network-centric systems. As military operations increasingly depend on decentralized and agile units, the demand for modernized handheld radios with improved durability, range, and encryption has grown significantly.

The very high frequency (VHF) segment held the largest market share in 2024. VHF radios, typically operating in the 30 MHz to 300 MHz range, are widely used for ground-to-ground and ground-to-air communication due to their ability to cover long distances in open terrain. These radios are particularly effective in line-of-sight communications and are often employed in field operations, convoy movements, and mission-critical coordination between units. Their robustness and capability to function in challenging outdoor environments make them a preferred choice for many ground-based military applications.

The ultra-high frequency (UHF) segment is anticipated to experience the fastest CAGR between 2025 and 2034. These radios are commonly used in tactical ground communications, airborne operations, and naval applications where obstacles like buildings or terrain might interfere with signal quality. UHF systems support higher data transmission rates and better bandwidth utilization, which is essential for real-time communication, video transmission, and situational awareness in fast-paced combat scenarios. As military strategies increasingly rely on mobile, interconnected, and data-driven systems, UHF radios continue to see growing adoption for their versatility, reliability, and integration capabilities with modern communication networks.

The conventional radios segment held the largest market share in 2024. These systems are valued for their simplicity, proven performance, and ease of use in structured command environments. However, conventional radios typically operate on limited frequencies and lack the flexibility to adapt to rapidly changing communication protocols or emerging threats. Despite this, they continue to be used in various tactical settings where basic and stable communication is sufficient, especially in regions with constrained defense budgets or where legacy systems still dominate.

The software-defined radios (SDR) segment is projected to achieve the fastest CAGR between 2025 and 2034. Unlike traditional systems, SDRs utilize software to control signal processing functions, allowing for dynamic reconfiguration of frequencies, waveforms, and encryption protocols without altering the hardware. This adaptability makes SDRs highly suitable for modern, network-centric warfare environments where interoperability, secure data exchange, and rapid updates are essential. SDRs enable seamless communication between different branches of the military and allied forces, supporting a wide array of communication formats and mission-critical applications. Their ability to integrate with satellite systems, unmanned vehicles, and digital battlefield networks further underscores their growing adoption.

The command & control communication segment dominated the market with the largest share in 2024. Tactical radios used in this application are designed to provide secure, resilient, and uninterrupted communication channels under extreme and dynamic conditions. They support a wide range of operational needs, from issuing commands and receiving situational updates to coordinating logistics and force movements. As modern warfare increasingly depends on speed and precision, reliable command and control communication systems have become vital for mission success, minimizing response time and enhancing the strategic execution of complex operations.

The surveillance and reconnaissance segment is expected to register the fastest CAGR between 2025 and 2034. These radios enable soldiers, drones, and other surveillance assets to relay real-time video, imagery, and intelligence across the networked battlefield. The ability to share this information quickly and securely ensures rapid threat assessment, target identification, and informed decision-making. Tactical radios used in surveillance and reconnaissance often feature advanced data capabilities, low latency, and high encryption standards to maintain operational security while providing comprehensive situational awareness.

The army segment held the largest share of the market in 2024. These radios are crucial for coordinating infantry movements, artillery support, and armored vehicle deployments, especially in complex and rapidly changing battlefield environments. The ruggedness, portability, and reliability of tactical radios enable soldiers to stay connected in diverse terrains and weather conditions, ensuring that commands and intelligence flow efficiently between frontline troops and command centers. With increasing emphasis on network-centric warfare, the army continues to invest in advanced tactical radio systems that offer enhanced encryption, interoperability, and data capabilities to support real-time situational awareness and mission coordination.

The navy segment is projected to experience the highest compound annual growth rate CAGR between 2025 and 2034. Tactical radios for naval applications are designed to withstand harsh marine environments, including saltwater corrosion and extreme weather conditions. These systems facilitate voice and data exchange for fleet coordination, navigation, and surveillance missions, enabling effective command and control over vast oceanic distances. The integration of tactical radios with satellite communication and advanced encryption ensures that naval forces can maintain secure lines of communication even in contested or remote areas. As navies worldwide modernize their fleets and expand their operational scope, the demand for sophisticated tactical radio solutions tailored for maritime use is steadily increasing.

By Type

By Frequency

By Technology

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Military Tactical Radio Market

5.1. COVID-19 Landscape: Military Tactical Radio Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market TrEnd Uses and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and TrEnd Uses

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. VEnd Useor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Military Tactical Radio Market, By Type

8.1. Military Tactical Radio Market, by Type

8.1.1. Handheld Radio

8.1.1.1. Market Revenue and Forecast

8.1.2. Manpack Radio

8.1.2.1. Market Revenue and Forecast

8.1.3. Vehicle-Mounted Radio

8.1.3.1. Market Revenue and Forecast

8.1.4. Base Station Radio

8.1.4.1. Market Revenue and Forecast

8.1.5. Airborne Radio

8.1.5.1. Market Revenue and Forecast

8.1.6. Naval Radio

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Military Tactical Radio Market, By Frequency

9.1. Military Tactical Radio Market, by Frequency

9.1.1. Very High Frequency (VHF)

9.1.1.1. Market Revenue and Forecast

9.1.2. Ultra-High Frequency (UHF)

9.1.2.1. Market Revenue and Forecast

9.1.3. High Frequency (HF)

9.1.3.1. Market Revenue and Forecast

9.1.4. Others (Multiband, SHF, EFH)

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Military Tactical Radio Market, By Technology

