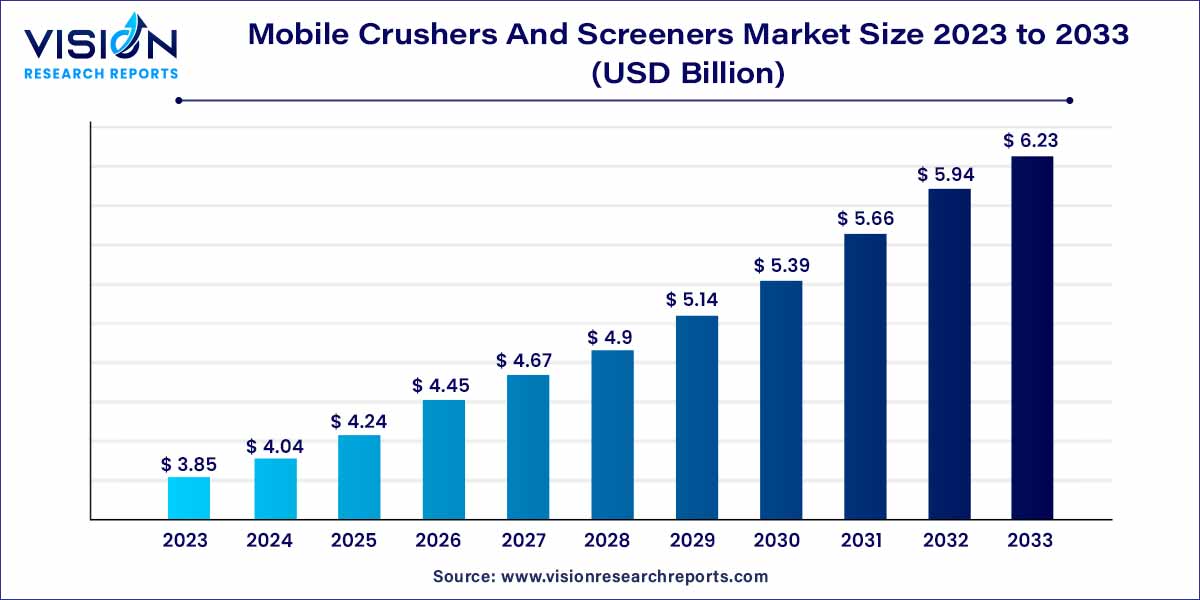

The global mobile crushers and screeners market size was estimated at USD 3.85 billion in 2023 and it is expected to surpass around USD 6.23 billion by 2033, poised to grow at a CAGR of 4.93% from 2024 to 2033.

The mobile crushers and screeners market, a cornerstone of the modern industrial landscape, embodies the fusion of cutting-edge technology and industrial necessity. This market segment revolves around highly specialized machinery designed to crush and screen various materials, ranging from stones and minerals to recycled products. Its significance lies in its pivotal role across diverse sectors, including construction, mining, recycling, and agriculture.

The growth of the mobile crushers and screeners market is propelled by several key factors. Firstly, the escalating demand for construction materials, driven by rapid urbanization and infrastructure projects globally, fuels the need for efficient material processing solutions. Additionally, the emphasis on recycling and sustainable practices in industries intensifies the market growth. Technological advancements play a pivotal role, with innovations such as automation and IoT integration enhancing operational efficiency and reducing environmental impact. Furthermore, the market benefits from the expanding mining and quarrying activities, creating a robust demand for mobile crushers and screeners. Lastly, the market's global reach, catering to both developed and emerging economies, amplifies its growth trajectory, making it a vital sector in the industrial landscape.

