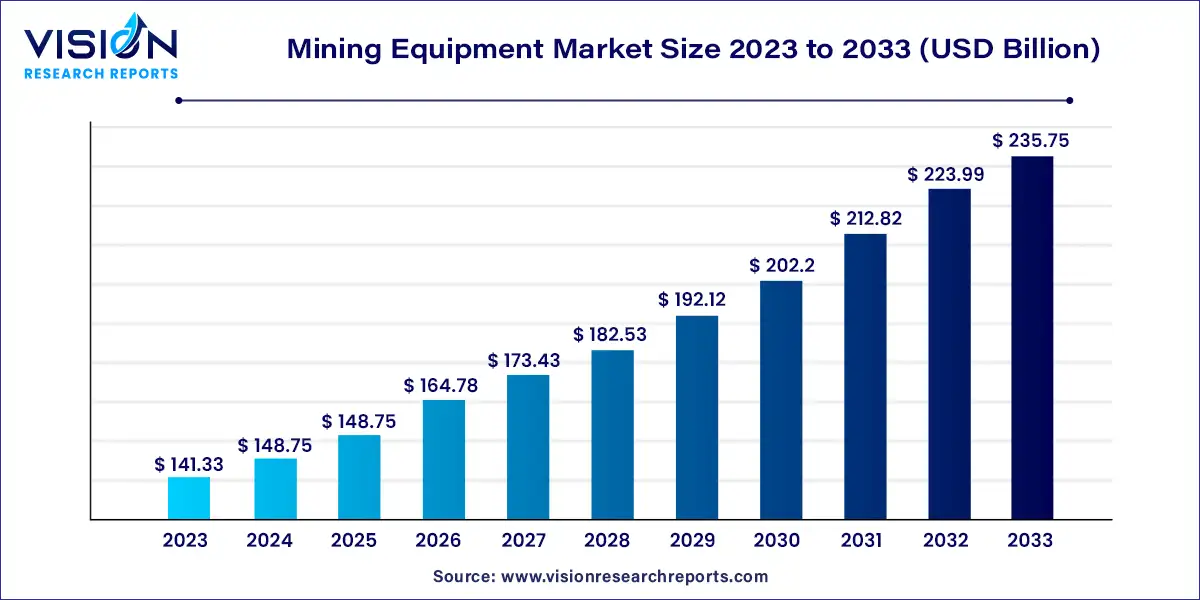

The global mining equipment market was estimated at USD 141.33 billion in 2023 and it is expected to surpass around USD 235.75 billion by 2033, poised to grow at a CAGR of 5.25% from 2024 to 2033. The mining equipment market encompasses a wide range of machinery and tools utilized in various stages of the mining process, from exploration to extraction and transportation of minerals and ores. This dynamic sector plays a crucial role in the global economy, serving industries such as coal, metal, and mineral mining.

The growth of the mining equipment market is propelled by several key factors. Firstly, the increasing demand for metals and minerals, driven by industrialization and infrastructure development worldwide, stimulates the need for advanced mining machinery. Additionally, rapid technological advancements, including automation and digitalization, enhance operational efficiency and productivity, driving the adoption of modern mining equipment. Moreover, stringent environmental regulations and growing sustainability concerns prompt the mining industry to invest in eco-friendly equipment solutions, fostering market growth. Furthermore, the shift towards rental and leasing options provides cost-effective alternatives for mining companies, further boosting market expansion. Overall, these factors converge to fuel the growth trajectory of the mining equipment market, promising continued advancement and innovation in the sector.

The surface mining equipment segment emerged as the market leader, capturing a substantial 39% share of global revenue in 2023. Over the forecast period, increasing demand for commodities like iron ore, coal, diamonds, and chromium in developing countries is expected to create fresh opportunities for surface mining equipment. This equipment's widespread adoption facilitates various mining activities, including resource exploration and the construction of stable surfaces and embankments.

In underground mining, equipment evolution has revolutionized operating systems. The transportation system within mines plays a pivotal role. The robust construction and high impact capability of underground mining equipment make it indispensable for subterranean operations, thereby driving demand for such equipment throughout the forecast period.

The crushing, pulverizing, and screening equipment segment is poised to witness a notable CAGR of 4.33% during the forecast period. Manufacturers of processing equipment catering to crushing, pulverizing, and screening foresee increased sales, buoyed by growing demand for both fixed and mobile product lines. The utilization of mobile processing equipment for crushing, pulverizing, and screening is projected to escalate, further propelling market expansion globally.

Drills and breakers systems equipment accounted for a significant 6.9% share of global revenue in 2023. The demand for mining drills and breakers is expected to surge in the forecast period, driven by the expanding scope of mining activities worldwide and advancements in technology such as IoT, automation, infrared, optical micro cameras, and artificial intelligence.

The coal mining sector emerged as the market leader, commanding a substantial 38% share of global revenue in 2023. Significant growth is anticipated in the mining equipment sector, particularly in coal mining applications, driven by the increased demand for electricity generation. Coal mining equipment has witnessed expanded utilization and adoption as coal excavation activities have surged.

Recent advancements in technology have spurred interest in mining for rare earth metals. The substantial investments in new technology underscore the importance of focusing on long-term value for large metal mining operations. Additionally, emerging methods of exploitation are expected to emerge, aiming to maximize production in a cost-effective manner.

Underground mining equipment plays a crucial role in excavating hard minerals, particularly those containing metals such as gold, silver, copper, zinc, and nickel. Utilizing tools like 3D geological models helps in understanding the size and shape of mineral deposits, facilitating the development of effective mining and exploration strategies.

Asia Pacific emerged as the market leader, commanding a significant 36% share of global revenue in 2023. The region's market dominance is driven by the increasing adoption of clean energy resources and the rising popularity of electric vehicles, particularly in developing countries like China and India. These factors are expected to fuel further market growth in the region in the forthcoming years.

In the North America region, a robust expansion at a Compound Annual Growth Rate (CAGR) of 4.14% is projected during the forecast period. This growth trajectory is propelled by escalating mineral mining activities, the heightened utilization of cutting-edge mining equipment, and supportive government initiatives. Moreover, the transition from traditional underground mining methods to more advanced and cost-effective open-pit mining techniques is anticipated to spur demand for mining products in the region over the forecast period.

By Equipment Type

By Power Source

By Power Output

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mining Equipment Market

5.1. COVID-19 Landscape: Mining Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mining Equipment Market, By Equipment Type

8.1. Mining Equipment Market, by Equipment Type, 2024-2033

8.1.1. Equipment Type

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Surface Mining Equipment

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Crushing, Pulverizing & Screening Equipment

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Drills & Breakers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Mining Equipment Market, By Power Source

9.1. Mining Equipment Market, by Power Source, 2024-2033

9.1.1. Power Source

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Electric

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Mining Equipment Market, By Power Output

10.1. Mining Equipment Market, by Power Output, 2024-2033

10.1.1. <500 HP

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. 500-2000 HP

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. >2000 HP

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Mining Equipment Market, By Application

11.1. Mining Equipment Market, by Application, 2024-2033

11.1.1. Metal Mining

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Non-metal Mining

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Coal Mining

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Mining Equipment Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.1.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.2.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.3.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.4.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Equipment Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Power Source (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Power Output (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Epiroc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Boart Long year Ltd

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Caterpillar Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. China Coal Energy Group Co. Ltd

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Vipeak Mining Machinery Co. Ltd

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Guangdong Leimeng Intelligent Equipment Group Co. Ltd

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Henan Baichy Machinery Equipment Co. Ltd

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Komatsu Ltd

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Liebherr

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Metso Qutotec

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others