10.1 Military Tactical Radio Market, by Technology

10.1.1. Conventional Radios

10.1.1.1. Market Revenue and Forecast

10.1.2. Software-Defined Radios (SDR)

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Military Tactical Radio Market, By Application

11.1. Military Tactical Radio Market, by Application

11.1.1. Command & Control Communication

11.1.1.1. Market Revenue and Forecast

11.1.2 Surveillance & Reconnaissance

11.1.2.1. Market Revenue and Forecast

11.1.3 Electronic Warfare

11.3.1. Market Revenue and Forecast

11.1.4 Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Military Tactical Radio Market, By End Use

12.1. Military Tactical Radio Market, by End Use

12.1.1. Army

12.1.1.1. Market Revenue and Forecast

12.1.2. Navy

12.1.2.1. Market Revenue and Forecast

12.1.3. Air Force

12.1.3.1. Market Revenue and Forecast

Chapter 13. Global Military Tactical Radio Market, Regional Estimates and Trend End Use Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type

13.1.2. Market Revenue and Forecast, by Frequency

13.1.3. Market Revenue and Forecast, by Technology Mode

13.1.4. Market Revenue and Forecast, by Application Size

13.1.5. Market Revenue and Forecast, by End Use Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type

13.1.6.2. Market Revenue and Forecast, by Frequency

13.1.6.3. Market Revenue and Forecast, by Technology Mode

13.1.6.4. Market Revenue and Forecast, by Application Size

13.1.7. Market Revenue and Forecast, by End Use Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type

13.1.8.2. Market Revenue and Forecast, by Frequency

13.1.8.3. Market Revenue and Forecast, by Technology

13.1.8.4. Market Revenue and Forecast, by Application

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type

13.2.2. Market Revenue and Forecast, by Frequency

13.2.3. Market Revenue and Forecast, by Technology

13.2.4. Market Revenue and Forecast, by Application

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type

13.2.6.2. Market Revenue and Forecast, by Frequency

13.2.6.3. Market Revenue and Forecast, by Technology

13.2.7. Market Revenue and Forecast, by Application

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type

13.2.9.2. Market Revenue and Forecast, by Frequency

13.2.9.3. Market Revenue and Forecast, by Technology

13.2.10. Market Revenue and Forecast, by Application

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type

13.2.12.2. Market Revenue and Forecast, by Frequency

13.2.12.3. Market Revenue and Forecast, by Technology

13.2.12.4. Market Revenue and Forecast, by Application

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type

13.2.14.2. Market Revenue and Forecast, by Frequency

13.2.14.3. Market Revenue and Forecast, by Technology

13.2.14.4. Market Revenue and Forecast, by Application

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type

13.3.2. Market Revenue and Forecast, by Frequency

13.3.3. Market Revenue and Forecast, by Technology

13.3.4. Market Revenue and Forecast, by Application

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type

13.3.6.2. Market Revenue and Forecast, by Frequency

13.3.6.3. Market Revenue and Forecast, by Technology

13.3.6.4. Market Revenue and Forecast, by Application

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type

13.3.8.2. Market Revenue and Forecast, by Frequency

13.3.8.3. Market Revenue and Forecast, by Technology

13.3.8.4. Market Revenue and Forecast, by Application

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type

13.3.10.2. Market Revenue and Forecast, by Frequency

13.3.10.3. Market Revenue and Forecast, by Technology

13.3.10.4. Market Revenue and Forecast, by Application

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type

13.3.11.2. Market Revenue and Forecast, by Frequency

13.3.11.3. Market Revenue and Forecast, by Technology

13.3.11.4. Market Revenue and Forecast, by Application

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type

13.4.2. Market Revenue and Forecast, by Frequency

13.4.3. Market Revenue and Forecast, by Technology

13.4.4. Market Revenue and Forecast, by Application

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type

13.4.6.2. Market Revenue and Forecast, by Frequency

13.4.6.3. Market Revenue and Forecast, by Technology

13.4.6.4. Market Revenue and Forecast, by Application

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type

13.4.8.2. Market Revenue and Forecast, by Frequency

13.4.8.3. Market Revenue and Forecast, by Technology

13.4.8.4. Market Revenue and Forecast, by Application

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type

13.4.10.2. Market Revenue and Forecast, by Frequency

13.4.10.3. Market Revenue and Forecast, by Technology

13.4.10.4. Market Revenue and Forecast, by Application

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type

13.4.11.2. Market Revenue and Forecast, by Frequency

13.4.11.3. Market Revenue and Forecast, by Technology

13.4.11.4. Market Revenue and Forecast, by Application

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type

13.5.2. Market Revenue and Forecast, by Frequency

13.5.3. Market Revenue and Forecast, by Technology

13.5.4. Market Revenue and Forecast, by Application

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type

13.5.6.2. Market Revenue and Forecast, by Frequency

13.5.6.3. Market Revenue and Forecast, by Technology

13.5.6.4. Market Revenue and Forecast, by Application

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type

13.5.8.2. Market Revenue and Forecast, by Frequency

13.5.8.3. Market Revenue and Forecast, by Technology

13.5.8.4. Market Revenue and Forecast, by Application

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. Harris Corporation (L3Harris Technologies)

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Thales Group

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Raytheon Technologies Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. BAE Systems plc

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Rohde & Schwarz GmbH & Co. KG

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Leonardo S.p.A.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. General Dynamics Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Elbit Systems Ltd.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Cisco Systems, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. CACI International Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. App End Useix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others