| Report Coverage | Details |

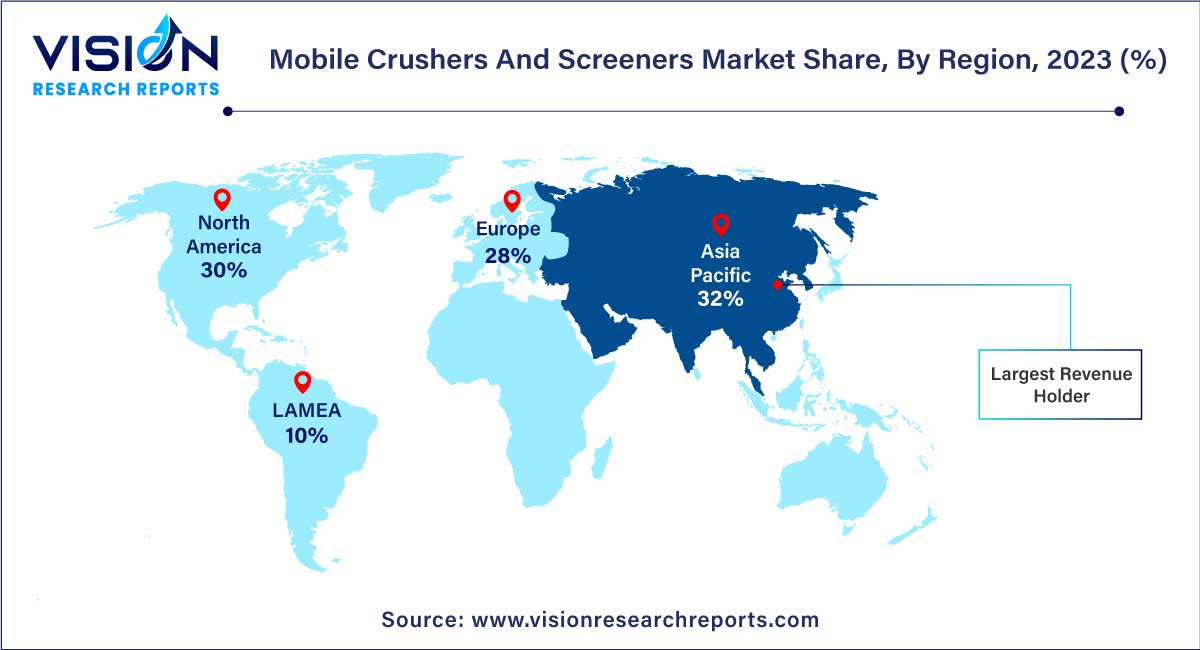

| Revenue Share of Asia Pacific in 2023 | 32% |

| CAGR of Middle East & Africa from 2024 to 2033 | 5.49% |

| Revenue Forecast by 2033 | USD 6.23 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The crushers segment held a highest revenue share of 70% in 2023 and is expected to register a CAGR of 4.87% over the forecast period. When it comes to crushers, there is a diverse range of options available to cater to different material processing requirements. Jaw crushers, for instance, are widely used in mining and construction sectors due to their ability to crush hard and abrasive materials effectively. Cone crushers, on the other hand, are preferred for secondary and tertiary crushing stages, offering higher reduction ratios and finer end products. Impact crushers find extensive use in quarrying applications, as they can process both soft and medium-hard materials, making them versatile for various tasks.

The screeners segment is projected to grow at the largest CAGR of 5.36% over the forecast period. Screeners, the market offers an array of choices tailored to specific screening needs. Vibrating screeners, equipped with vibrating decks, efficiently separate materials based on size and shape. They find extensive use in applications requiring precise classification, such as in mining and aggregate industries. Scalpers, designed to screen out larger materials before the crushing process, prevent unnecessary wear and tear on crushers, enhancing their longevity. These screeners are crucial in industries dealing with rough materials, ensuring the crushers operate optimally. Trommel screeners, characterized by rotating drum screens, are highly effective in screening a variety of materials, making them popular in composting and waste management operations.

The mining & quarry segment contributed the largest market share of 32% in 2023 and is anticipated to register a CAGR of 5.24% over the forecast period. In mining and quarry operations, mobile crushers play a pivotal role by crushing large rocks and ores into smaller, manageable pieces. These machines are essential for extracting valuable minerals and metals, providing a crucial initial step in the production chain. Mobile screeners in these applications help sort and classify different materials based on size, ensuring the extracted materials meet the required specifications for further processing.

The construction segment is expected to expand at the highest CAGR of 5.75% over the forecast period. In the construction aggregates industry, mobile crushers and screeners are fundamental for producing high-quality aggregates used in various construction projects. Aggregates, including crushed stone, sand, and gravel, are the backbone of construction materials. Mobile crushers efficiently break down large stones into smaller pieces, creating the foundation for roads, buildings, and infrastructure projects. Screeners, equipped with advanced screening technologies, sort and classify aggregates based on size and quality, ensuring that the final product meets the standards set by construction engineers and architects.

Asia Pacific dominated the market with a share of 32% in 2023 and is anticipated to expand at a CAGR of over 5.64% over the forecast period. Asia-Pacific emerges as a pivotal market due to rapid urbanization, burgeoning construction activities, and significant investments in mining and quarrying. Countries like China and India are at the forefront of market expansion, driven by large-scale infrastructure projects and a surging demand for construction materials. The region’s mobile crushers and screeners market benefit from a vast consumer base and a constant influx of technological innovations, shaping it as a vital growth center.

Middle East & Africa is anticipated to grow at the fastest CAGR of 5.49% during the forecast period. In the Middle East and Africa, the market experiences growth propelled by ongoing urban development initiatives and an upswing in construction projects. Countries in the Gulf Cooperation Council (GCC) region, such as Saudi Arabia and the UAE, witness significant market demand, driven by large-scale infrastructure investments. The need for mobile crushers and screeners in mining operations and the construction of mega projects in this region ensures a steady market expansion, making it a crucial geographical segment in the global landscape.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Crushers & Screeners Market

5.1. COVID-19 Landscape: Mobile Crushers & Screeners Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Crushers & Screeners Market, By Type

8.1. Mobile Crushers & Screeners Market, by Type, 2024-2033

8.1.1. Crushers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Screeners

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Mobile Crushers & Screeners Market, By Application

9.1. Mobile Crushers & Screeners Market, by Application, 2024-2033

9.1.1. Mining & Quarry

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Construction Aggregates

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Material Recycling

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Mobile Crushers & Screeners Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Sandvik AB

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Metso Outotec

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Komatsu Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Terex Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ASTEC INDUSTRIES

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. INC.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. KLEEMANN

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. McCloskey International

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. RUBBLE MASTER HMH GMBH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. thyssenkrupp AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others