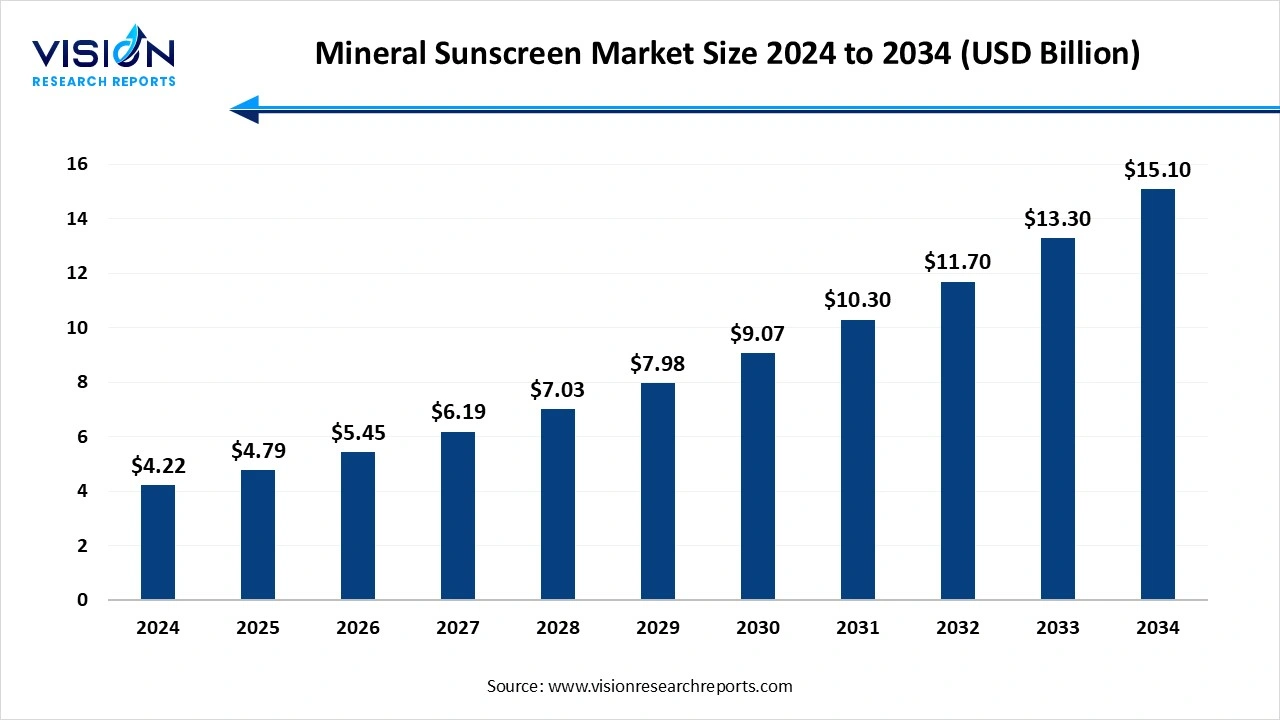

The global mineral sunscreen market size was valued at USD 4.22 billion in 2024 and it is predicted to surpass around USD 15.10 billion by 2034 with a CAGR of 13.60% from 2025 to 2034.

The mineral sunscreen market has experienced significant growth in recent years, driven by increasing consumer awareness of the harmful effects of UV radiation and a rising preference for natural and safe skincare products. Mineral sunscreens, which primarily contain active ingredients such as zinc oxide and titanium dioxide, offer broad-spectrum protection by physically blocking UV rays, making them a popular choice among health-conscious consumers and those with sensitive skin. The market is further propelled by the growing demand for eco-friendly and reef-safe formulations amid rising environmental concerns.

The mineral sunscreen market is experiencing robust growth primarily due to increasing consumer awareness regarding the harmful effects of prolonged UV exposure, such as skin cancer, premature aging, and other dermatological conditions. Consumers are becoming more health-conscious and are actively seeking safer alternatives to chemical sunscreens, which may cause irritation or allergic reactions. Mineral sunscreens, which use natural active ingredients like zinc oxide and titanium dioxide, are widely perceived as gentler and safer, especially for sensitive skin types, including children and individuals with skin conditions.

In addition to consumer health concerns, environmental awareness is a significant growth driver for the mineral sunscreen market. Increasing evidence of the harmful impact of chemical sunscreens on marine ecosystems, particularly coral reefs, has led to regulatory bans and restrictions in several popular tourist destinations. This has encouraged both consumers and manufacturers to shift toward eco-friendly and reef-safe mineral sunscreens.

North America dominates the global mineral sunscreen market. This leadership is primarily driven by heightened consumer awareness about the risks of sun exposure, increasing demand for clean and natural skincare products, and strong regulatory support for the use of safe, mineral-based ingredients like zinc oxide and titanium dioxide. The U.S. market, in particular, has a well-established consumer base for premium and dermatologist-recommended sun protection products, reinforcing its position at the forefront of global demand.

The Asia-Pacific region is emerging as a high-growth area in the mineral sunscreen market, driven by a growing middle-class population, rising disposable incomes, and increased awareness about skincare. Markets in Japan, South Korea, China, and India are witnessing rapid expansion, as consumers seek high-quality sun protection that aligns with traditional beauty standards and concerns about skin discoloration and aging. Local brands, along with international players, are leveraging this opportunity by launching innovative mineral-based formulations tailored to regional preferences.

Mineral sunscreens and sunblocks made up 55% of the total revenue in the mineral sunscreen market in 2024. This growth is fueled by increased awareness about skincare and a rising preference for natural, clean beauty products, which has significantly boosted demand for mineral-based sunscreens and sunblocks. These products are designed to offer broad-spectrum protection, essential for preventing skin damage, premature aging, and skin cancer caused by UV exposure. Sunscreens within this market are formulated to provide lightweight, non-greasy coverage that can be easily applied and absorbed by the skin. They are often marketed for daily use and appeal to consumers looking for natural or reef-safe options. Sunblocks, on the other hand, tend to have a thicker consistency and create a more visible layer on the skin, offering a robust defense particularly useful for outdoor activities and prolonged sun exposure.

The demand for mineral sunscreen-based lip balms is projected to grow at a compound annual growth rate (CAGR) of 14.6% between 2025 and 2034. Increasing consumer awareness about the importance of protecting lips from harmful UV rays is driving the popularity of products that combine hydration with effective sun protection. A survey conducted by The Beauty Buddy Ltd. reveals that lip balm is the most widely used lip care product, with 93% of respondents applying it daily. Following this, 67% use lip oil, 62% use lip scrub, 50% use lip masks, and 48% opt for lip sunscreen or SPF products. Moreover, 44% of participants prioritize sun protection, highlighting the diverse lip care concerns that consumers address as part of their everyday routines.

Mineral sunscreen lotions accounted for 41% of the market share in 2024. Mineral sunscreen lotions typically contain zinc oxide or titanium dioxide as active ingredients that physically block ultraviolet rays, offering broad-spectrum protection. These formulations are favored for their lightweight texture and moisturizing properties, making them suitable for daily use on various skin types, including sensitive skin. Innovations in lotion formulations have also helped reduce the common whitening effect associated with mineral sunscreens, increasing their appeal to a wider consumer base. The convenience and versatility of lotion forms, combined with increasing consumer awareness about sun safety, continue to drive their strong demand in both developed and emerging markets.

The market for mineral sunscreen sticks is projected to expand at a CAGR of 16.1% between 2025 and 2034. Mineral sunscreen sticks represent a growing segment within the market, appreciated for their portability and precise application, especially on small or sensitive areas such as the face, lips, and around the eyes. Sticks provide a convenient, mess-free option that appeals to active individuals and those who prefer quick touch-ups on the go. These solid formulations deliver concentrated mineral sun protection with minimal risk of product wastage. As consumers seek more user-friendly and travel-compatible sun protection options, mineral sunscreen sticks are gaining popularity, particularly among outdoor enthusiasts and sports communities.

By Product

By Form

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mineral Sunscreen Market

5.1. COVID-19 Landscape: Mineral Sunscreen Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Mineral Sunscreen Market, By Product

8.1. Mineral Sunscreen Market, by Product

8.1.1. Sunscreen & Sunblock

8.1.1.1. Market Revenue and Forecast

8.1.2. Moisturizers

8.1.2.1. Market Revenue and Forecast

8.1.3. Lip Balm

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Mineral Sunscreen Market, By Form

9.1. Mineral Sunscreen Market, by Form

9.1.1. Lotions

9.1.1.1. Market Revenue and Forecast

9.1.2. Cream

9.1.2.1. Market Revenue and Forecast

9.1.3. Spray

9.1.3.1. Market Revenue and Forecast

9.1.4. Gels

9.1.4.1. Market Revenue and Forecast

9.1.5. Sticks

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Mineral Sunscreen Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by Form

Chapter 11. Company Profiles

11.1. Neutrogena (Johnson & Johnson)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. La Roche-Posay (L’Oréal Group)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Burt’s Bees (Clorox Company)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Blue Lizard Australian Sunscreen

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Bare Republic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Coola

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Alba Botanica

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Badger Balm

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Thinkbaby (Who Makes Thinkbaby)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Aveeno (Johnson & Johnson)

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others